- BONK’s RSI and OBV have shown strong bearishness over the past month

- A rebound to $0.00004 could be likely, but whether the market structure can turn bullish depends on capital inflows

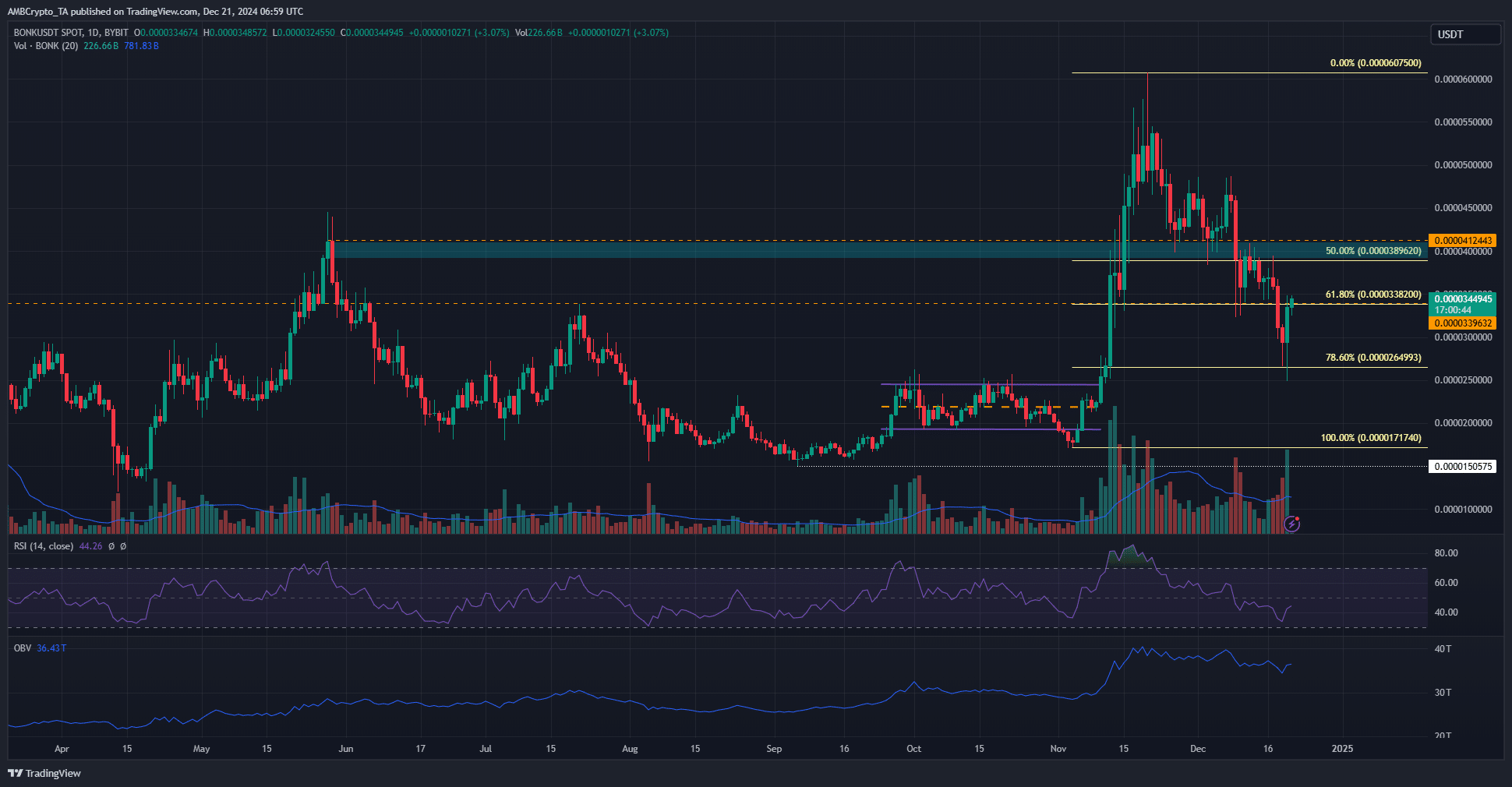

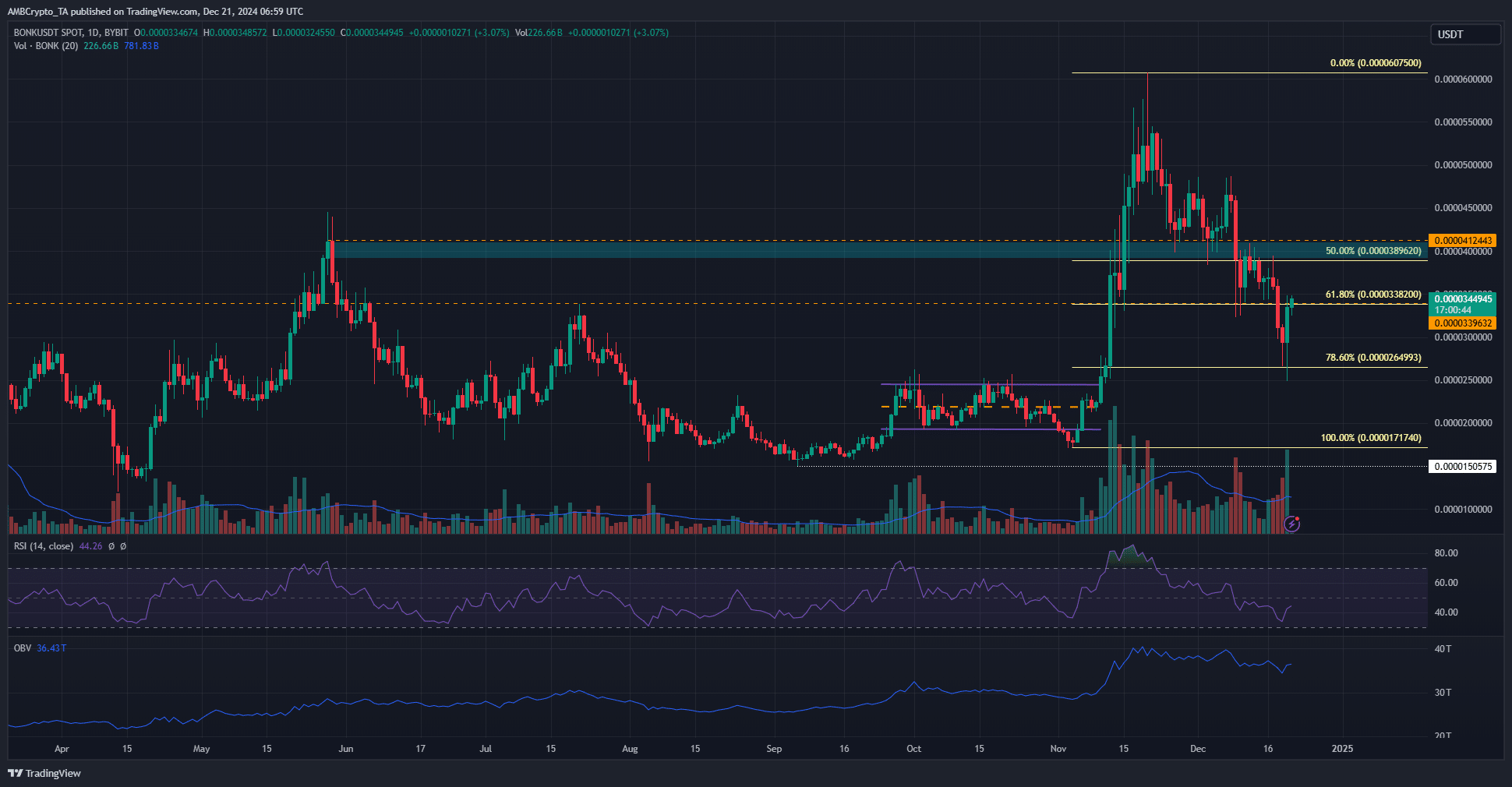

BONK fell 59% in 30 days from November 20 to December 20. This steady downward trend saw significant selling volume on certain days, such as December 9, when Bitcoin [BTC] facing rejection from the $100k level.

Since then, the memecoin has struggled to hold key support levels. In fact, the latest BTC correction sent BONK towards another key support level at $0.0000265.

BONK bulls are trying to scale the resistance at $0.0000338

Source: BONK/USDT on TradingView

The daily RSI for BONK stood at 44 and was below the neutral 50, underscoring the bearish momentum. The OBV also made a series of lower highs and lower lows over the past month. Together with the steady losses since mid-November, this highlighted that the bears still had the upper hand in the market.

The recent decline forced the memecoin to retest the 78.6% Fibonacci retracement level at $0.0000264, but no daily session was closed below. Since hitting a local low of $0.0000248 on Friday, the altcoin’s price has risen 39%.

The $0.00004 zone was initially a support point, but turned into resistance in recent weeks. It is expected that it will once again serve as a stern resistance. A daily session close to $0.0000394 would turn the daily market structure bullish.

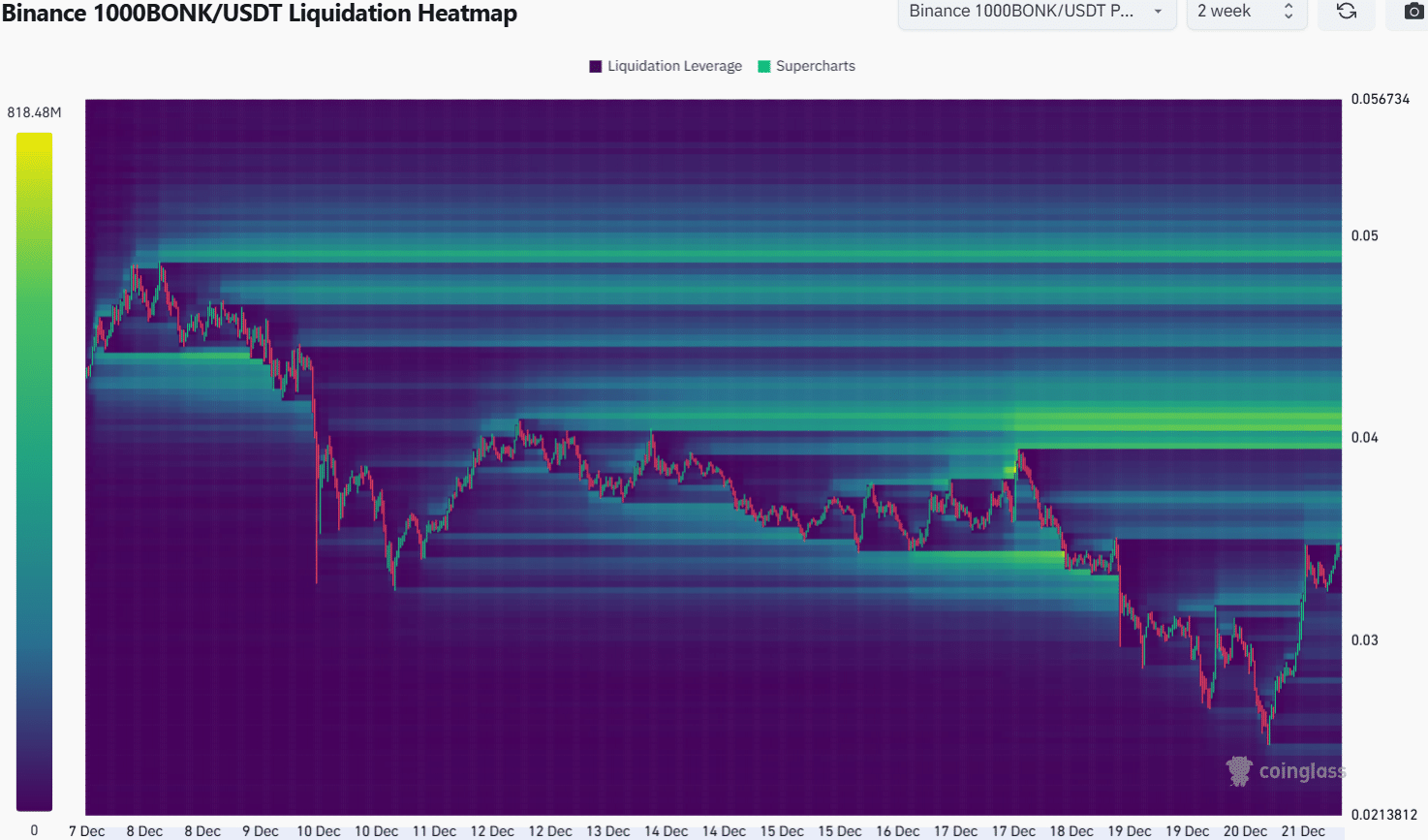

The liquidation levels are consistent with the technical findings

The $0.00004 resistance zone identified on the daily chart had a significant concentration of liquidation levels around it, the two-week liquidation heatmap showed.

AMBCrypto found that liquidity in the south was also relatively scarce. Therefore, an attempt to retest this resistance is very likely in the coming days.

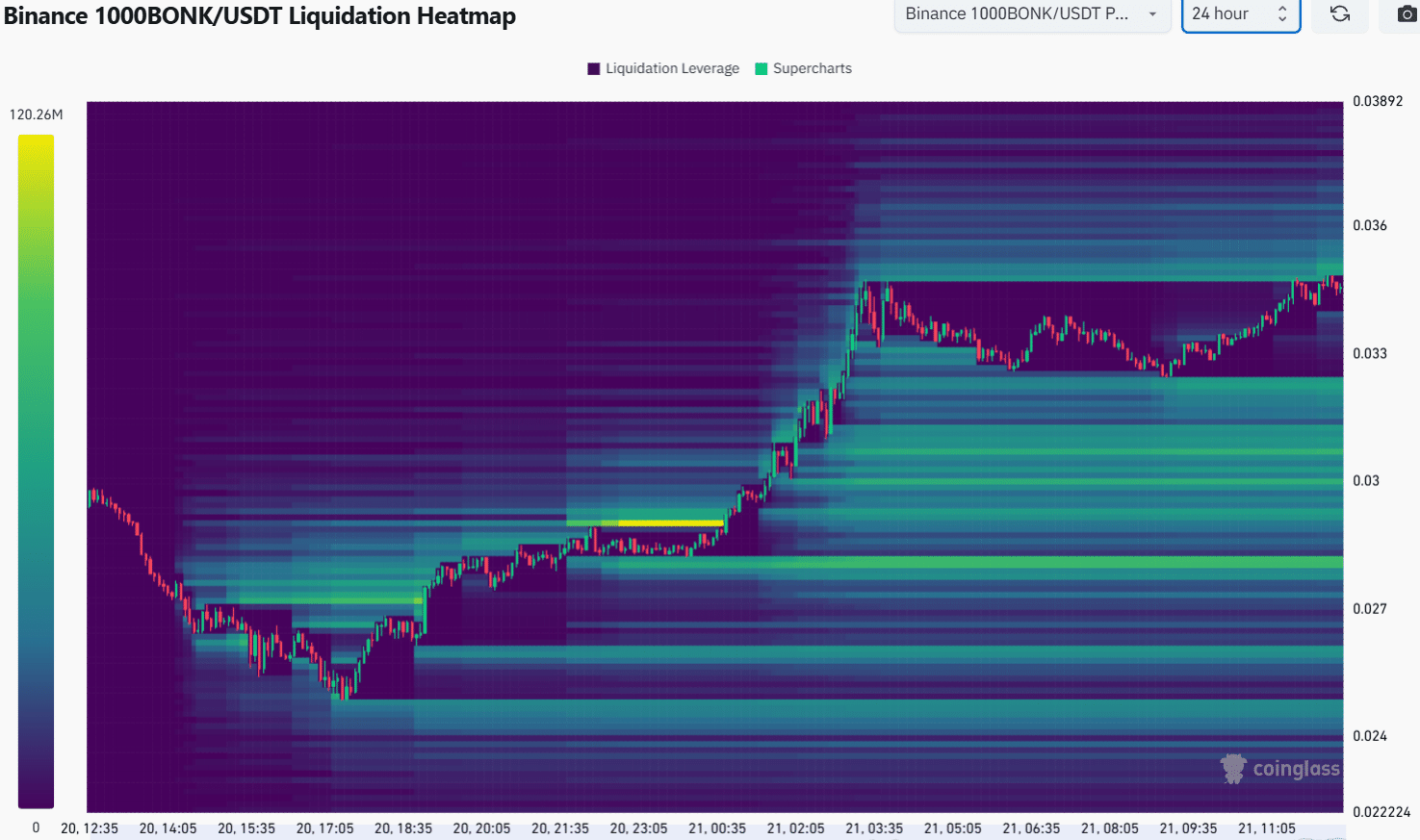

The 24-hour liquidation heatmap indicated a potential range between $0.0000322 and $0.000035. So, it is possible that the liquidity that has built up around $0.000035 in recent days could see a bearish reversal in the near term.

Is your portfolio green? Check the bonk profit calculator

And yet the magnetic zone around $0.00004 seemed much stronger. Even in the event of a price decline in the next two days, the target for the coming week would be the resistance at $0.00004.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer