- BNB faced key resistance at $617, with bullish sentiment pointing to a possible breakout.

- Rising open interest and steady social dominance signaled growing confidence, but volatility looms.

Binance [BNB] is gaining a lot of attention as bullish sentiment continues to strengthen across the market. At the time of writing, BNB was trading at $609.51, showing an increase of 1.94% over the past 24 hours.

Both the crowd and smart money indicators point to optimism; Can BNB break the key resistance levels and extend the current rally?

Can BNB break major resistance levels?

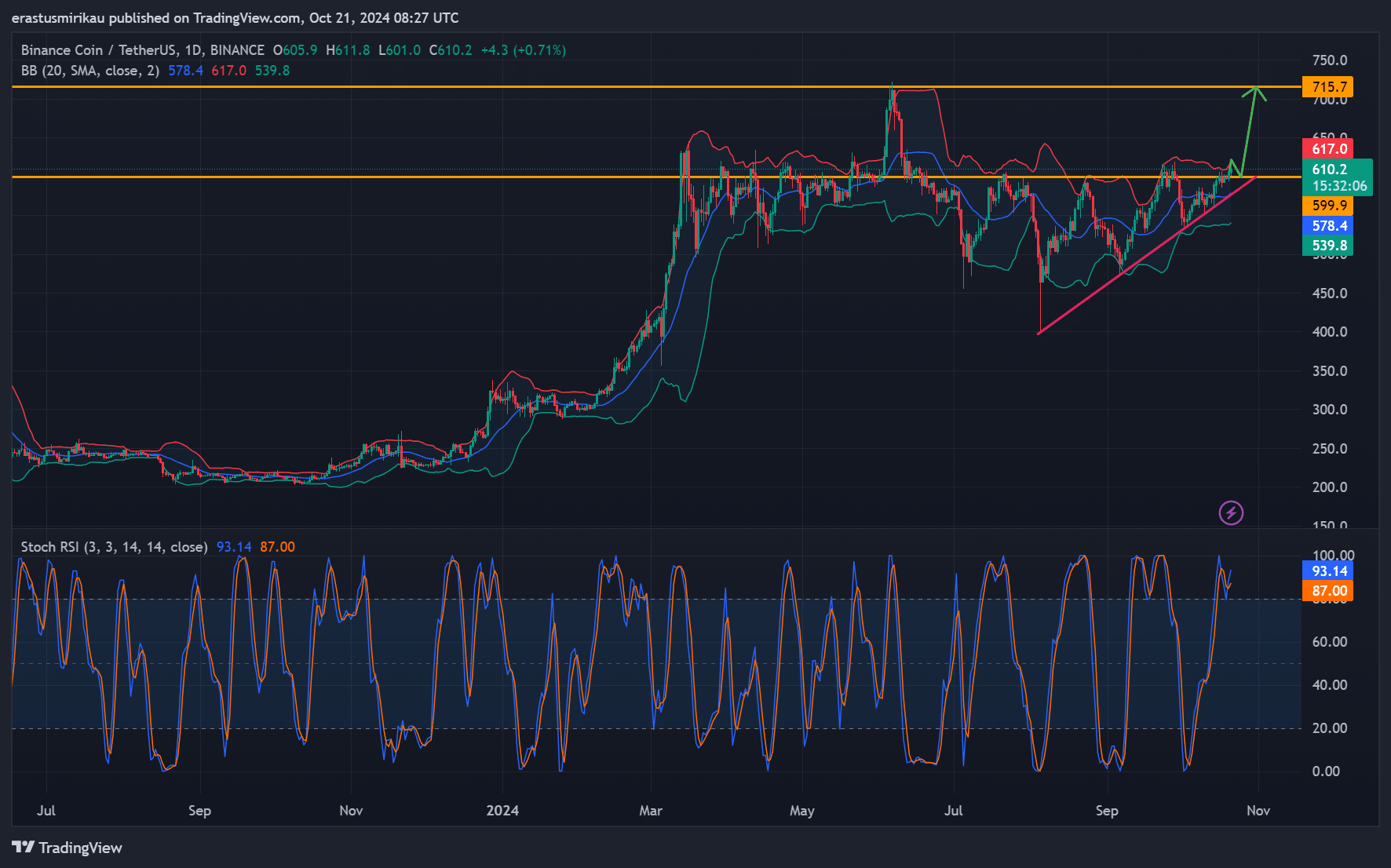

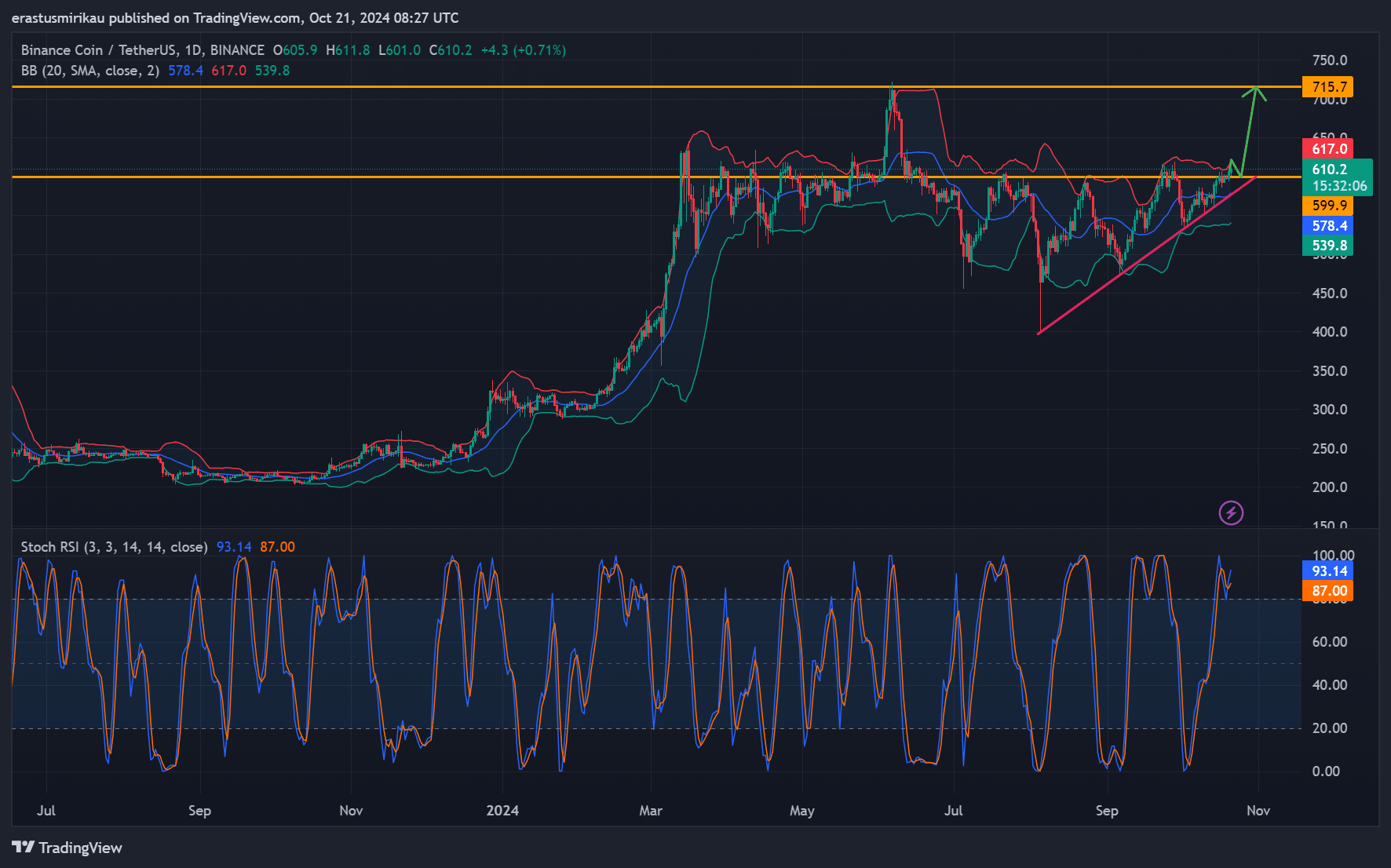

BNB’s price action is showing encouraging signs of strength. When the token was trading above $600 at the time of writing, it faced a crucial resistance zone at $617.

This level has proven to be a difficult barrier in the past, but clearing it could pave the way for a push toward the next big target at $715.7. Therefore, breaking through this resistance is crucial for further upward momentum.

Furthermore, the stochastic RSI was at an overbought level, confirming the strong buying pressure behind BNB’s recent rise.

However, an overbought RSI often precedes a short-term pullback, suggesting that BNB may experience a short correction before the rally resumes.

Traders should keep an eye on the $599 support level in case this retracement materializes.

Source: TradingView

BNB: Is more interest building?

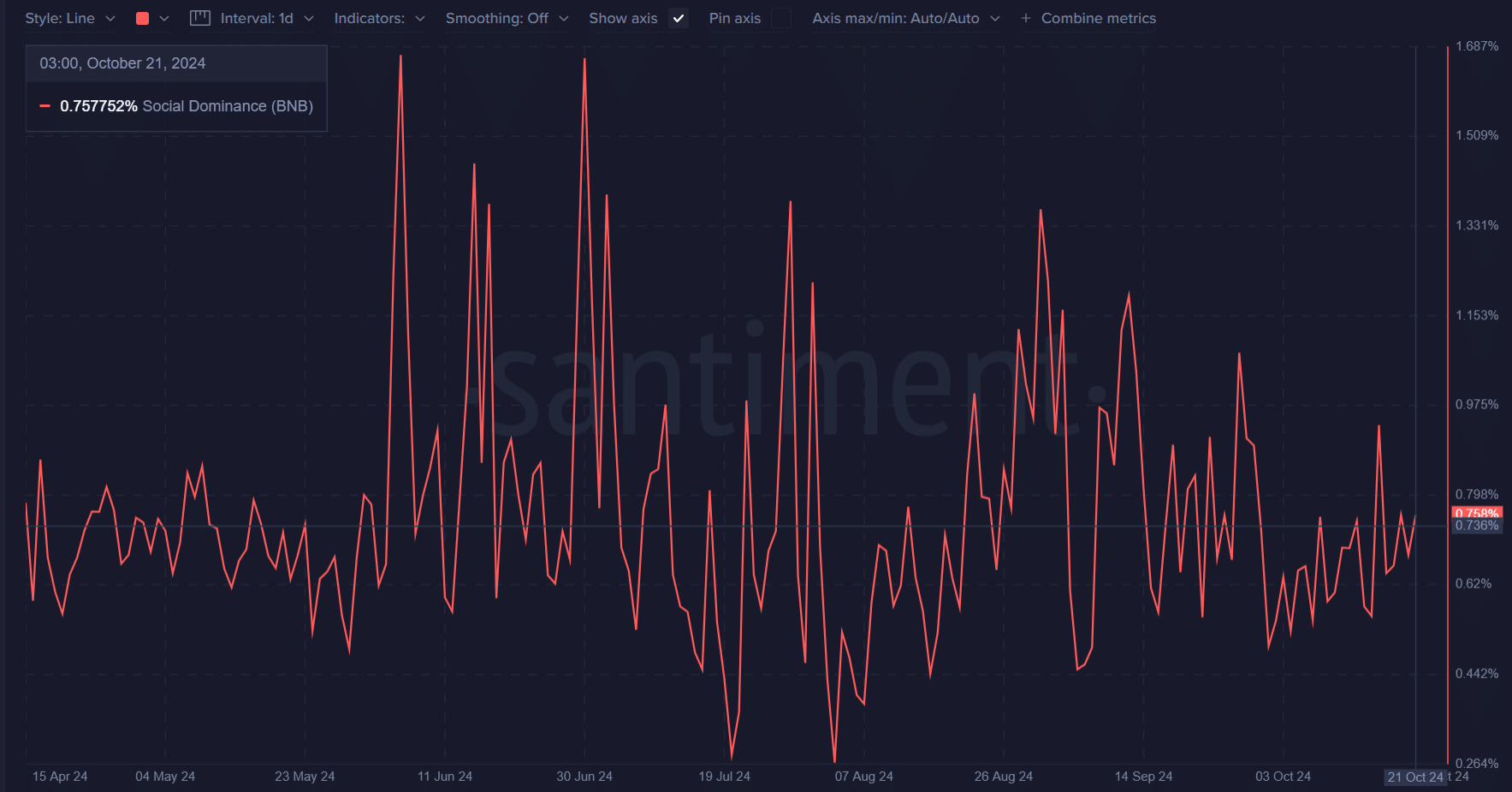

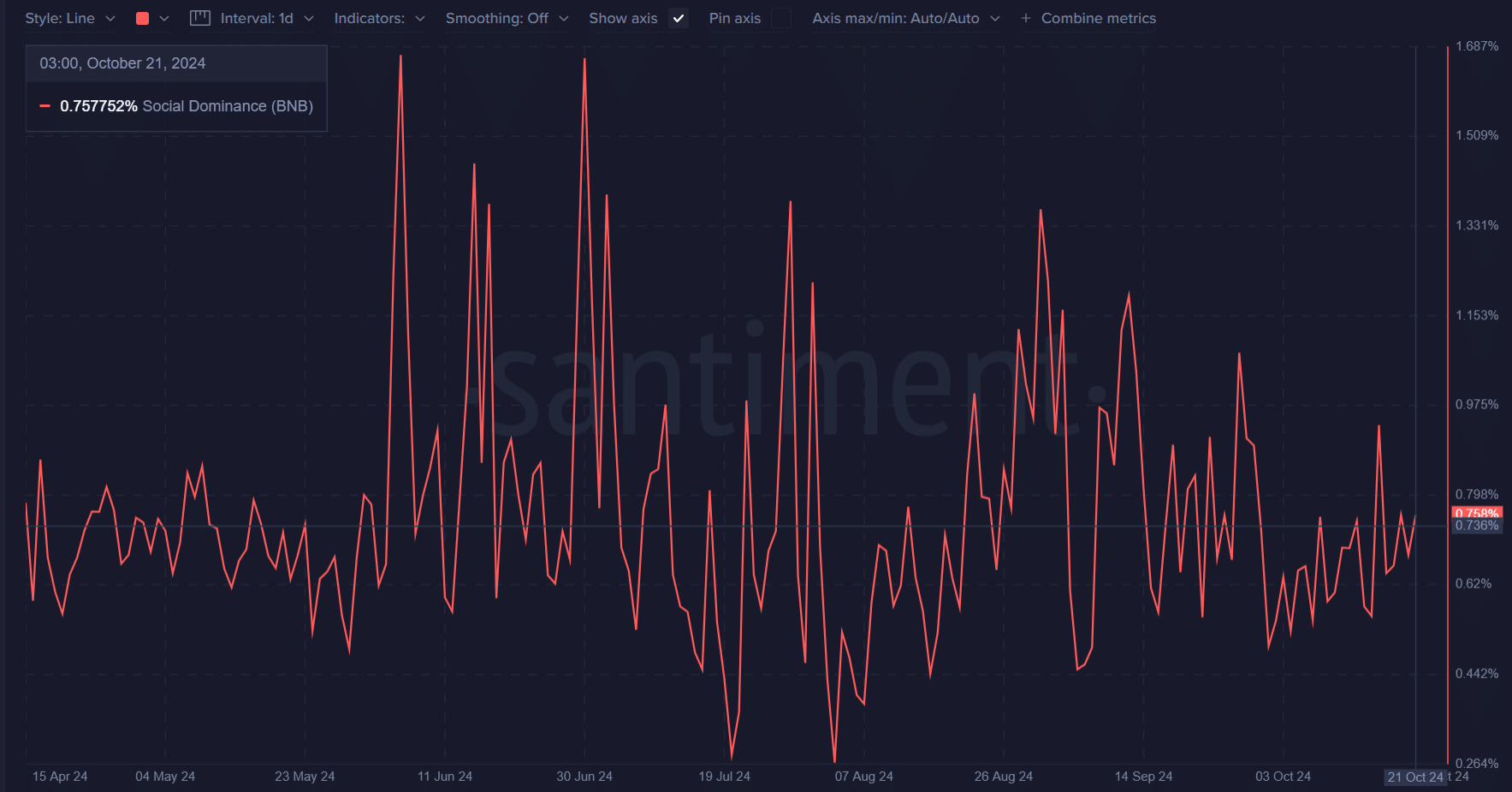

Although the coin’s social dominance has fluctuated in recent months, it stood at 0.757% at the time of writing, reflecting the market’s steady attention.

This consistency in social activity is significant, as greater social dominance typically accompanies growing investor interest.

If this trend continues, it could drive more market participants to BNB, further supporting its price. However, it is important to note that social dominance alone is not sufficient to guarantee sustainable price growth.

Source: Santiment

A sign of trust?

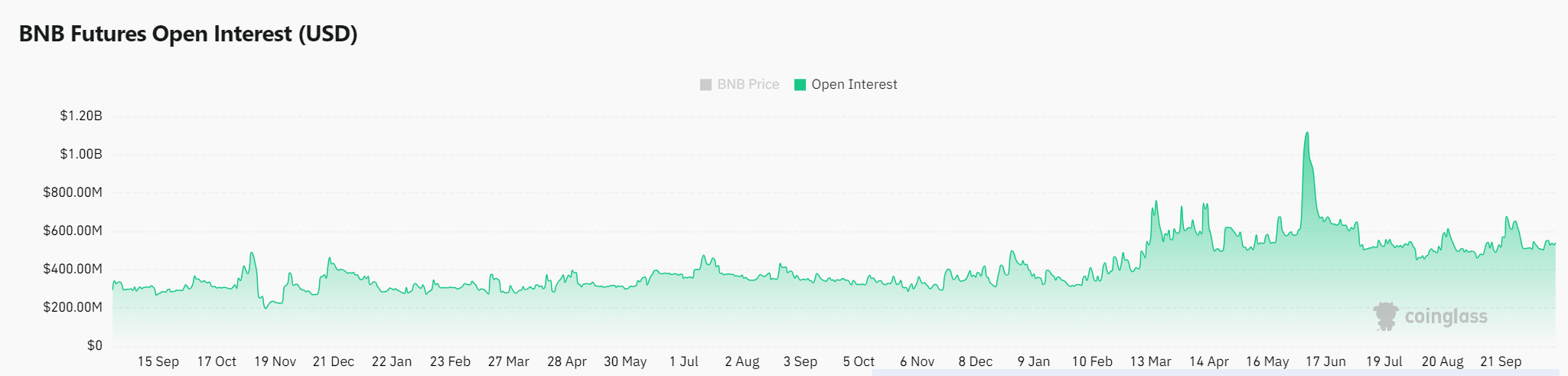

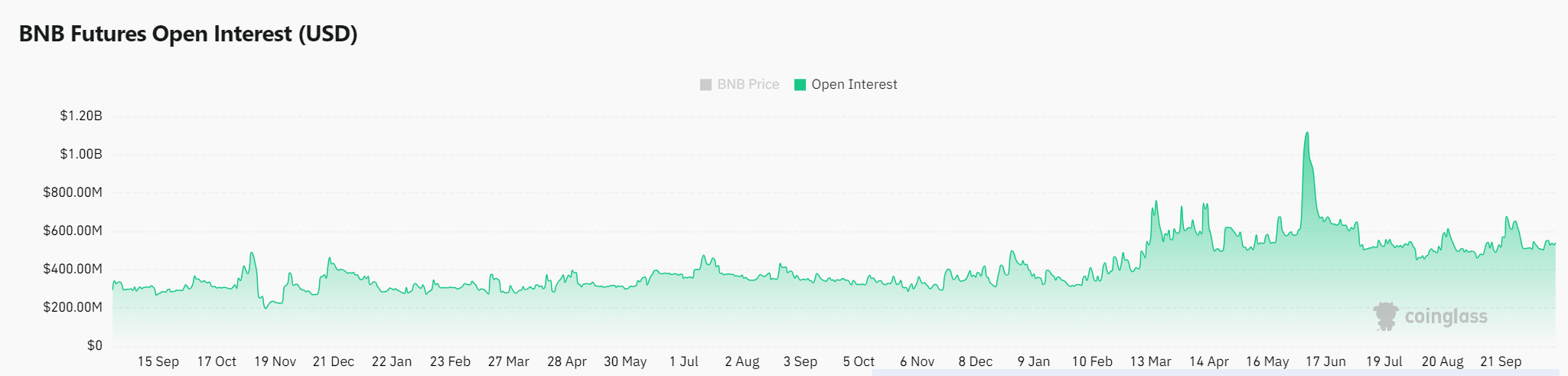

Open interest in the futures market increased by 5.94% and totaled $562.01 million at the time of writing.

This increase in open interest reflected growing interest from traders and suggested that more bets are being placed on Binance Coin’s future price movements.

A rise in Open Interest often leads to increased volatility, which could provide further trading opportunities for Binance Coin in the near term.

However, a higher Open Interest also means greater exposure to market risk, as large traders may unwind their positions, which can cause sharp price movements. Traders should remain vigilant as Open Interest increases.

Source: Coinglass

Read Binance Coin’s [BNB] Price forecast 2024–2025

Will BNB maintain its bullish momentum?

Binance Coin’s rising price, bullish sentiment, and rising open interest all point to potential upside. However, overcoming the key resistance at $617 remains essential.

While Binance Coin appears well positioned for further gains, short-term corrections could still occur. If BNB breaks this resistance, a rally towards $715 seems likely, paving the way for more bullish action.