- Sentiment around BNB turned bearish as weighted sentiment fell.

- Market indicators were bearish suggesting a further decline in the price of BNB.

BNB chain [BNB] has once again outperformed its contemporaries in real-life usability and returns. According to Polkadot Insider’s tweet dated June 3, BNB was the best blockchain according to the real yield index. Other than BNB, Dot [DOT] And Ethereum [ETH] round out the top three on the list.

Real Yield Index of a blockchain refers to the measure of the actual return that investors or participants can earn from owning and engaging in that blockchain network, after adjusting for inflation

It quantifies the real value and profitability of the blockchain ecosystem… pic.twitter.com/6ybKpJlPPe

— Polkadot Insider (@PolkadotInsider) June 3, 2023

What does this achievement mean?

A blockchain’s real yield index refers to the measure of the actual return that investors or participants can earn from owning and engaging in that blockchain network after adjusting for inflation.

A high real return index means that the actual return that users can receive from owning and participating in that blockchain network is relatively high.

So, at the time of writing, invest in BNB seemed like a good option for investors. However, the ground reality was different.

BNB’s network stats don’t look good

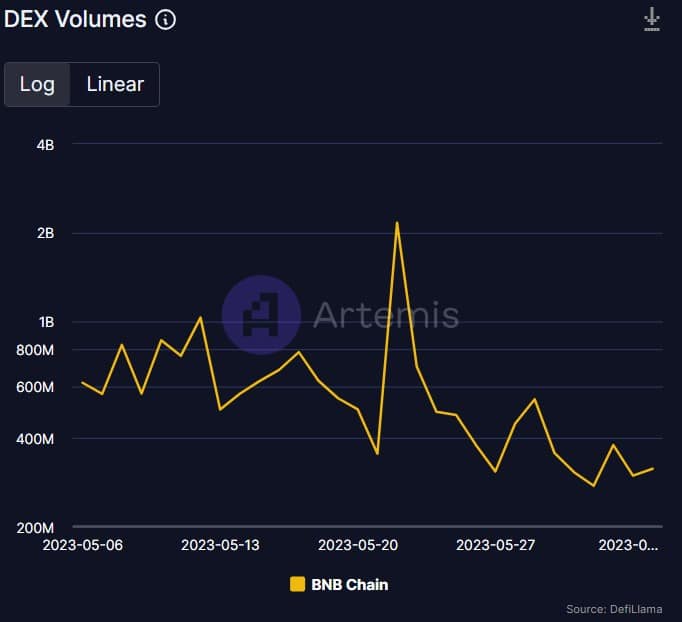

According to Artemis, BNB’s DEX volume reported declining momentum, reflecting BNB’s declining popularity on decentralized exchanges. BNBdaily active addresses also decreased.

Source: Artemis

Investors have no confidence in BNB Chain

Santiment’s chart revealed that, aside from network metrics, BNBThe site’s popularity also dropped last week as social volume fell slightly. Sentiment around BNB also turned negative, as evidenced by the dip in weighted sentiment.

Source: Sentiment

In addition, the total number of BNB holders also remained stagnant for the past seven days. After spikes, BNB’s rate declined. Simply put, a slower rate means that a coin is used less often in transactions within a given time frame.

Source: Sentiment

BNB’s troubles are far from over

BNB had a tough week as the coin’s price dropped 4% in the past seven days. According to CoinMarketCapat the time of writing, BNB was trading at $301.14, with a market cap of over $46 billion.

According to data from Santiment, BNB’s troubles may last longer as the MVRV ratio fell sharply last week. However, funding rates were green, reflecting demand in the derivatives market.

Source: Sentiment

Is your wallet green? Check the BNB Profit Calculator

The bears have prepared

The same bearish photo was also featured on BNB‘s daily chart as multiple market indicators supported the sellers. In particular, the MACD showed a bearish crossover. In addition, BNB’s Relative Strength Index (RSI) was below neutral.

The Money Flow Index (MFI) also followed the same trend, further increasing the likelihood of a sustained price fall.

Source: TradingView