The minimum trading price of the top Ethereum NFT collections, including the Bored Ape Yacht Club and CryptoPunks, has fallen over the past 24 hours, continuing a trend of plummeting prices for so-called “blue chip” NFTs.

CryptoPunks and Bored Ape Yacht Club rock bottom prices are down nearly 8% and 7% respectively in the last 24 hours, as per CoinGecko facts. Nansen’s Blue Chip 10 index of the top 10 NFT collections dropped 31% year to date.

In recent weeks, the Bored Ape Yacht Club has seen bigger losses, with the “floor price” – or the cheapest listed NFT on a secondary marketplace – falling nearly 19% over the past 30 days as measured in ETH. A bored monkey starts at 36.4 ETH, or about $68,200.

Yuga Labs writes the book on cryptopunks – literally

That is the lowest Bored Ape floor price, in ETH terms, measured by NFT Price Floor since November 2021, when the project was just taking off. Meanwhile, Mutant Ape Yacht Club prices are down 26% in ETH terms over the past 30 days, now starting at 7 ETH or $13,150. CryptoPunks prices are down less than 3% over the same period.

Bored Ape’s price floor peaked at 152 ETH in April 2022 — which was worth $429,000 at the time — just before the drop in NFT-based land for creator Yuga Labs’ Otherside metaverse game. The NFT market has largely lost momentum since then, though Ape’s prices have fallen faster than some other notable projects in the space.

The impact of Blur?

Some NFT traders believe that the main factor in the rock bottom price crash the influence of the leading NFT marketplace Blur on trading and lending volumes.

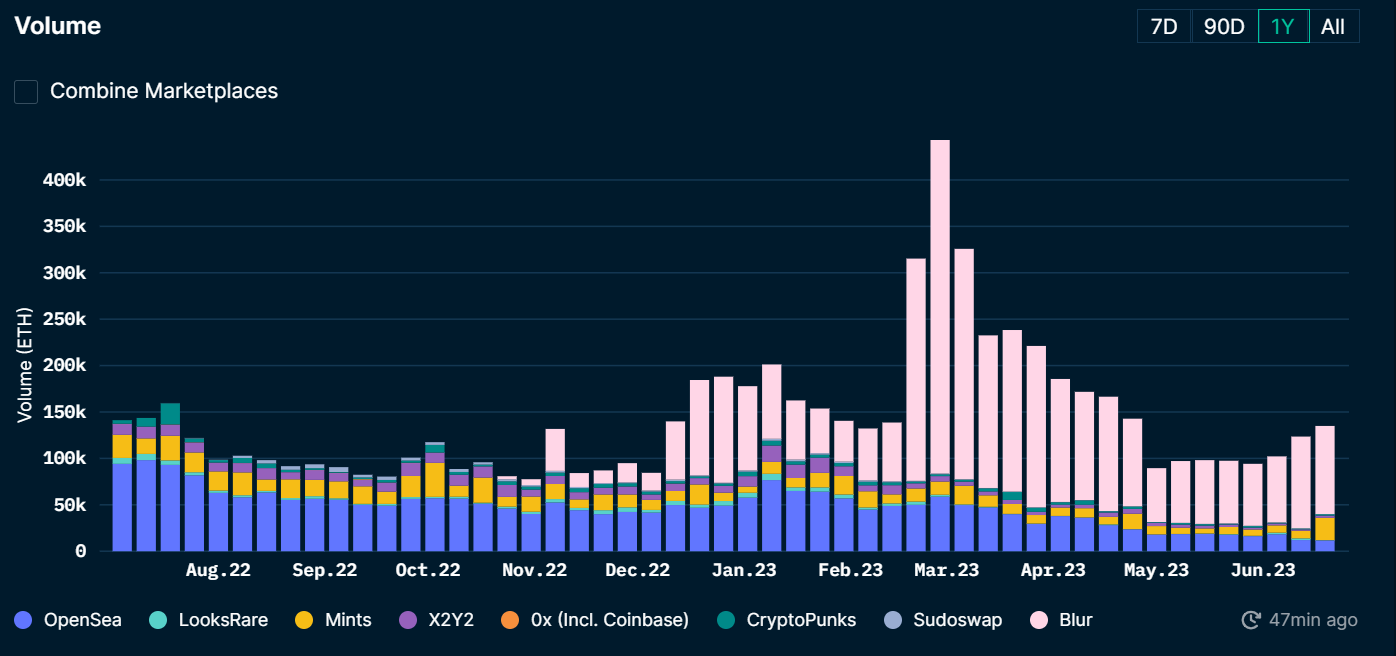

Data from crypto analytics firm Nansen shows that NFT trading volume has declined significantly over the past two months. Blur’s adverse effects on NFT trading volumes and prices came first seen at the end of Aprilabout two months after the initial allocation of the Blur token airdrop that helped the marketplace overtake OpenSea.

Recent NFT Trading Volume Data. Image: Nansen

The decline in NFT trading volumes since May can likely be attributed to the end of the doubling of trading rewards on the Blur marketplace.

Notable pseudonymous trader and co-founder of Wumbo Labs, Cirrus pointed out that traders also let their NFTs sell for knockdown prices to maintain high trading volume to farm more tokens on Blur, further suppressing rock bottom prices.

On May 1 Blur launched its NFT lending platform Blend, which quickly attracted significant volumes as users rushed to farm BLUR tokens. According to a Dune dashboard by pseudonymous developer Beetle, the total amount of loan volume on Blend has so far risen to $929 million, dominating more than 95% of the NFT lending space.

Imagine walking into a watch shop and seeing 10 guys repeatedly throwing all the Rolexes back and forth at each other

This is what it feels like to log into Blur and see how farmers interact with these “luxury digital assets”

No genuine new buyers will want this nonsense

— Cirrus (@CirrusNFT) June 16, 2023

The founder of DeFi analytics platform DeFiLlama, 0xngmi, wrote in a tweet that Blur rewards incentivized users to “churn out loans as much as possible, significantly inflating borrowing volume.”

The loans also increase liquidation risk in the market, which can drive their prices down. Cirrus, for example marked a risky leveraged position on Blend worth more than $2 million, backed by 32 Bored Ape NFTs as collateral. Cirrus wrote that the user has already suffered a loss of about 100 ETH from the loans, which they used to “maintain Blur.”