NFT

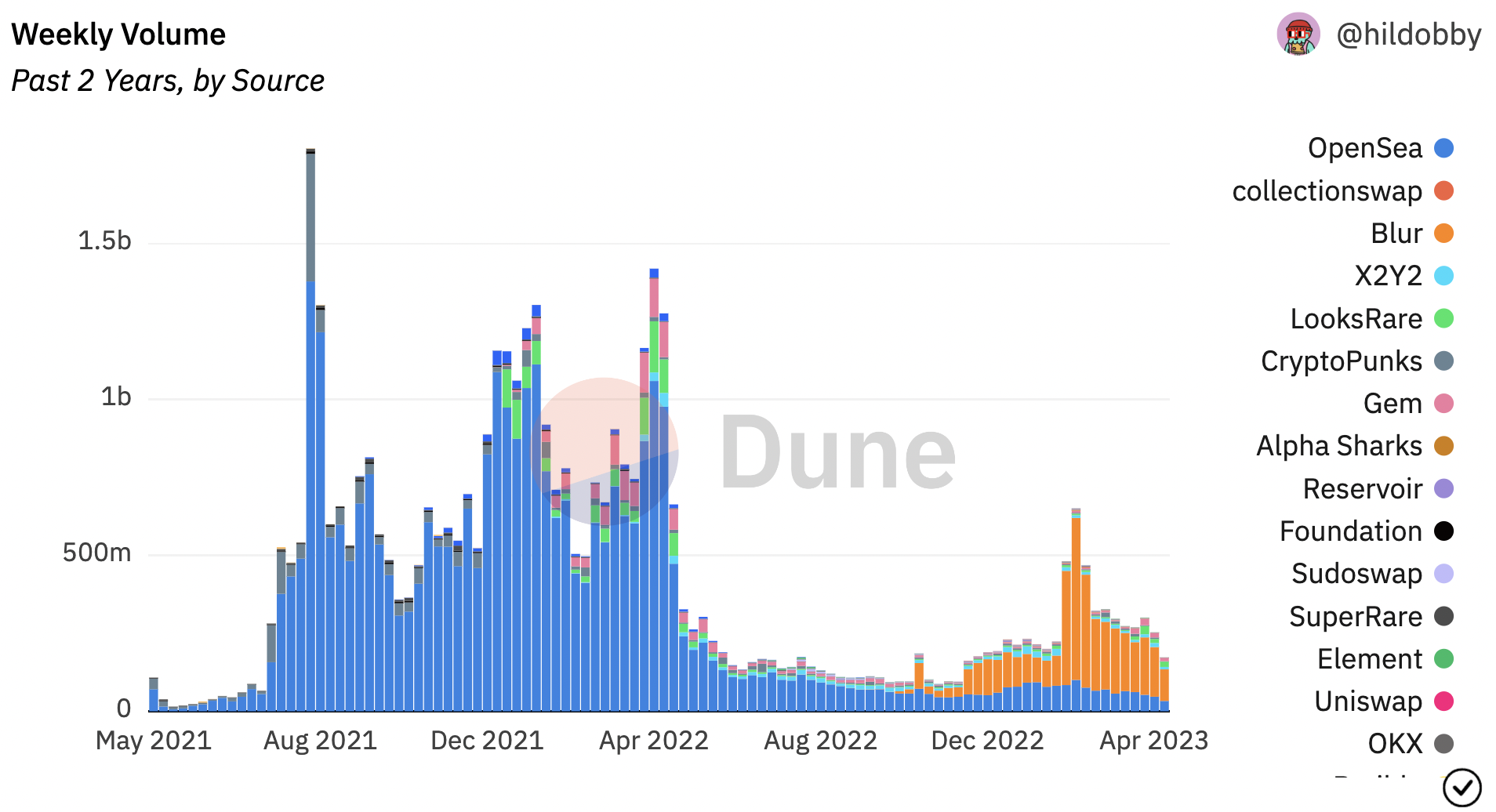

OpenSea again handles more than half of all Ethereum NFT transactions, but still has some way to go to overtake upstart rival Blur for overall volume.

Over the past week, OpenSea has averaged about 10,400 Ethereum NFT transactions per day according to a popular Dune dashboard by user hildobby.

Blur, the NFT marketplace slash aggregator focused on high volume trading, has seen around 8,500 a day.

In third place is the platform formerly known as Gem, which was acquired by OpenSea last year. Rebranded as “OpenSea Pro” by OpenSea, the marketplace averaged 2,800 per day during the same period.

But that’s just the number of raw transactions. Blur still dominates overall weekly volume. It currently sees over $100 million, a 60% share of the Ethereum NFT market compared to OpenSea’s 18.6%.

Blur offers zero-fee transactions and caps royalty payments to NFT makers — perks meant to encourage more transactions and, supposedly, better price discovery. It also just launched a peer-to-peer NFT lending protocol called Blend.

Blur (orange) was responsible for a large increase in NFT trading volume earlier this year.

Overall, weekly Ethereum NFT volume has fallen since a brief rebound in February, when the Blur hype was at its peak leading up to a token airdrop on Valentine’s Day. At the time, Blur was seeing a whopping $519.5 million in weekly NFT volume.

It is worth noting that hildobby’s dashboard only tracks Ethereum NFTs. Other networks, such as Solana, now handle significant volume.

Solana-based Tensor, an NFT marketplace slash aggregator in the same vein as Blur, shows about $1.6 million in volume in the last 24 hours, about the same as OpenSea Pro.

David Canellis contributed reporting.