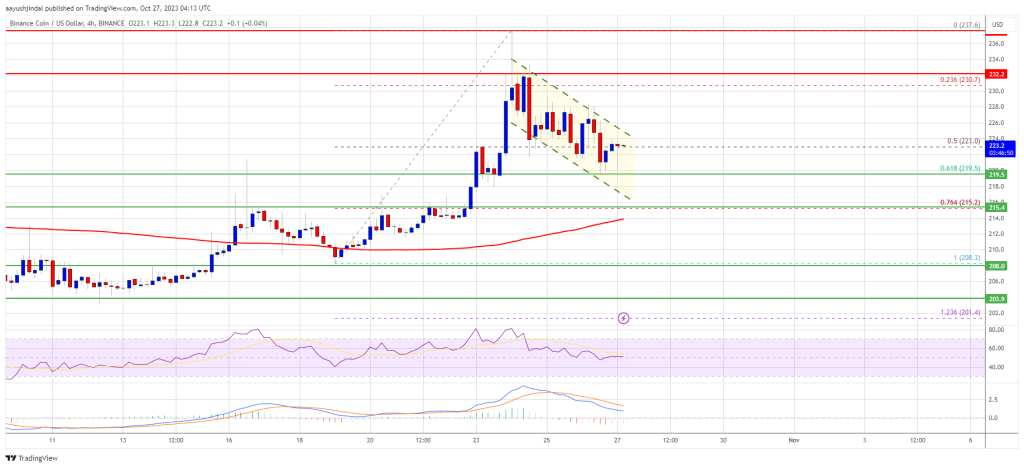

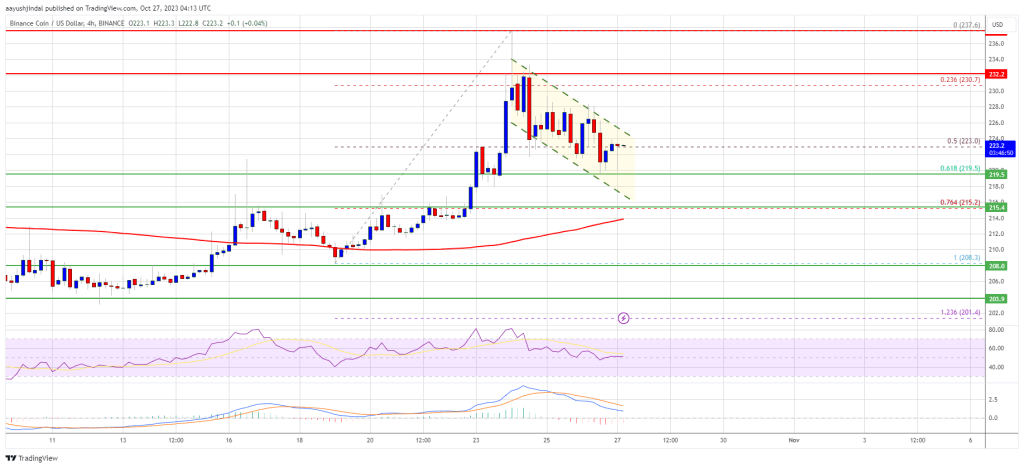

BNB price struggled to rise above $240 and corrected gains against the US dollar. It is now approaching a key support zone at USD 220 and USD 215.

- The BNB price is slowly falling towards the $220 support against the US dollar.

- The price is now trading above $215 and the 100 simple moving average (4 hours).

- A major bullish flag pattern is forming with resistance around $225 on the 4-hour chart of the BNB/USD pair (Binance data source).

- The pair could gain bullish momentum if there is a clear move above $228.

BNB price looks fresh

In recent days, BNB price saw a decent recovery wave above the key resistance zone at USD 220. Bitcoin rose more than 20% to $35,000, helping BNB avoid a major downside break.

The price climbed above the USD 225 and USD 230 resistance levels. However, it struggled near the $238-$240 zone. A high was formed near $237.6 and the price recently started a downward correction. There was a move below the USD 235 level.

BNB fell below the 50% Fib retracement level of the upward move from the $208.3 swing low to the $237.6 high. It is now trading above $215 and the 100 simple moving average (4 hours). There is also a major bullish flag pattern forming with resistance around $225 on the 4-hour chart of the BNB/USD pair.

If a new increase occurs, the price may encounter resistance near the $225 level. The next resistance is near the $228 level. A clear move above the $228 zone could see the price rise further. In the said case, BNB price could test $238. A close above the USD 238 resistance could set the pace for a bigger rise towards the USD 250 resistance.

Lose more?

If BNB fails to clear the USD 228 resistance, it could trigger another decline. Initial downside support is near the $220 level and the 61.8% Fib retracement level of the upward move from the $208.3 swing low to the $237.6 high.

The next major support is near the $215 level or the 100 simple moving average (4 hours). If there is a downside break below the USD 215 support, the price could fall towards the USD 207 support. Any further losses could trigger a bigger decline towards the $202 level.

Technical indicators

4-hour MACD – The MACD for BNB/USD is losing pace in the bullish zone.

4-hour RSI (Relative Strength Index) – The RSI for BNB/USD is currently above the 50 level.

Major support levels – USD 220, USD 215 and USD 207.

Major resistance levels – $225, $228 and $238.