The founder of Blur, an OpenSea rival that targets savvy traders, today defended the market amid a protracted fall in NFT prices.

Pacman, whose real name is Tieshun Roquerre, responded to Twitter chatter about whether Blur is responsible for killing the market.

“We launched on Oct. 22. Since then, some rock bottom prices have risen, some rock bottom prices have fallen,” Pacman tweeted late on July 5. “One of the few times rock bottoms went up together was when we got liquidity in nfts via our airdrop. One of the few times rock bottoms went down together was when $40 million in liquidity was removed through the Azuki coin (no stones throwing , the market simply moves based on liquidity more than anything else).

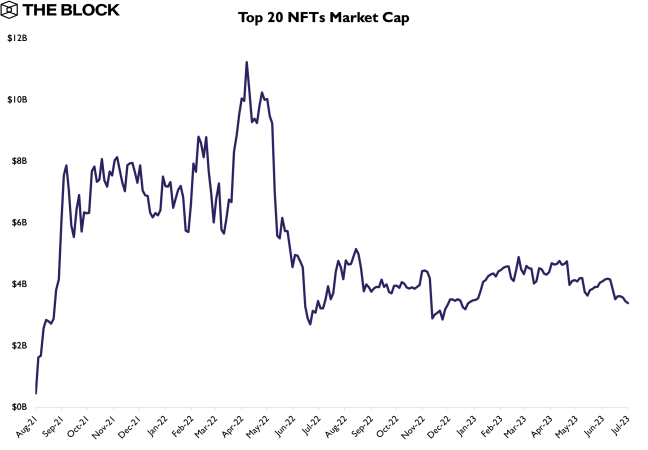

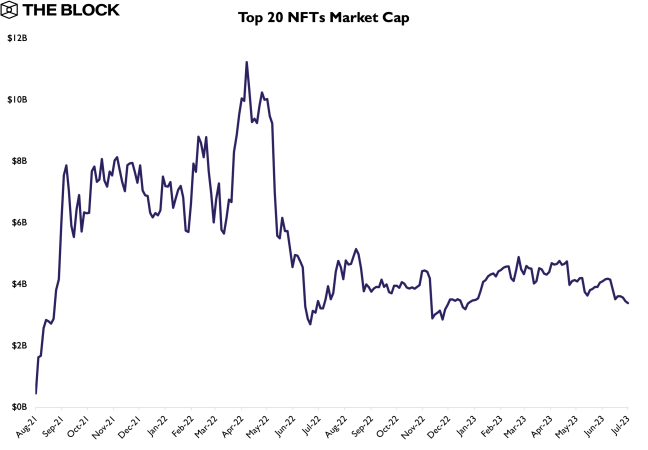

The NFT market has been in a suppressed state for over a year, at least compared to the staggering highs of 2021. Lately, even the best collections have suffered.

The floor price – the cheapest entry point for an NFT collection – of Yuga Labs’ Bored Ape Yacht Club is currently at 28 ETH (about $53,000), its lowest in more than 18 months and less than half the value at the beginning of the year, according to NFT Price Floor data. The bottom price of Azuki, another popular collection, crashed after its maker Chiru Labs botched the launch of a new set of NFTs last week.

In both cases, the finger was pointed at Blur, the Paradigm-backed marketplace for professional traders.

Lior Messika, whose investment firm Eden Block is an investor in Yuga Labs, said NFT whales who previously identified as “gatherers” are now calling themselves traders or even “Blur farmers,” adding that space had become distorted by the “fear and greed of a few merchants.” Brad Kay, a research analyst at The Block Research, said much of Azuki’s sell-off can be attributed to Blur’s lending platform.

Dominating trading volumes

Blur certainly dominates trading volumes. It currently accounts for 70% of the NFT market volume on Ethereum, according to data from The Block Research. The Block reported earlier this year that the company is raising cash at a valuation of $1 billion.

In his tweet today, Pacman suggested that criticism of Blur’s success is misplaced.

“When asset prices are up, people don’t really talk about the cause (i.e. blurring injecting liquidity), but when they’re low, the pitchforks come out,” he said. “Bad takes spread like wildfire and at this point I just think of it as the cost of doing business.”

Despite the sell-off in major collections, data from The Block Research suggests the broader market is holding up about the same as last year. The chart below shows the combined market capitalization of the top 20 NFT collections, where the bottom price is multiplied by the supply.

NFT Market Cap. Source: The Block Research.