- BTC is sound money and a risk-off asset, according to BlackRock.

- But ETH is a speculative bet on the adoption of blockchain technology.

BlackRock, the world’s largest asset manager, recently presented unique yet diverse pitch decks for Bitcoin [BTC] And Ethereum [ETH].

The dual pitch deck was presented during a digital assets conference in Brazil. BlackRock’s Robbie Mitchnick presented BTC as a ‘risk-off’ asset, putting it on par with or better than gold.

On the other hand, ETH was promoted as a ‘risk-on’ asset, similar to US stocks.

BTC as money; ETH as a bet

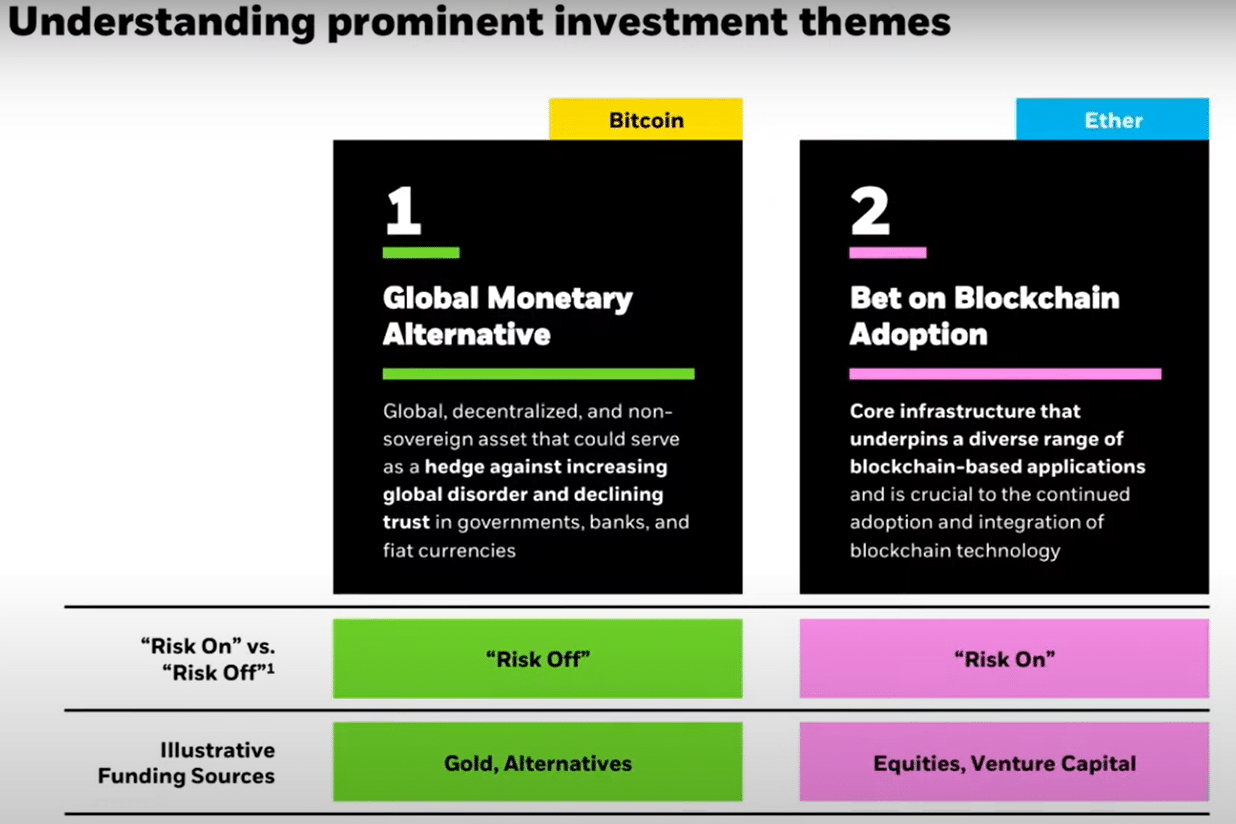

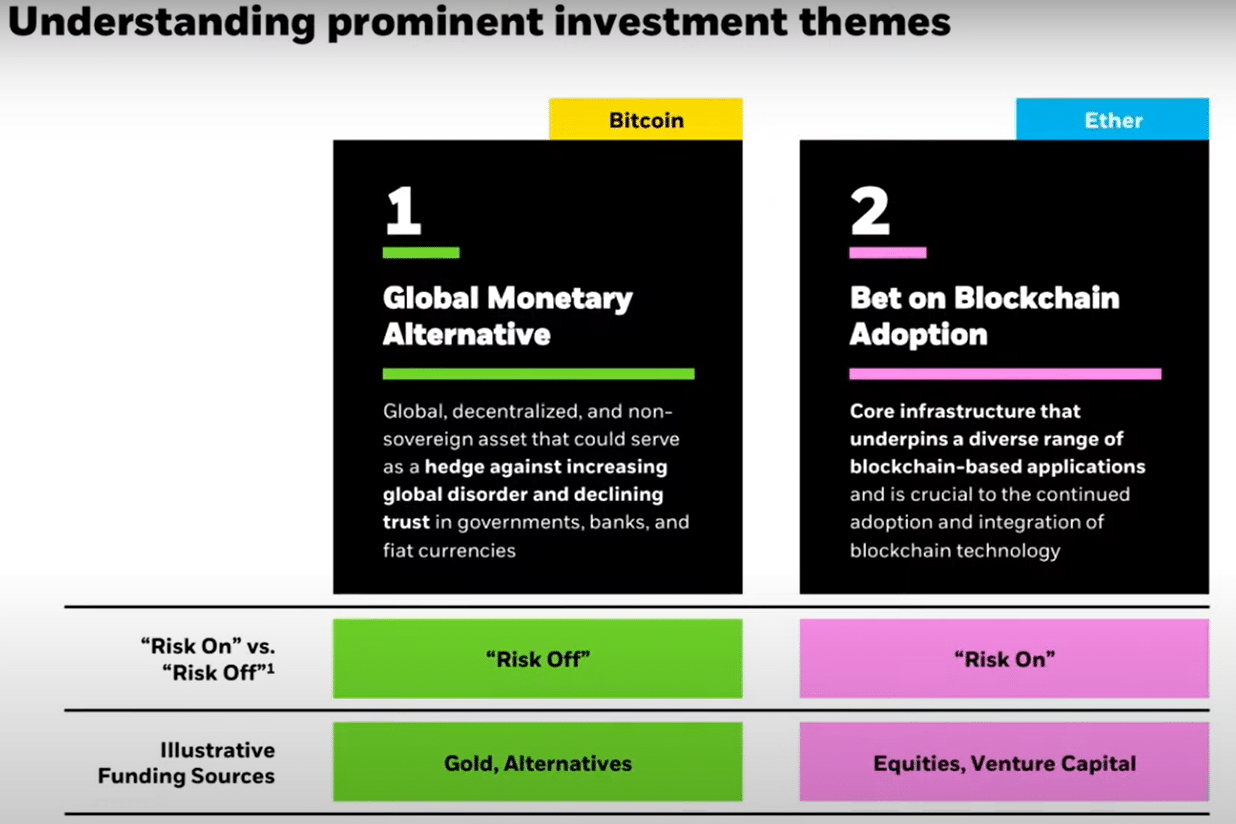

The asset manager touted BTC as a global monetary alternative and an excellent hedge against declining trust in governments and the ruthless devaluation of the fiat currency.

Source: BlackRock

Rather, ETH was presented as a speculative bet on the adoption of blockchain technology, an investment that Mitchnick equated to US stocks.

He noted,

“On the one hand you have BTC, a commodity like gold and an alternative to stocks and bonds. Ethereum, more of a long-term technology, is betting that this blockchain will bring more use cases and more value to the economy in the future.”

Part of the crypto community echoed Mitchnick’s presentations, highlighting that BTC is ‘money’ with less inflationary pressure than fiat currencies, which lose value annually.

But it also settled the raging debate that has been going on for some time: ETH is not money. Since the introduction of Blobs earlier this year, ETH’s inflation rate has actually increased, making it less of an “ultra-sound currency.”

If forecasts hold, BTC could rise more sharply during future geopolitical tensions, while ETH could fall in such scenarios.

BlackRock’s perspective is crucial because it is a trendsetter and is widely recognized. Together with Grayscale, the asset managers are seen as responsible for the US shift and final approval of US spot BTC ETFs.

Since the ETF’s inception, BlacRock’s ETFs have outperformed all alternative offerings and exceeded key milestones.

At the time of writing it is BTC ETF, iShares Bitcoin Trust [IBIT]had cumulative net flows of $21.5 billion with nearly $23 billion in net assets.

That said, BlacRock’s ETH ETF, ETHA, has netted total inflows of $1.1 billion since trading began in July.

Ergo, the world’s largest asset manager, could influence the way other investors view the sector. According to some market observers, the message seems clear: Bitcoin is money, while the rest of crypto is speculative.

Meanwhile, BTC was valued at $62,000, down 5% from the weekly charts. On the other hand, ETH was valued at $2.4K, down 8.5% over the same period.