- Bitcoin ETFs saw renewed inflows, with BlackRock’s IBIT registering $15.8 million on September 16.

- The large ETF inflows positively impacted Bitcoin’s price, pushing it above $60,000 while confidence increased.

The Bitcoin [BTC] The ETF market has recently shifted from a consistent streak of outflows to days of renewed inflows, a trend that began on September 12.

Blackrock’s IBIT makes headlines

iShares Bitcoin Trust from BlackRock [IBIT] attracted a lot of attention after experiencing no activity for weeks.

On September 16, IBIT recorded inflows of $15.8 million. This was the first daily net inflow in three weeks.

According to Farside Investors, this has contributed to a combined net inflow of $12.8 million for US spot BTC ETFs.

However, this increase was short-lived as IBIT returned to zero inflows the next day.

Other Bitcoin ETFs Analyzed

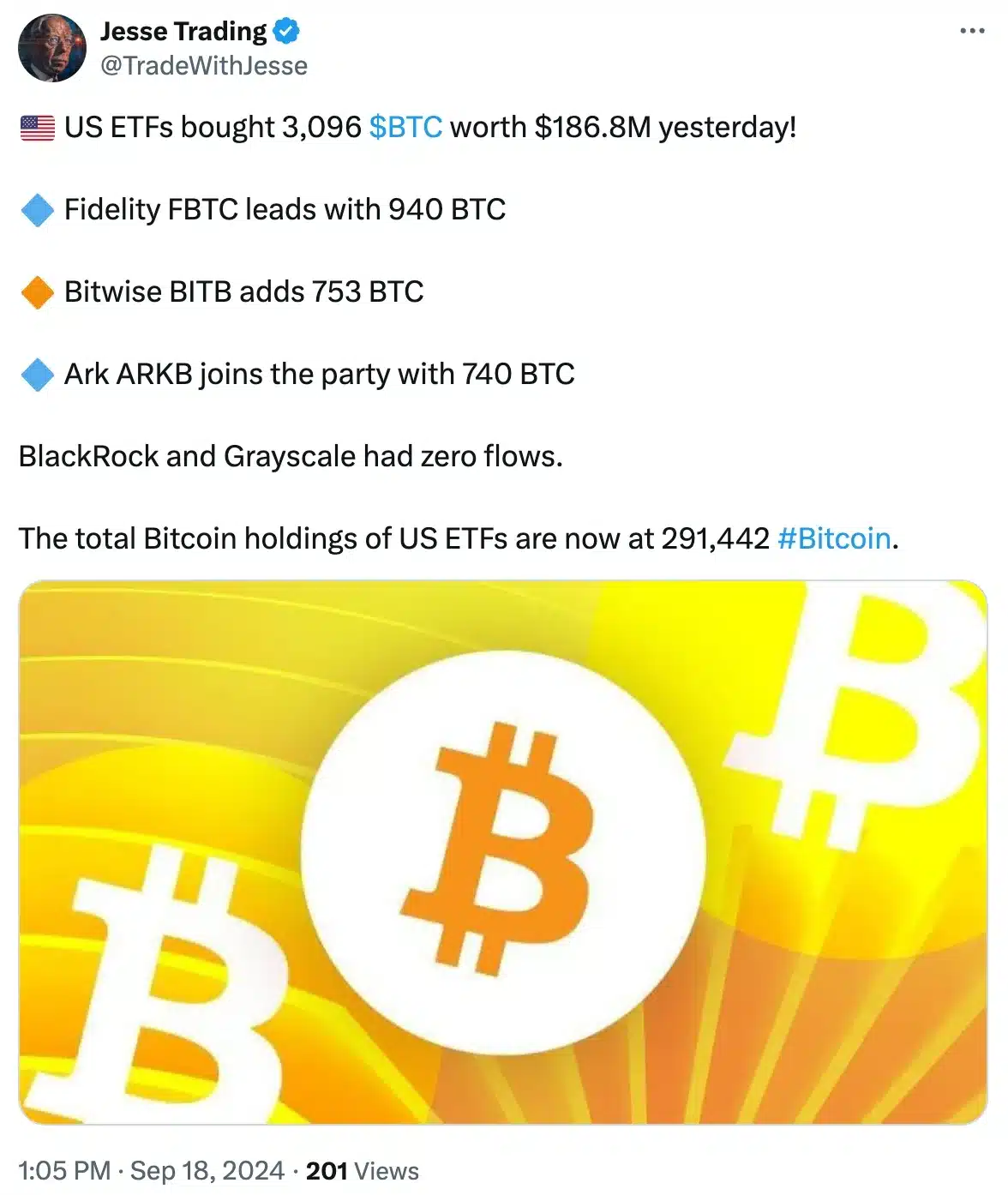

On September 17, several major Bitcoin ETFs experienced notable inflows, signaling renewed investor interest.

Fidelity’s FBTC led the pack with an impressive inflow of $56.6 million, followed by Bitwise’s BITB with $45.4 million and Ark’s ARKB with $42.2 million.

VanEck’s HODL saw more modest inflows of $20.5 million, while Invesco’s BTCO recorded $10.2 million, Franklin’s EZBC $8.7 million, and Wtree’s BTCW grossed $3.2 million.

Meanwhile, Grayscale’s GBTC remained stagnant, recording zero flows over the same period.

Source: Jesse Trading/X

Community response

Note on the same, X user Puppeteer said,

“That is a significant increase in Bitcoin holdings by US ETFs, indicating strong institutional confidence.”

Trader and investor joined the fray Mark the monkeywho said,

“BlackRock and Grayscale may hold off for a while, but the demand is there and they are preparing for what could be a major catalyst in the coming months.”

This underlines the community’s continued confidence in BTC ETFs, even despite zero flows from prominent players like BlackRock and Grayscale.

Looking back at the past, BlackRock’s entry into the emerging crypto ETF space created a lot of excitement among investors.

With $9 trillion in assets under management, BlackRock’s entry into the market provided a boost in institutional confidence and a polished perspective, driving the adoption of cryptocurrency ETFs.

Impact on the price of Bitcoin

That said, while Bitcoin ETFs saw notable inflows, BTC itself faced challenges breaking the $60,000 threshold on September 17.

However, with the latest increase of 2.96%, BTC was trading at $60,432 at the time of writing. CoinMarketCap.

This upward momentum underlines the positive impact that ETF inflows have had on Bitcoin’s price trajectory, reflecting a potential bullish trend.