- BTC is down 10% in the last 30 days, but still found itself in a declining bullish consolidation.

- One analyst looked at a new ATH based on previous consolidation cycles.

Bitcoin [BTC]the largest cryptocurrency, has suffered a sharp decline in recent weeks. At the time of writing, the king coin was trading as high as $57736, having dropped 9.58% in the past week.

In the month of August, the crypto experienced an extremely volatile market. During this period, the crypto fell to a local low of $49,000 before staging a moderate recovery.

Despite the recent decline, BTC is still 16.6% above the recent local low, consolidating in a down yet bullish trend. Likewise, it was 59.94% above the yearly low of $38,505 recorded earlier this year.

These indicators and market behavior have led analysts to predict a repeat of a bull run 2.0 to a new all-time high. For example, popular crypto analysts Mags sees a new all-time high, citing historical cycles.

Market sentiment

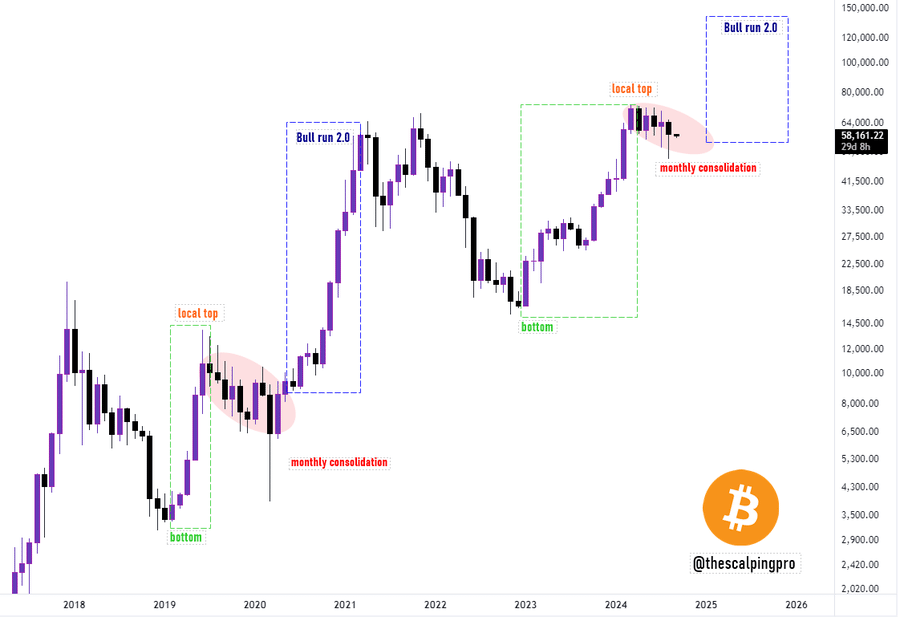

In his analysis states Stockroom tightened the previous two cycles with monthly consolidation, resulting in a new bull run.

Based on the cycle analogy, after BTC reaches a bottom and then a local top, a period of consolidation follows, which is later preceded by a strong bull run.

He shared his analysis via X (formerly Twitter) and noted that:

“Bitcoin – Bull run 2.0 incoming. The current monthly consolidation for BTC looks a lot like the previous cycle, when the price rose all the way to its all-time high.”

Source:

This argument points to the previous bull run, which was the result of months of consolidation.

In particular, consolidation plays a crucial role in stabilizing markets. This period allows the market to absorb the recent price action, preventing extreme volatility.

It also helps reduce speculative pressure as short-term traders tend to close their positions.

With the advent of long-term traders, investors begin to accumulate, gradually increasing demand, resulting in an increase in purchasing activity.

What Bitcoin’s Charts Suggest

Mags believed that a new bull run was imminent for the king coin. The question is: what do other indicators show?

Source: CryptoQuant

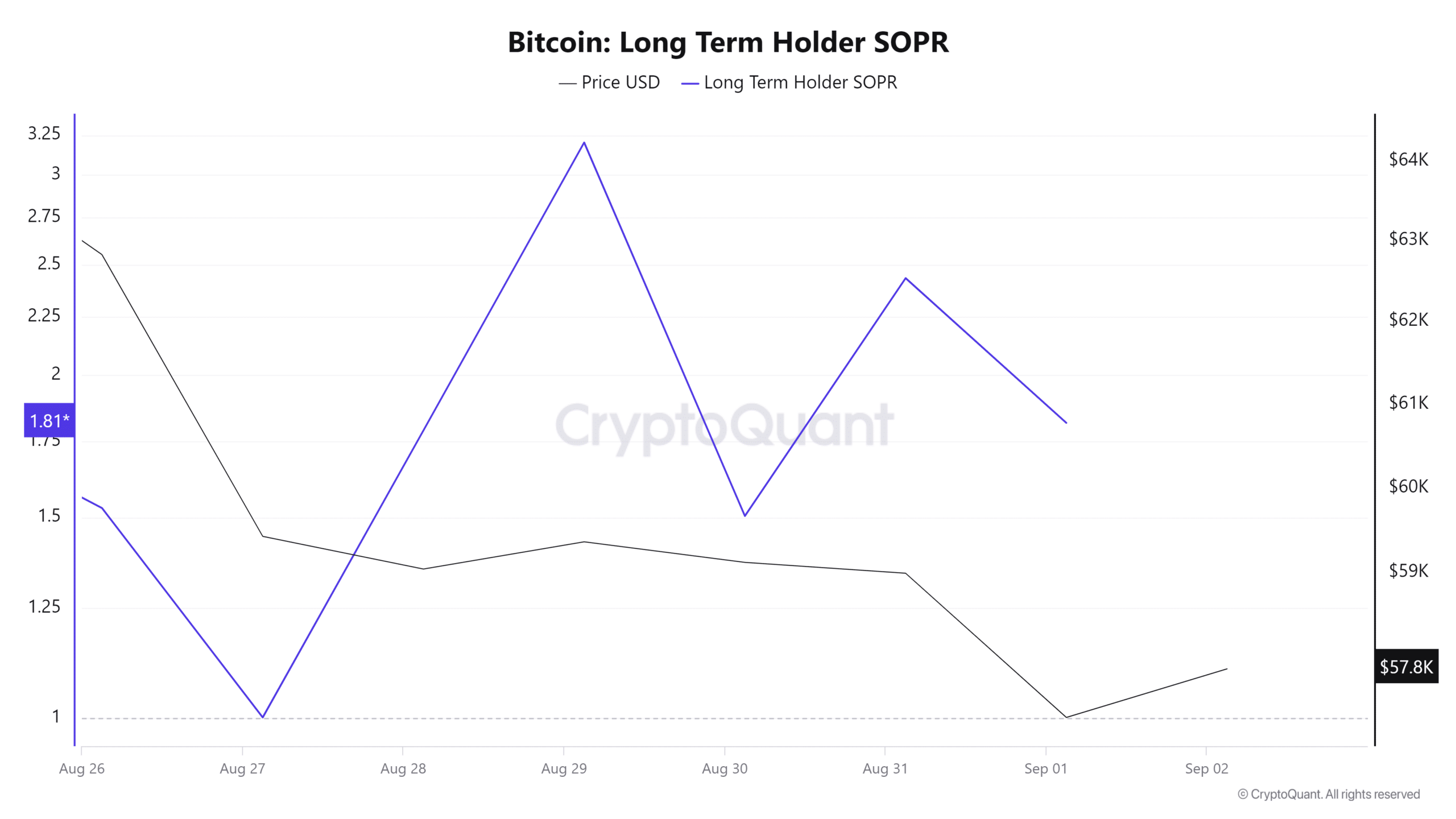

For starters, Bitcoin’s long-term holder SOPR has averaged around one over the past seven days. When the profit rate for long-term holders remains around one, it suggests that crypto is being sold at cost.

This indicates market consolidation, with long-term holders experiencing neither profit nor loss. Such a scenario leaves long-term owners waiting for profitable sales in the future.

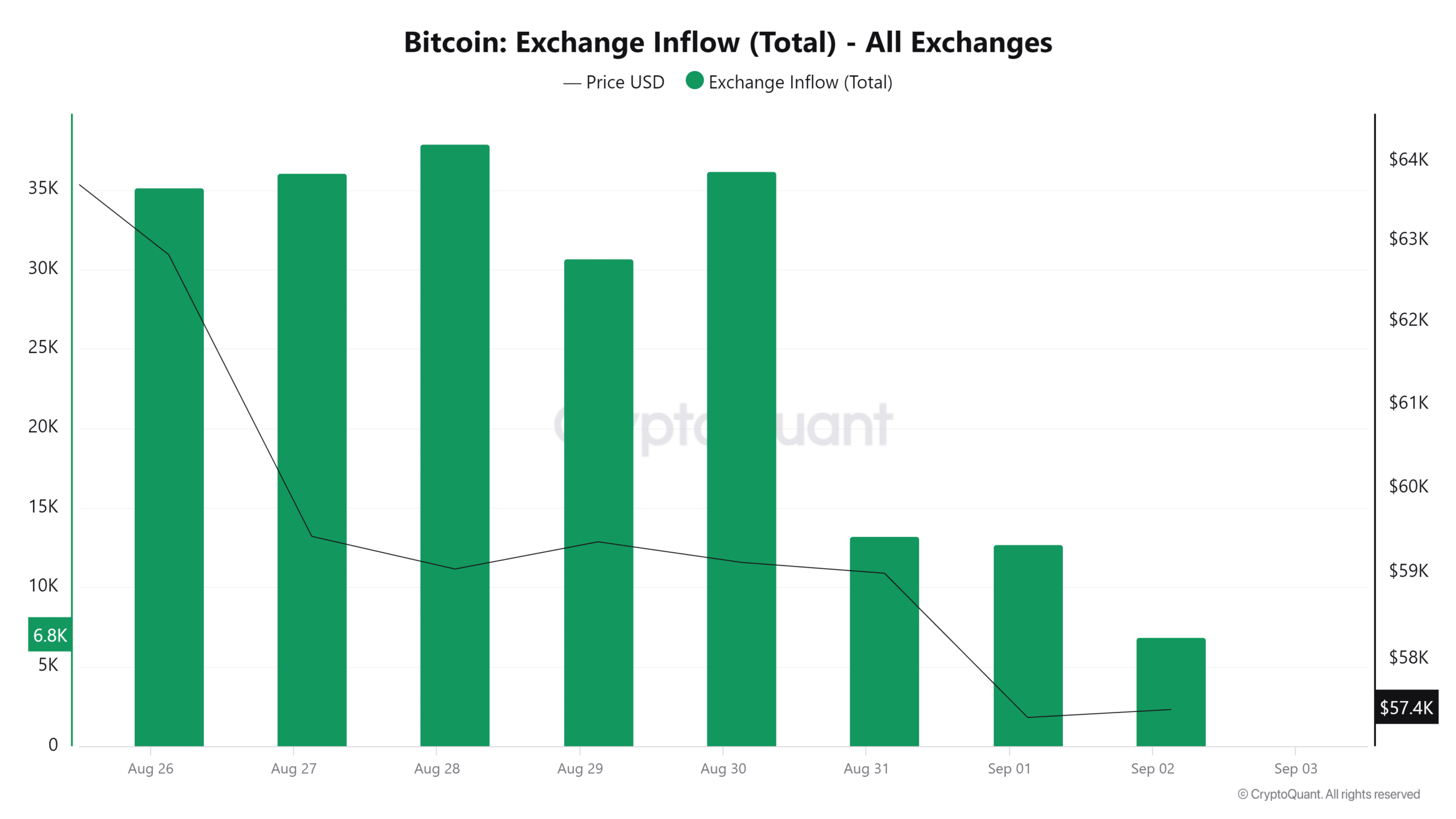

Source: CryptoQuant

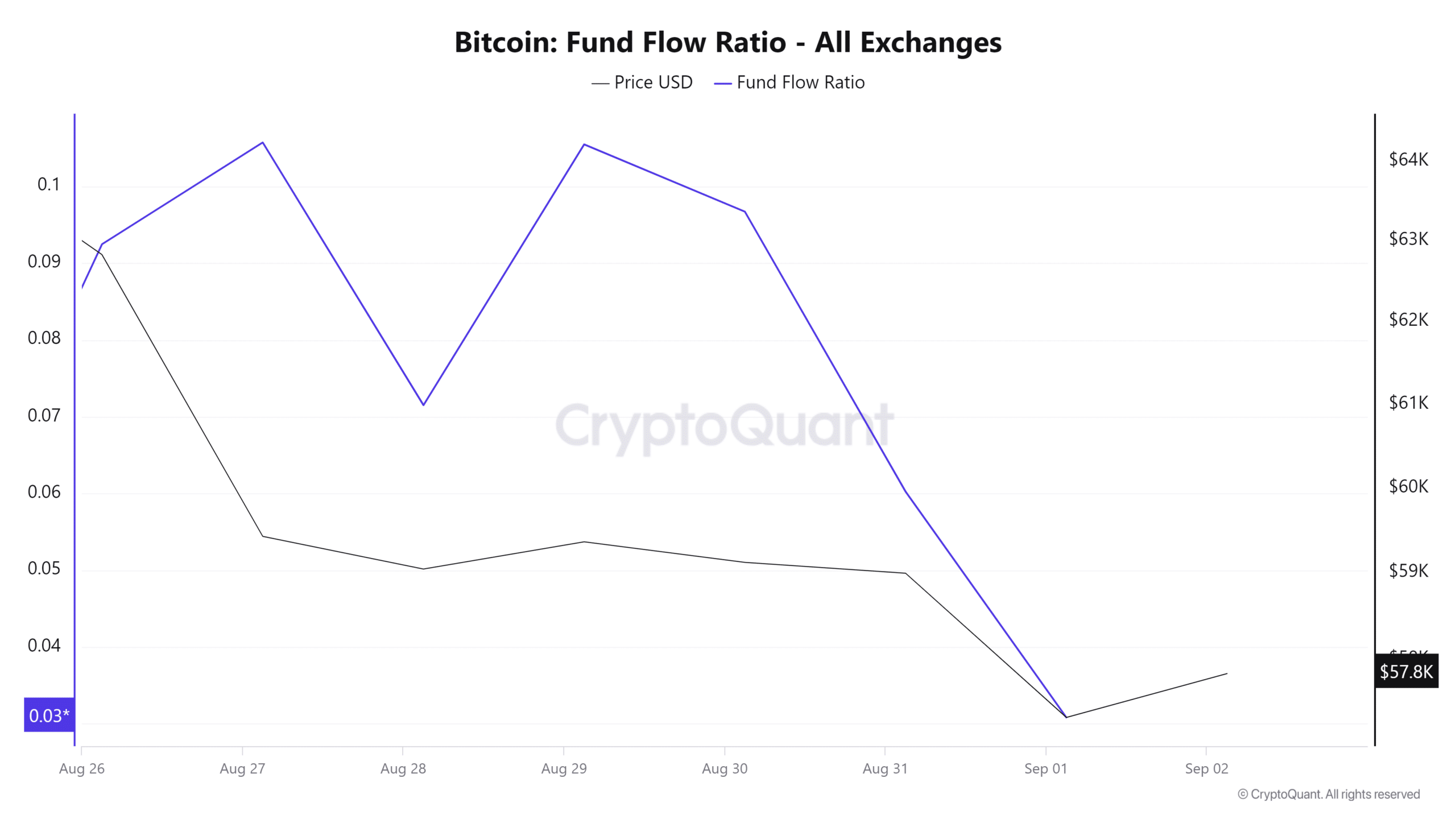

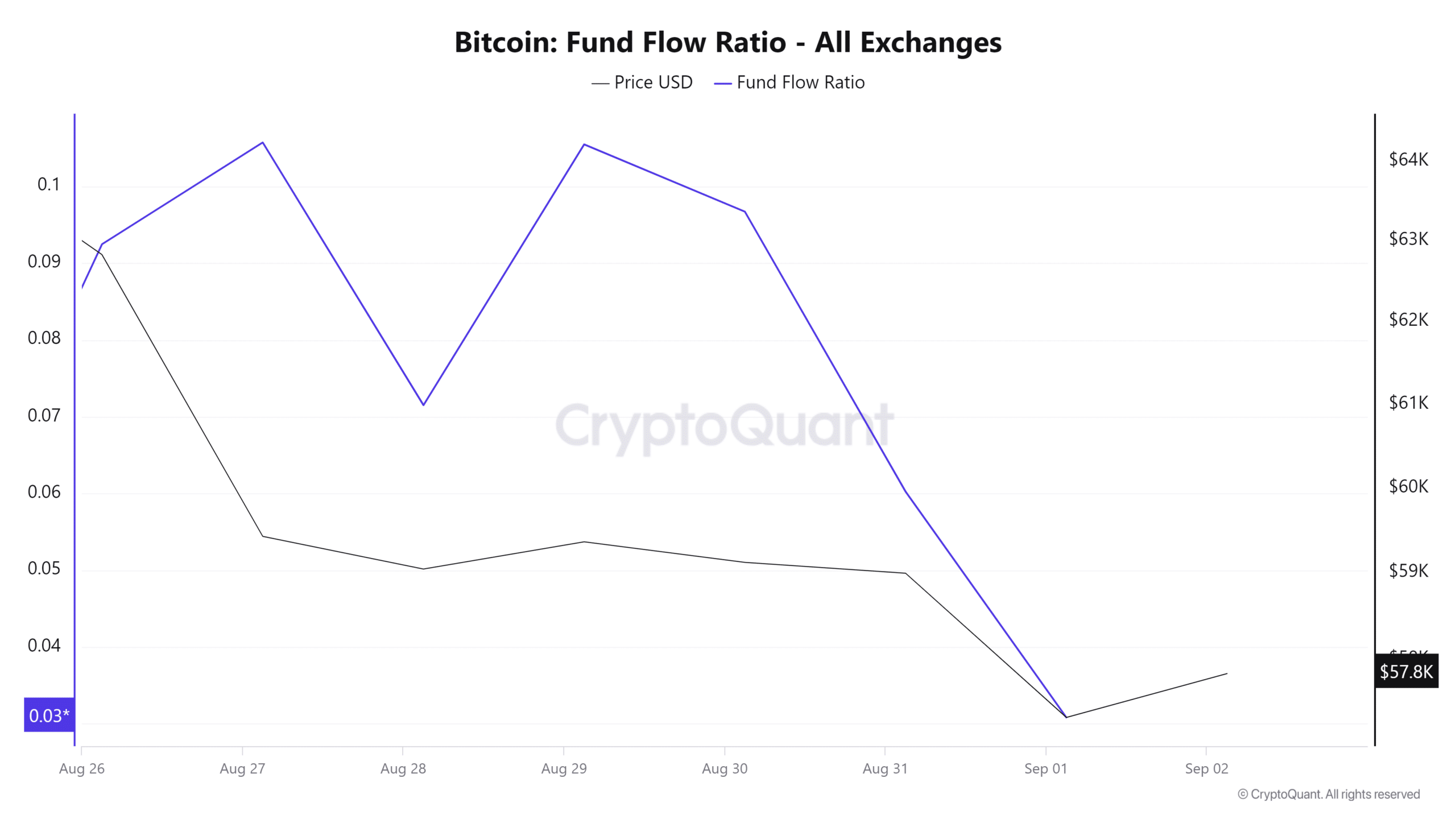

Furthermore, the fund flow ratio has been consistently below 1 for the past seven days. This means that more BTC has been withdrawn from the exchanges, rather than being deposited.

This is a bullish signal, indicating that investors are withdrawing their crypto from exchanges for long-term holdings, reducing the supply available for immediate sale.

Such moves reduce selling pressure and increase demand, which in turn helps in trend reversal.

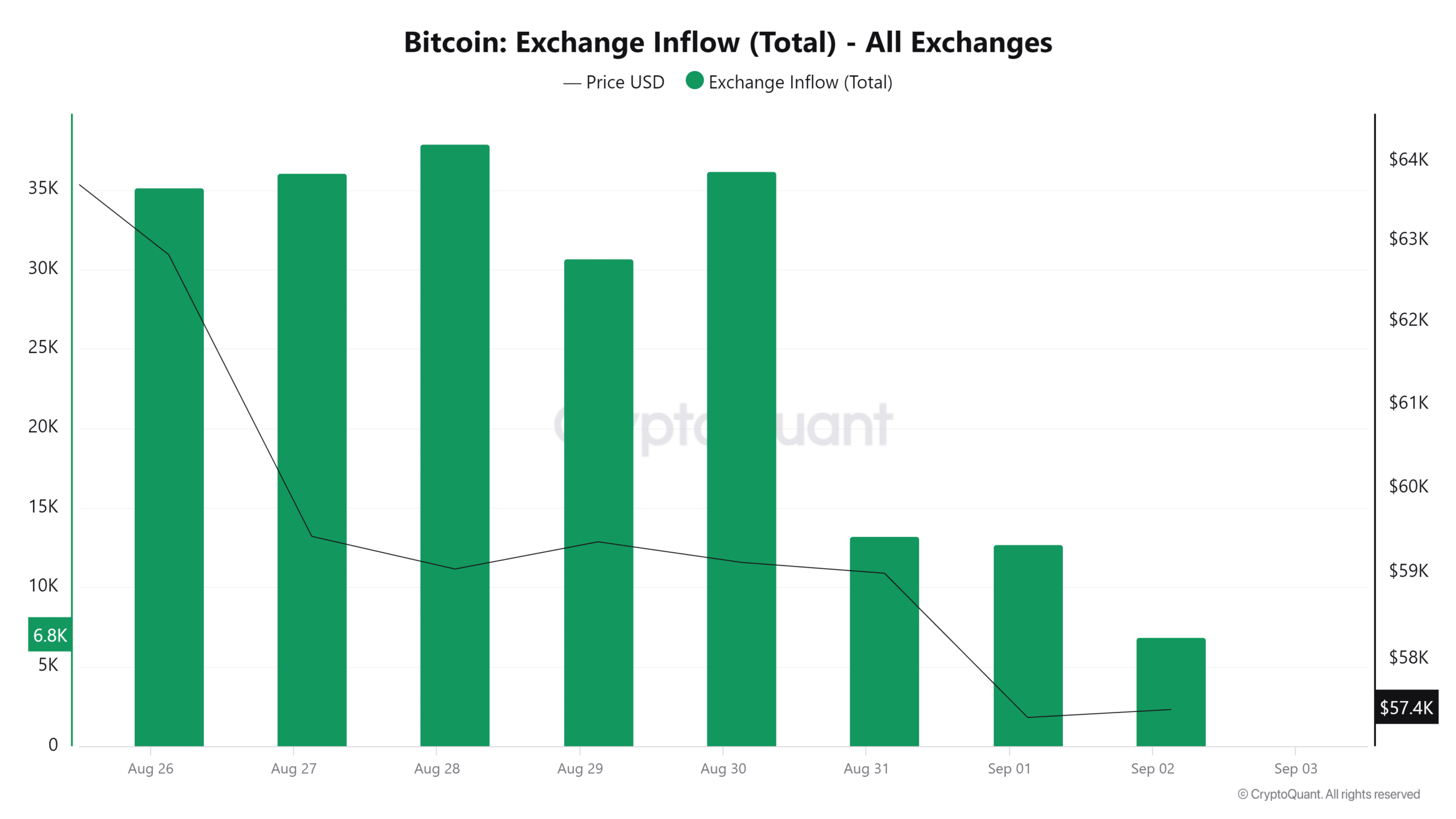

Source: Cryptoquant

Finally, inflows on the BTC exchanges have declined over the past three days, from a weekly high of 37899.7 to a low of 6869. Such a decline in inflows on the exchanges indicates holding behavior as investors expect higher prices.

This market sentiment reduces selling activity, which is bullish as there are fewer coins readily available for trading.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Although BTC has fallen over the past 30 days, it is a downtrend, but a bullish consolidation. As market indecisiveness increases, investors choose to hold, reducing supply.

Such accumulation behavior leads to reduced supply and an increase in demand, allowing bulls to retake the markets. This will lead to BTC breaking above the $61,159 resistance level, possibly heading towards $70,000.