- BTC was experiencing strong downward momentum at the time of writing, as BTC fell 2.45%.

- One analyst predicted a bearish reversal based on two momentum indicators.

Bitcoin [BTC]the largest cryptocurrency, has experienced extreme volatility in 2024. That year, BTC rose to an all-time high of $73,794 in March. However, since then it failed to maintain its momentum, hitting a low of $49,000.

At the time of writing, BTC was trading at $55774, after dropping 2.45% on the daily charts. This decline continued a monthly decline. In the last 30 days it is down 2%.

Therefore, at press time, market conditions raised questions about whether Bitcoin was about to decline further.

To this extent, CryptoQuant analyst Yansei Dent suggested that BTC was undergoing a bearish reversal, citing MVRV and Active Address.

Market sentiment

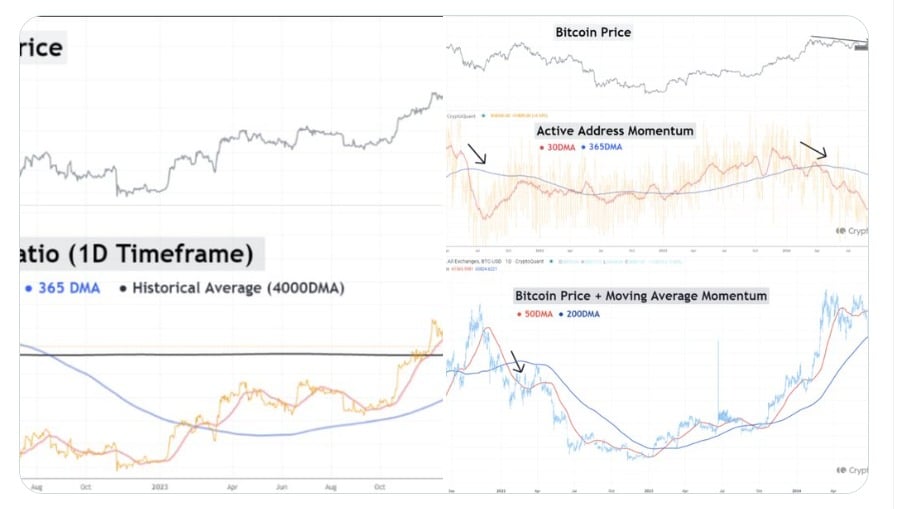

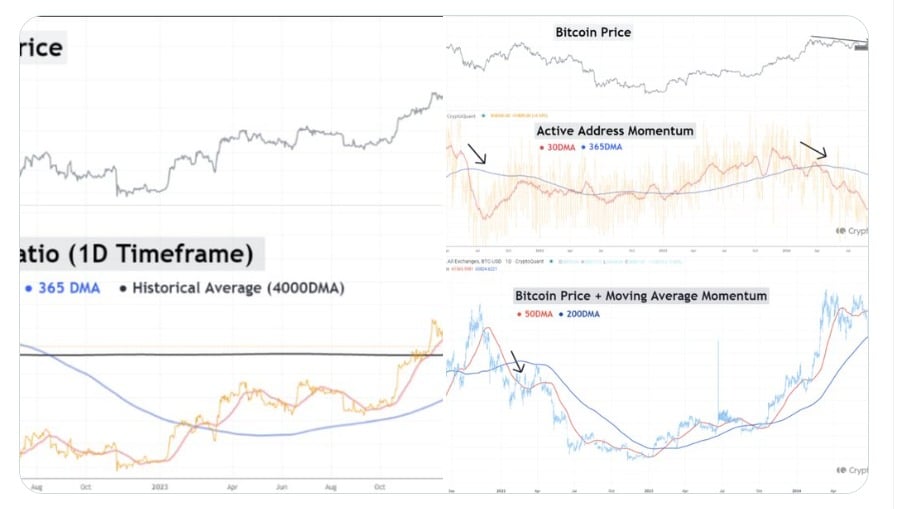

In one X (formerly Twitter) post, the analyst noted that applying moving averages to MVRV and active address revealed a death cross. Such a pattern was observed during the bearish reversal of the 2021 cycle.

Source:

Based on this analysis, the 30DMA fell below the 365DMA, indicating a slowdown in the number of active addresses, which is a bearish signal for the short term. Reduced new and active addresses suggested less activity in the chain.

Furthermore, the analysis showed that the 50DMA was on a downward trend, although it was still below the 200DMA. However, if 50DMA falls below 200DMA, it indicates a bearish trend.

Therefore, both the active address momentum (30DMA below 365DMA) and the possible convergence of the 50 DMA and 200 DMA suggested that the market is entering a short-term bearish phase.

What the Bitcoin graph indicates

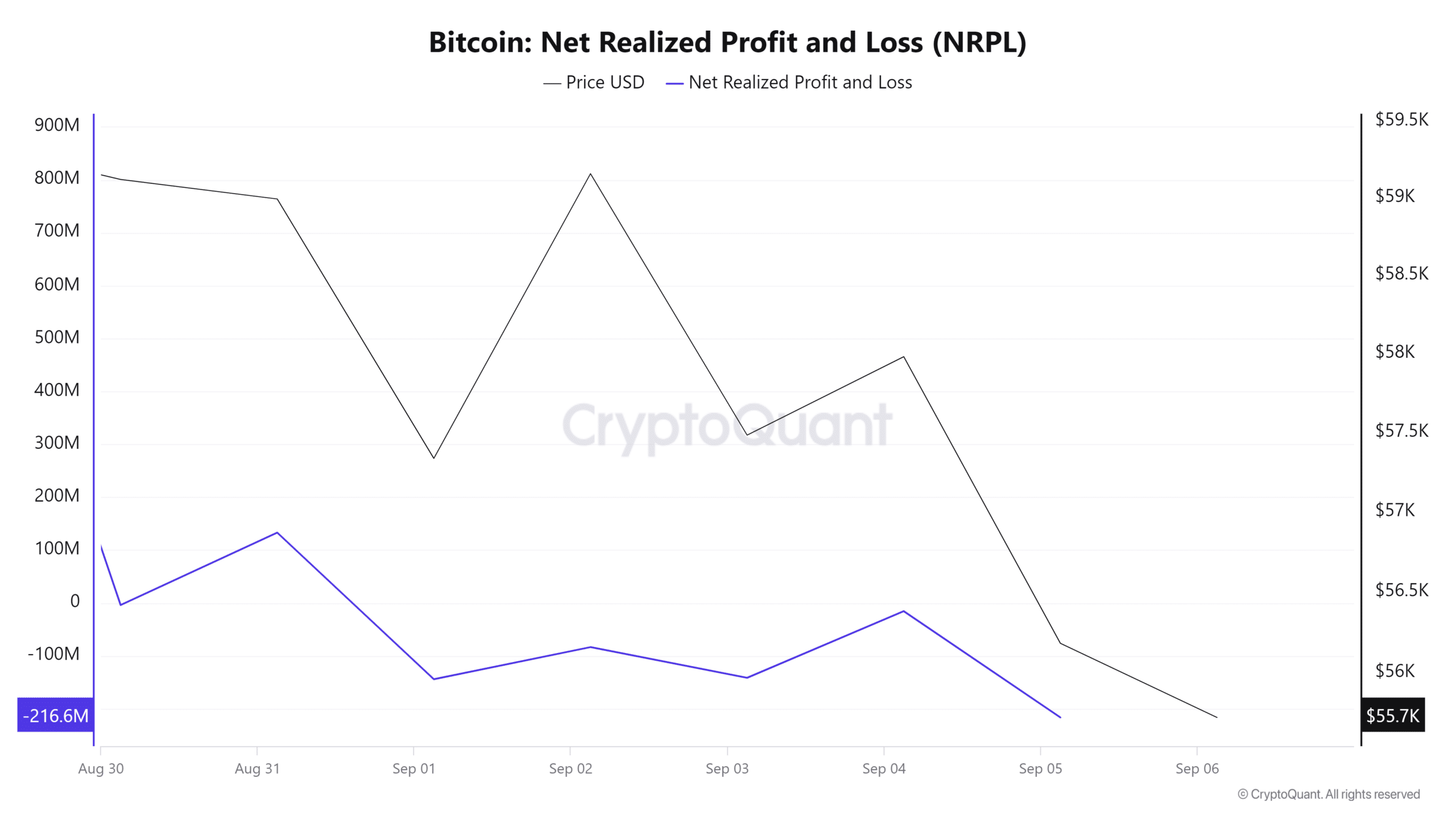

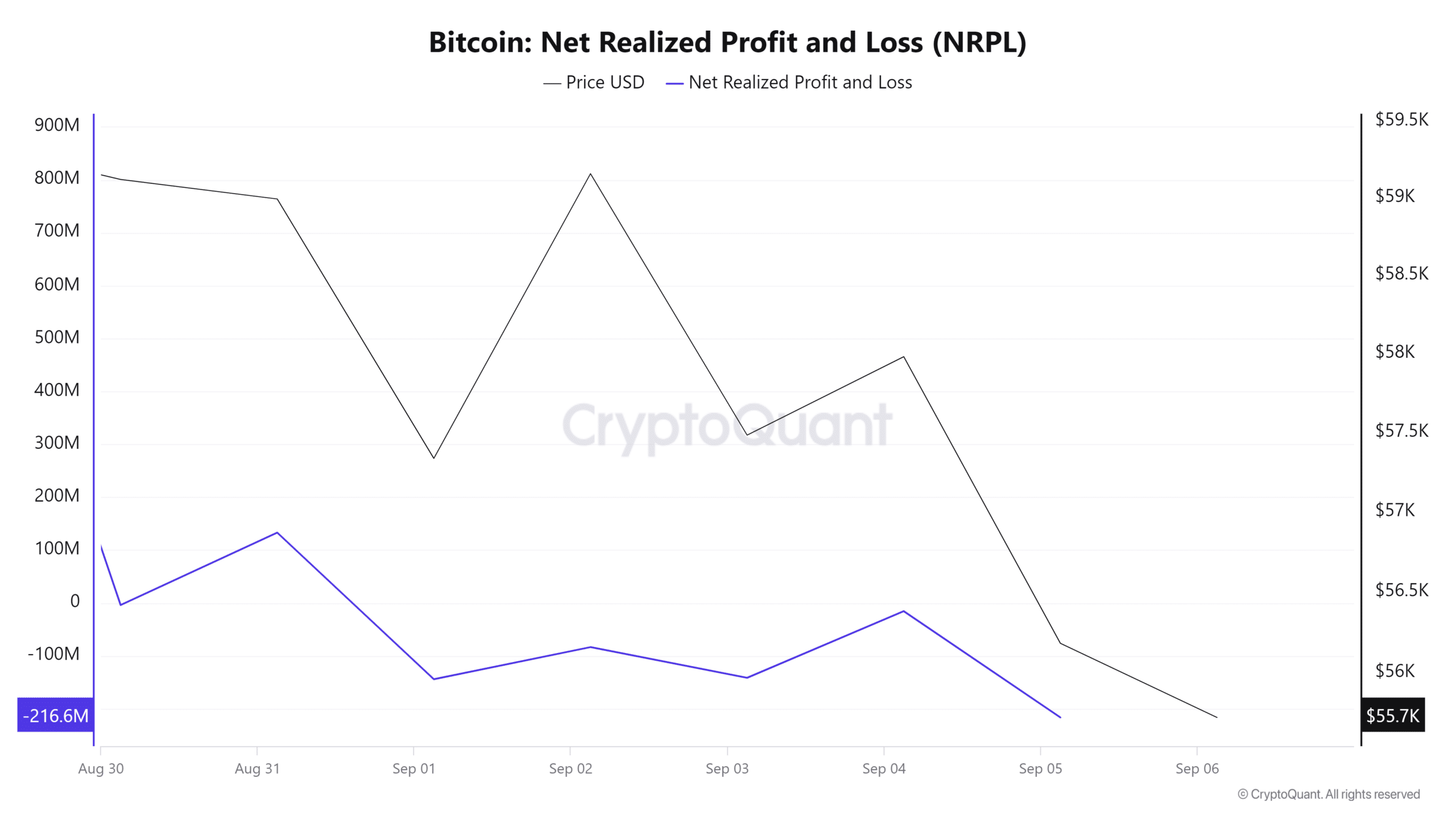

Source: CryptoQuant

Compounding the struggle is that Bitcoin’s net realized gain/loss has been negative for the past seven days. In general, a negative NRPL showed that the market was going through a bearish phase as investors sold at a loss.

When investors are not confident in the future price movements of crypto, they tend to sell to cut their losses.

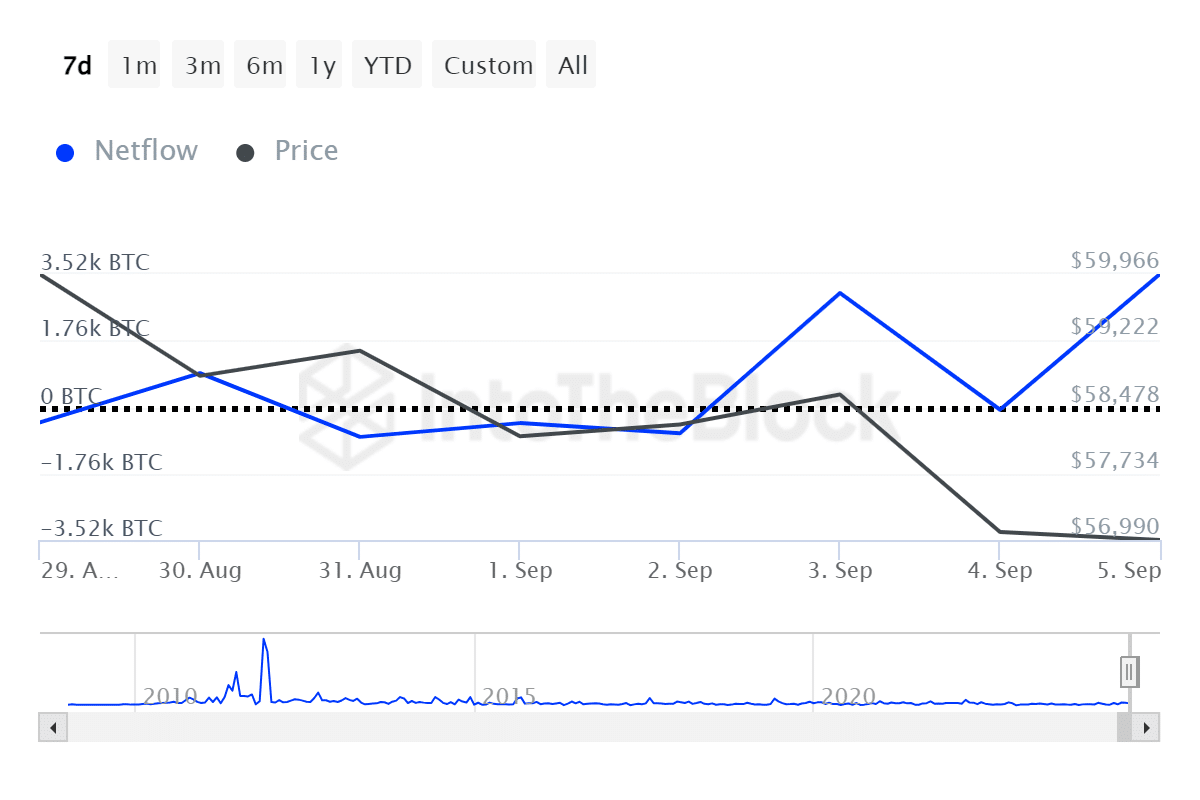

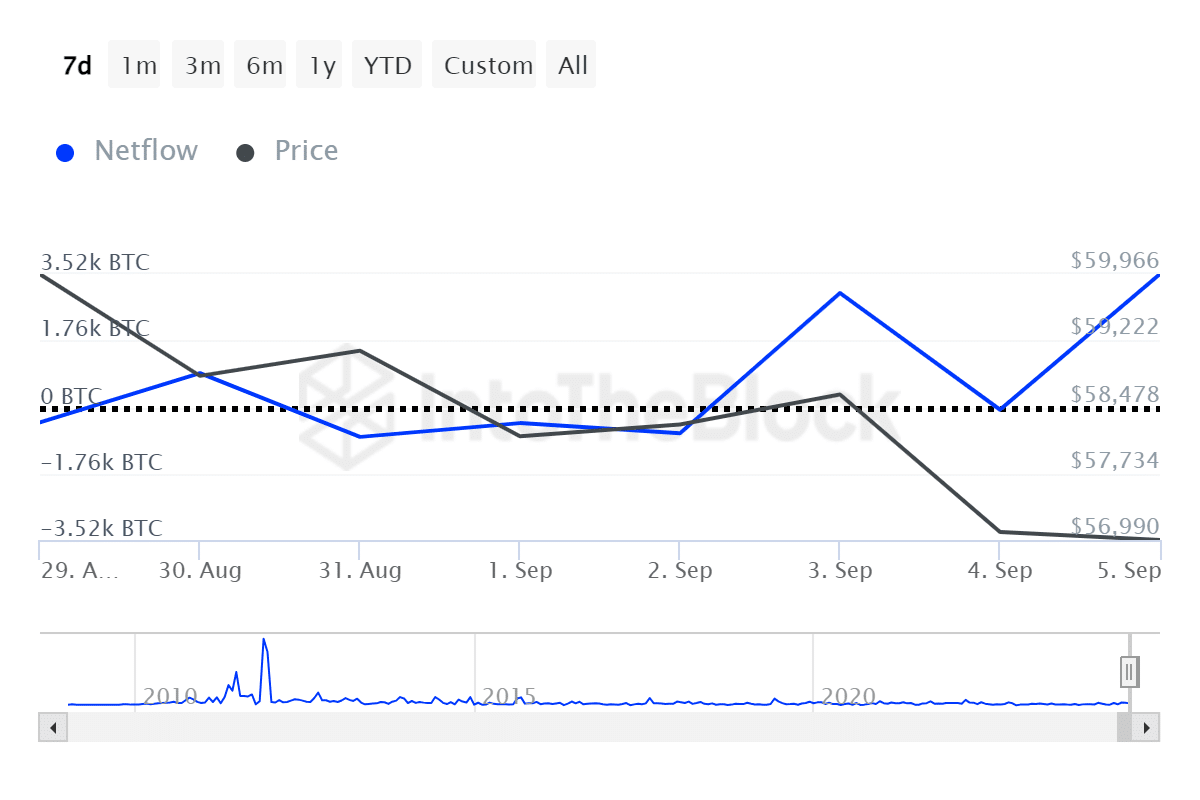

Source: IntoTheBlock

Moreover, in the past seven days, there have been four days of negative inflows from large investors. When large owners transfer their assets to exchanges, this results in selling pressure.

Such an action by whales can lead to a drop in prices, as it indicates a lack of confidence in the future prospects. This is another bearish signal, as large investors expect lower prices or decide to realize their current gains to avoid more losses.

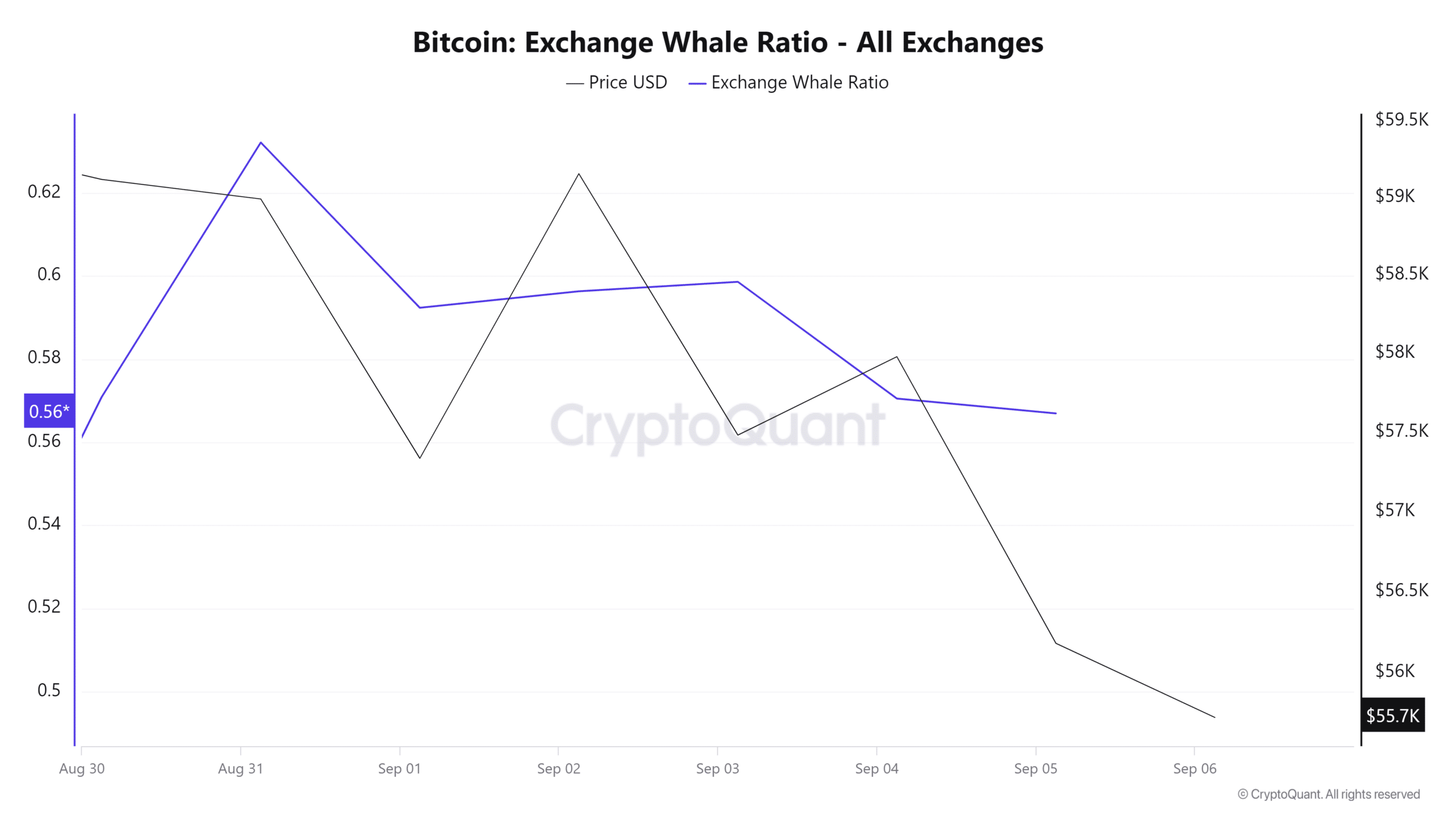

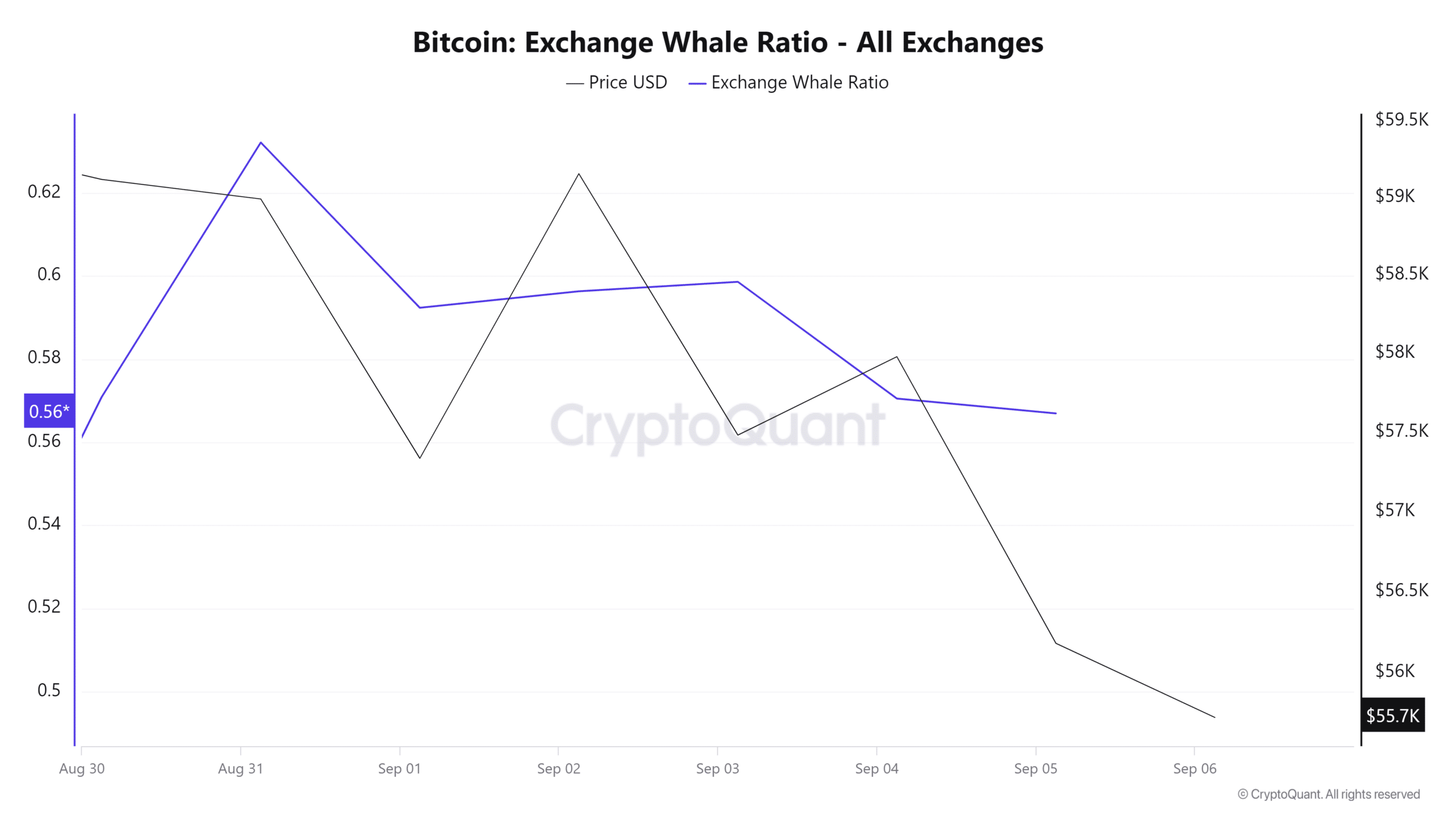

Source: CryptoQuant

Finally, BTC’s whale exchange rate has remained at an average of 50% over the past seven days. This showed that 50% of the inflow into the stock exchanges comes from whale activity.

When whales move their assets to exchanges, it shows that they are preparing to sell, which could result in selling pressure.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Therefore, as Yonsei Dent stated, current market conditions showed a potential further decline.

Therefore, if the prevailing market sentiment continues, BTC will fall to $50670. For a trend reversal, the bulls need to hold a support area at $55k.