The NFT market has experienced a significant shock over the past three days, with more than 1,200 NFTs being liquidated following a historic low plunge in the floor price of several prominent or ‘blue-chip’ NFTs

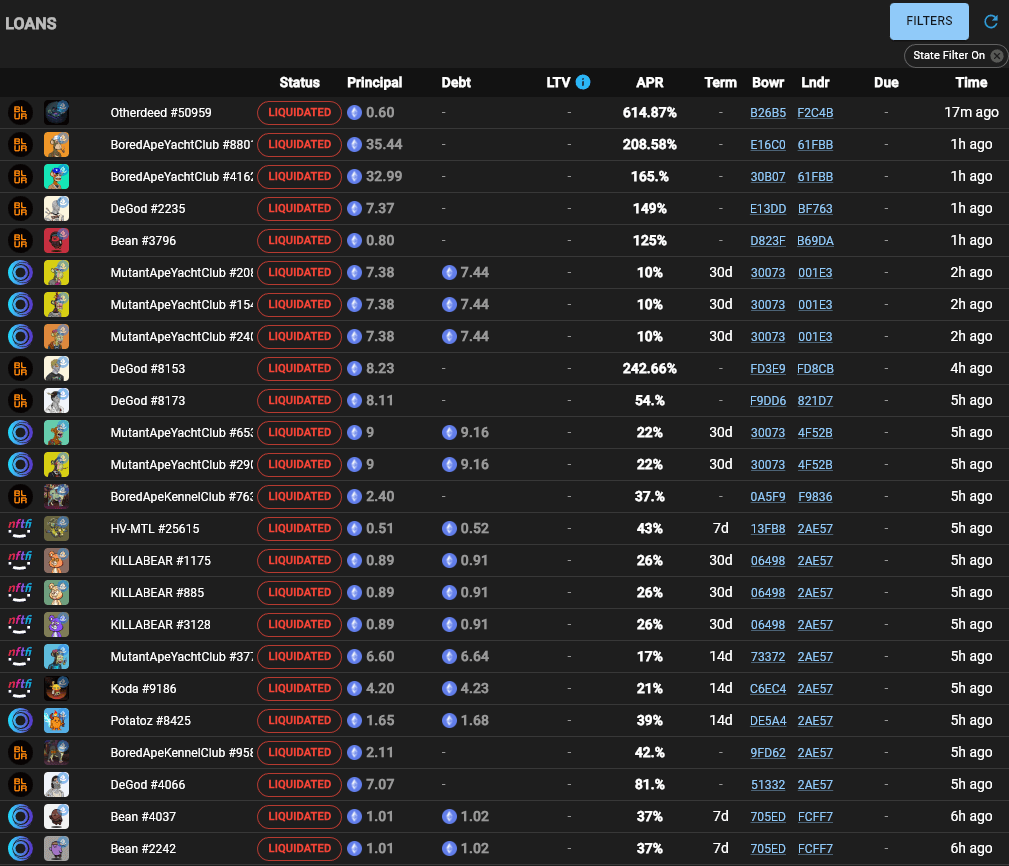

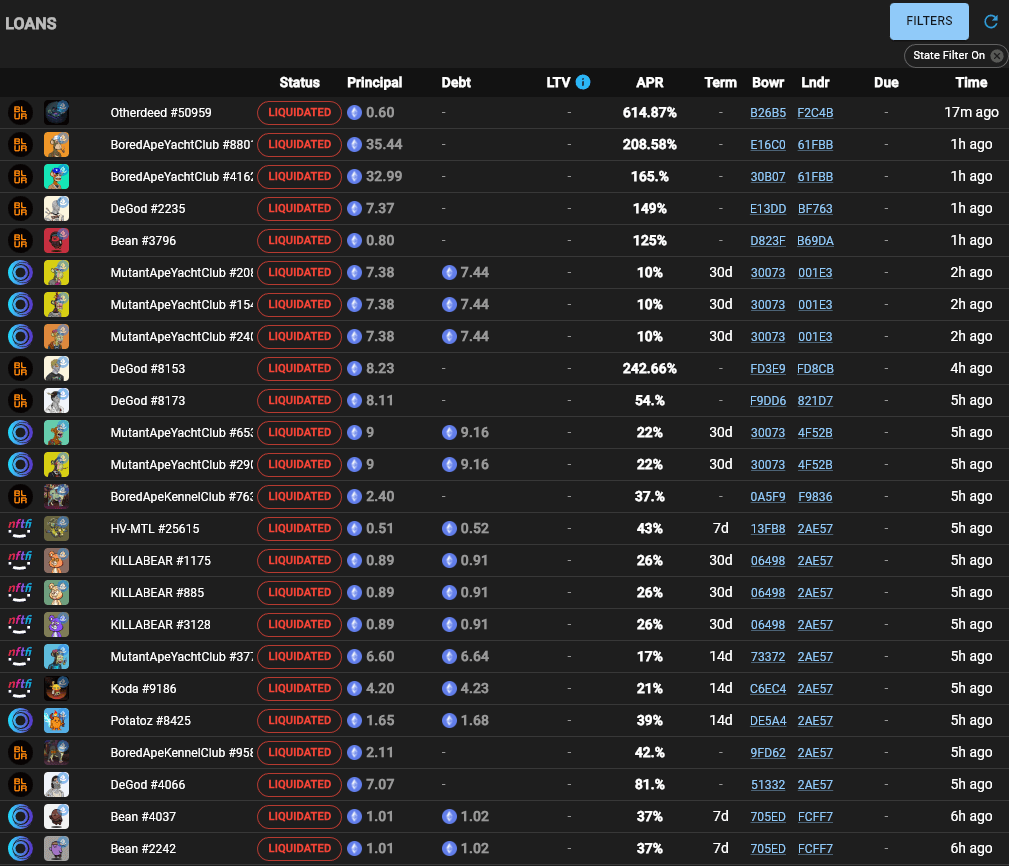

Data from the NFT analytics site, Snow Genesis, shows that hundreds of NFTs used as collateral for loans are at risk of liquidation. While some of these debts have been repaid, several NFTs have already been auctioned. The table below shows the most recent Snow Genesis NFT liquidations at the time of going to press.

CirrusNFT, Wumbo Labs, noted that several investors who took out loans on their blue chip NFT, including Azuki, CloneX, MAYC and BAYC, were affected during the period. The Beanz NFT collection saw the most liquidations, as 636 of its NFTs – 3% of the total supply – were affected.

Cirrus said the pace of these liquidations was alarming, highlighting that last year’s daily average was between 10 and 15 NFTs. However, he added:

“Good news is that the pace of liquidations has slackened dramatically in recent hours and there is not a crazy amount of underwater loans left.”

NFT’s bottom price tank

Over the past week, the bottom price of several NFT collections has fallen massively, despite the upward price movement in the broader crypto market.

The floor price of Bored Ape NFT crashed below 30 ETH on July 2, its lowest value since October 2021, before recovering to its current value of 31.5 ETH, according to Coingecko data.

At its peak, Bored Ape NFTs were selling for over 500 ETH, with several A-list celebrities, including Justin Bieber, spending over $1 million on one of the collections.

Azuki also took significant losses for his holders after the shoddy release of his Elementals collection. The bottom price of the collection fell by more than 20%, with community members proposing to sue founder Zagabond for 20,000 ETH.

Meanwhile, other blue-chip NFT collections such as DeGods, Pudgy Pegions, Azuki Elementals, and BAKC, Moonbirds also took significant hits during the reporting period.