- The stock was acquired in July 2021 when BTC was valued at just $7.57.

- One analyst attributed such incidents to the sell-side liquidity crisis.

About 500 Bitcoins [BTC]inactive for almost 12 years, have recently been transferred to multiple new wallets, sparking the curiosity of the broader cryptocurrency market.

According to Look at chainthe stock, which was worth $35 million at the time of writing, was acquired in July 2021. At the time, BTC was valued at just $7.57.

At the time of writing, no conclusive information was available regarding the entity and the nature of the transfer.

However, if you were to go with the populist belief that the wallet is preparing for a sell-off, they would likely end up benefiting as much as 9247x.

A broader market trend?

AMBCrypto did further research and recently noticed a broader trend of dormant coins becoming active.

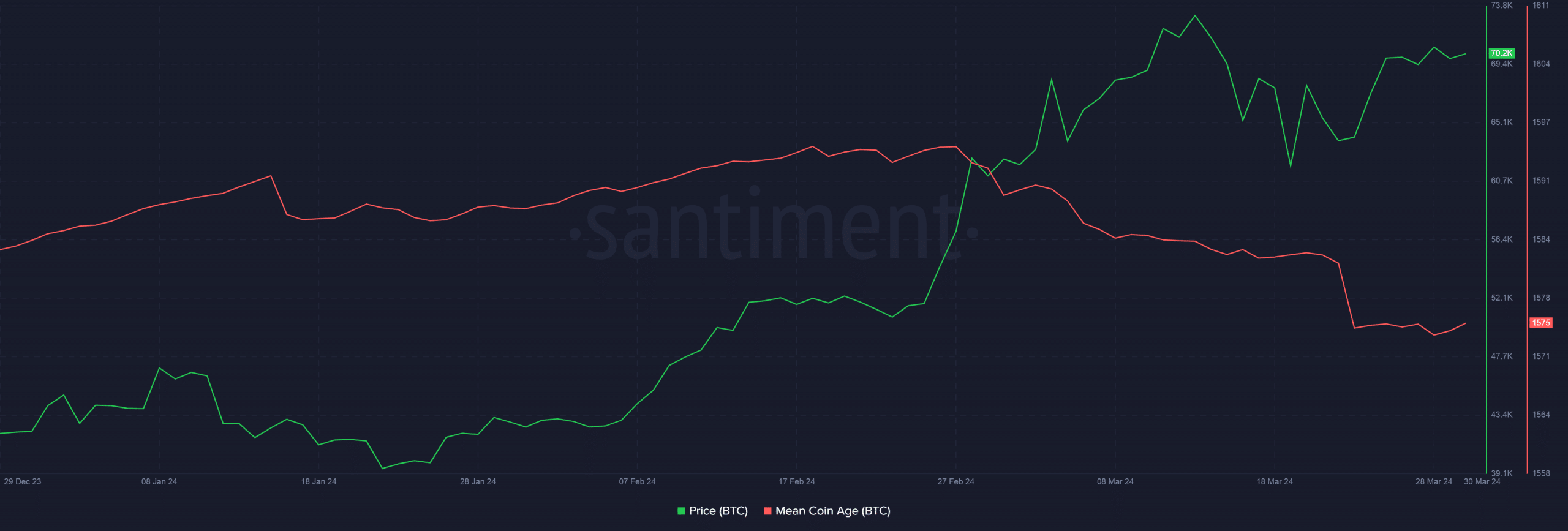

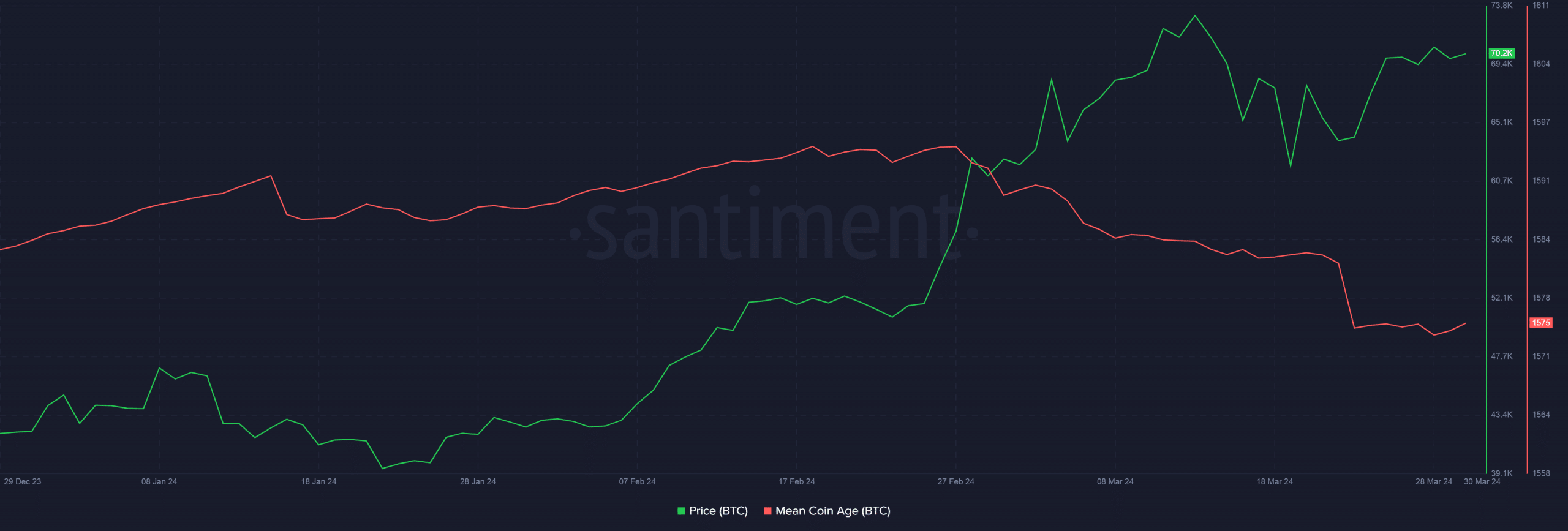

Santiment’s Mean Coin Age indicator – which measures the average number of days that all BTC tokens remained at their respective addresses – fell steadily in March.

Source: Santiment

What could be the reasons?

There may be several factors that cause really old Bitcoins to suddenly end up on the chain.

First, the wallet holder could no longer have access to their BTCs due to the loss of private keys or the cold wallet. Once they collect the keys, they start moving Bitcoins.

However, such examples are scarce.

Second, many long-term holders (LTH), who were patiently waiting for Bitcoin’s price to rise exponentially, may finally decide to sell and lock in profits.

Ki Young Ju, The CEO of on-chain analytics firm CryptoQuant attributed the recent incidents involving the movement of old coins to Bitcoin’s sell-side liquidity crisis.

For the uninitiated, a sell-side liquidity crisis occurs when there are not enough Bitcoins to purchase. This usually happens when demand greatly exceeds supply.

With the introduction of spot ETFs, demand for Bitcoin, especially from institutional investors, is unrelenting.

Read Bitcoin’s [BTC] Price forecast 2024-25

On the other hand, Bitcoin production has failed to meet this demand, creating a shortage of supply available for trading.

This allowed old coins to get moving, hoping to take advantage of increased demand.