The BNB price is still consolidating above the $200 support zone against the US dollar. It could trigger a significant upside if resistance breaks above $220.

- The BNB price is slowly moving towards the $220 resistance against the US dollar.

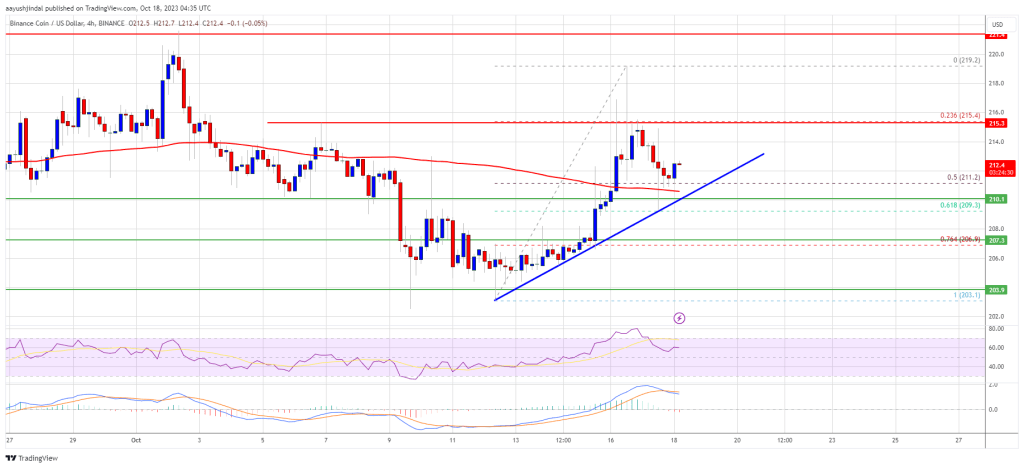

- The price is now trading above $210 and the 100 simple moving average (4 hours).

- A major bullish trendline is forming with support around $211.5 on the 4-hour chart of the BNB/USD pair (Binance data source).

- The pair could gain bullish momentum if there is a daily close above $220.

BNB price remains within a range

Over the past week, BNB price has retested the $200-$202 support zone. The bears made another attempt to clear the key $200 support but failed. A low was formed near $203 before the price started a decent climb like Bitcoin and Ethereum.

There was a move above the USD 210 and USD 212 levels. The price tested the key resistance at USD 220. A high is formed near $219.2 and the price is now consolidating above the 50% Fib retracement level of the upward move from the $203 swing low to the $220 high.

BNB is now trading above $210 and the 100 simple moving average (4 hours). There is also a major bullish trendline forming with support near $211.5 on the 4-hour chart of the BNB/USD pair.

Source: BNBUSD on TradingView.com

If there is a new increase, the price may encounter resistance near the $215.5 level. The next resistance is near the $220 level. A clear move above the $220 zone could see the price rise further. In the said case, BNB price could test $235. A close above the USD 235 resistance could set the pace for a bigger rise towards the USD 250 resistance.

Lose more?

If BNB fails to clear the USD 220 resistance, it could trigger another decline. The initial downside support is near the $211 level and the trendline. The next major support is near the $207 level or the 76.4% Fib retracement level of the upward move from the $203 swing low to the $220 high.

If there is a downside break below the USD 207 support, the price could fall towards the USD 202 support. Any further losses could trigger a bigger decline towards the $185 level.

Technical indicators

4-hour MACD – The MACD for BNB/USD is losing pace in the bearish zone.

4-hour RSI (Relative Strength Index) – The RSI for BNB/USD is currently above the 50 level.

Major support levels – $211, $207 and $202.

Major resistance levels – $215, $220 and $222.