- Bitcoin ETFs saw outflows of $804.8 million from August 27 to September 4.

- North Korean hackers are targeting crypto companies, impacting the stability of ETFs and investor confidence.

September was a tough month for the leading cryptocurrency, Bitcoin [BTC].

Not just Bitcoin struggled to break past the $60,000 mark, but Bitcoin Exchange Traded Funds (ETFs) have also faced major challenges.

In recent days, Bitcoin ETFs saw outflows of $804.8 million, sending shockwaves among investors and enthusiasts.

Of particular note was BlackRock’s iShares Bitcoin Trust ETF (IBIT), which has not attracted any inflows since August 27.

The fund had no inflows on many days, including August 27, 28, 30 and September 3, further fueling market concerns.

Are North Korean hackers to blame?

Amid these events, US authorities have warned of an imminent threat from North Korean hackers, specifically targeting crypto companies involved in the growing Bitcoin ETF market.

For context, North Korean hackers, specifically the Lazarus Group, have a well-established pattern of targeting cryptocurrency companies and platforms.

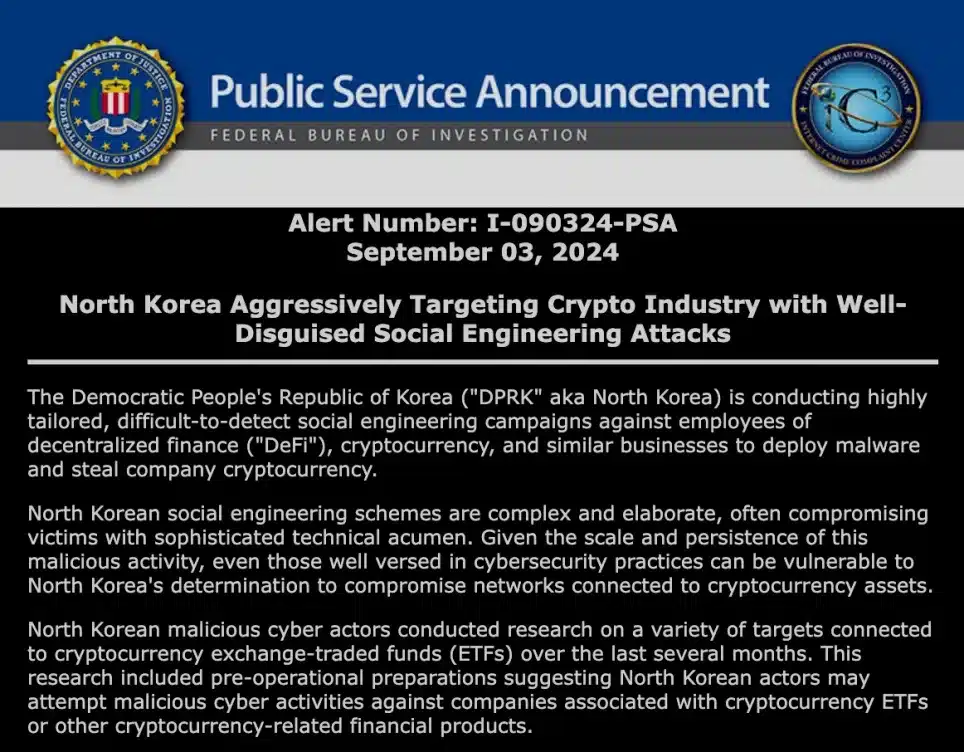

The The FBI revealed this that North Korean cybercriminals are focusing their efforts on employees of decentralized finance (DeFi) and cryptocurrency companies.

According to the announcement, these criminals use very “hard-to-detect social engineering campaigns.”

Source: ic3.gov/

The warning has raised concerns about the long-term viability of the Bitcoin ETF space as it faces both financial and cybersecurity challenges.

The shift of IBIT investors

However, it is important to note that IBIT’s cumulative net inflows since its launch on January 11 approached $21 billion.

In fact, on July 22, IBIT experienced a significant inflow of half a billion dollars, the largest since March 13, according to SpotOnChain facts.

This shift highlights the ETF’s fluctuating appeal to investors over time, reflecting changing market dynamics and sentiment.

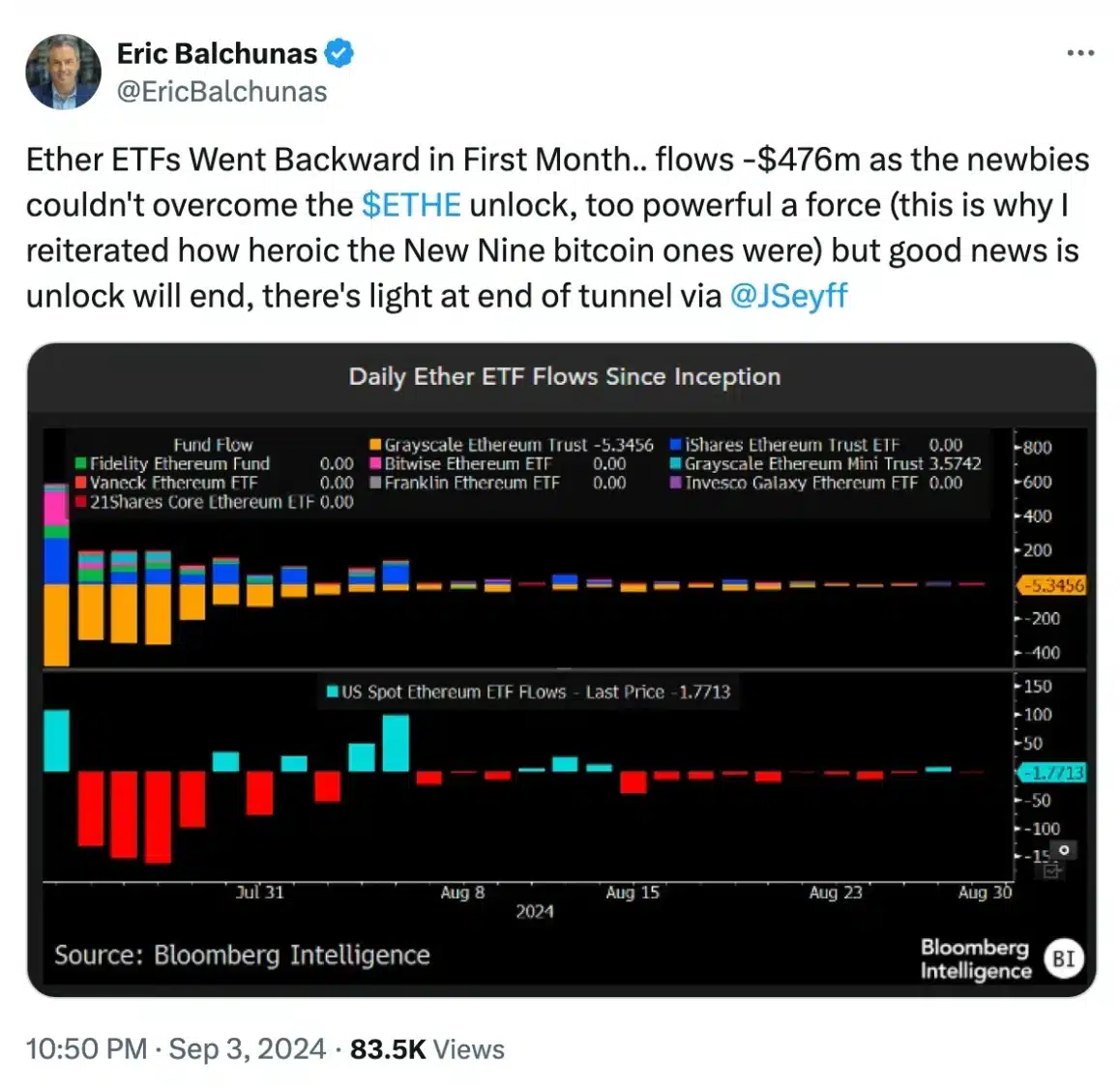

Ethereum ETF continues to outflow

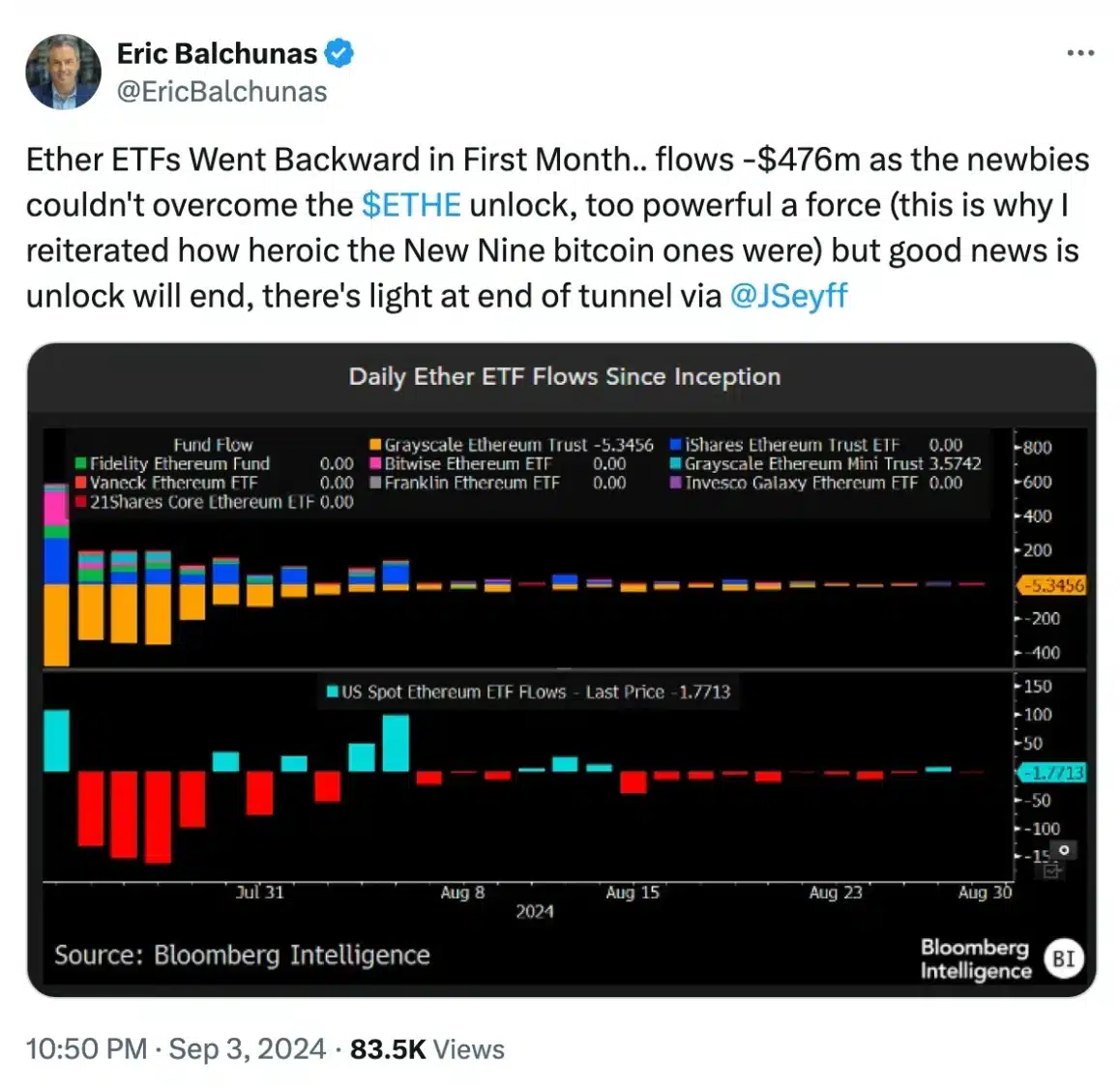

Ethereum, on the other hand [ETH] ETFs have seen consistent outflows, with only short periods of inflows.

Comparing the same time frame used for Bitcoin ETFs – from August 27 to September 4 – ETH ETFs recorded outflows on August 27 and 29 and again on September 3 and 4.

On August 30 and September 2, the ETFs experienced no inflows.

The only notable inflow occurred on August 28, when ETH ETFs recorded a modest net inflow of $5.9 million, according to Farside Investors.

Similarly, BlackRock’s Ethereum ETF has experienced mostly zero flows in recent weeks, mirroring the trend seen in BlackRock’s Bitcoin ETF.

However, despite the recent turmoil, ETF analyst Eric Balchunas maintains a positive outlook, believing better days lie ahead.

Source: Eric Blachunas/X