This article is available in Spanish.

The Bitcoin price has already risen 10% in the past seven days and has risen above the $67,000 mark again in the past few hours. The Coinmarketcap Fear And Greed Index has done just that now switched to greed in light of the recent buying momentum and shows no signs of slowing down.

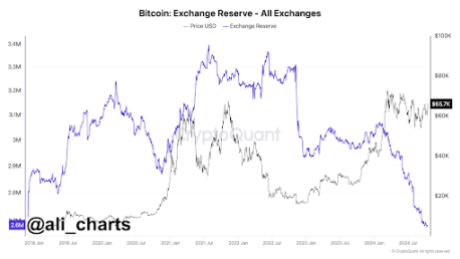

The buying pressure on Bitcoin has been so large in recent days, leading to a massive drop in the amount of BTC available on crypto exchanges. According to on-chain data, this has caused the Bitcoin exchange reserve to fall to a five-year low.

BTC Exchange Reserve Falls to 5-Year Low

In recent days, demand for Bitcoin has exceeded supply, leading to a sharp decline in foreign exchange reserves. According to CryptoQuant data reposted by crypto analyst Ali Martinez on social media platform

Related reading

Martinez’s chart reveals an intriguing trend in Bitcoin’s foreign exchange reserves that has been developing throughout the year. At the beginning of 2024, reserves amounted to approximately 3.05 million BTC. However, this number has fallen dramatically since then.

The declining supply of Bitcoin on exchanges could be that attributed to a number of key factors. First, there is the growing interest from institutional players, especially after the approval and growing momentum of Spot Bitcoin ETFs. These ETFs have led to significant purchasing activitywith the US-based Spot Bitcoin ETFs ultimately becoming the second largest holders of BTC after Satoshi Nakamoto.

Many long-term holders also contributed to the buying pressure as many continued to buy in droves. Even periods of price corrections and sell-offs by short-term holders were highlighted by the movement of more BTC in stable hands for the long term that will sell less quickly.

As a result, the total amount of Bitcoin held on crypto exchanges has fallen by approximately 450,000 BTC since January, bringing the current reserve to just 2.6 million BTC. This is the lowest level since January 2019, and such a sharp decline usually signals a bullish outlook for Bitcoin. “We all know what this means,” Martinez said said.

What does this mean for the Bitcoin price?

The current state of Bitcoin’s foreign exchange reserves suggests that market participants are increasingly holding on to their BTC in anticipation of future gains, as many people continue to speculate on where the Bitcoin price could go in the coming months.

Related reading

When there are fewer coins available on exchanges, it often indicates reduced selling pressure, pushing the price higher as demand continues to rise.

Uptober is now fully in playand Bitcoin is already up 6.3% this month. At the time of writing, Bitcoin is trading at $67,200. This remarkable price puts Bitcoin on track to surpass its all-time high of $73,737 before the end of October.

Featured image created with Dall.E, chart from Tradingview.com