- BTC has experienced increased volatility over the past month.

- Despite the decline, new whales continue to enter the market, while the old ones maintain their position.

Bitcoin [BTC] has experienced one of the most dramatic Septembers yet. Historically, September is associated with a bearish market. However, over the past week, BTC has attempted to defy this historical pattern.

In fact, the crypto has registered a local high of $60670, from a low of $52546. At the time of writing, Bitcoin was trading at $58819. This marked a 3.19% increase on the weekly charts.

Despite this breakout attempt, BTC has lost all recent gains over the past three days, hitting a local low of $57488.

Such market behavior indicates that bulls are trying to take over the market, but they are not strong enough to displace the bears.

This struggle is well evidenced by the current activity of the whale, which is trying to regain market confidence.

This phenomenon was observed by CryptoQuant’s analysis as they suggested that old whales were holding out while new ones entered the market.

Whales continue to hold on

According to CryptoQuantDespite the decline, new whales were actively buying, while old whales continued to hold out.

Source: CryptoQuant

These traders are accumulating at a base price of $62,038, which is a decline of 3.28%. This shows their confidence in the long-term value of BTC.

On the other hand, the old whales (more than 155 days) continued to maintain their positions. The holding behavior suggested that they expect prices to rise in the near future.

The fact that they are unwilling to close their positions to avoid further losses shows strong confidence.

These old whales are holding their positions from a base price of $27,843, which is a massive increase of 115.54%.

Although they are in a position where big profits can be realized, the old whales continue to hold on as they expect further price increases. This is another classic bullish signal.

In addition to whales, miners and Binance traders continue to hold on. Although miners with a base price of $43179 are making a profit of 38.19%, there are no signs of mass selling indicating that they are selling in phases.

Generally, new whales and Binance traders are active in the market, while old whales continue to hold their positions.

This combination indicates a potential for further price increases and a sign of overall market maturity.

What BTC Charts Indicate

While BTC is experiencing bearish market sentiment, the prevailing conditions can undoubtedly set the crypto up for massive gains.

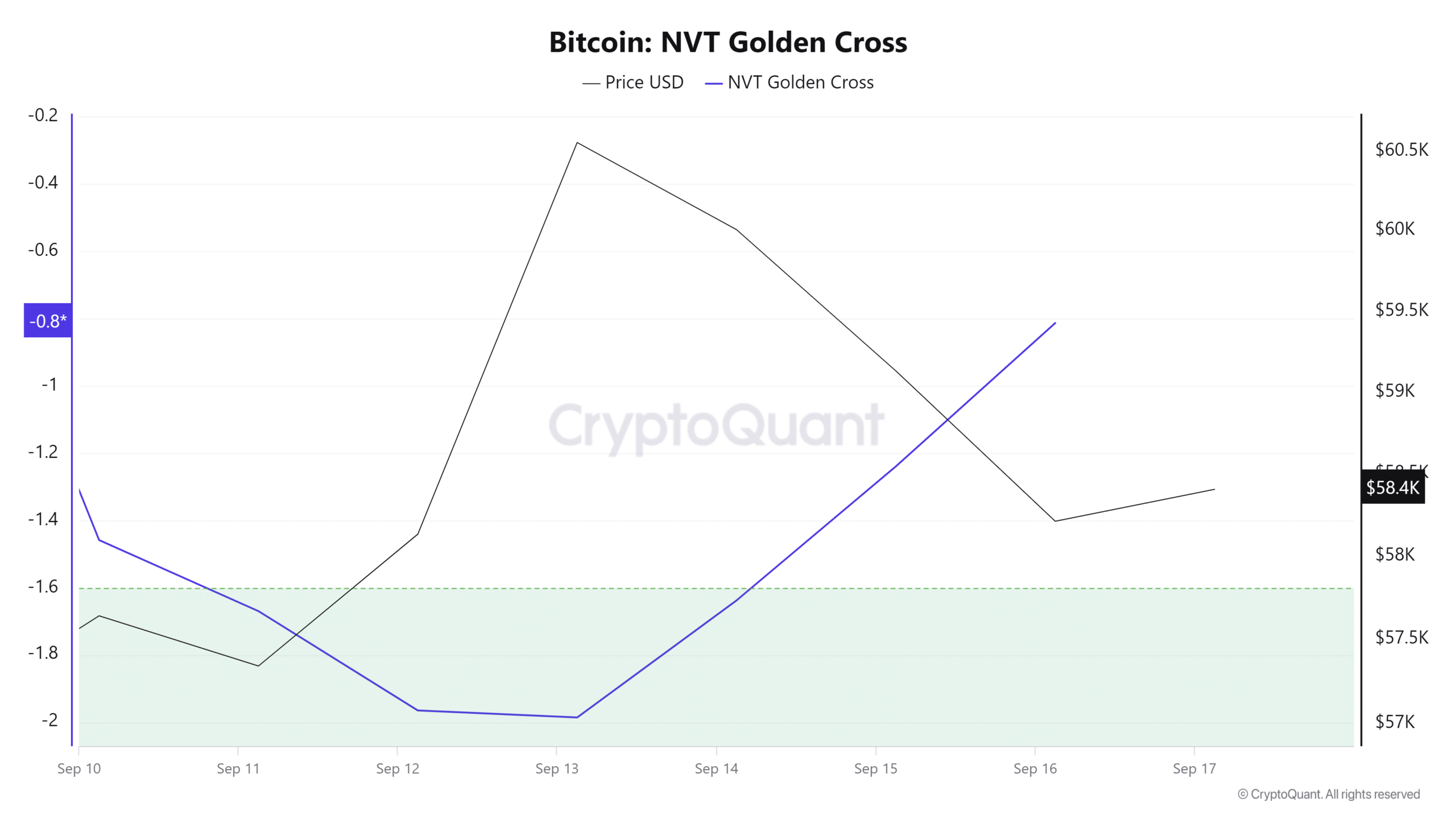

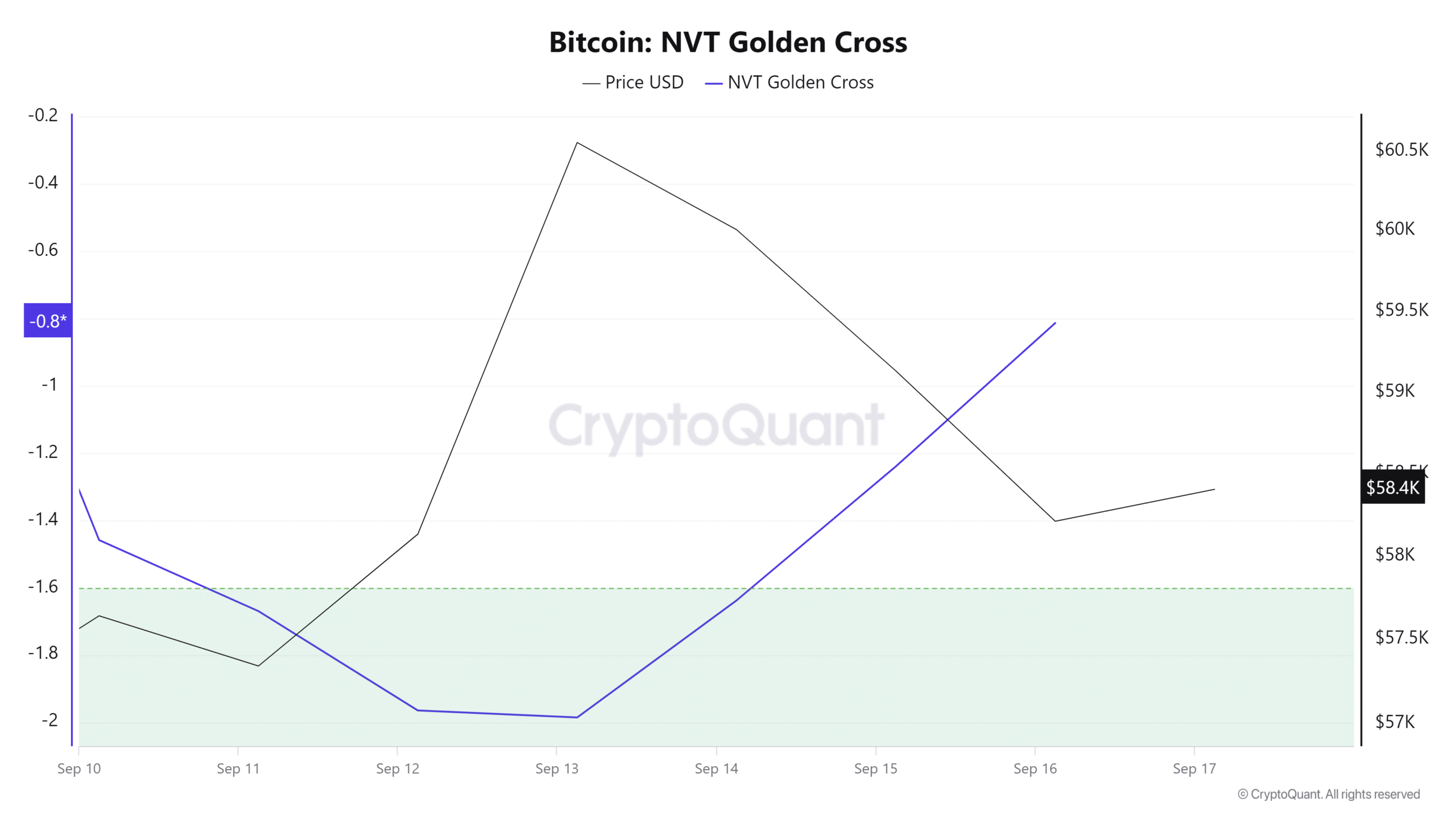

Source: CryptoQuant

To start with, the NVT Gouden Kruis has experienced a strong rebound in the past week. An NVT gold cross indicated that the 50-day moving average of NVT has moved above the long-term (200-day MA).

This was a sign that prices were likely to enter a bullish phase as the market capitalization rises relative to the network’s transaction volume.

So investors seemed to expect further price appreciation based on network fundamentals and market sentiment.

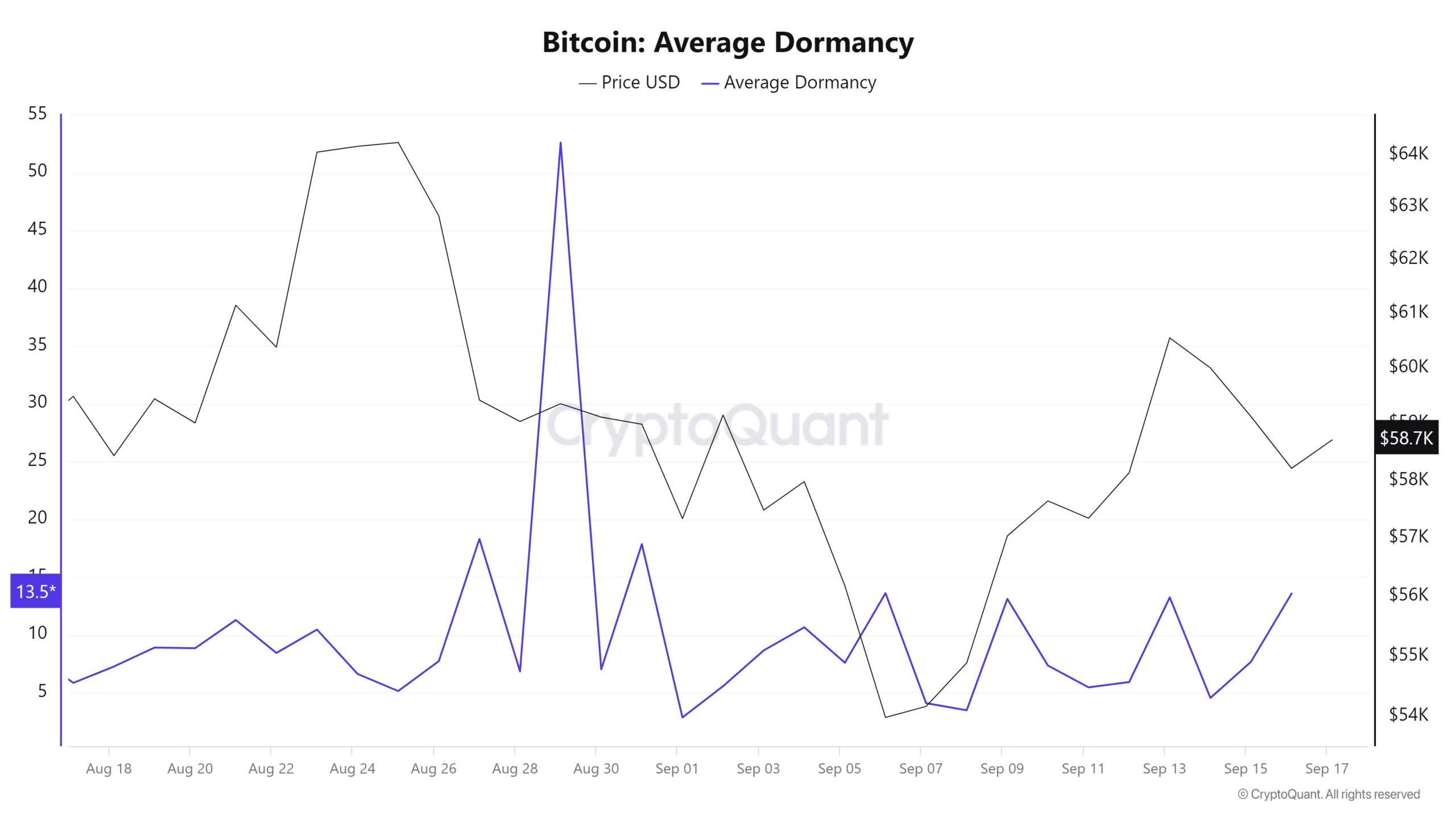

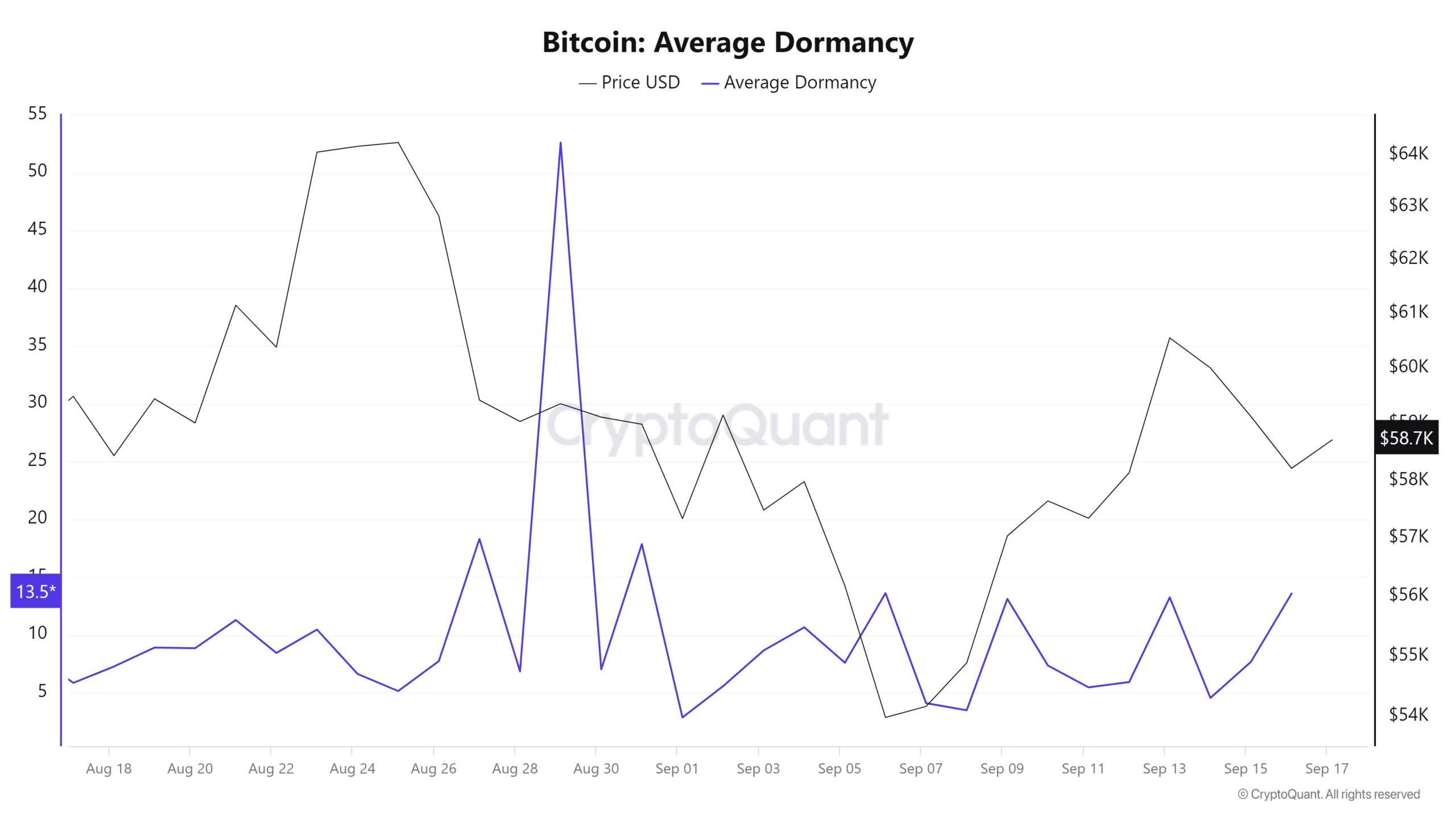

Source: CryptoQuant

Furthermore, Bitcoin’s average dormancy has dropped since August 29, from 52.89 to 13.5 at the time of writing.

A decline in average dormancy indicates that long-term holders are not selling their assets, while term holders are.

This showed that the market was in the accumulation phase as short-term holders sold to long-term holders as they expected prices to rise in the future.

This was another bullish signal, as the long-term holders’ accumulation suggested confidence in the future price of the asset.

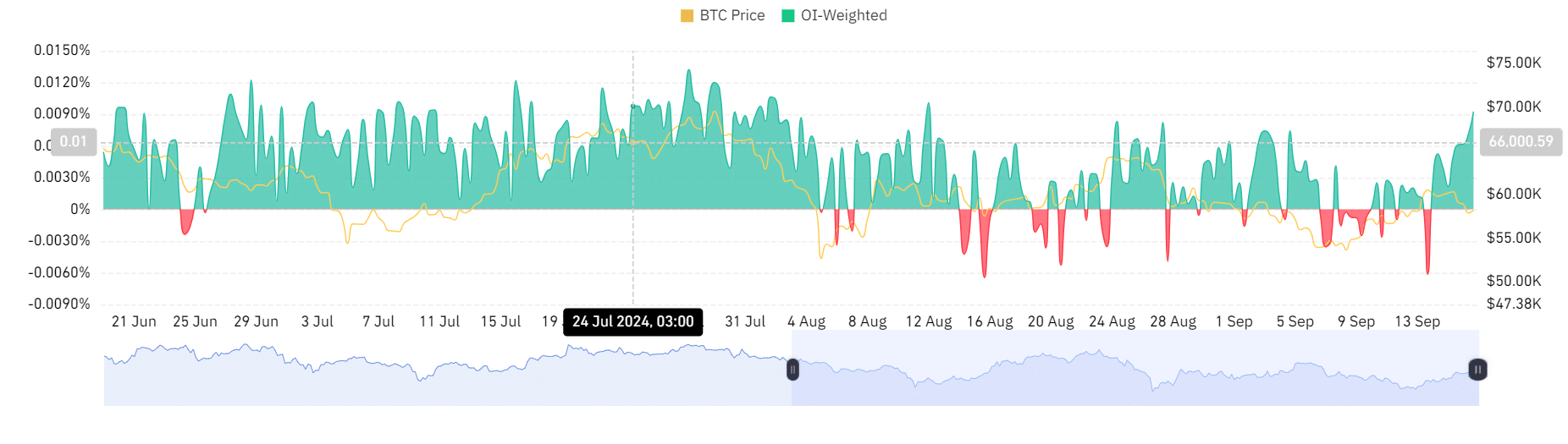

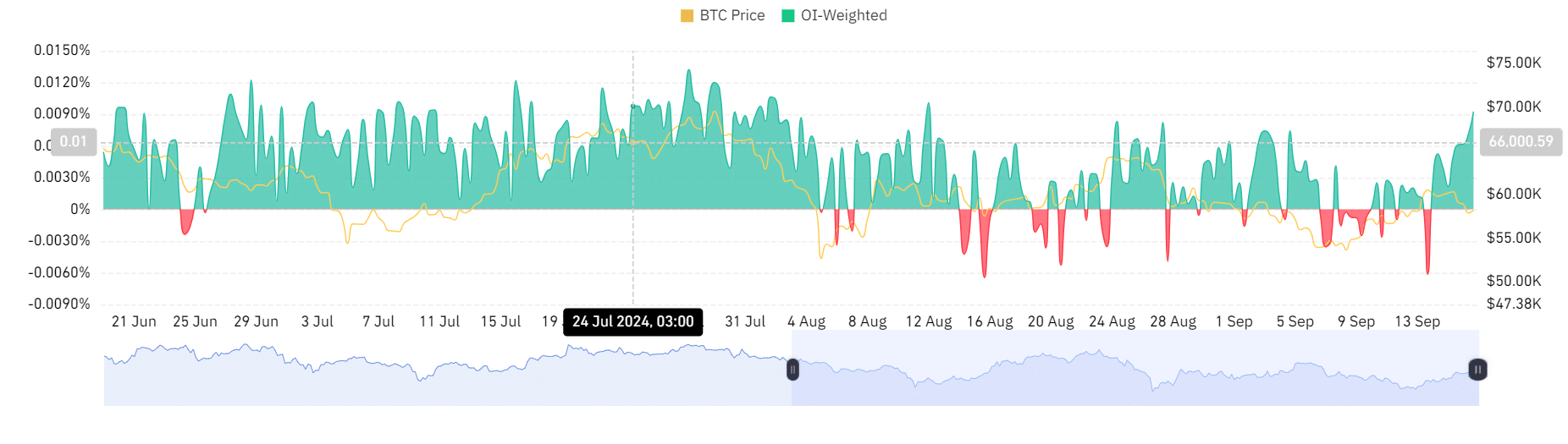

Source: Coinglass

This demand for BTC’s long positions was further supported by a positive OI-weighted funding rate.

A positive Open Interest Weighted Funding Rate indicated that the market had more demand for long positions than for shorts.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Therefore, as noted by CryptoQuant analysts, Bitcoin enjoyed a greater market advantage among long-term holders.

This was positive market sentiment as they expected further price increases. So, if this positive sentiment is maintained, BTC will break the persistent resistance level at $61182.