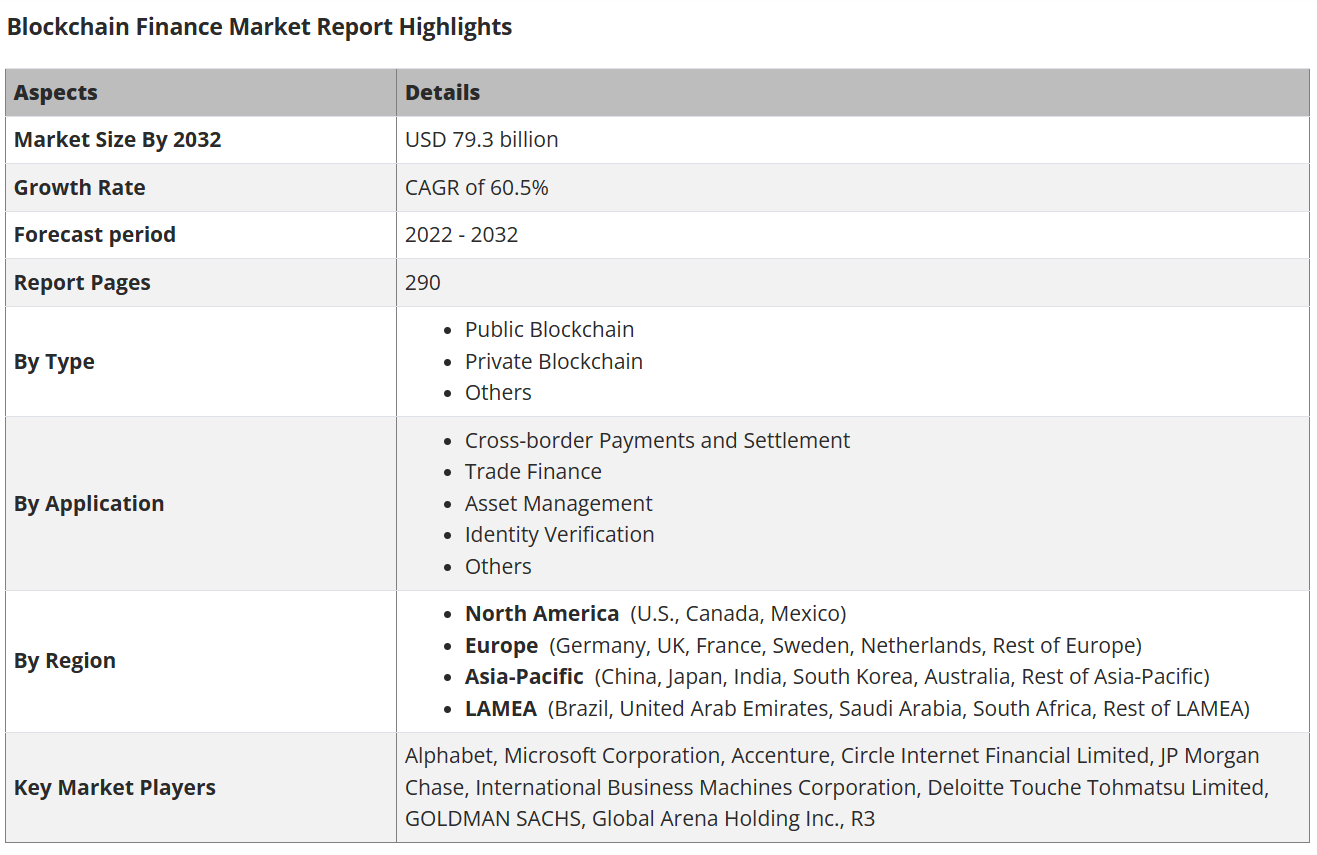

The global blockchain finance market – which includes public and private blockchains, trading, payments, settlements and asset management – is well positioned to grow to a $79.3 billion market by 2032.

A report from Allied Market Research shows that blockchain financing market players are intensively exploring collaborations and acquisitions as a top strategy. The disruptions in traditional finance caused by the COVID-19 pandemic, coupled with the promise of reducing operational costs, paved the way for the mainstreaming of the digital ecosystem.

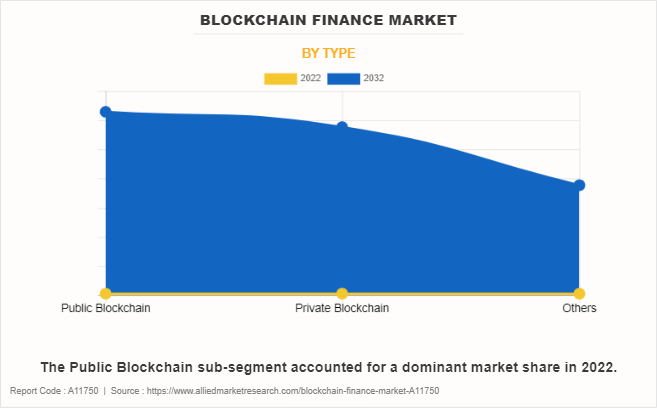

The public blockchain sub-segment is responsible for the dominant market share. Source: Allied Market Research

By 2023, the public blockchain sub-segment will represent the lion’s share of the type of blockchains in use worldwide. Bitcoin (BTC) and Ether (ETH) are some of the prominent crypto ecosystems that use public blockchains. Public blockchains have numerous benefits, as explained in the report:

“Public blockchains use significant computing power, making them ideal for maintaining large distributed ledgers related to financial transactions. These factors are expected to drive the blockchain financing market.”

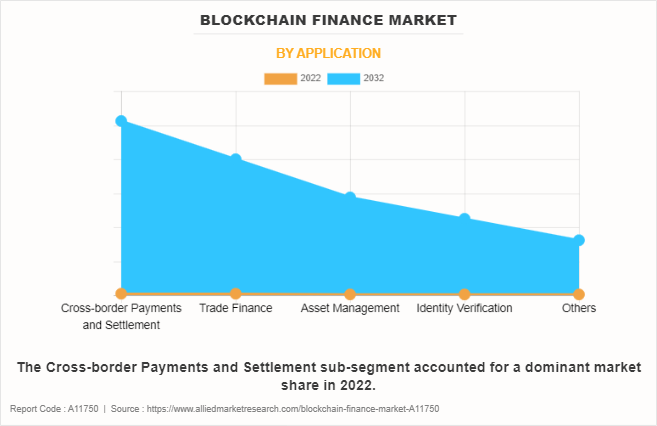

When it comes to the applications of blockchain finance, cross-border payments and trade are two of the largest sub-segments, driven by rising demand from individuals, enterprises, traders, industries and international development groups.

The cross-border payments and settlement sub-segment is responsible for the dominant market share. Source: Allied Market Research

As shown above, the trend is expected to continue as users continue to look for cheaper alternatives to move their savings around the world. North America dominated the blockchain finance market in 2022 and is expected to maintain its lead in blockchain finance adoption.

Highlights of the Blockchain Finance Market Report. Source: Allied Market Research

Based on the quantitative analysis of trends and dynamics of the blockchain finance industry, Allied Market Research predicted a compound annual growth rate (CAGR) of 60.5%. Based on the estimates, the industry is poised to grow into a $79.3 billion market.

Related: Beyond Finance and Bitcoin: How Blockchain is Disrupting Secure Messaging

A recently published report from digital payments network Ripple shows that blockchain could potentially save financial institutions around $10 billion in cross-border payment fees by 2030.

The results show that global payment leaders are dissatisfied with the old rails for cross-border payments.

Find out why 97% believe #blockchain and #crypto will transform the way money moves in our latest whitepaper with @Faster_Payments. https://t.co/qacuAAzZrR pic.twitter.com/ForjM05Wbb

— Ripple (@Ripple) July 28, 2023

“In the survey, more than 50% of respondents believe that lower payment costs – both domestically and internationally – are the most important benefit of crypto,” the report said. The statement complements Allied Market Research’s report, which bases its growth trajectory forecast on cheaper and safer alternatives.

Magazine: Singer Vérité’s fan-first approach to Web3, music NFTs, and community building