As the latest Ethereum (ETH) second-tier platform Blast grows by the day, some crypto enthusiasts are raising concerns about its security, tokenomic design, and even its ‘L2’ status. The Blast team had been silent for five days, but then explained the benefits of its multi-signature solution.

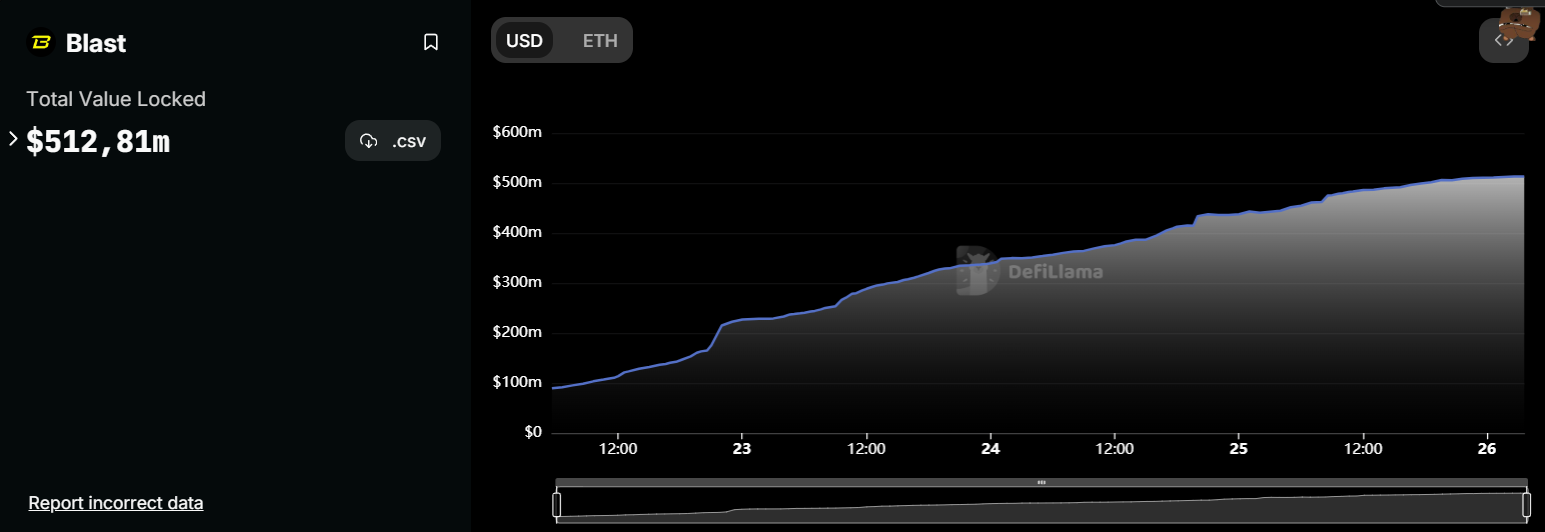

Ethereum L2 Blast sees $500 million deposited, says DefiLlama

Today, November 26, 2023, Ethereum (ETH) staking platform Blast recorded its total value locked (TVL) metric reaching an equivalent of over $500 million. At the time of writing, Blast savers had injected more than $512,810,000 into their contracts, DefiLlama data shows.

It launched on November 21 and raised its first $100 million in less than 24 hours, making it perhaps TVL’s fastest growing blockchain network.

According to data from 21 Shares’ dashboard on Dune Analytics (which, unlike DefiLlama, sees Blast’s TVL at “only” $382 million equivalent), the network managed Consensys’ Linea, Starknet, Polygon zkEVM, dYdX Chain and is on its way to leaving the foundation incubated by Coinbase in the dust.

As previously reported by U.Today, Blast is promoting itself as the first-ever Ethereum L2 with native yield. It withdraws all the money injected into Lido Finance and rewards savers with payouts and Blast Points. Blast stablecoin depositors can also benefit from Maker’s tokenized T-bills program.

The protocol raised $20 million from a group of renowned venture capital funds, including Paradigm, Standard Crypto and Primitive Ventures, with participation from powerful angel investors Andrew Kang and Santiago Santos.

“Multisigs can be very effective if used properly”: Blast team rejects criticism

At the same time, the protocol has been heavily criticized by the cryptocurrency community since its launch of the ‘early access’ phase for its centralization and Ponzi-like tokenomics.

Some skeptics felt that Blast looks like a single-node sidechain secured by a multi-sig contract, rather than being a true L2.

On November 25, representatives from Blast (believed to be founded by Blur NFT’s main figurehead, Tieshun “Pacman” Roquerre) shared a thread to address concerns about multi-sig risks.

They emphasized that upgradable contracts protected by multi-sig solutions are much more secure than stable contracts. In the case of Blast, the multi-sig is in the right hands:

You want to be sure that each multisig signing key is individually secure. This helps make the multisig antifragile. Each key must be in cold storage, managed by an independent party and geographically separated (…) For Blast, each signer has exactly those properties. They are deep technical engineers who have experience with high-stakes applications ranging from financial applications to smart contracts.

Also, the Blast team teased a security update next week: one of the hardware wallet provider’s multi-sig addresses will be changed.