- Tao has the potential to bounce to $ 240, but it is unlikely that it will go higher.

- The CMF did not agree with the other technical indicators and suggested that bulls now prevail.

Bittersor [TAO] Fell below the level of $ 216 on April 6 and reached $ 167 on April 7. Since then it bounced almost 30% to re -test $ 216 – an important horizontal level in the past month.

Source: Tao/USDT on TradingView

The 1-day graph of Bittensor showed that the downward trend in the game has been since the last week of January. That was then the level of $ 416, the previous swing low, was broken.

In the following weeks, the $ 434-$ 450 region was changed from support to resistance. This was clearly towards the end of February.

In the past six weeks, the OBV has been a steady decrease when the TAO prices fell from $ 470 to $ 180. In recent days, the level of $ 216 was also reversed from support to resistance.

Further losses were expected and a price movement to $ 140- $ 150 probably seemed in April.

Surprisingly, the Bittensor 1-Day OBV saw a slight increase in recent days, the CMF rose higher last week with a considerably larger margin.

At the time of the press it was at +0.05, a level that some analysts use to indicate significant capital inflow.

Although the purchasing pressure saw a noticeable increase on the CMF, the market structure and the momentum Beerarish were.

Tao traded under the 20-day advancing average (blue) and the Bollinger tires showed that volatility increased, and more losses were probably attracted to the lower tire since the price.

How traders can position themselves

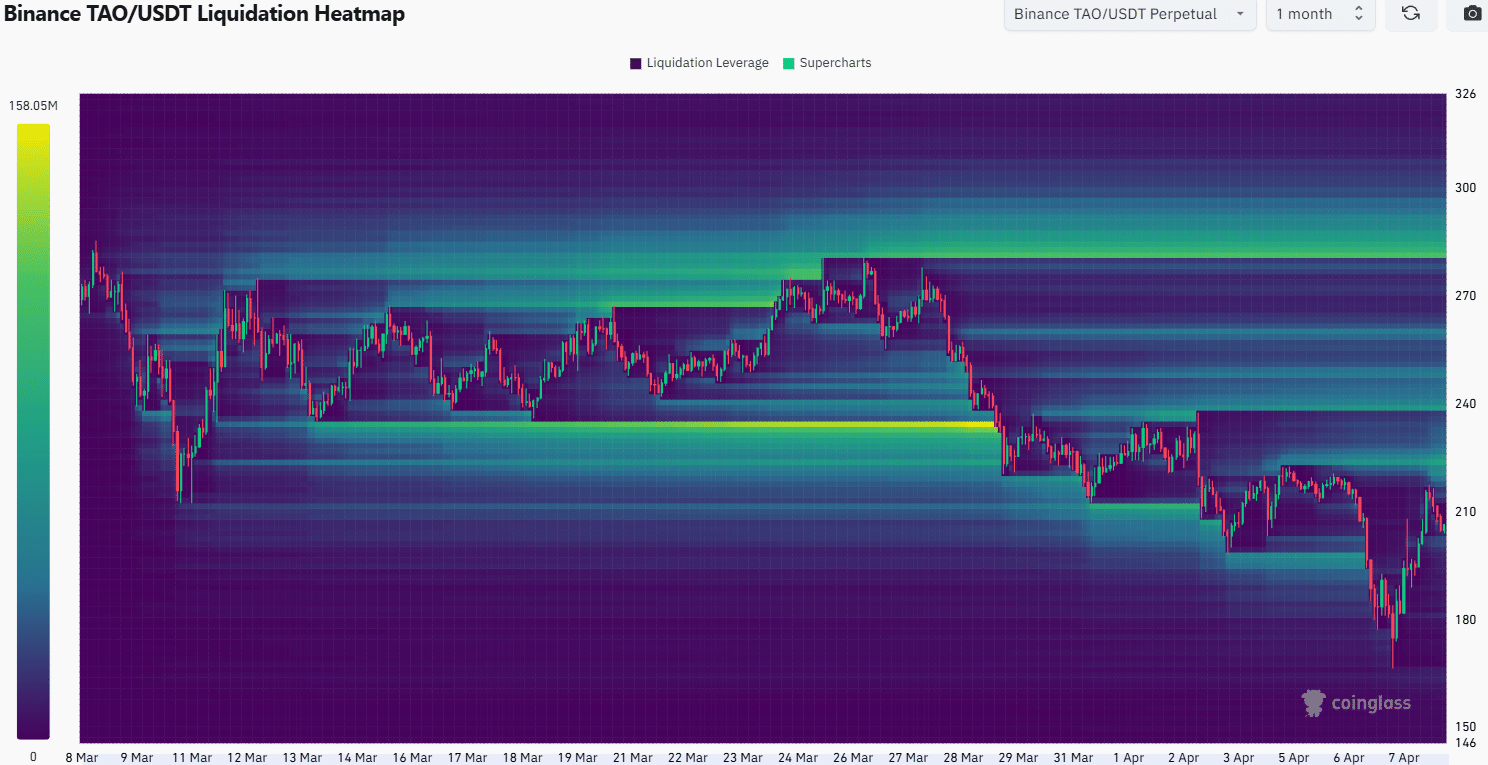

The 1 -month liquidation heating showed a collection of liquidity at $ 240 and also at $ 220. That is why these levels were the price objectives in the short term, because they are remarkable magnetic zones close to the price.

Zooming in on the 1-week liquidation heat jap and the $ 220 card appeared much sharper.

The liquidity cluster in this region was considerable last week, which again underlines the high chance that the TAO prices will float higher to wipe the $ 220 area.

As soon as this happens, a bearish reversal would become a feasible option. It was more difficult to be sure if $ 220 would see a bearish reversal or whether Tao could climb to $ 240. Traders should be prepared for both options.

As an alternative, if the momentum shifts and Tao climbs above $ 240, traders must be even more careful, because it would probably make a price of $ 280- $ 300. Until $ 240 is reversed in the short term, traders can remain in a biased biased.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer

![Bittersor [TAO] Crypto seems to reach $ 240, but do bears take control of?](https://free.cc/wp-content/uploads/2025/04/TAO-Featured-1000x600.webp.webp)