- The recent drop in ETH’s price seemed like a retracement.

- Market sentiment pointed to a likely pullback, driven by waning buying pressure.

Over the past 24 hours, Ethereum [ETH] has entered a so-called retracement – a temporary dip that often precedes a renewed rally in bullish markets – resulting in a decline of 2.70% during this period.

AMBCrypto reports that the downturn could continue, potentially reversing the 1.62% gain ETH has made over the past week.

ETH faces continued weakness

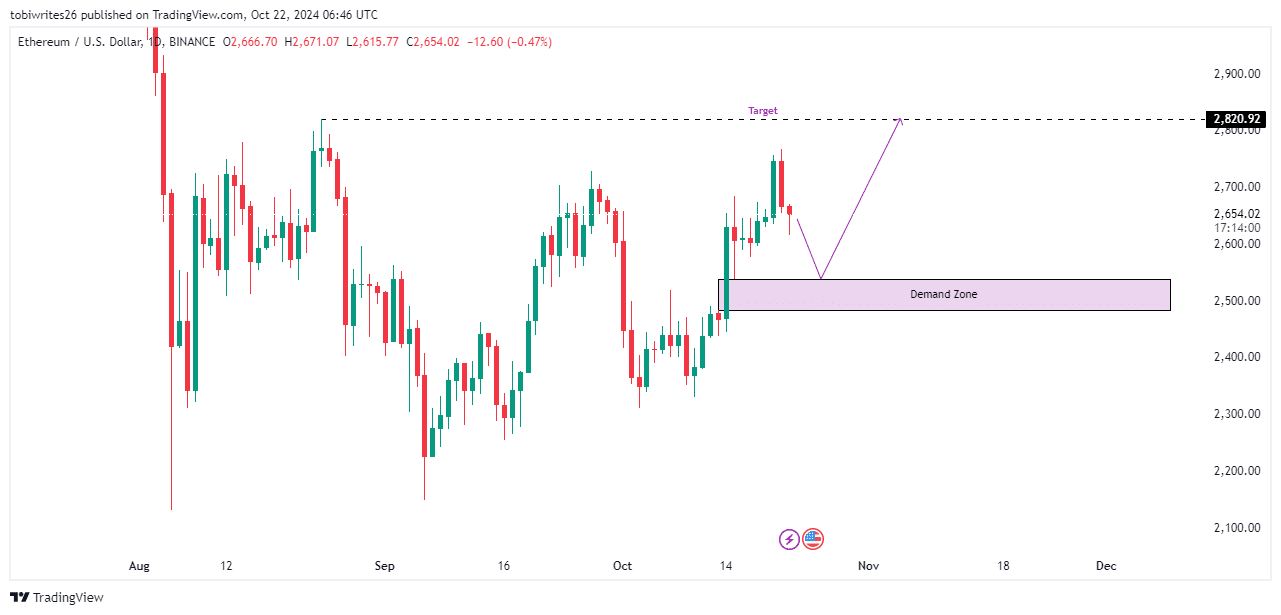

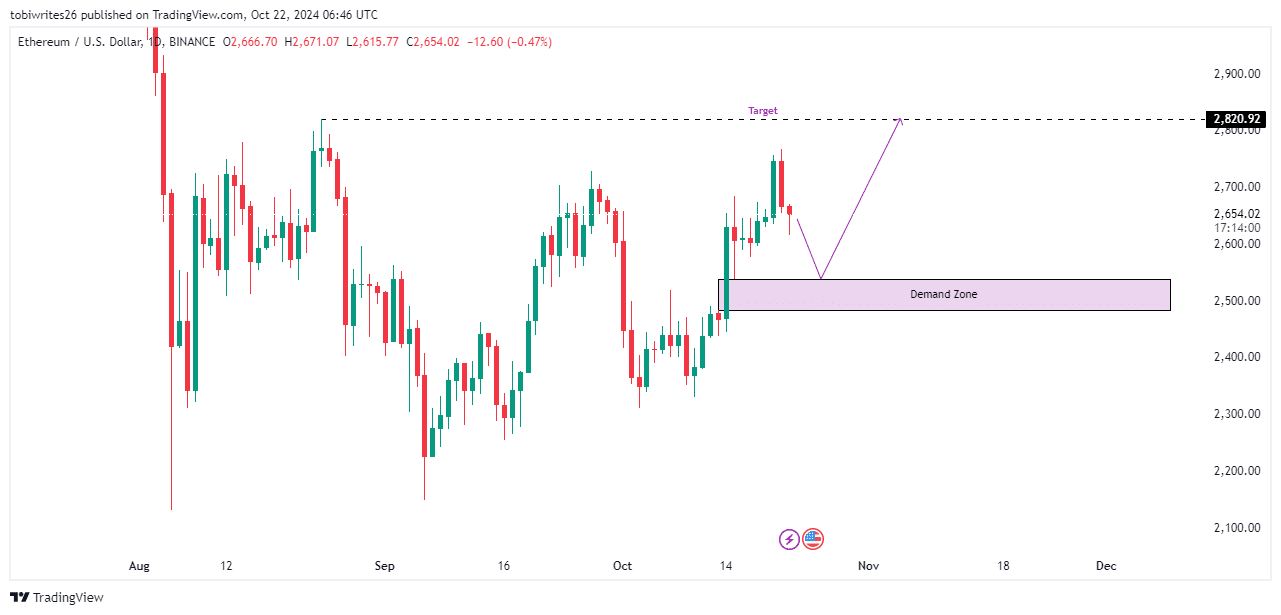

The ETH chart is currently missing bullish signals, indicating a possible further decline while searching for an optimal liquidity level to support a price increase.

Right now, the nearest liquidity zone is the demand area that extends between $2,536.47 and $2,484.44. If the price enters this region, ETH could recover to $2,820.92, which serves as a key target.

Source: TradingView

However, if ETH falls below this demand zone, it could trigger a stop hunt – a tactic where traders look for additional liquidity before making a final upward push.

A prolonged downward move could indicate that ETH has entered a bearish trend.

Traders are looking for momentum in the ETH market

Recent trading activity indicates that the market is looking for momentum, pointing to a possible decline from the current price of $2,654.02.

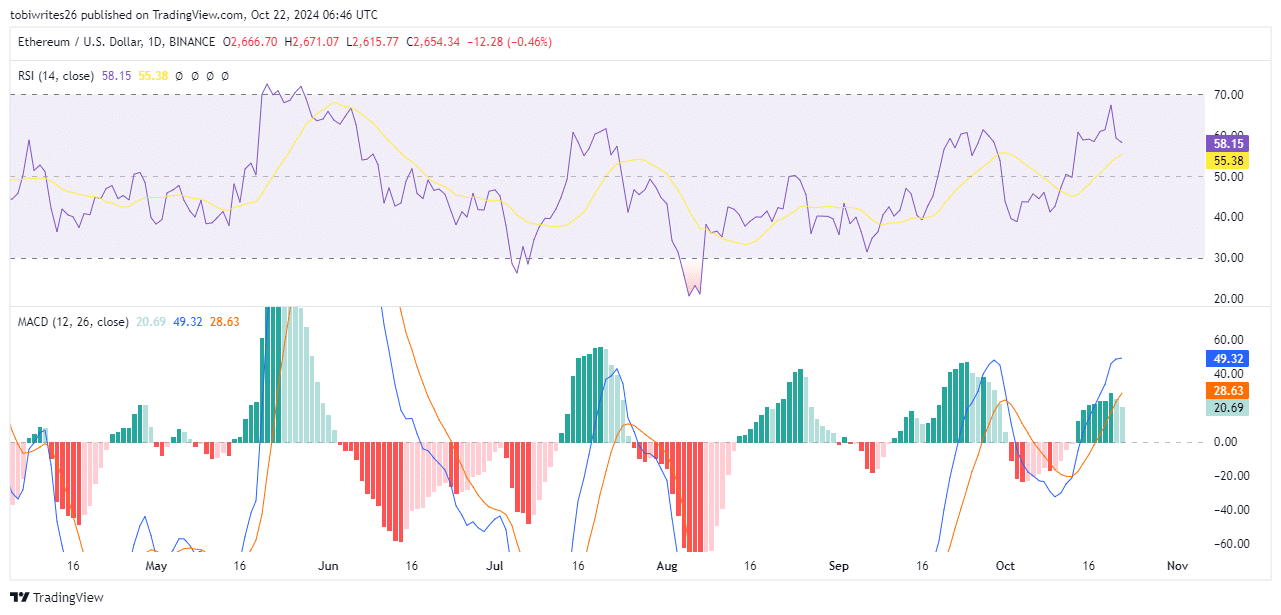

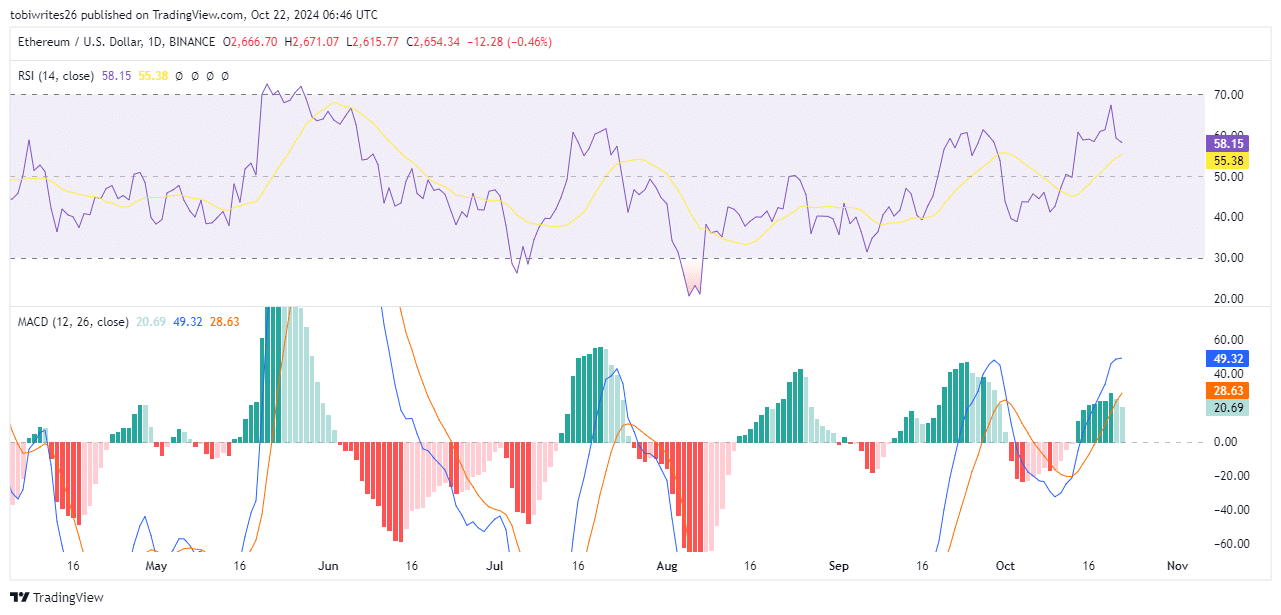

The Relative Strength Index (RSI) works on a scale of 0 to 100, with 50 representing the neutral point. Values above 50 indicate positive momentum, while values between 50 and 60 indicate moderate buying pressure.

Conversely, values below 50 reflect selling pressure, with a range of 30 to 50 indicating moderate selling. Values above 70 indicate overbought conditions, while values below 30 suggest oversold conditions.

Currently, ETH has an RSI value of 58.15, but it is trending down, indicating that the price may fall as it seeks a demand zone, even if it remains actively bullish.

Source: trading view

Likewise, the MACD, which is still positive, has also shown a notable drop in momentum, as indicated by the fading green bars on the chart.

This suggests that while overall market health is good, buying pressure is gradually waning.

Temporary withdrawal from sellers

Open Interest, an indicator used to assess traders’ sentiment in the current market, shows that traders are primarily positioning themselves to short assets.

Read Ethereum’s [ETH] Price forecast 2024–2025

According to Mint glassOpen Interest fell to $13.56 billion, reflecting a decline of 2.89%.

If this trend continues, it indicates that selling pressure may be driving the asset lower, although a bullish trend may still exist.