- BTC has been heavily shorted over the past three days, but the recent price surge has increased liquidation.

- Bitcoin investors’ FUD and doubts about the rally will push prices higher, indicating volatility.

Bitcoin [BTC]the largest cryptocurrency by market capitalization, has recently made a moderate recovery on its price charts. At the time of writing, BTC was trading as high as $57110, after gaining 4.27% over the past day.

As prices recovered, trading volume rose 53.38% over the day to $33.57 billion. Moreover, BTC’s market capitalization increased by 4.24% to $1.13 trillion.

Before this rise, BTC was in a strong downward trajectory, falling 6.54% over the past 30 days. Therefore, despite the recent gains, the price remained relatively low from the recent high of $65103 and down 22.8% from the ATH.

Current market conditions are giving BTC signs of life, with analysts showing optimism. For example, Santiment analysis suggested further price increases, citing Bitcoin’s market value.

What market sentiment says

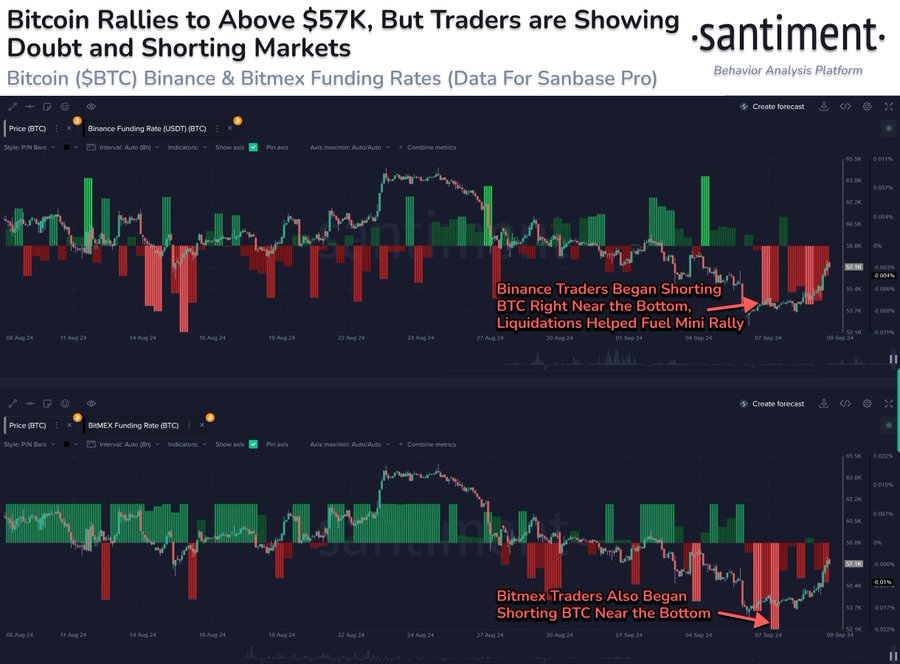

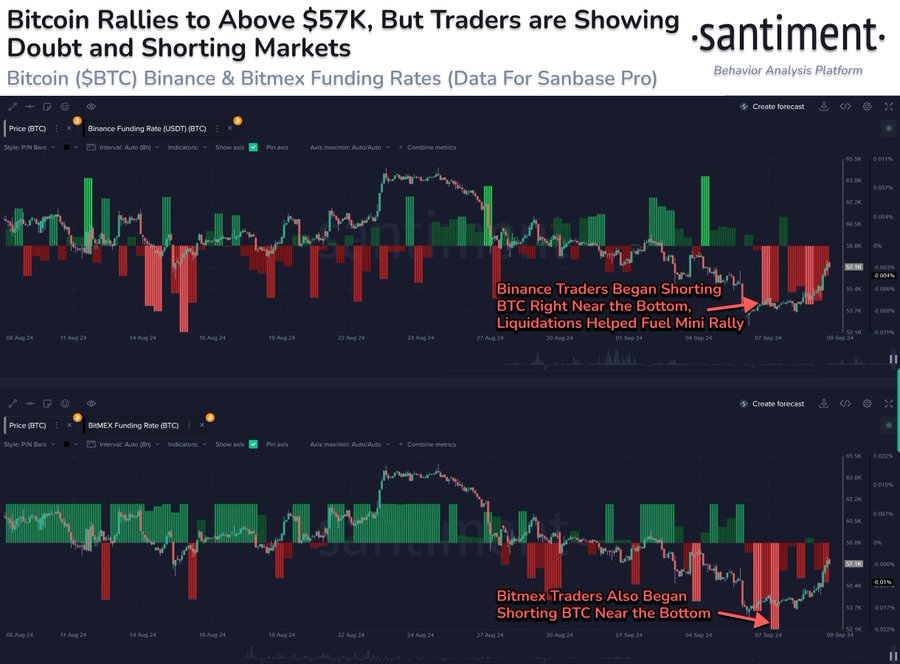

Santiment noted that the value of BTC has increased over the past 24 hours, although it has been shortened over the past four days on major exchanges such as Binance and Bitmex.

Source: Santiment

In this context, many traders are betting that BTC prices will fall. Typically, shorting occurs when traders borrow and sell BTC, with the intention of buying it again at lower prices.

So the heavy short positions since Saturday imply that many traders are expecting prices. This market sentiment is usually driven by FUD, as investors lack confidence in the price direction and expect a pullback.

However, if prices do not fall as short sellers expect and rise, they will come under pressure.

These investors are forced to buy back the assets they borrowed to cover their positions, especially when there is a risk of greater losses. As noted by the gains over the past 24 hours.

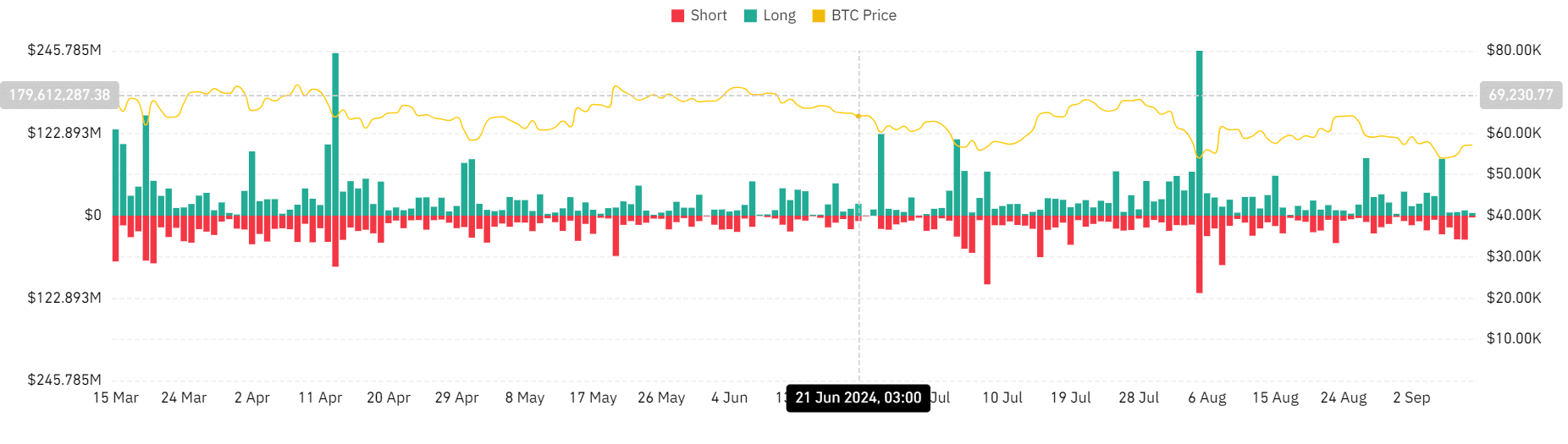

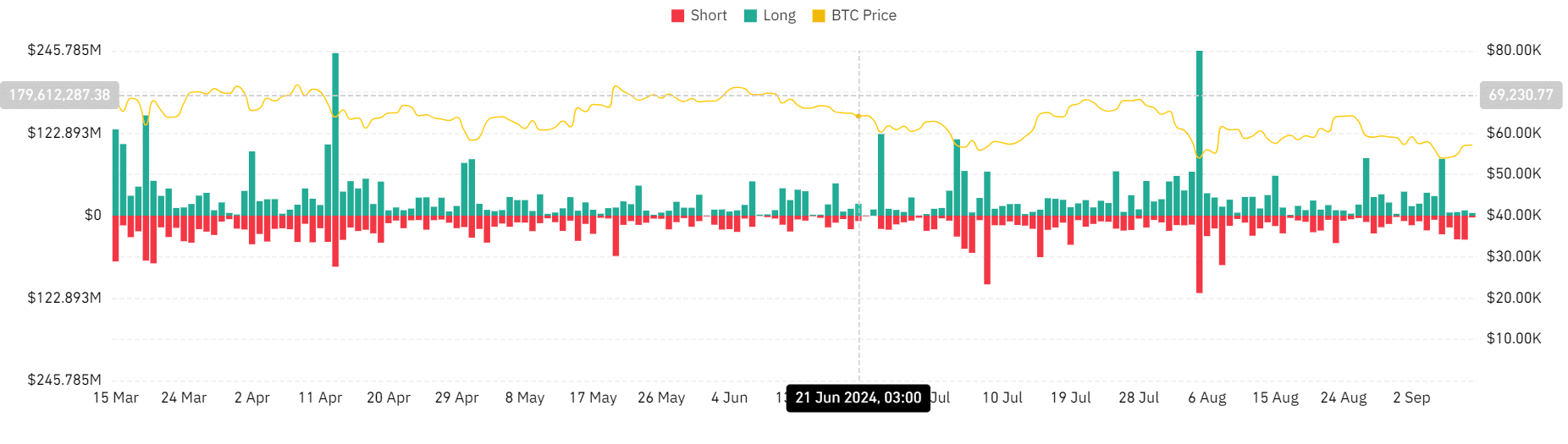

Source: Coinglass

Thus, the price increase has resulted in increased liquidation of short positions, indicating market volatility. This forced buying results in increased demand, which causes prices to rise, resulting in a short squeeze.

Bitcoin price charts

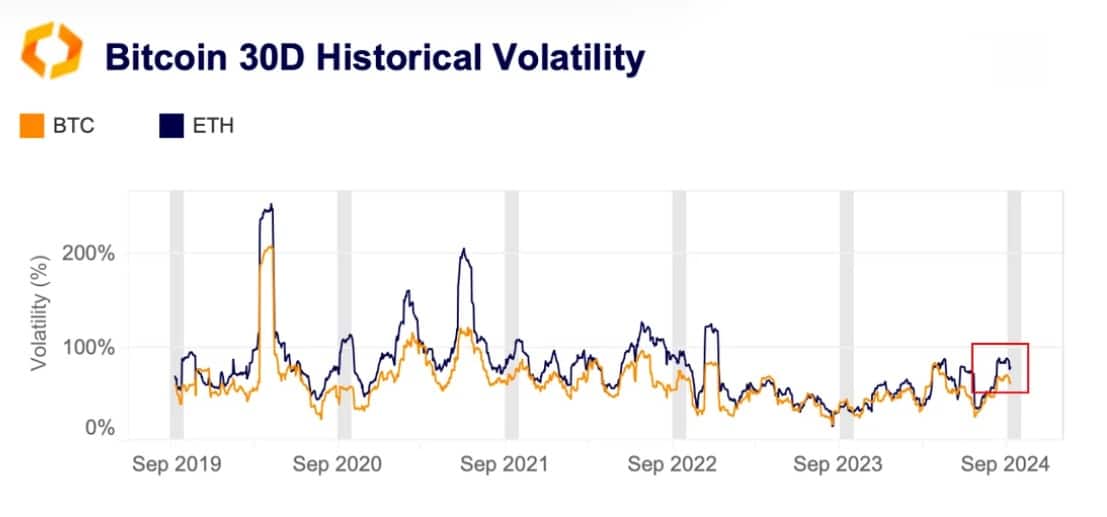

As noted by Santiment, the Bitcoin market is experiencing greater uncertainty, resulting in greater volatility. Normally, September is historically associated with volatility, with BTC’s 30-day volatility surging 70% this year.

Source: Kaiko

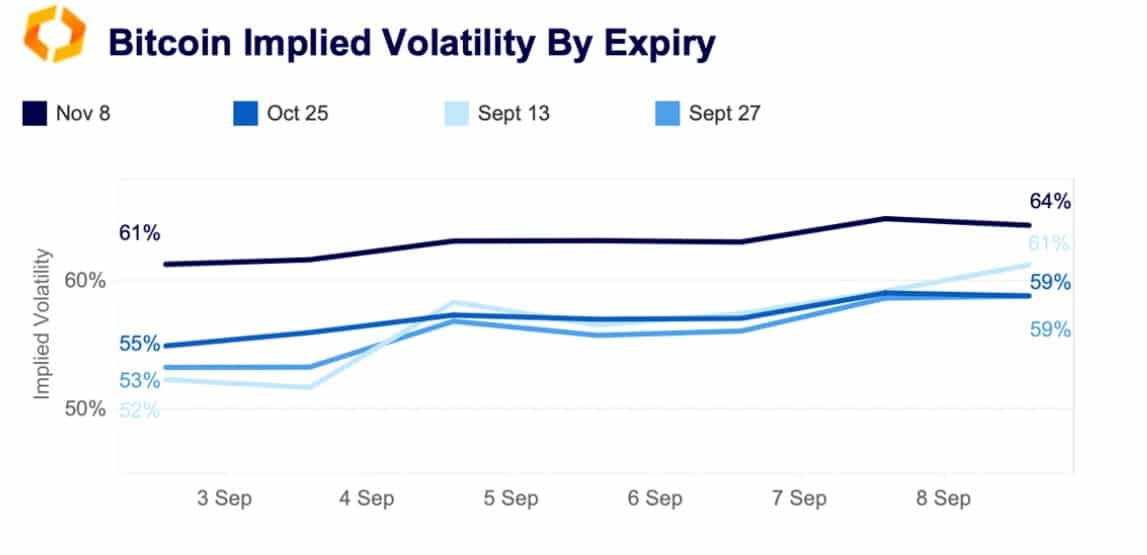

So indicators such as implied volatility have risen since the beginning of September, after falling in August. Short-term options in particular are up 60% from 52%.

Source: Kaiko

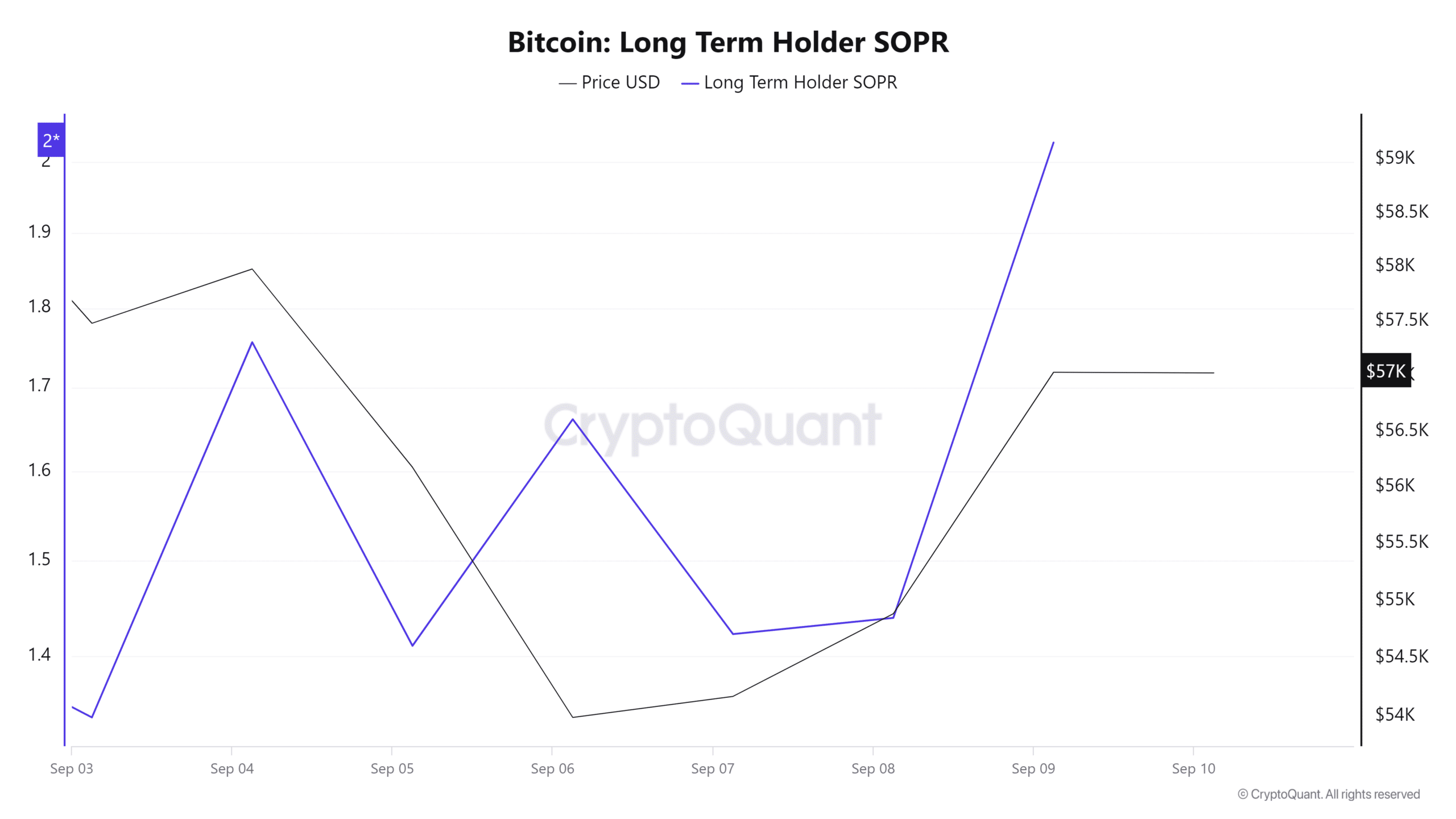

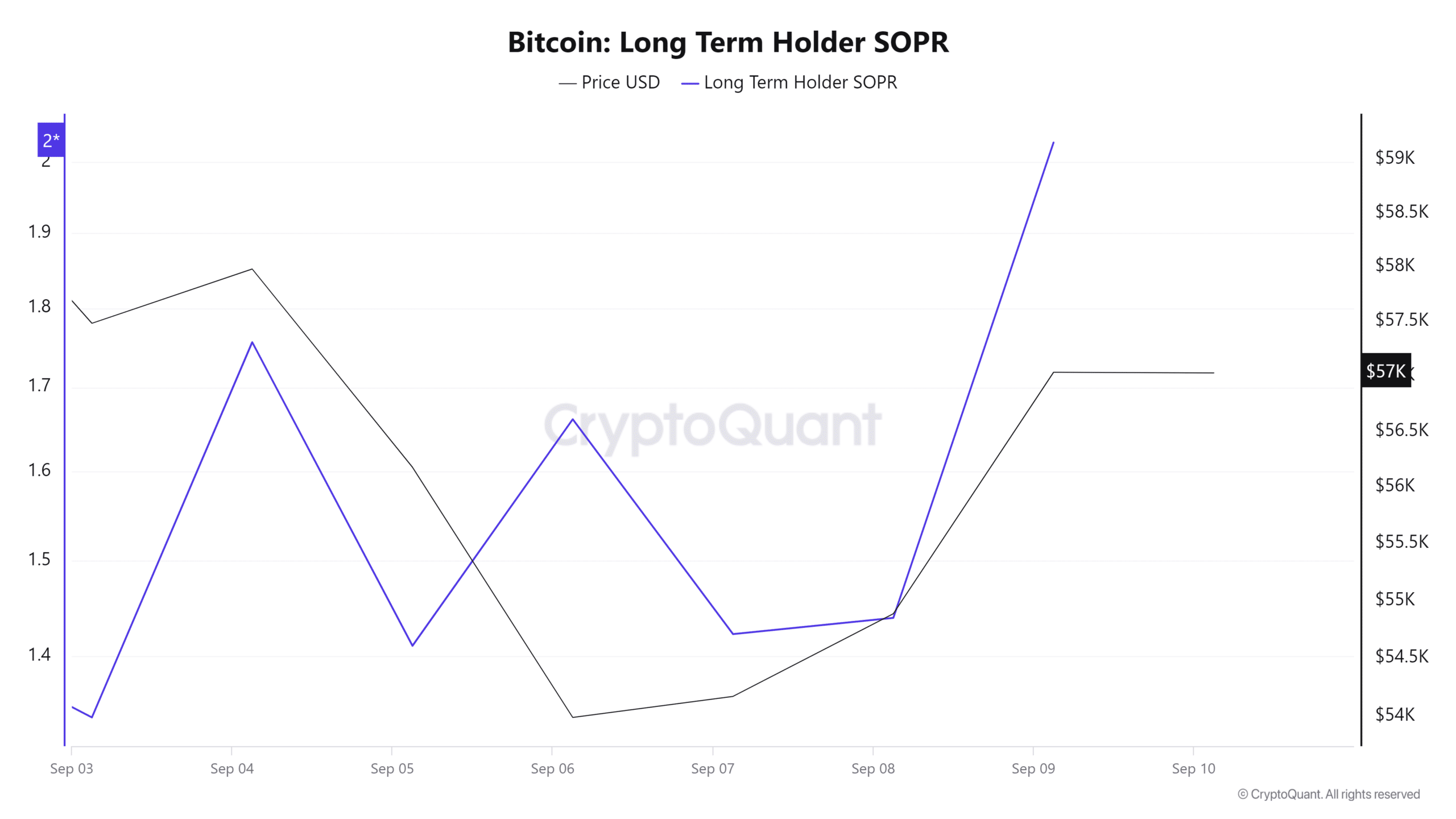

In addition, the upcoming US presidential elections are contributing to the current market uncertainty. This FUD is further supported by a sudden increase in the Long Term Holder SOPR from 1.4 to 2.0.

So even though prices rise, they may experience a pullback in these sales to close realized gains.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price forecast 2024–2025

Therefore, the demand for short positions means that investors expect prices to fall. However, the demand for short positions can lead to increased demand, further resulting in further price increases.

If FUD pushes prices higher, BTC will challenge and strengthen the USD 59363 resistance to cross the USD 60,000 mark.