- Technical patterns show that Bonk could see a sharp fall because it finds a rebound level.

- Long liquidations in the market have risen as traders push the price lower.

Bonk has had a falling series last month, which was intensified in the last seven days when it fell active by 10.45%. This decrease has continued in the last 24 hours, with the price losing another 2.03%.

According to Ambcrypto’s research, a much steeper decrease is probably looking for the best price to re -introduce, so that the price then increases.

A technical path on a decreasing process

On the graph, Bonk acts within a decreasing channel characterized by lower highlights and lower lows, where price trends move in a support and resistance zone.

Bonk recently responded from the resistance line of the pattern and has continued to fall, a movement that will probably extend further down to the level of support, which may lead to a loss of 27.20%.

Source: TradingView

The motive behind this fall is that investors probably push the price lower in search of a discount level where they can actively collect it.

This can bring the price to the support level and a strong momentum can ultimately push it higher.

Will the fall happen?

Bonk has a great chance of falling further, because the market sentiment at the Derivatenmarkt has been strong Bearish.

An important indicator of this are the liquidation data, which shows how many long and short traders have lost within a specific period.

Currently there have been $ 438,000 in long liquidations, compared to only $ 6,400 in short liquidations. This means that for every $ 1 of long contracts, only $ 0.0146 in short contracts was concluded.

The most important inequality shows that the market is heavily crooked in favor of shorts, which suggests that prices will continue to fall.

Source: Coinglass

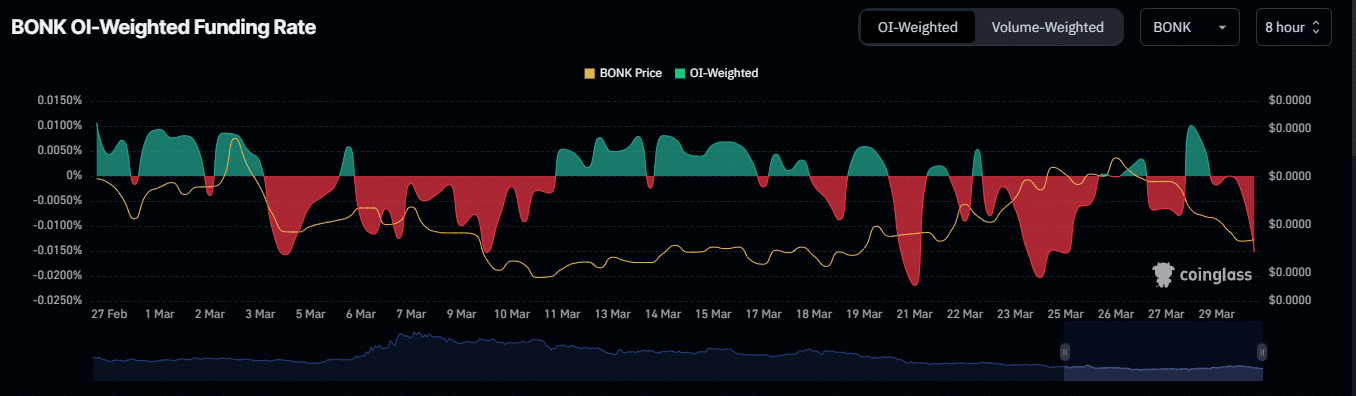

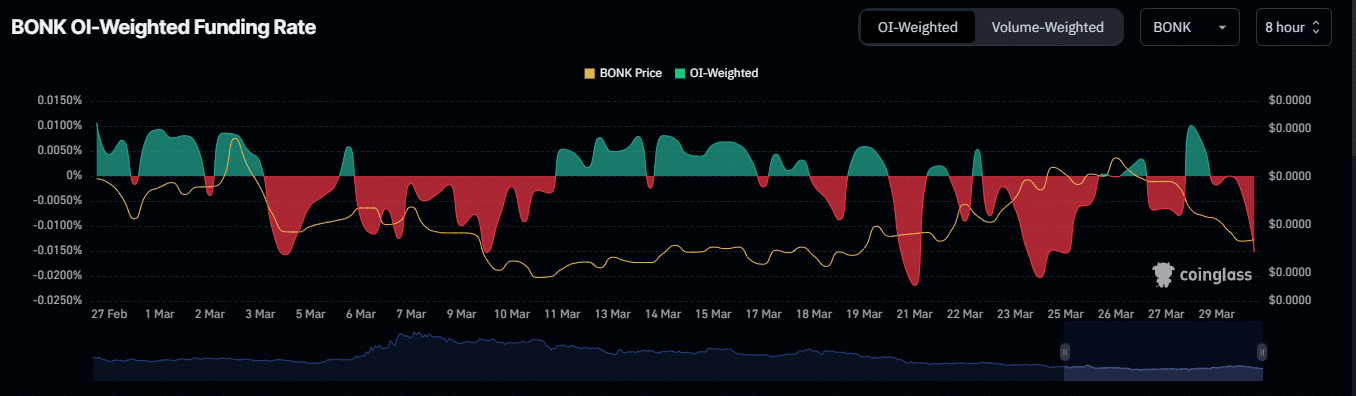

The OI-weighted financing percentage, which collects the financing percentage and open interest data on several trade fairs, indicates that a huge wave of sales is still in the game.

At the time of writing, this metric was crossed to a negative area, with a lecture of -0.0152. This region is associated with price falls, so it is likely that Bonk will see a significant decrease.

More Bears Signals Surfters

The Bearish Trend in the market remains strong, because two technical indicators – the parabolic SAR (stop and backwards) and bull bear power – confirm the presence of sellers.

The parabolic sar, who uses dots to determine the potential market direction, indicates downward pressure when dots appear above the price. This suggests that Bonk could decrease further.

Source: Coinglass

Similarly, the Bull Bear Power confirms, which shows whether buyers or sellers are leading market transactions that sellers (bears) have control.

The Rode Momentum continues to build and signals further downward movement. For now, the bears send the market, and if this persists, Bonk is probably lower.