- Bonk has formed an important technical pattern on the graph and points to a bullish reversal.

- Buying activity and bullish sentiment from the Derivatenmarkt are currently contributing to Bonk’s rally potential.

Bonk [BONK] has stayed one of the most impressive tokens on the market in the past month. In the past week alone, the active achieved 44.63%, with a monthly relocation of 21.22%.

This step suggests that there is a growing interest in the memecoin and a tendency to achieve further market wins, because market sentiment mostly shifts for buyers.

A bullish pattern could add to Rally

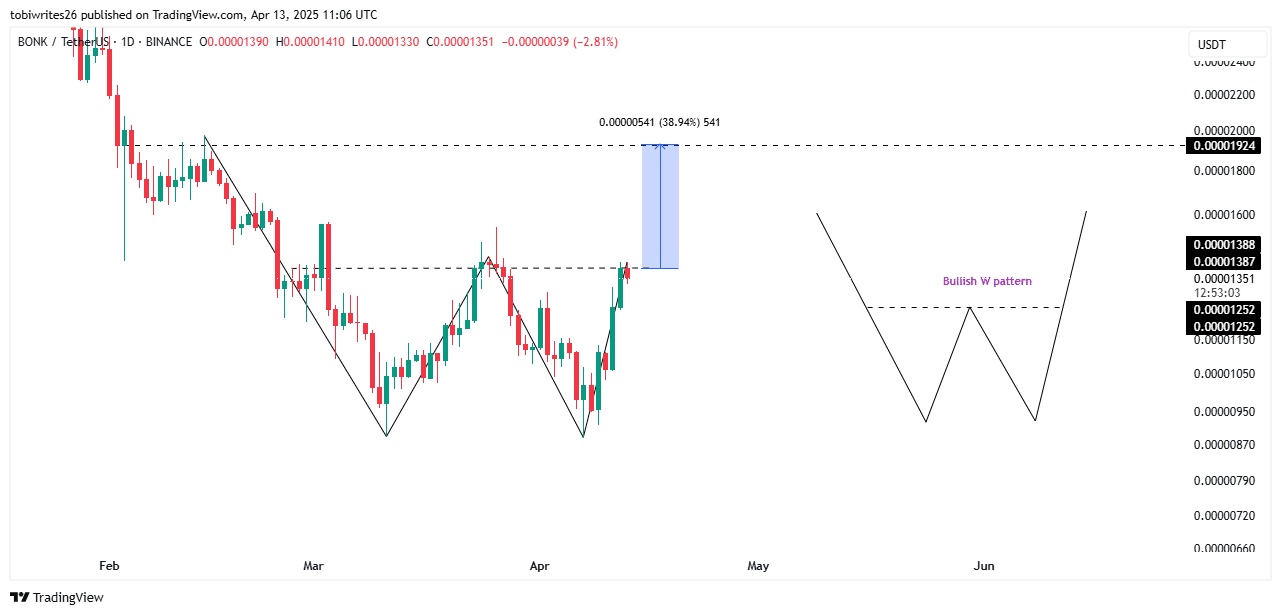

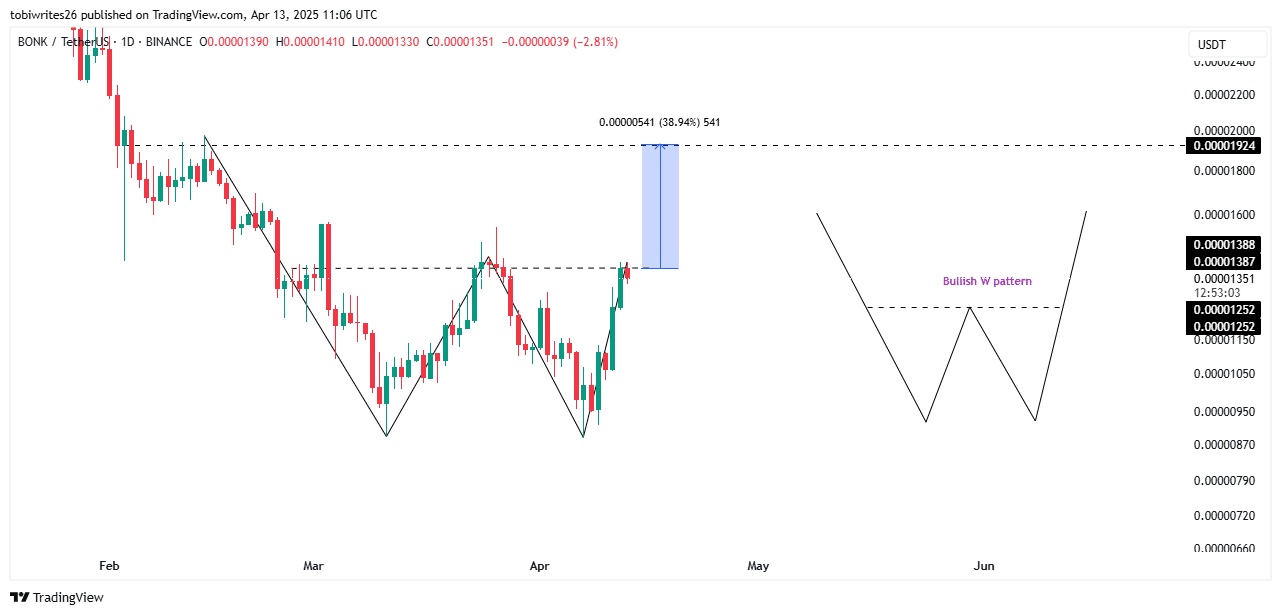

Bonk has formed a bullish pattern that is known as the “W” pattern, which is known to act as a catalyst for assets to recover and to achieve further market profits after a fracture of structure.

This structure interruption takes place when it actively spends a resistance line, which leads to the start of a rally. In the case of Bonk, the extensive dotted line marks the level to be violated.

Source: TradingView

As soon as this infringement occurs, Bonk could make a big price jump, by around 38% and up to $ 0.00001924 on the graph.

Above this price target are not -marked gaps for real value, which are well -known liquidity levels on the graph, which suggests that the price could achieve further profit by acting in those points.

Market indicator and demand to Bullish Sentiment

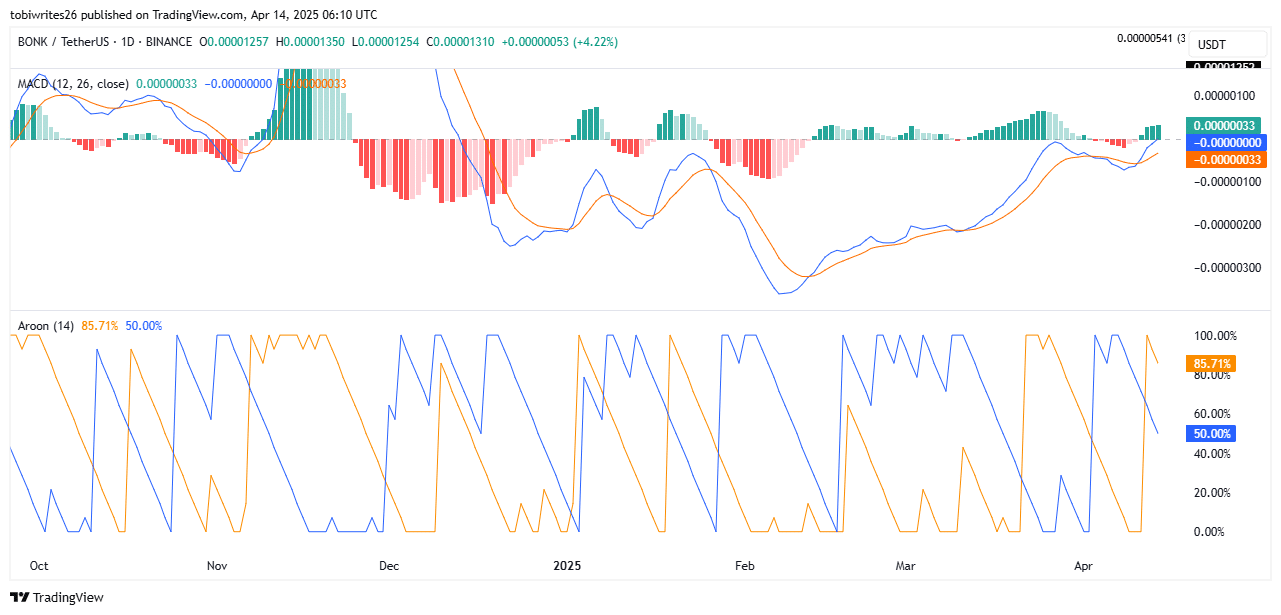

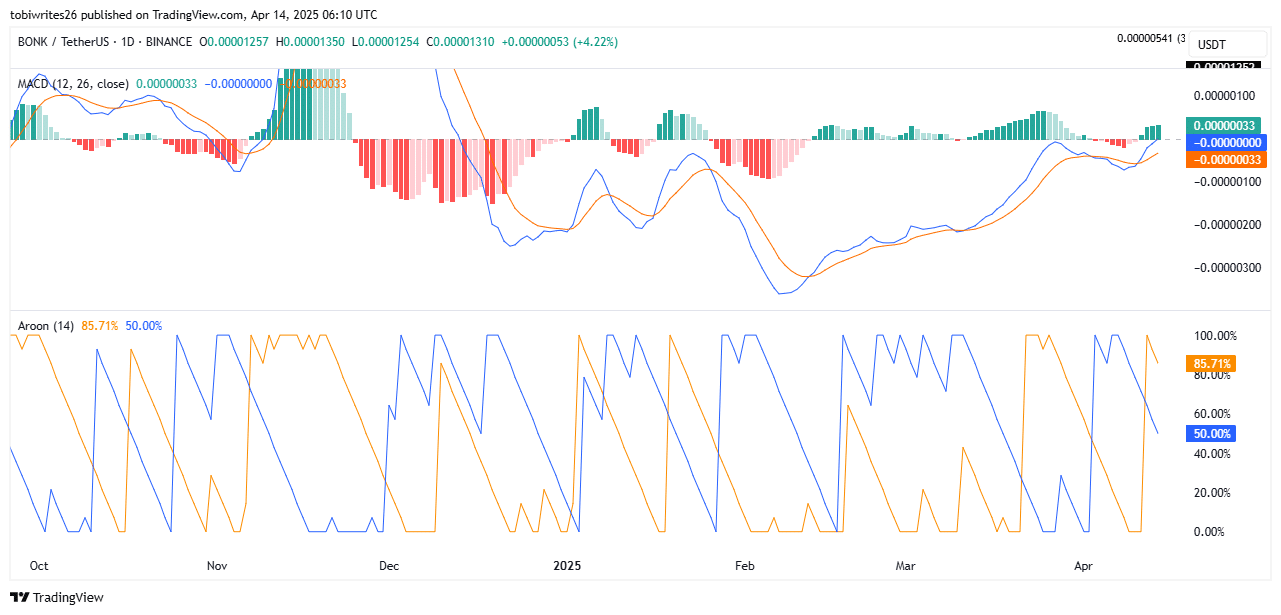

Technical indicators suggest that an outbreak of this level of resistance is available. The advancing average convergence and divergence (MACD) indicates that the rally can shape soon.

At the time of the press, the blue MacD line was placed at the neutral level of 0.00 and was upstairs. The volume guno shows exponential growth.

If the MACD line goes to the positive area and the histogram continues to increase, this will confirm the rising momentum among traders who actively buy Bonk.

Source: TradingView

The Aron indicator analyzes market trends and their strength using two lines – Aroon Up (Orange) and Aroon down (blue).

A bullish sentiment is confirmed when the Aroon Up line remains above the Aroon -Down line. Current measurements show the orange line at 85.71% and the blue line at 50.00%. These measurements correspond to the prevailing market story.

Buyers actively acquire Bonk on the Spotmarkt. They bought $ 2.6 million from the active and transferred it to private portfolios.

This shift from fairs to private portfolios indicates growing confidence in the long-term potential of the active.

If the trend continues in the coming week, Bonk could see further price valuation. This scenario increases the possibility of a large upward movement in the upcoming trade sessions.

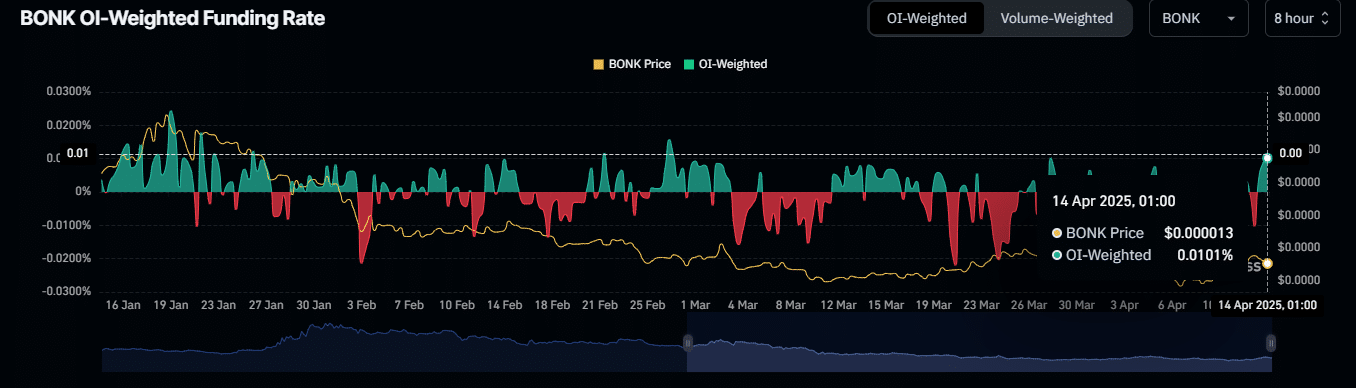

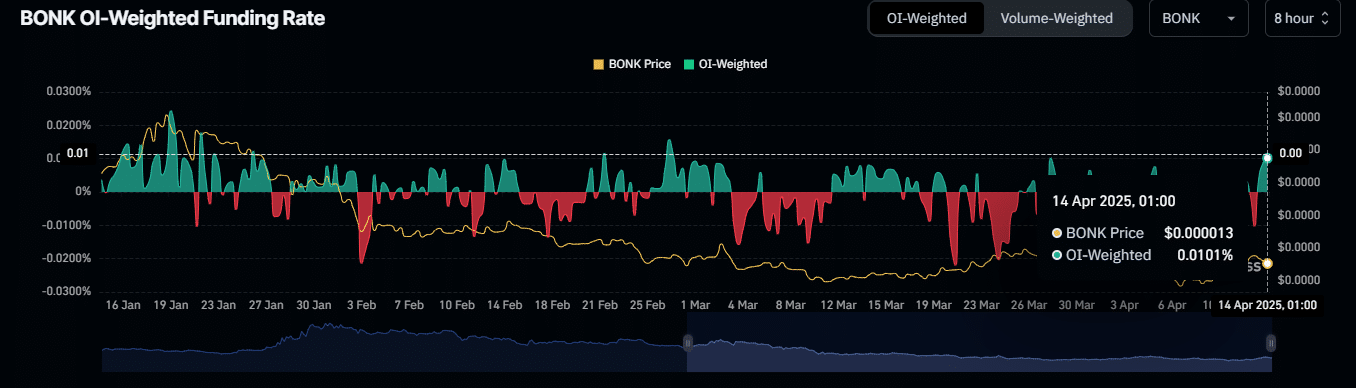

Source: Coinglass

The OI-weighted financing interest combines the financing rate and open interest to assess the possible marketing direction.

It indicates that the market prefers long traders. At the time of writing, the OI-weighted financing speed was 0.0101%.

This lecture confirms a high purchase activity on the market that could support an outbreak of the resistance level. If the resistance level is violated, it can cause a further rally, which may lead to new highlights for Bonk.

In general, De Bonk -Rally seems likely, with the market that is expected to rise and the Activum exceeds clear goals.