- BTC fell 6.31% last week.

- One analyst noted even more downsides, citing the Pi Cycle MA.

While October is usually associated with an uptrend, Bitcoin’s is [BTC] the recent price action has failed to reflect this. As such, BTC has experienced a sharp decline over the past week. At the time of writing, Bitcoin was trading as high as $61,436.

This marked a drop of 6.31% in the weekly charts.

However, over the past 24 hours, there has been a slight recovery on the BTC price charts, with an increase of 0.92%. Bitcoin is also in an uptrend on the monthly charts, up 8.18%.

Therefore, the lack of clear direction regarding price movements has left the crypto community talking. One of them is the popular crypto analyst Rekt Capital, which suggested that BTC is poised for a further downtrend.

A look at market sentiment

In its analysis, Rekt Capital stated that BTC is continually rejected by the PI Cycle MA.

Source:

According to this analysis, as long as PI Cycle MA acts as resistance, BTC will continue to form a downtrend. So BTC will confirm the downtrend if it marks the light blue downtrend, especially if the current trend continues.

However, the analyst also noted that buyers are starting to accumulate even as the price continues to decline. This was demonstrated by the fact that BTC is starting to form a four-hour bullish divergence.

In context, repeated rejections from this level indicate that buyers are struggling to push prices above resistance.

Therefore, any rejection adds to bearish pressure, highlighting that Bitcoin is currently facing a supply barrier, halting its momentum.

So, based on this example, BTC will experience a further decline on its price charts if current market sentiment continues.

What Do BTC Charts Suggest?

Notably, the above analysis provides a detailed bearish outlook for Bitcoin. However, it is essential to determine what other market indicators are saying.

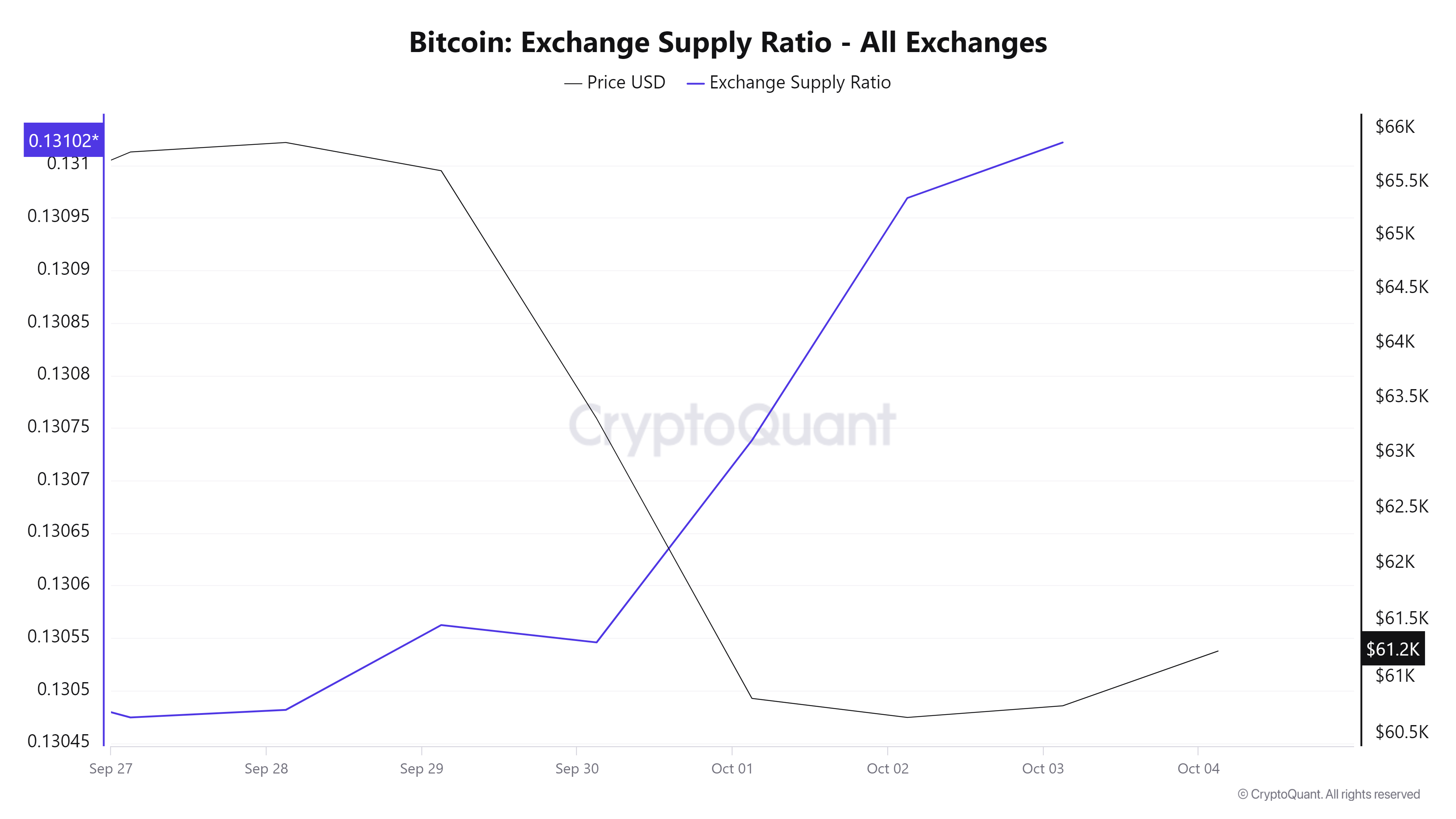

Source: Cryptoquant

First, Bitcoin’s supply ratio has increased from 0.1304 to 0.131 in recent days.

The spike in stock market supply implies that investors are pouring their assets into stock exchanges to sell. Such market behavior causes downward price pressure, especially if sales activities intensify.

Source: Santiment

Additionally, Bitcoin’s MVRV Long/Short differential has narrowed over the past seven days, from a high of 4.3% to 3.2%.

This decline signals weaker confidence among long-term owners as their profitability margins decline. The shift signals bearish sentiment as long-term holders have less incentive to hold their positions.

Source: Santiment

Furthermore, this lack of confidence among investors is illustrated by declining Open Interest (OI) per exchange. OI fell from $6.1 billion to $5.2 billion. Such a drop indicates that investors are closing their positions without opening new ones.

Read Bitcoins [BTC] Price prediction 2024–2025

Simply put, current market sentiment is bearish.

Therefore, if these conditions persist, Bitcoin will find the next support around the $58272 resistance level. Next, a trend reversal will see BTC reclaim $62,700.