- BNB breaks past $600 on rising volume and the RSI close to overbought, indicating potential for a rally to $620.

- Short squeezes and rising open interest support further upside momentum in the near term.

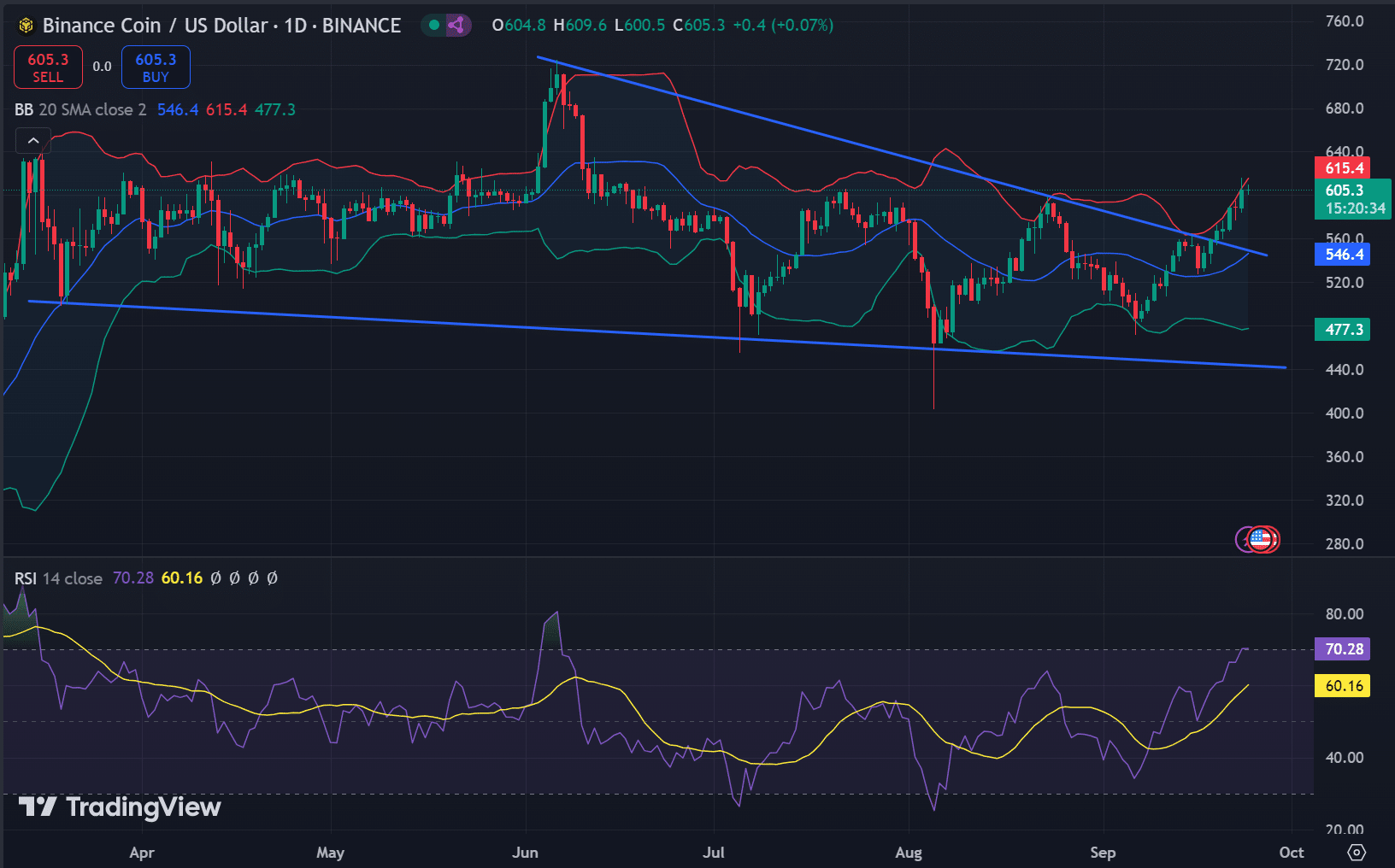

Binance coin [BNB] has surged past the crucial USD 600 level, catching the attention of traders eyeing their next potential target at USD 620. The big question now is whether BNB can maintain this momentum or retreat.

BNB’s Price Action: Will $600 Hold?

BNB’s recent price action shows a clear break from the downtrend, bouncing towards $605.3 after testing the $600 resistance. This level has become the main battleground for both bulls and bears.

The RSI at 70.28 indicates that the market is overbought, increasing caution for a possible correction. However, if BNB can hold above $600, it could test $620 soon.

Traders see the $615.4 level as the next resistance area, while $546 serves as crucial support if a retracement occurs.

Source: TradingView

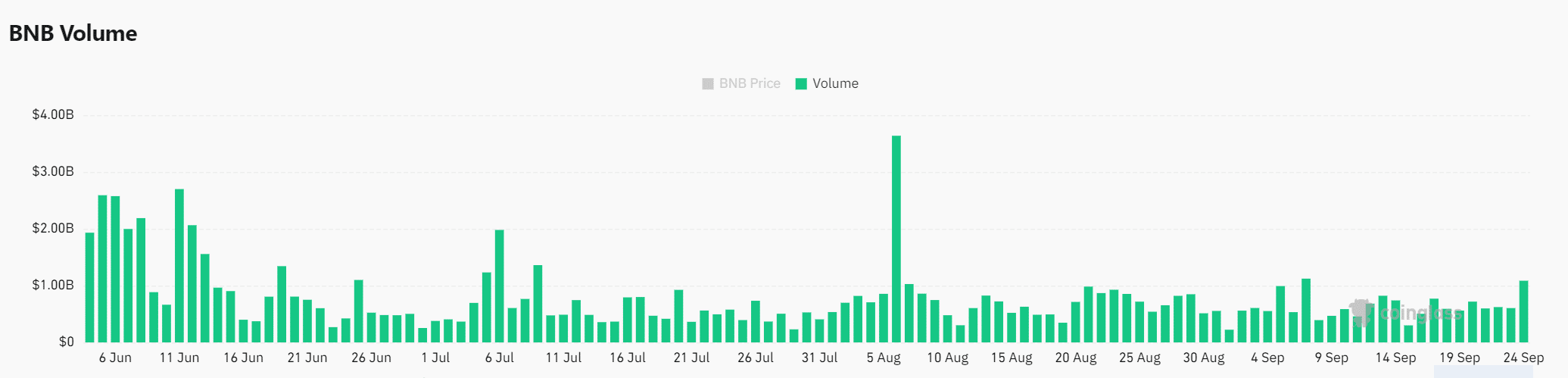

Increase in volume fuels confidence

With a 38.29% spike in trading volume to $1.03 billion, BNB shows increased market interest. Rising volume at a crucial price level is a strong indicator that more traders are getting in.

This increase suggests market participants are supporting the outbreak, which could push prices higher. As long as volume remains robust, BNB appears poised for more gains.

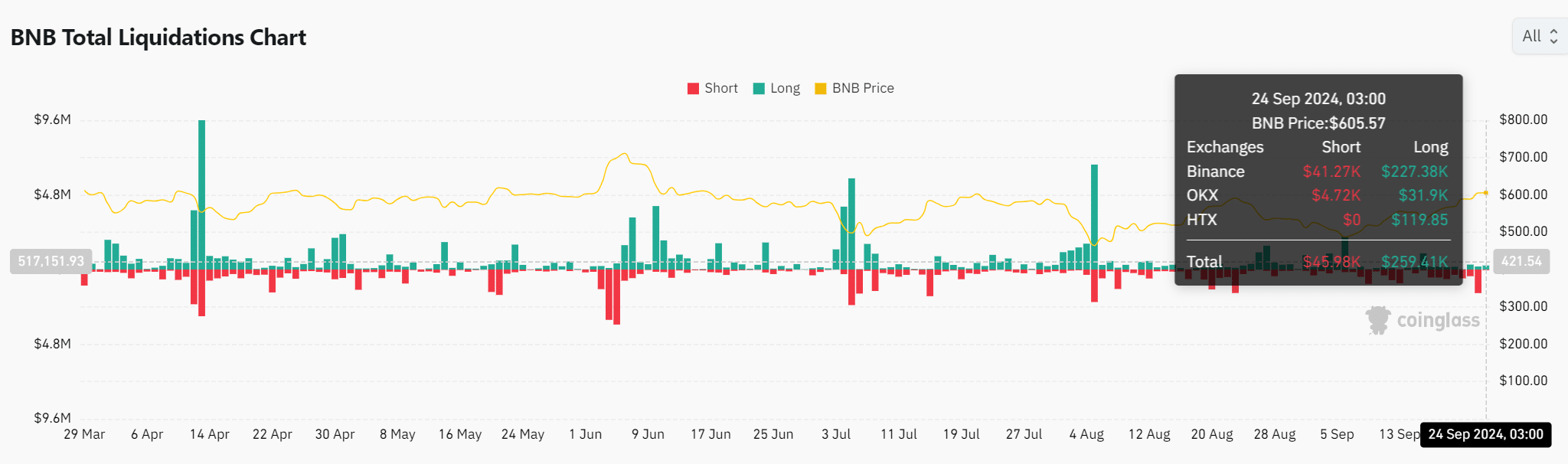

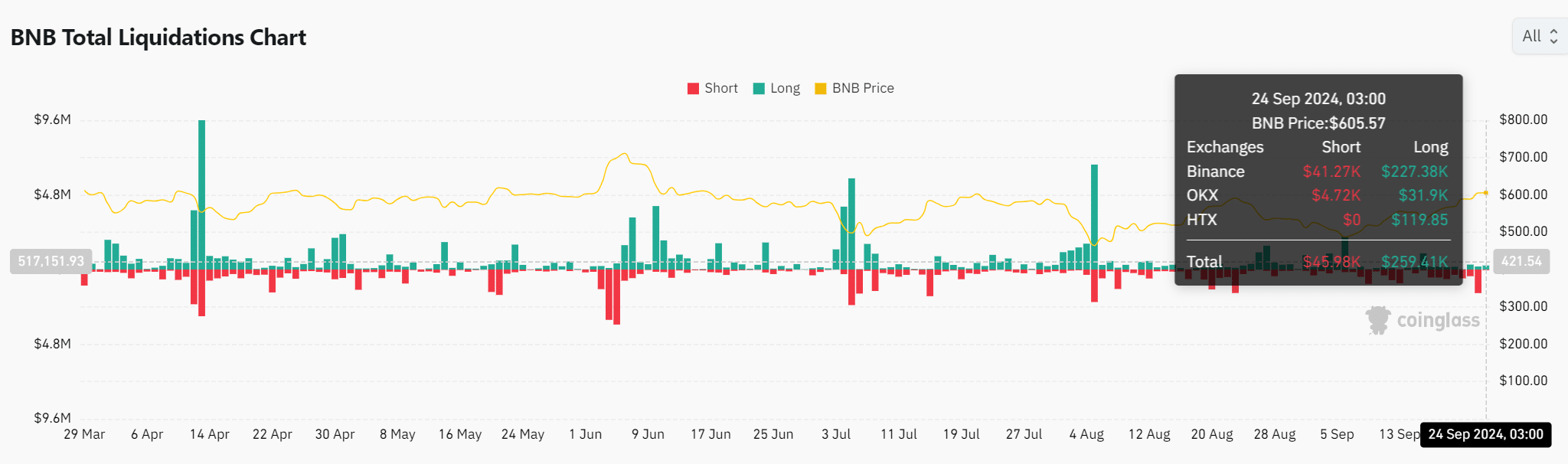

Source: Coinglass

Liquidation: shorts that feel the heat

BNB’s liquidation data paints a clear picture: short sellers are coming under pressure, with $45.98K in shorts being liquidated, compared to $259.41K in long liquidations.

Consequently, this imbalance promotes bullish momentum. The short squeeze is a major contributor to BNB’s recent upward move, increasing the likelihood of further price increases as shorts continue to be liquidated.

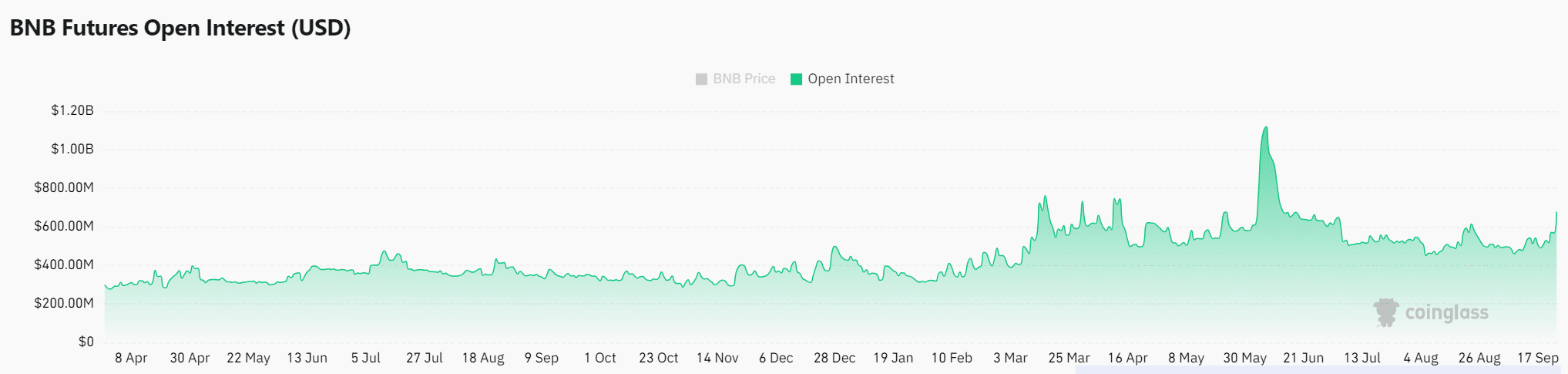

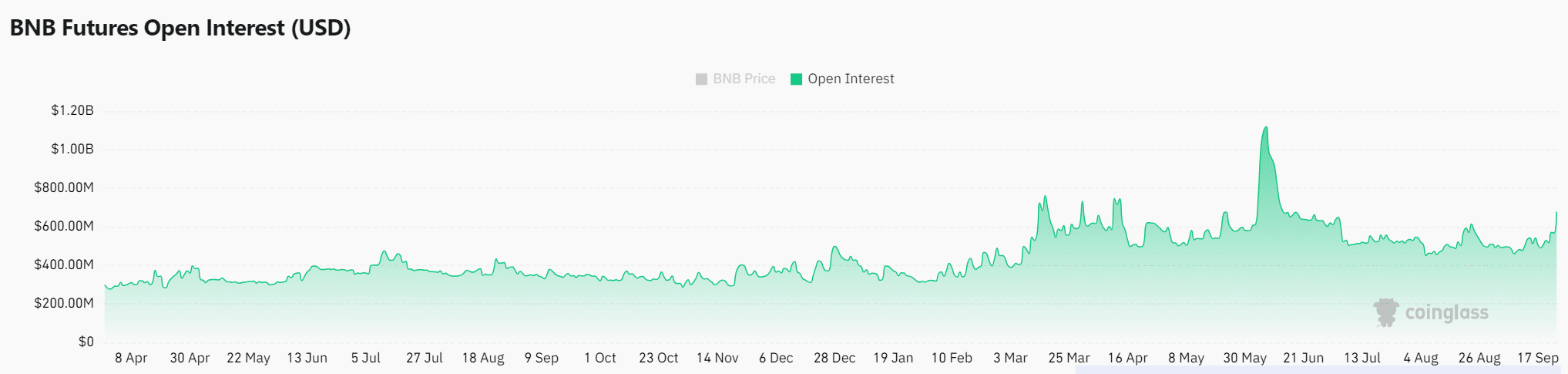

Source: Coinglass

Market confidence is growing

BNB’s Open Interest rose 13.74% to $671.80 million, a sign of growing confidence among traders. Rising open interest combined with rising prices indicates new capital is flowing into the market, further supporting the current rally.

Therefore, BNB seems to have strong support for another step forward. The increasing capital in the market reflects optimism about continued bullish action in the short term.

Source: Coinglass

What’s next for BNB?

The BNB’s rise above $600, supported by rising volume and widening open interest, indicates that momentum is likely to continue.

With short sellers under pressure and traders showing strong support, BNB looks poised to head towards $620 in the coming days.

Read Binance Coin’s [BNB] Price forecast 2024–2025

However, if BNB fails to maintain its current momentum and falls below the $600 level, we could see a quick pullback towards the $546 support.

This would indicate a weakening of bullish strength and open the door to more volatility, potentially leading to further downside pressure.