- BNB recently fell below $500, resulting in a resurgence in buying pressure.

- Assessing the possible consequences for the price if it maintains momentum.

The Binance coin from Binance Smart Chain [BNB] has shown resilience above the $500 price level since March. An interesting result, as most top coins are now heavily discounted from their March highs.

BNB even reached a new local high in June, indicating a robust utility. Of course, there have been a few occasions here and there. where the price fell below $500, followed by a rapid recovery.

This also applies to the recent bearish performance in recent weeks, with the price falling to $471 on September 6.

BNB was exchanging hands at $509.6 at the time of writing, reaffirming strong demand below $500. The outsourcing shows that BNB has been trading sideways since March with significant up and down swings.

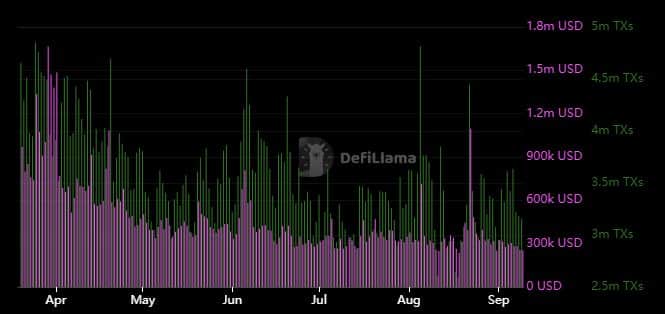

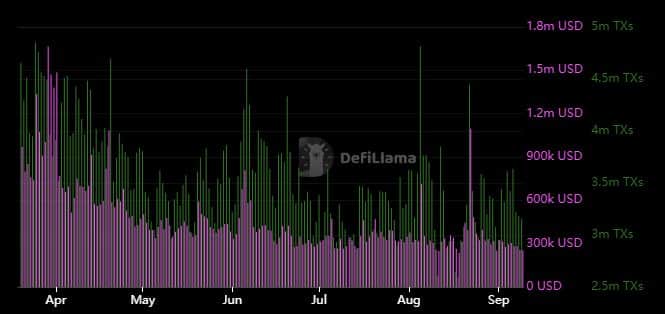

Source: DeFiLlama

The above price chart showed clear support and resistance in the last two swing lows and swing highs. Based on these observations, price appears to be building momentum towards a new swing high.

If successful, BNB can expect another 15% plus upside until the next major resistance level. An outcome that could push the price above $190.

Assessing the prospects of the BNB chain

BNB was already up more than 7% from the last weekly low at press time. This coincides with a recent spike in offseason expectations following a decline in Bitcoin dominance.

However, BNB’s ability to maintain its current momentum will depend on the demand for the token and activity on Binance’s smart chain.

Dune-on-chain data revealed a 6.19% increase in weekly active addresses at the time of writing. However, network activity was not yet fully in place, evidenced by a 1.1% decline in weekly transactions.

This was also reflected in network rates, which also fell this weekend.

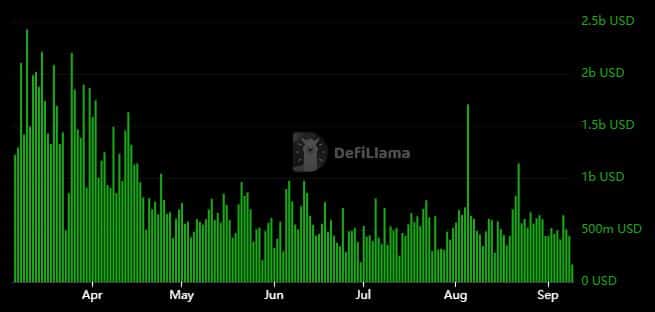

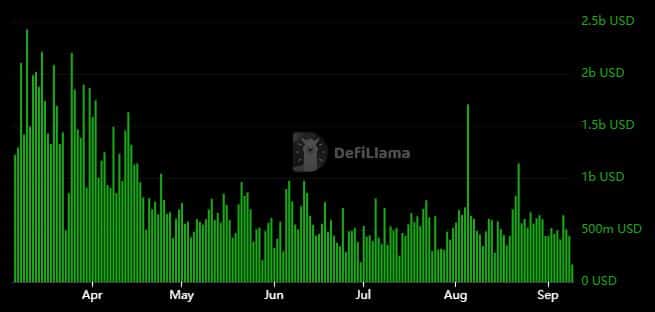

Source: DeFiLlama

These findings are essential because they underline the state of biological demand in the BSC. Strong network activity leads to more demand for BNB, which in turn drives its price.

This can be observed during instances of increased market confidence, especially in altcoins.

In terms of volume, data from the chain indicates a significant decline over the past five months. The same goes for the past two weeks, as the market embraced more uncertainty.

Source: DeFiLlama

Read Binance Coin’s [BNB] Price forecast 2024–2025

The return of the altseason would likely lead to a resurgence in volume across the chain, closer to levels last seen in March.

While that remains to be seen, BNB would likely benefit from a robust increase in demand in such a scenario. Meanwhile, a further decline from current levels could trigger a wave of panic selling.