Mike McGlone, Bloomberg Intelligence’s senior macro strategist, outlines his bearish view on Bitcoin (BTC) following the crypto king’s strong performance in the first half of the year.

McGlone tells his 58,000 Twitter followers that he thinks Bitcoin is in a bad technical position as it continues to fall despite the recent strength in the stock market.

According to the market strategist, Bitcoin’s rally above $30,000 this year could be seen as too long a rally in a macro bear winter.

“Bitcoin Could Extend Within a Downtrend…

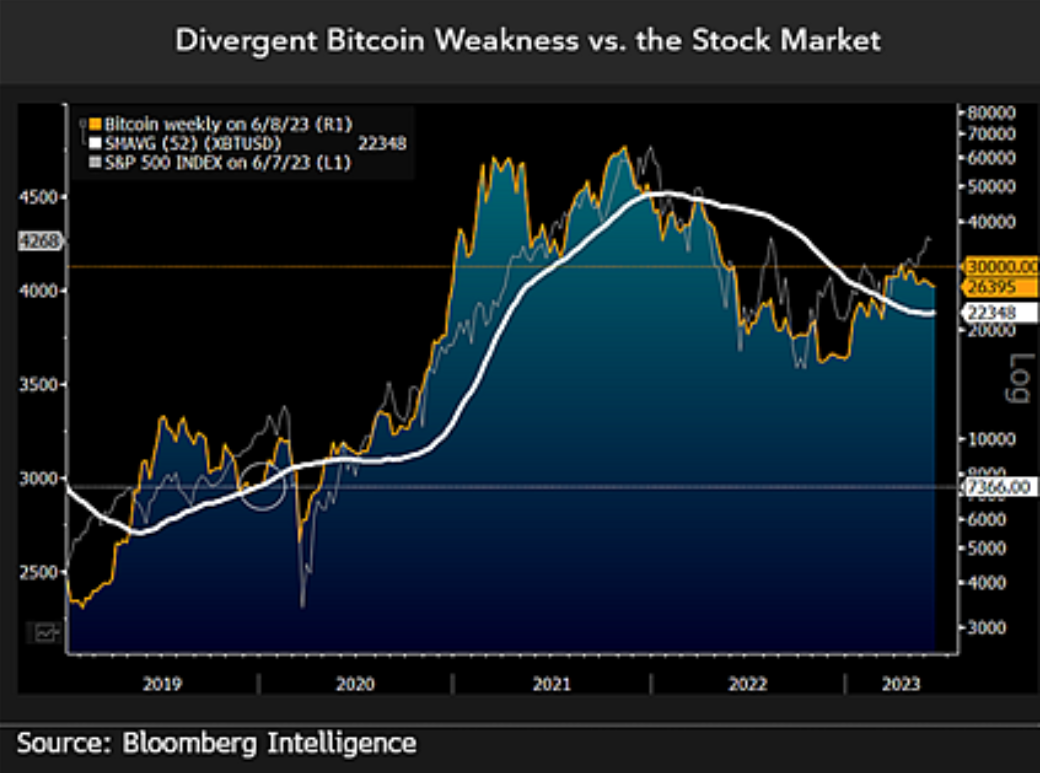

Our graphic shows the downward journey of Bitcoin’s 52-week moving average versus the upward trend at the start of the pandemic. The crypto has bounced back from being too cold at around $15,000 in 2022 and may have gotten too hot at around $30,000 in April.

It is the continued patterns of booms on the back of liquidity and busts when removed that tip our directional bias for Bitcoin towards respecting the 52-week downward average.

The fact that the Fed has tightened twice despite a bank run shows the tenacity of the central bank. Slumping copper and cryptos appear to be heeding the warning, particularly in contrast to the resilient stock market.

Earlier this month, McGlone said the second half of the year could be ugly for crypto assets and stocks, as he believes the Federal Reserve is still on track to raise interest rates.

At the time of writing, Bitcoin is trading at $25,849, down more than 2% in the past 24 hours.

Don’t Miss Out – Subscribe to receive crypto email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf the Daily Hodl mix

Image generated: Midway through the journey