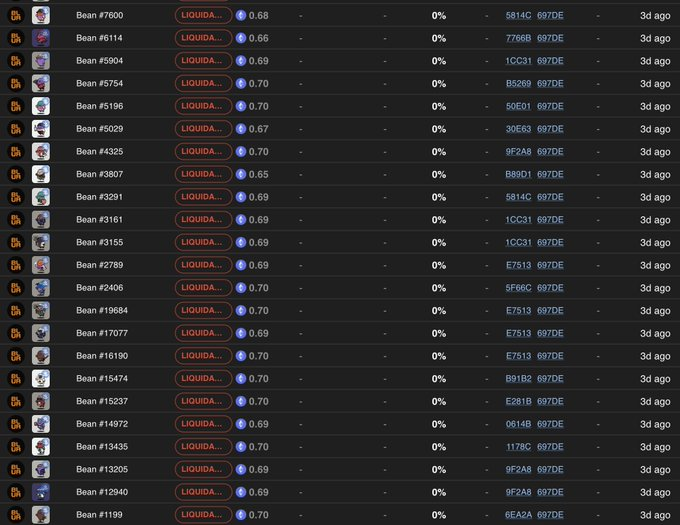

According to CirrusNFT, there have been 1244 liquidations in the last 96 hours. This does not include forced sellers who sold their collateral to pay off loans before they were underwater. This is considered the most catastrophic liquidation in NFT history, and it shows no signs of stopping.

Over the past few days, we’ve seen the worst liquidation cascade in NFT history, and it’s not really close

There were 1244 liquidations in the last 96 hours (this excludes forced sellers who sold their collateral to pay back loans before they were underwater)

For reference… pic.twitter.com/3cpy8tDHi5

— Cirrus (@CirrusNFT) Jul 3, 2023

During this liquidation, the Azuki ecosystem was the hardest hit. With 10-15 NFT loans liquidated, over 630 Beanz and about 3% of total Beanz NFT liquidated. The good news is that the pace of liquidation has slowed significantly in recent hours and not many loans are under water anymore.

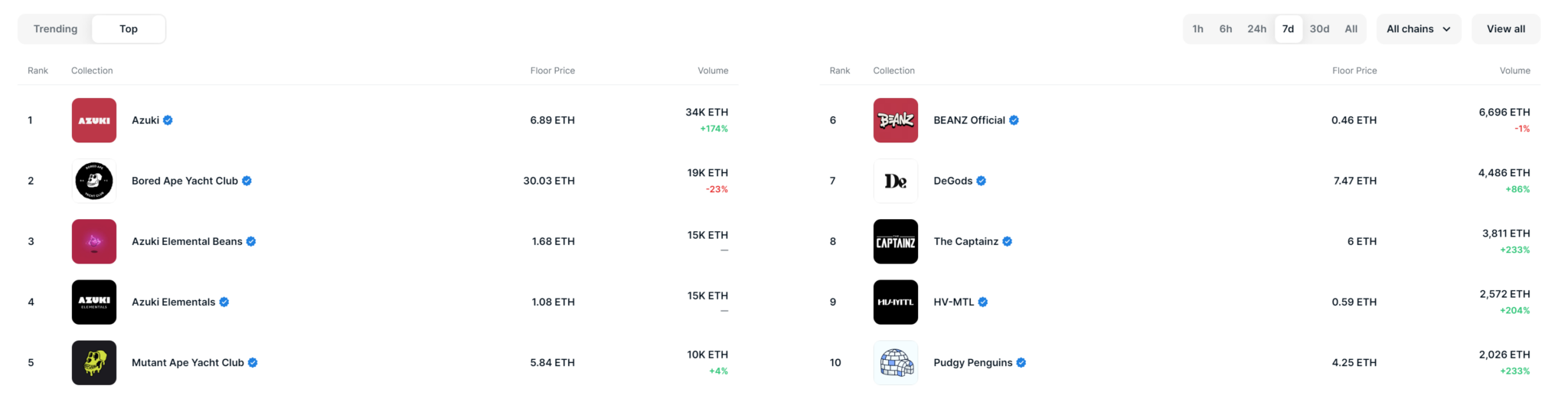

Some of the hardest hit NFT collections are from the Azuki ecosystem. In the past week, the Azuki, Elemental, and Azuki Elemental Beanz collections have all seen their bottom price drop by more than 20% in just 24 hours as they came under heavy criticism from the community.

Specifically, in the midst of a chaotic market, the popular NFT maker still launched a new collection of Azuki Elemental and quickly collected $38 million in just 15 sales. However, the municipality feels very disappointed. Elemental’s new design is generally no different from the original collection, Azuki (released February 2022), and has been accused by the community of defrauding users in the 20,000 ETH lawsuit announced yesterday.

Since Azuki’s Elemental collection went down, the Azuki collection in general has dropped below 6 ETH. In addition, Bored Ape Yacht Club (BAYC) saw a 16% drop, falling below the 30 ETH mark in regards to rock bottom prices. On the other hand, Mutant Ape Yacht Club (MAYC) is down 20% to less than 5 ETH.

Yuga Labs’ latest crypto game product, HV-MTL, has slashed its rock-bottom price. Yuga Labs is also down more than 24% since the beginning of this month.

Source: Open Sea

According to a recent update, AzukiDao’s lawsuit did not take place, but last night Azuki DAO’s management token contract was attacked due to a security flaw. The attackers have now won 35 ETH. Vulnerability is mainly due to lines of code not being thoroughly tested. The contract is currently suspended.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We recommend that you do your own research before investing.