In just a few days, the amount of value sent to the Blast Deposit contract on Ethereum has increased by an order of magnitude to $390 million.

A smart contract, advertised as a “bridge” for a yet-to-be-developed bullish rollup, has received about $340 million in ether and $50 million in stablecoins since launching Monday.

The contract is managed by a secure 5-key multisig, with 3 keys required to perform transactions. However, one of the five keys has no transaction history and the other four show initial ether deposits from the same Ethereum account.

An outside observer has no way of knowing whether the five keys were generated by five independent entities or people.

The development of the project, backed by VC firms Paradigm and Standard Crypto, along with a slew of influential crypto personalities and traders, is led by Blur co-founder Tieshun Roquerre, who goes by the pseudonym ‘Pacman’.

The former Thiel Fellow and MIT dropout previously told Blockworks that “each signer makes a unique contribution to Blast” and that the project uses “the same security model” as other L2s that specify Optimism, Polygon, and Arbitrum.

Although each of these networks is not completely reliable, it also has additional security components in addition to a multisig. For example, Arbitrum has a publicly elected “safety council” with twelve members, only two of which are part of the Offchain Labs development team.

Blockworks contacted Paradigm and Standard Crypto and Pacman for clarification.

Deposited ether cannot be withdrawn until February 2024, when the development team will need to amend the deposit contract, presumably alongside the launch of an actual rollup.

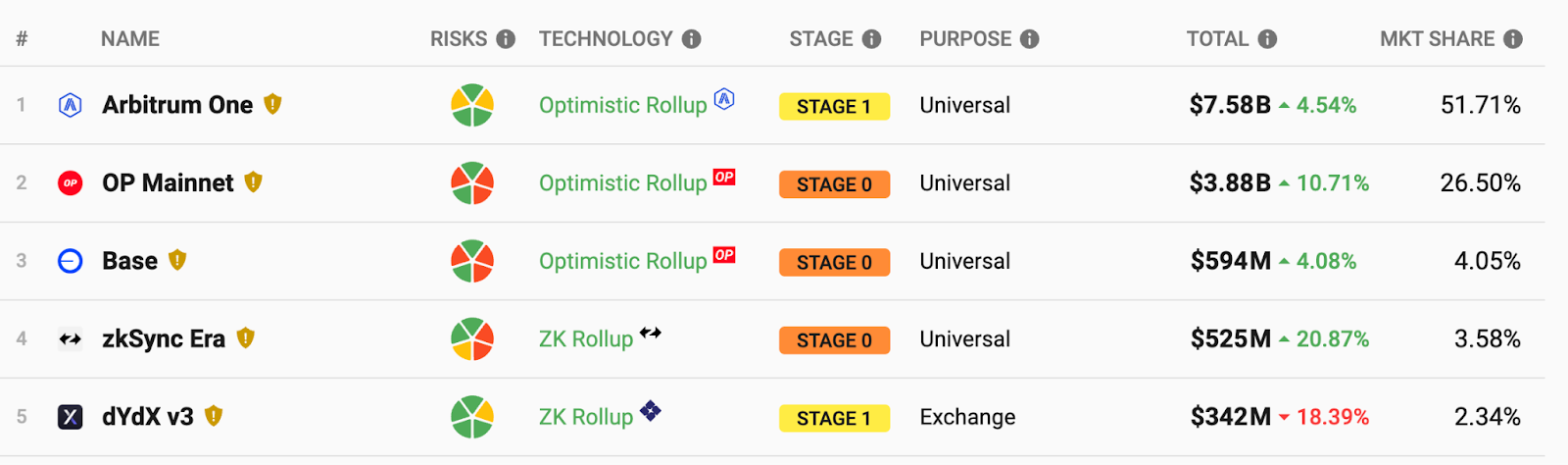

Ethereum layer-2 tracker L2BEAT lists the project in its “Upcoming” section, but if it were active today it would rank between zkSync Era, which mainnet launched in October 2022, and dYdX V3, the StarkEx combo pack that has been active since April 2021.

Active Ethereum L2s; Source; L2BEAT

One saver threw 10,000 ETH, worth $21 million at the time, into the contract in one transaction.

“Collective brains of Crypto Twitter” weighs in

Many crypto observers have expressed surprise at Blast’s rapid growth despite uncertain risks.

Blast has touted on its

important to clarify that this statement is false.

While I believe that striking should be made as risk-free as possible, we are not there yet. there are governance, contract and operator risks involved.

anyone using Blast should take this into account https://t.co/8z9dVJhr6J

— sacha

(@sachayve) November 21, 2023

Orlando Cosme, founder and attorney of OC Advisory, criticized the project, calling it an “onchain hedge fund” that “proves the regulators’ point.”

Blast proves the regulators’ point.

An onchain hedge fund controlled by a 3/5 anon multisig is not definitive. It’s “trust me bro.”

And centuries of “trust me brother” is why financial rules exist.

The added value of Crypto – and why crypto needs different regs – is to reduce trust.

We can do better.

— orlando.btc (@Orlando_btc) November 23, 2023

A survey by Tangent Ventures founder Jason Choi, who wants to tap into “the collective brain of CT,” has yielded more than 2,500 respondents. The unscientific poll puts the chance of an exploitation of the deposited crypto assets between now and February at 64%.

Will Blast Bridge be operated before February?

— Jason Choi (@mrjasonchoi) November 24, 2023

Offchain Labs Chief Strategy Officer AJ Warner noted in an X-post on Thursday that development company Arbitrum had considered a similar design but chose not to pursue it.

However, this does not mean that using bridging funds is necessarily a bad idea. There are, in theory, ways to manage/disclose risks etc. It’s just clear that the way Blast does it is not how we would approach it.

— AJ Warner (

,

) (@ajwarner90) November 23, 2023

Very few of the listed investors have publicly voiced their criticism of the project so far, although some claim to have expressed their concerns privately.

Dovey Wan, a Blast investor and founder of Primitive.Ventures, promoted the project’s success by raising capital with “pre-bull energy” and “strong pompanonomy,” while hand-waving safety concerns of the funds, by acknowledging ‘it’s just a multisig managed by 5 [profile pics] online.”

Wan urged crypto users to “build a bridge for culture, build a bridge for fun, build a bridge for what you can afford to lose everything,” adding the empty caveat that the promotion “no FA DYOR” – no financial advice, do your own research.