A Bloomberg analyst says the U.S. Securities and Exchange Commission (SEC) is gearing up to approve all bids for a spot market Bitcoin (BTC) exchange-traded fund (ETF).

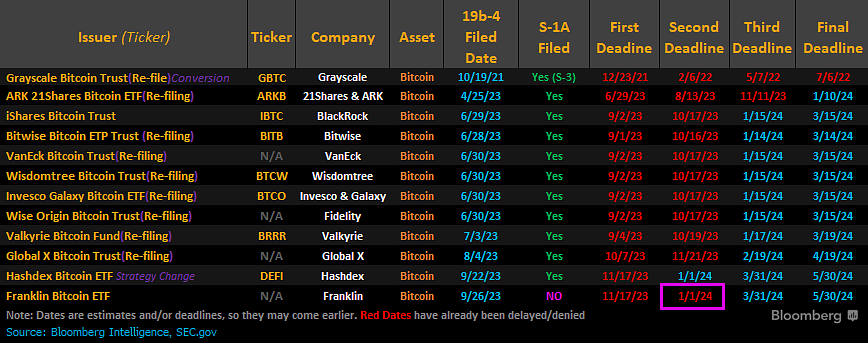

In a long thread on the social media platform X, James Seyffart say The SEC’s earlier-than-expected ruling on Franklin’s bids for a BTC ETF means the regulator could clear the way to approve the other in January.

“Wow. SEC went super early on Franklin. There wouldn’t be a new decision until January 1. Notably, Franklin is the only issuer that hasn’t filed an updated version. [Form] S-1 (asset-backed security registration) not yet. I wonder if that has any impact here…

If Franklin were to go super early today (and possibly Hashdex too?), that would see a full wave of approvals in early January.”

However, the SEC did not issue an early ruling on Hashdex’s offer. Instead, the regulatory body pushed it back to a specific date, prompting Seyffart to do so to believe that the SEC aims to approve all BTC ETF applications simultaneously.

“This delay on Hashdex all but confirms to me that this was likely a move to put every applicant in line for possible approval by the January 10, 2024 deadline.”

However, Seyffart says the process may not go smoothly as there may be issues with the filing process or the SEC may run into trouble. to deny the bids.

“I will make some comments here:

1. These are just the 19b-4 approvals (submission of new derivatives). We know this from updates and other sources [the] SEC is still not quite ready to approve the S-1s (prospectuses). So approval here could happen without an immediate launch.

2. They can still be rejected.”

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on TweetFacebook and Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney