- BNB bulls demonstrate dominance by pushing higher as most top coins face selling pressure.

- Binance’s demand for smart chain yield farming could be one of the main reasons for BNB’s positive effect.

Binance Smart Chain’s home currency BNB continues to rise even as the rest of the market struggled to maintain bullish momentum. Building on the upside achieved over the weekend, there is one major driver behind the bullish extension.

Demand for yield farming on the BSC has been a key driver allowing BNB to continue its rally so far this week. Especially after Binance’s announcement of Scroll’s SCR token on the Binance launch pool. Reportedly there have been whales buy up BNB for scroll yield mining.

Bitcoin and ETH experienced outflows on Tuesday, October 8, leading to lower prices over the past 48 hours. BNB managed to further increase the price during the same period thanks to continued demand. It was trading at $580 at the time of writing, after rising nearly 3% on Tuesday.

Source: TradingView

The bullish extension also allowed BNB to gain more than 6% over the past seven days. This made it the biggest gainer in the list of top 10 cryptocurrencies by market capitalization.

Note that BNB’s press time price was just 3.44% off the $200 target price. Why is this important? BNB has struggled to break above the $200 price range over the past three months.

This succeeded several times, but each time there was a revival of sales pressure. Will BNB pull back again or maintain its momentum above $600 this time?

Can BNB maintain the bullish momentum?

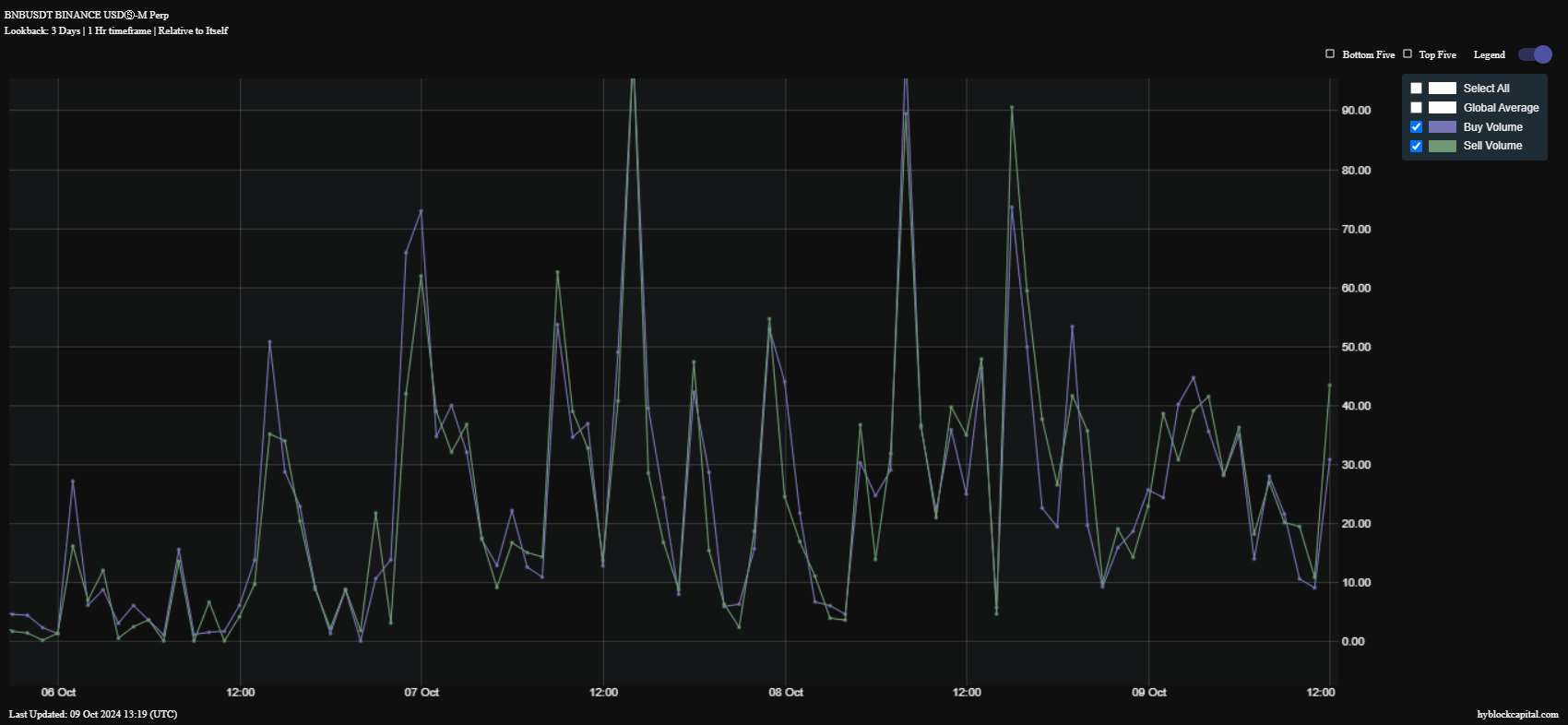

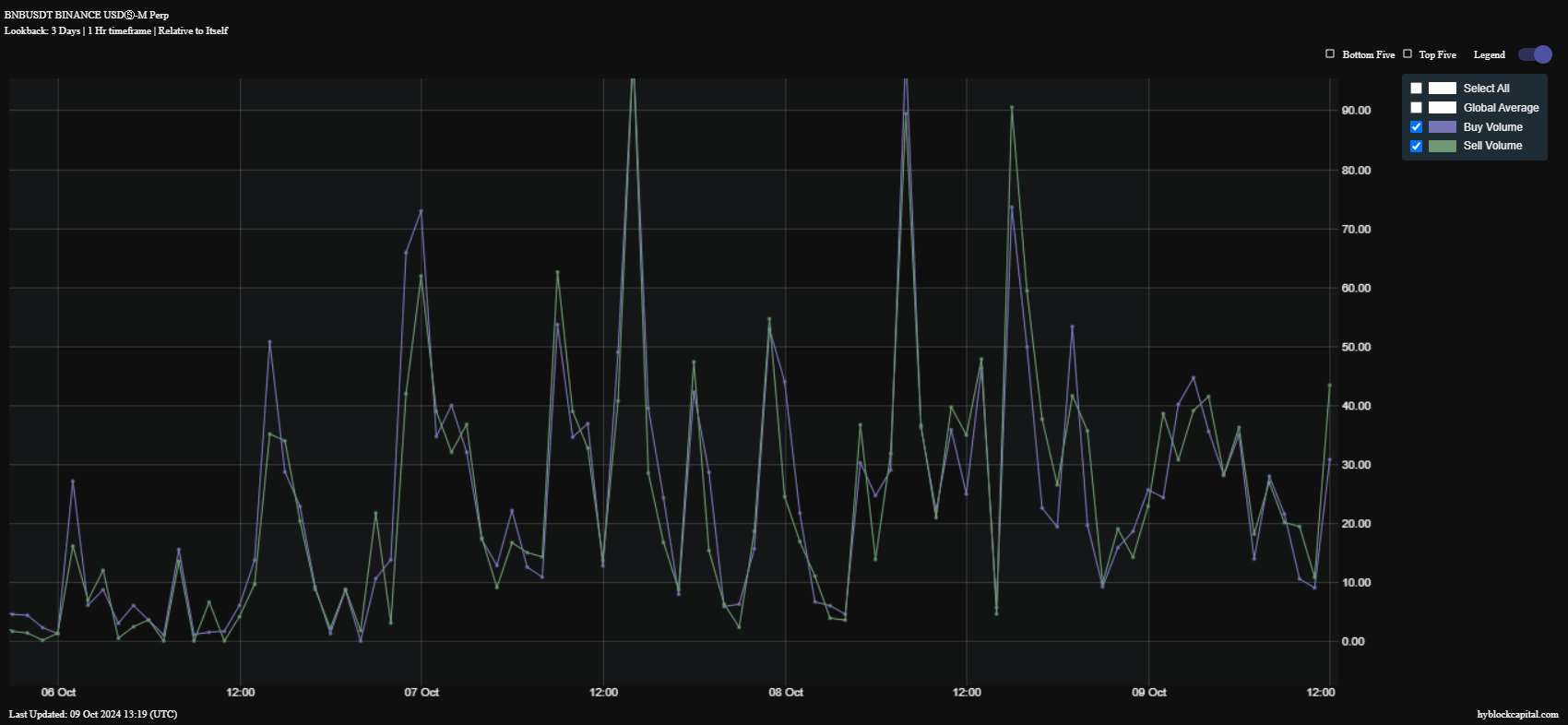

The cryptocurrency will undoubtedly experience some selling pressure as the current catalyst cools down. A look at the buying and selling volume in the chain shows that selling pressure appears to have increased over the past two days.

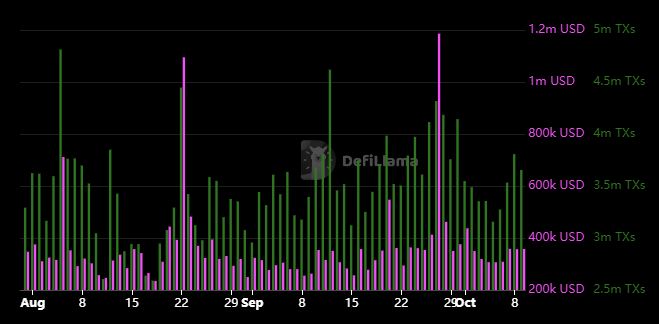

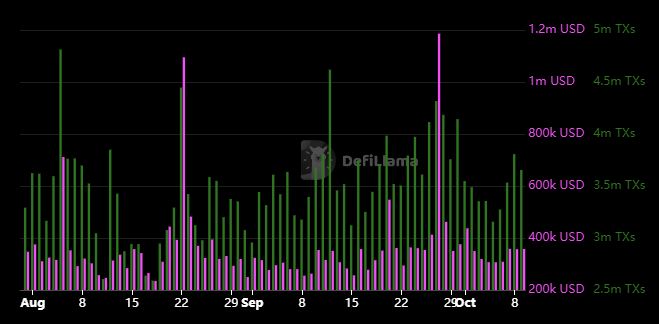

Source: DeFiLlama

The higher selling pressure compared to buying pressure suggests that BNB may be experiencing more friction in its price towards $200. However, that will depend on whether demand subsides, potentially paving the way for bears to take over.

Read Binance Coin’s [BNB] Price forecast 2024–2025

BNB’s performance was also marked by some recovery in network activity across the BNB chain. Transactions improved from a weekly low of 3.16 million TXS on October 5 to 3.65 million transactions on October 9.

Source: HyblockCapital

Rates on the network also showed a turnaround in the past three days, after falling since late September. Daily costs fell to $306,000 over the weekend and have since risen to over $350,000, reflecting the recovery in network activity.