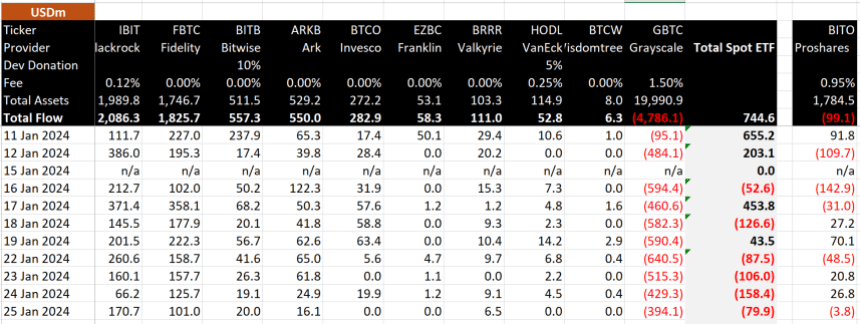

According to data from BitMEX ResearchBlackRock’s Bitcoin spot ETF – IBIT – has now set a new record, with total net inflows of $2 billion. This performance allows IBIT to maintain its position as the best-performing fund of the bunch, following the approval of 11 Bitcoin spot ETFs by the US Securities and Exchange Commission on January 10.

BlackRock’s IBIT maintains its dominant position as total net flows reach $744.6 million

On January 25, the tenth trading day of the Bitcoin spot ETF market, BlackRock’s IBIT produced an unsurprisingly positive performance, with inflows of $170.7 million. These gains allowed the investment fund to land on an exclusive list as the first Bitcoin spot ETF with a market cap of $2 billion.

Bloomberg analyst James Seyfarrt commented on this performance credited the recent price increase of BTC as a major factor. He said:

Yes the #Bitcoin pushed price $IBITassets in excess of $2 billion. This plus today’s likely new flows should mean interest rates will eventually top $2 billion.

Following the trading debut of BTC spot ETFs on January 11, IBIT quickly emerged as an investor favorite, with the market’s highest individual daily inflows of $386 million on January 12. BlackRock’s BTC spot ETF has managed to capture the attention of these investors throughout the period. the first two weeks of trading, evidenced by continued positive performance, which has resulted in total flows of $2.086 billion.

IBIT’s performance is closely followed by Fidelity’s FBTC, which recorded inflows of $101 million on January 25, bringing total inflows to $1.825 billion. Other Bitcoin spot ETFs with notable performance include Bitwise’s BITB and Ark Invest’s ARKB, both of which boast individual cumulative AUMs of over half a billion dollars.

In other news, Grayscale GBTC outflows remain a steady trend; However, there has been a notable decline in sales volume in recent days. At the time of writing, GBTC’s total outflows are estimated at $4.786 billion. Compared to a cumulative inflow of $5.53 billion, the total flows in the Bitcoin spot ETF market amount to $744.6 million.

Source: BitMEX

Bitcoin price overview

At the time of writing, Bitcoin is currently trading at $41,725.19, after gaining 4.52% in the past day, according to data from CoinMarketCap. This recent surge is quite significant considering the asset’s previous bearish form, marked by a 20% decline over the past two weeks, which led BTC to fall below $39,000.

Bitcoin’s price has been negatively affected by massive GBTC outflows; However, with selling pressure appearing to be easing, coupled with consistent positive performance from other ETFs, most notably BlackRock’s IBIT, the crypto market leader could soon stage a market recovery.

BTC trading at $41,802.61 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Featured image from Reuters, chart from Tradingview

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.