- Blackrock’s head of digital assets believes that Bitcoin could thrive in a recession environment

- The role of Bitcoin as a safe haven is now being tested

Bitcoin [BTC]At the time of writing, acted at $ 85,387, an increase of 2.30% in the last 24 hours. However, the market sentiment remains divided. In reality, intake have fallen by 54%, from 58.6k BTC/day to 26.9k BTC/day.

Nevertheless, BlackRock’s Robbie Mitchnick believes that Bitcoin could thrive, even in a recession. He pointed out that Bitcoin benefits from tax stimulus, lower interest rates and monetary relaxation – all common during economic decline.

Moreover, the fears for social unrest can push more people to Bitcoin as a hedge. While Q2 unfolds, the role of Bitcoin will be brought to the ultimate test as a safe haven. Will it prove his resilience?

BlackRock’s Bullish Outlook on Bitcoin

Through his Ishares Bitcoin Trust ETF (IBIT), BlackRock has established itself as an important institutional player in the Bitcoin market, with 570.582 BTC in his treasury. This only includes a remarkable addition of 22,076 BTC this year.

In a recent interviewRobbie Mitchchnick, Blackrock’s head of digital assets, created the decline of Bitcoin on 10 March under $ 80k to “premature expectations” around the economic prospects.

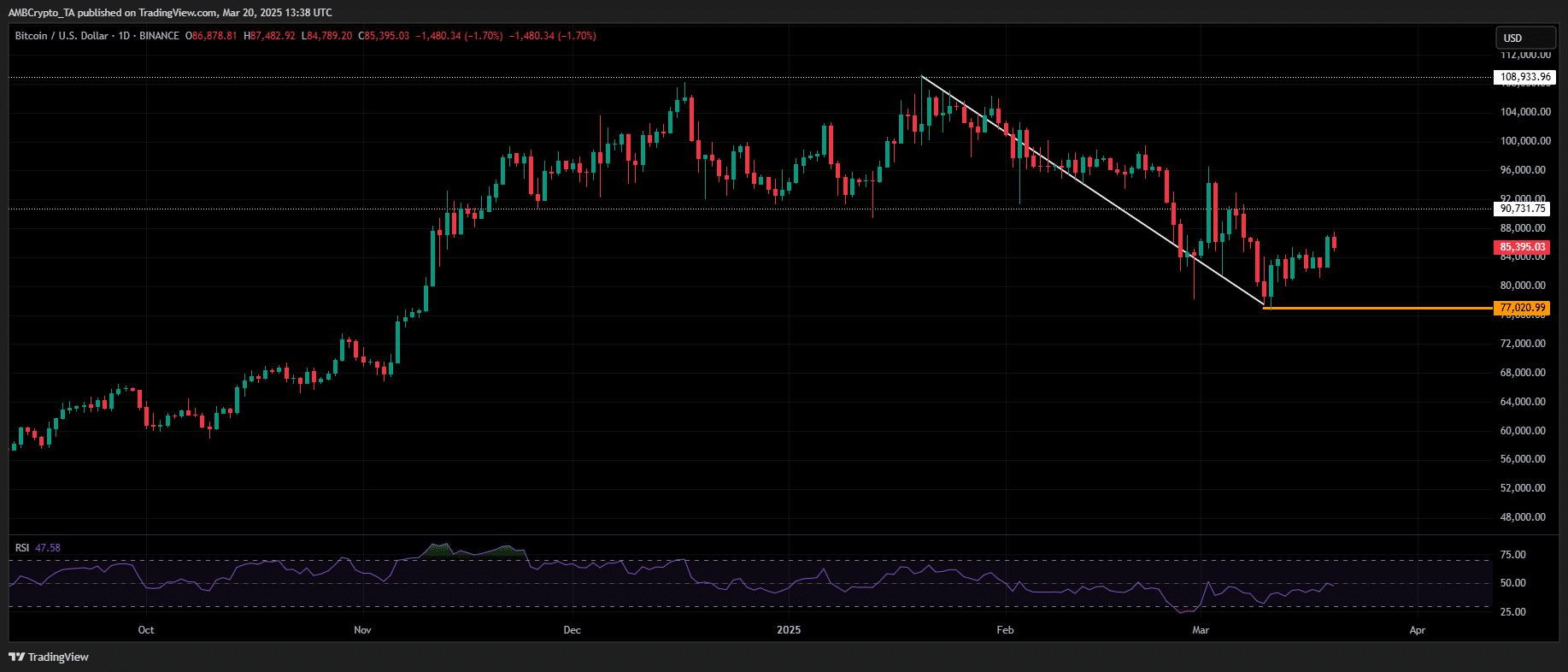

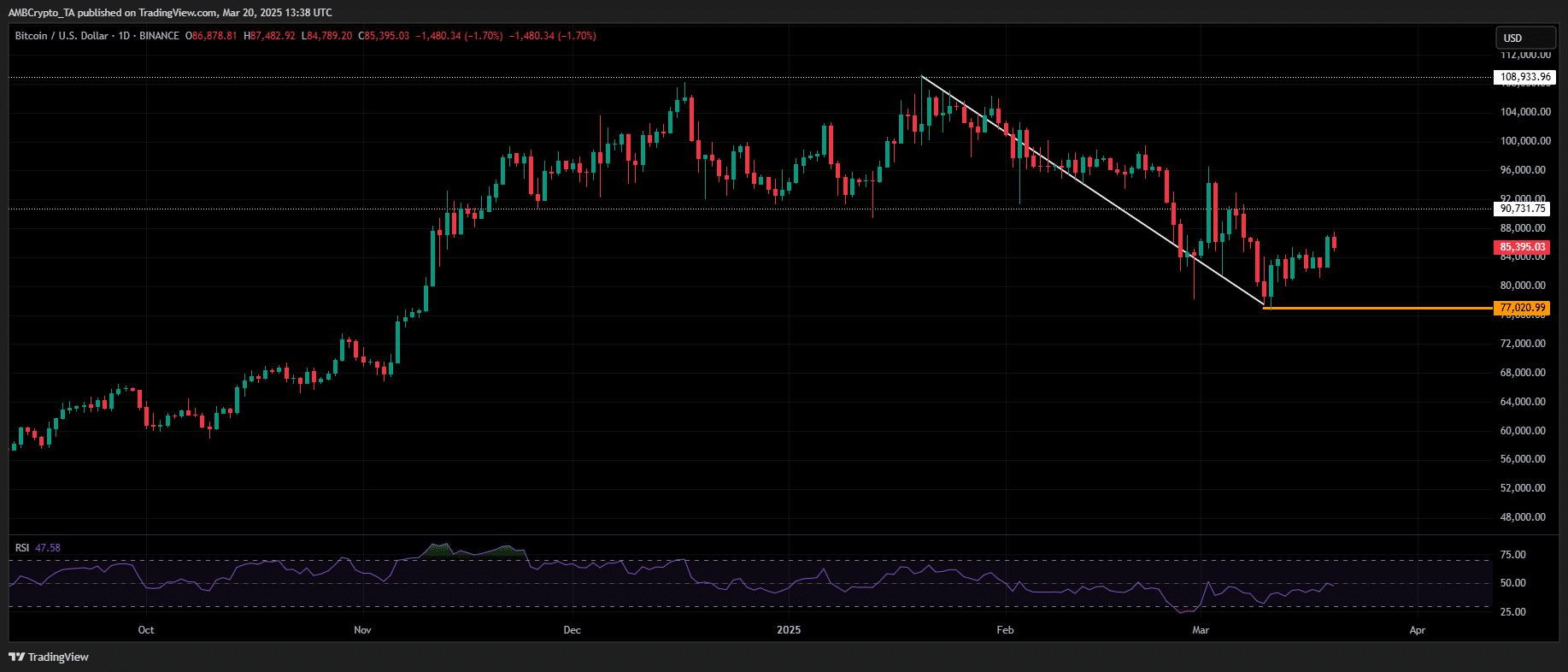

Source: TradingView (BTC/USDT)

According to Ambcrypto, important factors include an early rate reduction speculation, the evolving role of Bitcoin as a strategic reserve and insufficient awareness of the American debt crisis.

Further composition of this pressure are the strict tariff plans of Trump. While the short -term market reaction led to the sharp ‘dip’, BlackRock $ 218.10 million is in intake – The monthly High – has strengthened the statement of Mitchnick.

The chance of an American recession has returned to the foreground after the FOMC meeting, in which chairman Jerome Powell assumes a “waiting” attitude. In essence, the possibility of a recession cannot yet be completely excluded.

Bitcoin’s resilience in the midst of recession cycles

An important bullish signal during a recession is economic delay. Weak labor data dampens the aggregated question, as a result of which the Federal Reserve injects liquidity through interest rate letings.

This liquidity inflow often supports risk activa such as Bitcoin in the medium term.

Although BlackRock maintains a bullish position, one recession Usually receives a short cycle of decreasing demand, increasing unemployment and market corrections. This can put the safe port story of Bitcoin to the test.

The decrease of 22% of Bitcoin compared to its record high of $ 109K may indicate the start of a larger market correction, with more volatility ahead. This, unless Trump’s economic retestation causes a shift in market conditions.

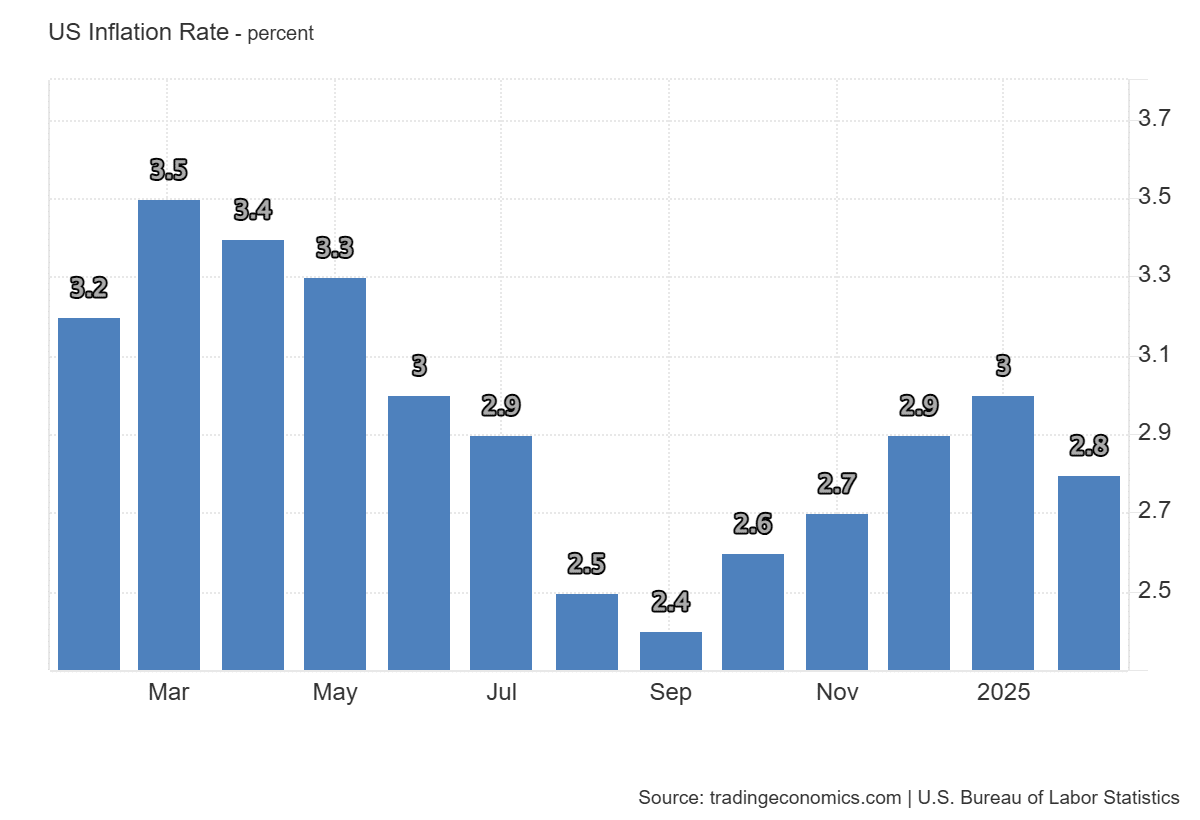

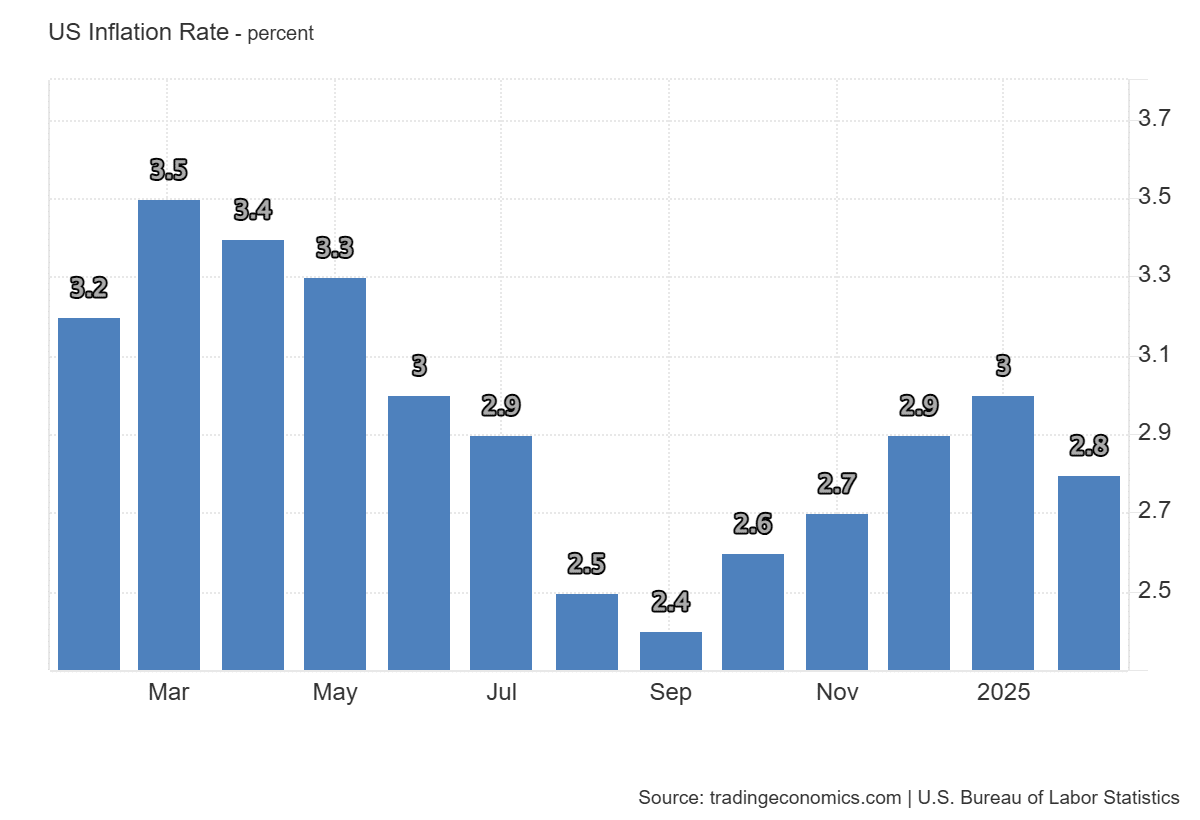

In February, inflation saw a decrease in the month on the month of 0.2%, which fell from 3% in January.

Source: Handelsconomy

This relaxing inflationary pressure has led the Fed to stop increases, although the possibility of further increases remains on the horizon.

The Bullish thesis of BlackRock depends on a more pronounced market rinse-a sign that a deeper correction may be needed before a bull market can really come true.