- BTC has fallen 3.64% in 24 hours.

- Analysts predict a further decline if the support at $55,355 does not hold.

Defying market trends, Bitcoin [BTC] saw a green September. However, it has seen a sharp decline in the past two days. At the time of writing, Bitcoin was trading at $61,407. This marked a drop of 4.31% on the weekly charts.

Previously, BTC was on an upward trajectory with an increase of 5.99% on the monthly charts. However, since hitting a high of $66,508, it has fallen to a low of $60,164.

This recent price movement has sparked widespread debate within the crypto community. To that extent a popular crypto analyst Bitcoin guy suggested a possible decline, citing the ABC structure on Elliot’s wave -B.

What the analysis shows

The analyst stated that BTC has broken a micro support, which could lead to a further decline.

Source:

According to this analysis, the market is bearish, which would result in two scenarios.

The first scenario is that BTC will form an ABC correction where Wave-A has started and prices are falling. The key here is that Wave-B will fail to push the price above previous highs. Therefore, in this scenario, BTC would hold its support above $55,355.

However, in the second scenario, Bitcoin will break below the $55,355 support level, entering a five-wave structure to the downside, indicating a much steeper decline.

ManofBitcoin’s analysis suggests a potential downside following the recent price movement. However, it is essential to determine what other fundamental factors suggest.

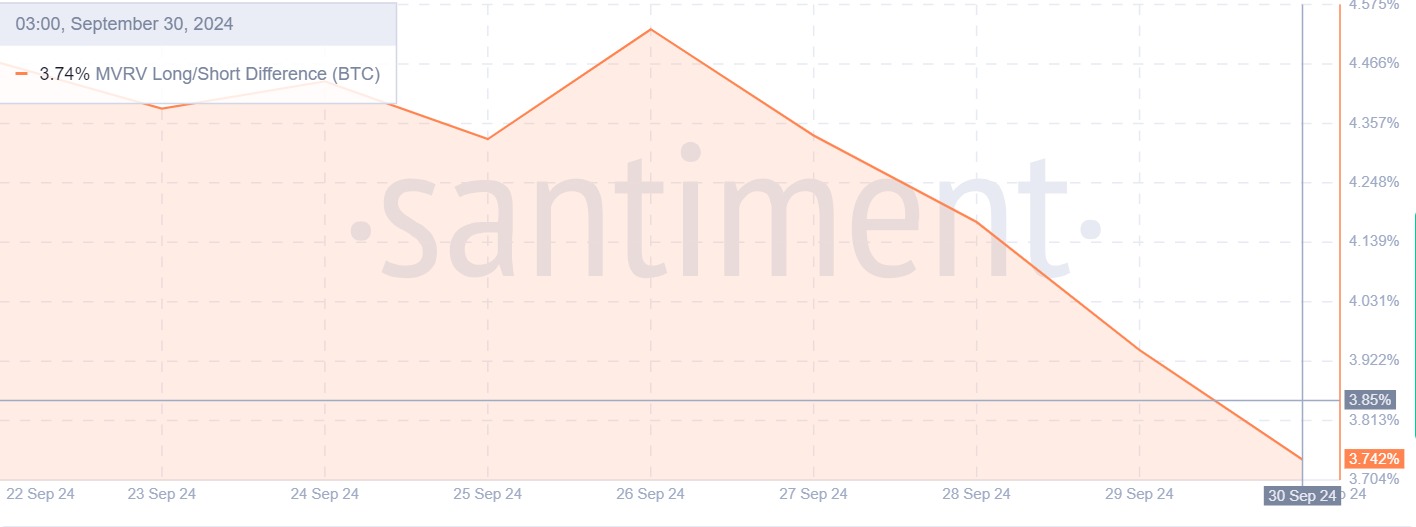

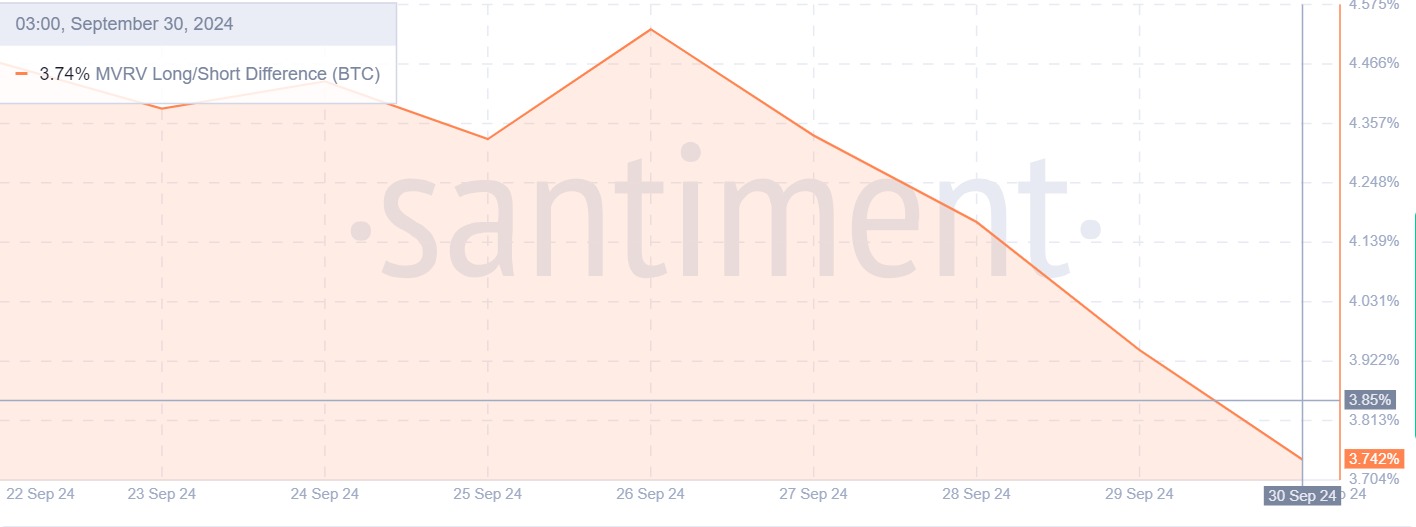

Source: Santiment

For starters, Bitcoin’s price-DAA divergence has remained negative over the past week. This suggests that BTC’s current price increase is not supported by fundamentals as on-chain activity has declined.

Such market conditions imply that price growth is unsustainable as it indicates a lack of confidence and declining interest.

Source: Santiment

Furthermore, MVRV’s long/short differential has narrowed from a high of 4.5% to 3.7% over the past week. Such a decline indicates that the market is at a stage where long-term holders are no longer willing to hold as much, and short-term holders may sell to avoid losses.

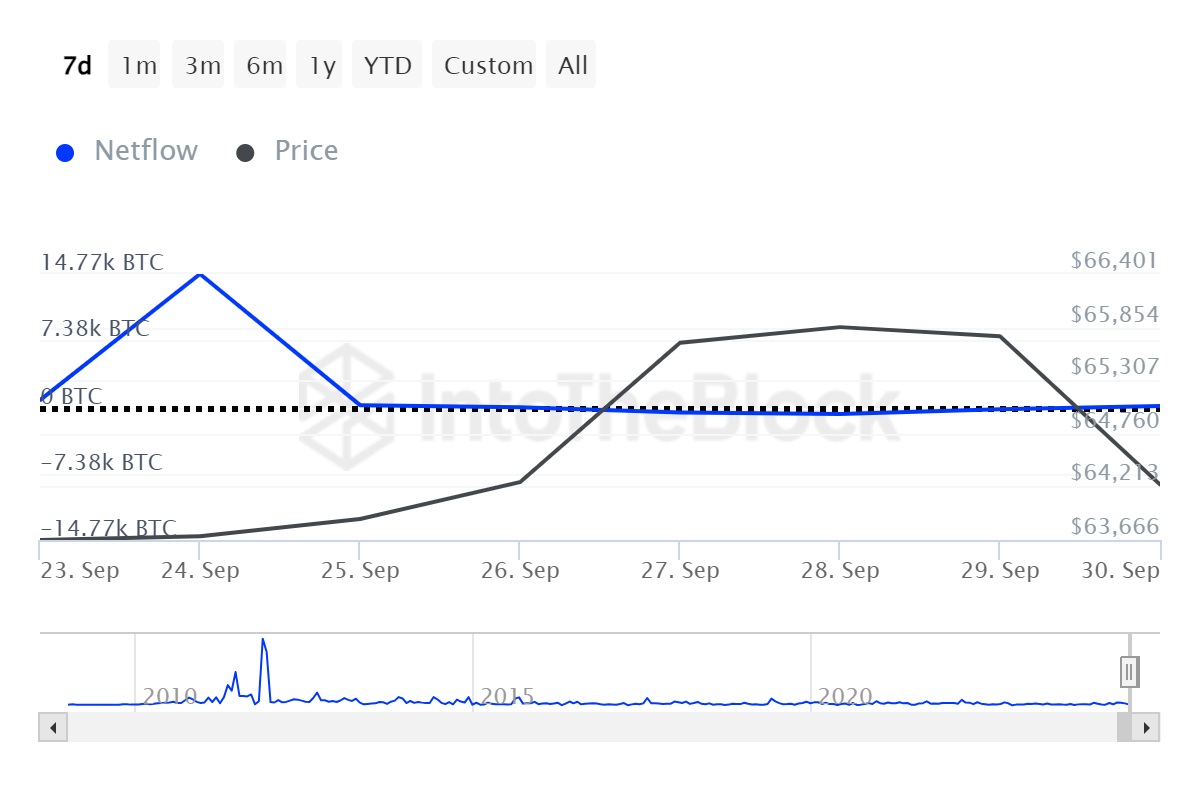

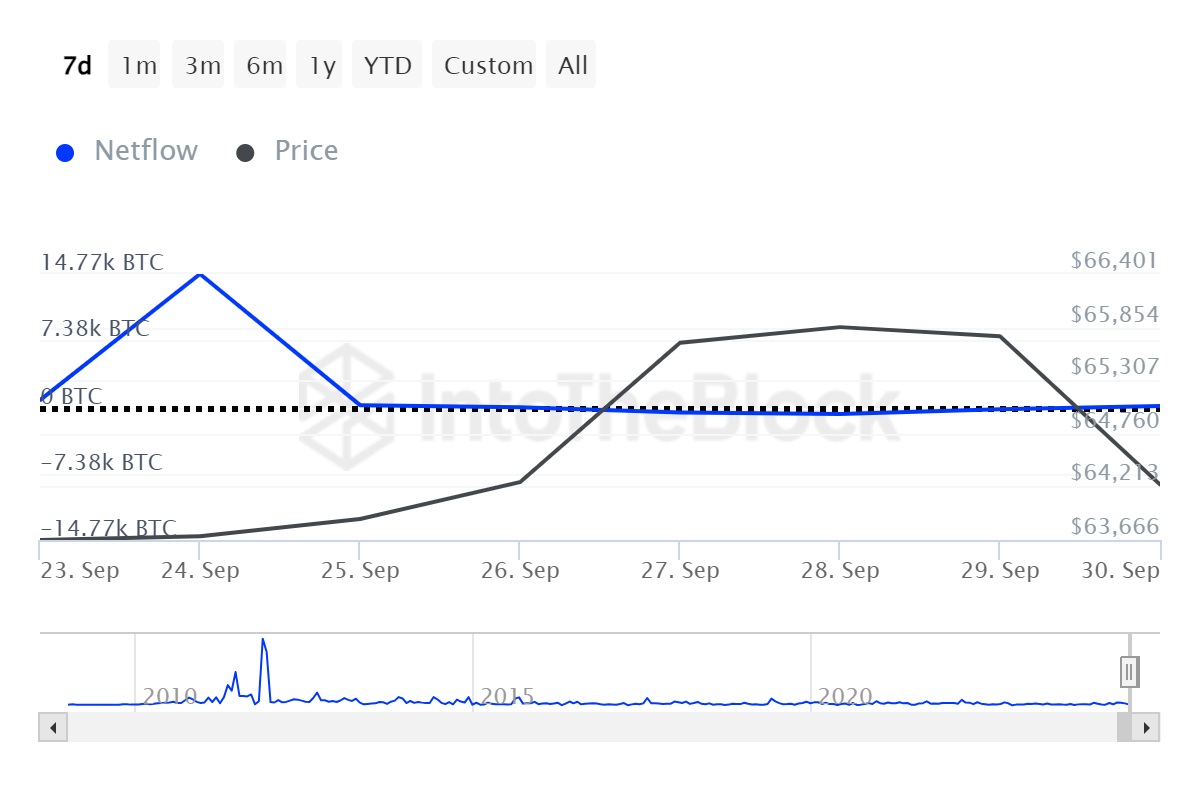

Source: IntoTheBlock

Finally, the net flow of major Bitcoin holders has reached negative levels since September 25. This suggests that large holders are not opening new positions while closing existing positions.

Read Bitcoin’s [BTC] Price forecast 2024-25

Reducing the flow of money from large investors indicates negative market sentiment, as high outflows indicate profit-taking or avoidance of further losses.

Simply put, Bitcoin is experiencing negative market sentiment, with bears trying to take over the market. Therefore, if these conditions continue, BTC will fall to $59,899. However, a reversal would see Bitcoin regain the $62675 level.