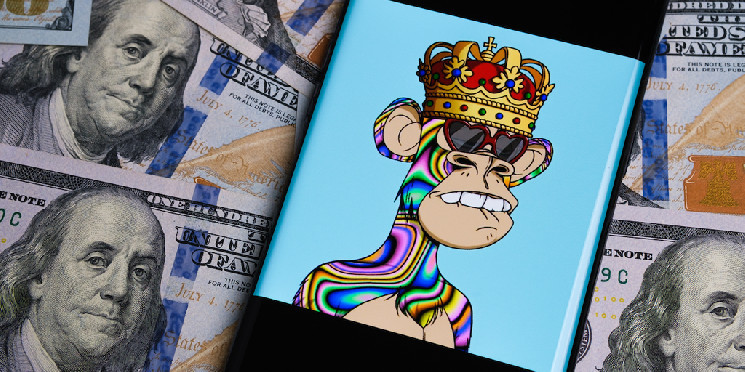

NFT

Yuga Labs, the maker of the Bored Ape Yacht Club, continues to dominate the NFT market, accounting for nearly 35% of total NFT trading volume over the past six months, according to a new report from DappRadar.

In addition to the Bored Ape Yacht Club and its associated collections, including the Mutant Ape Yacht Club and Otherside metaverse game land deeds, Yuga Labs also acquired the CryptoPunks and Meebits NFT project IP from original creator Larva Labs in 2022.

Yuga’s created or owned projects collectively generated more than $2 billion in trading volume over the last two quarters combined, according to the report, representing 34.6% of total market volume over that period.

DappRadar praised the $4 billion startup for supporting its projects and associated communities, suggesting possible reasons why people would continue to buy into the projects through secondary sales.

“While some projects have pushed their communities aside, abandoned development, or failed to deliver on promises to holders, or simply failed to meet high expectations,” the report reads, “Yuga Labs has emerged as a leading example of dedication to providing value and nurturing the community of NFT holders.”

The Bored Ape Yacht Club leads the NFT profile picture (PFP) market with a bottom price (or low-end secondary market price) of 51.45 ETH, or about $99,000, followed by CryptoPunks at 49.49 ETH ($95,150).

Launched in April 2021, the “blue chip” Bored Ape Yacht Club (BAYC) is a collection of 10,000 profile photos minted as NFTs on the Ethereum blockchain. It gained popularity quickly, reaching a peak price of 152 ETH (about $429,000 at the time) in April 2022, ahead of the launch of Otherside lots.

According to the report, BAYC has generated $504 million in NFT sales over the past two quarters, the Mutant Apes nearly matched that number at nearly $483 million, and the Otherside land deeds generated more than $322 million in transactions.

Not content with the Ethereum network, Yuga Labs also launched TwelveFold in February, a collection of 300 generative “NFTs” on the Bitcoin network using Ordinals Inscription. The first auction brought in about $16.5 million in sales.

The popularity and value of NFT collections like Bored Ape Yacht Club has even launched a cottage industry of borrowing money against NFTs – a space now worth $1 billion.

While Yuga Labs is known for allowing holders of its NFTs to create and even sell derivative projects and products, the company has also defended its intellectual property (IP) in court.

Last week, Yuga Labs won what the company called a “landmark legal victory for Web3” when a federal judge ruled in its favor against artist Ryder Ripps and ally Jeremy Cahen. The pair had launched a copycat collection from the Bored Ape Yacht Club called RR/BAYC which they called a parody of Yuga’s project.

“Investors and enthusiasts should take note of Yuga Labs’ approach, looking for projects with a track record of delivering on their promises and a doxed team to be accountable,” added DappRadar.

Early last year, the identities of two of the pseudonymous creators of the Bored Ape Yacht Club were revealed in a Buzz feed research. The duo, Wylie Aronow and Greg Solano, have since gradually become more public, appearing on DecryptGM’s podcast last October.

“I kind of see us as a garage band that made it,” said Aronow. “We’re still trying to keep that authenticity, and frankly I’m a little precious about it. We don’t do a lot of PR, we don’t do a lot of interviews, we’re pretty selective about that – just because that’s just a little too rock star for me.