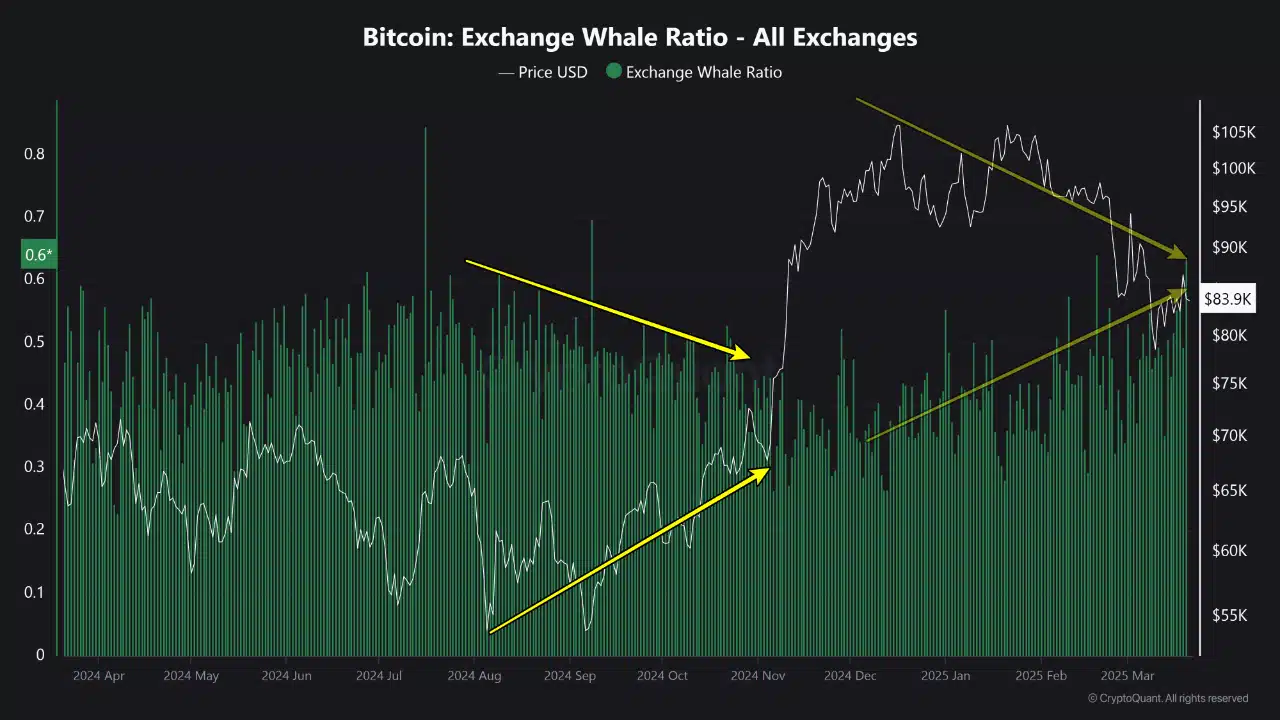

- The exchange rate ratio is 0.6, signaling that the large activities on large holders indicate on exchanges.

- BTC’s NUPL has cooled out of euphoria, but the market remained in the net profit area.

The return of increased whale activity has pushed the exchange wall fishing ratio, an important bitcoin, [BTC] Metriek, up to the highest level in months, that express concerns about renewed sales pressure.

According to CryptoquantThe Exchange Whale Ratio (EWR) has risen after 0.6. Historically, large holders spread when EWR exceeds this threshold.

Source: Cryptuquant

Cryptoquant analyst said,

“This behavior is often interpreted, because these major players actively reward their assets, which may indicate the upcoming sales pressure on the market.”

The metric, which reflects, has risen since the first quarter of 2024. The timing of these movements is close to an important turning point in the Bitcoin price action.

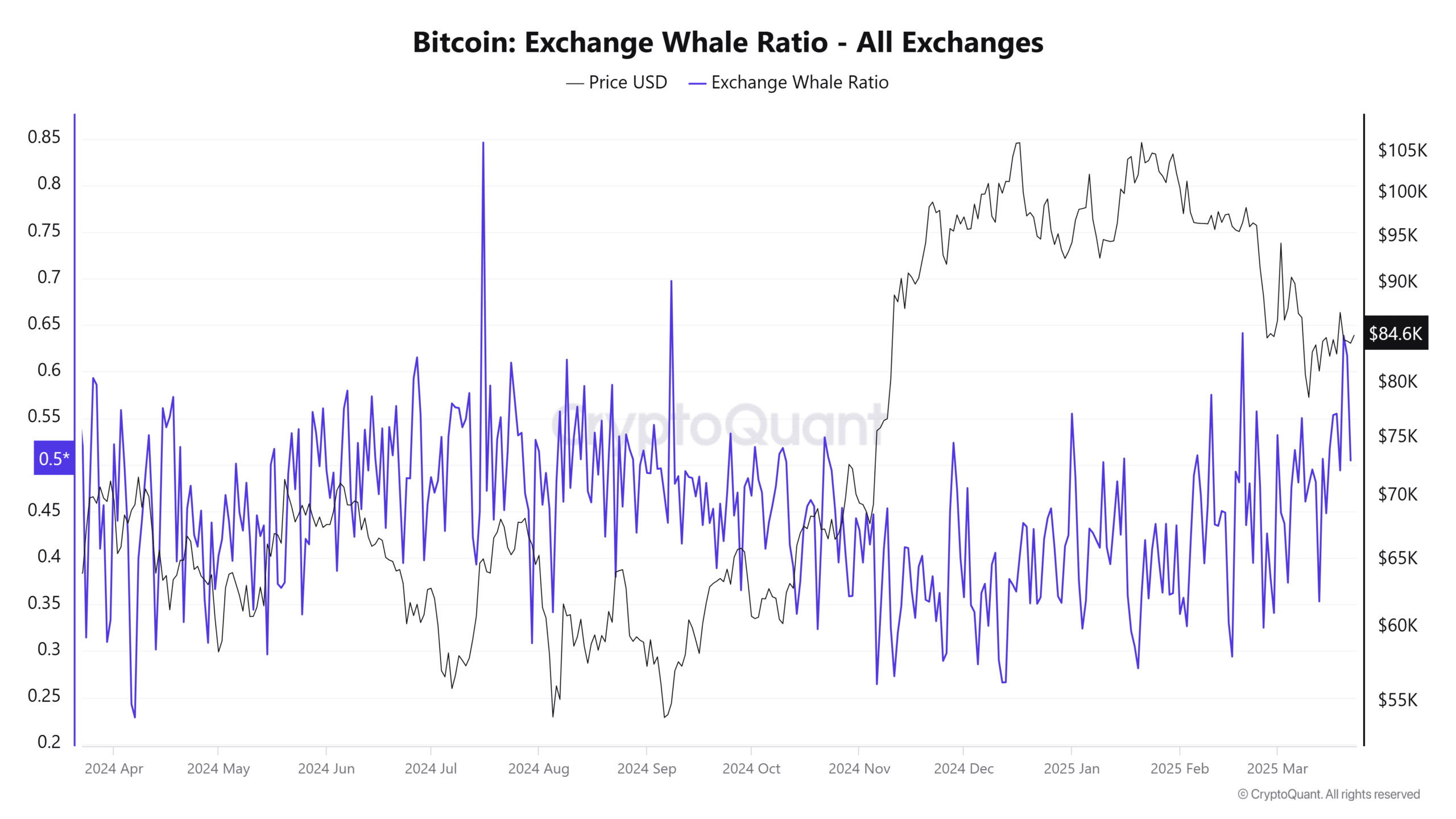

Bitcoin Whale Activity reflects how the exchange kovis ratio reflects

Bitcoin reached a record high of $ 106.128 on December 17.

Since then it has actively entered a correction phase, sliding by around 20% to $ 84,619 from March 23.

Source: Cryptuquant

The timing of this relapse overlaps with a series of sharp EWR -Spikes, especially at the end of 2024 and March 2025.

This correction of 20% is in line with remarkable EWR -Spikes at the end of 2024 and March 2025. During the Bitcoin climb from $ 55,000 to more than $ 100,000, EWR rose while the price met.

Although the whale inflow did not peak on the exact praise top, they steadily accepted the early win.

Interestingly, an EWR lecture of December of 0.36 saw the flood of the whale, even when the prices withdrew. This divergence, where rising whale activity meets the falling prices, often indicates distribution.

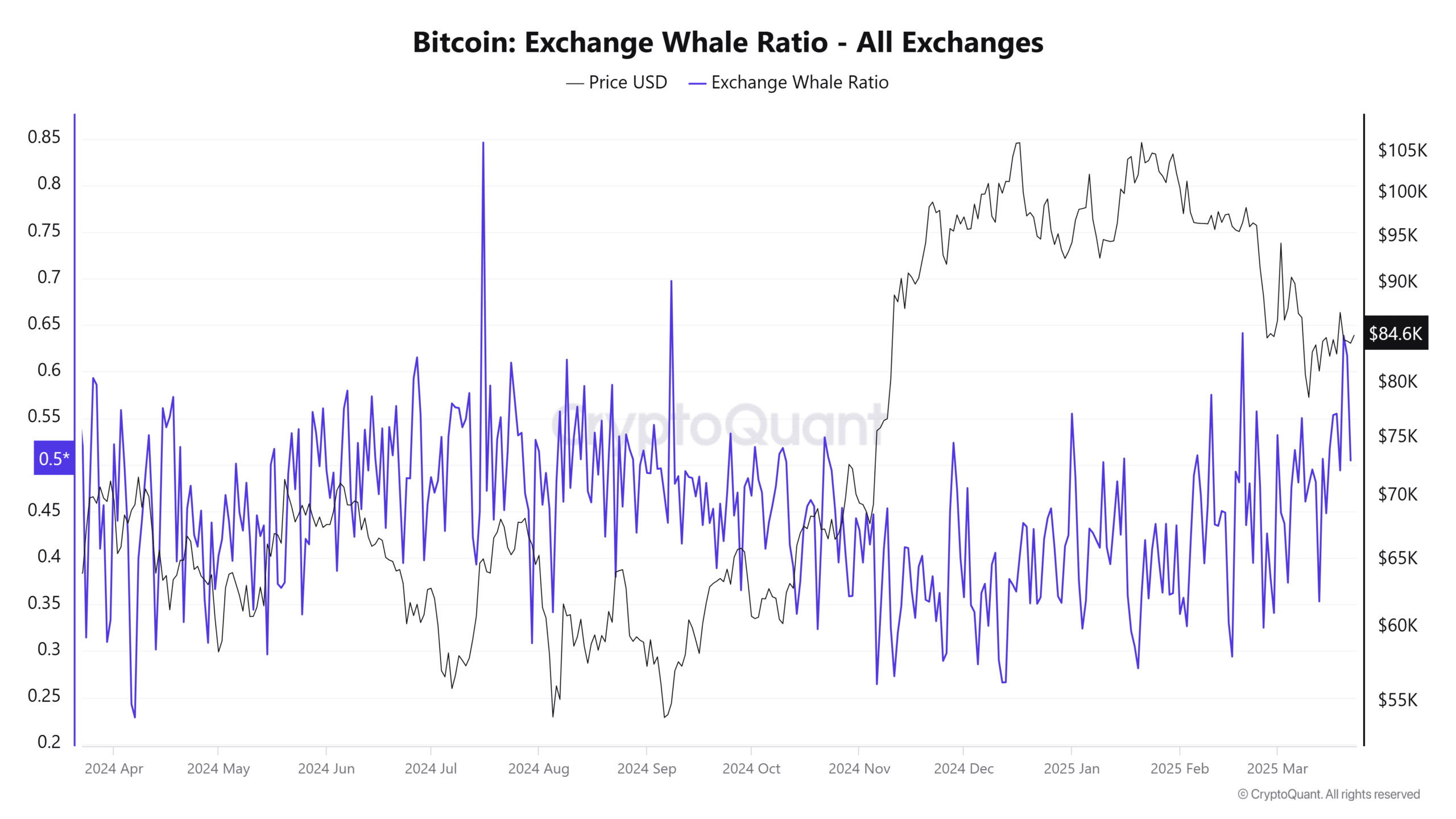

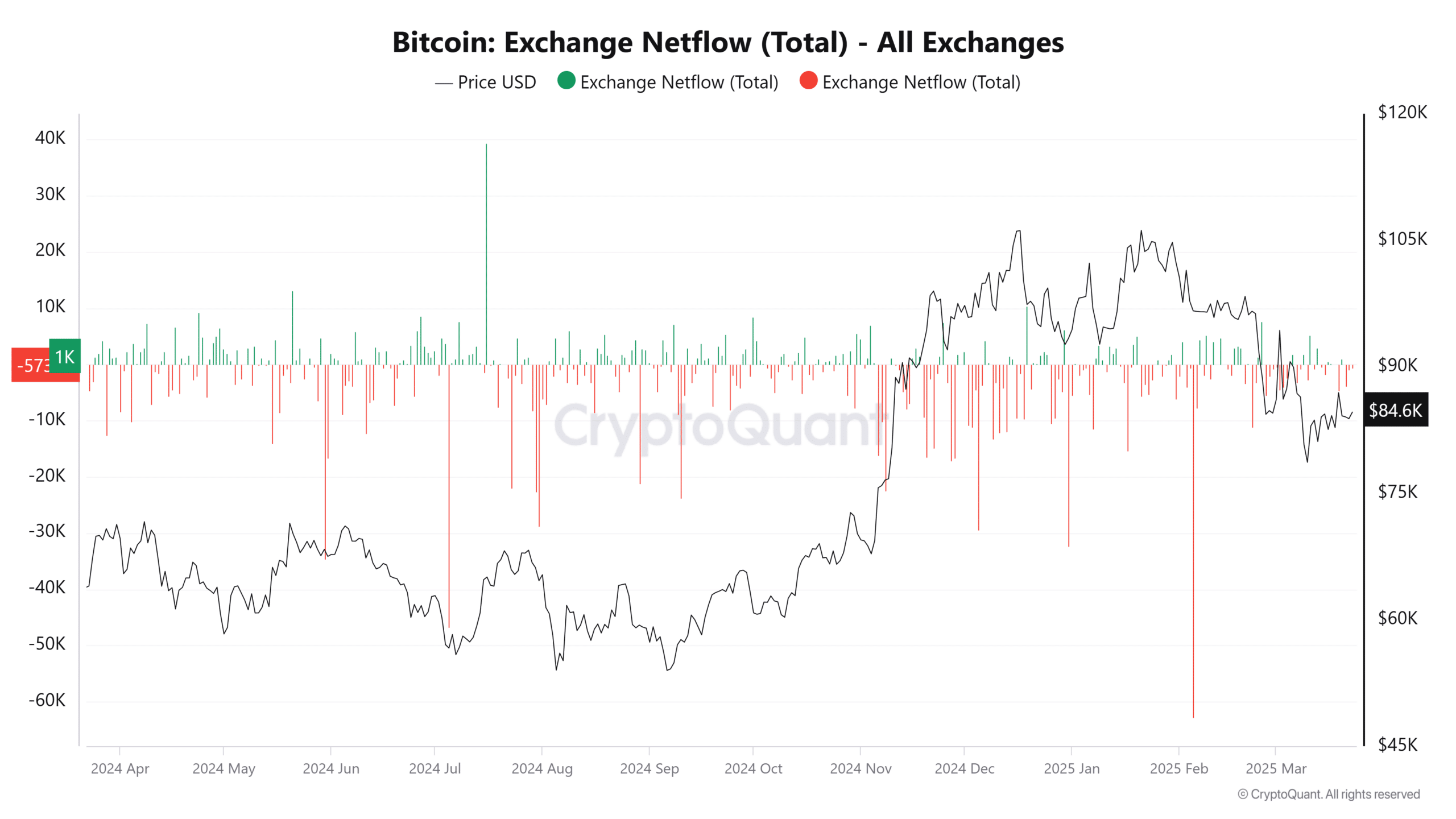

While the EWR reveals who acts, Netflow data clarifies how.

Who moves the money?

Source: Cryptuquant

Exchange network flows have moved from bullish to signs of redistribution according to the data.

Between April and October 2024, the monthly flow usually varied from 30,000 to 60,000 BTC. However, this trend began to change to Q4.

On 24 November, for example, the net entry to +7.033 BTC rose when Bitcoin approached nearly $ 68,000. Although the prize continued to gather, this inflow indicated that early movers realized profit.

On December 17, the day of Bitcoin’s of all time, Netflow showed a withdrawal of 1.531 BTC. This was smaller compared to earlier accumulative phases.

Netflows became fleeting in the post-peak period. Although not downright bearish, moderate Netflows in combination with a high EWR suggest that whales still transfer coins to exchanges, albeit on a reduced scale.

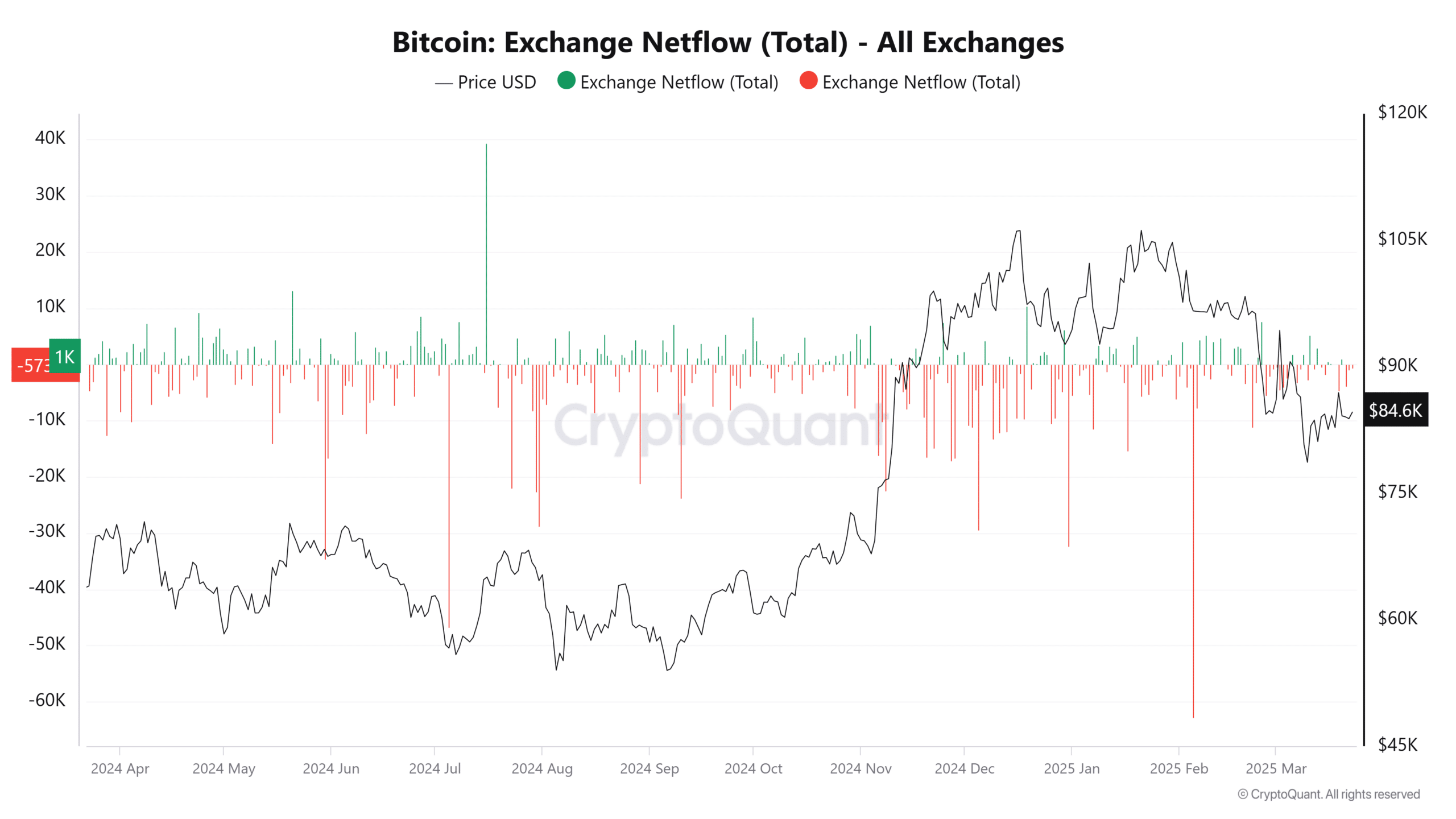

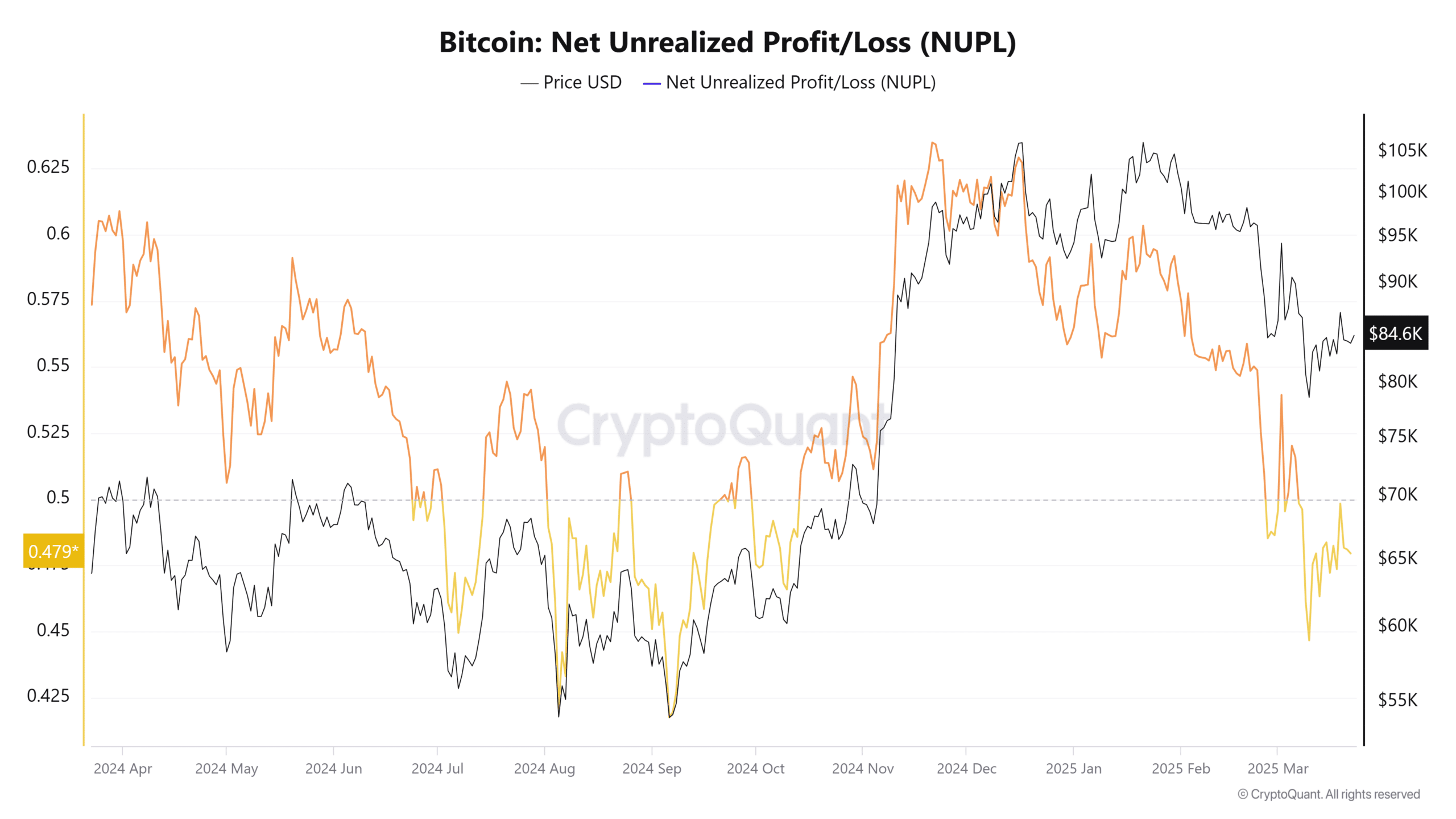

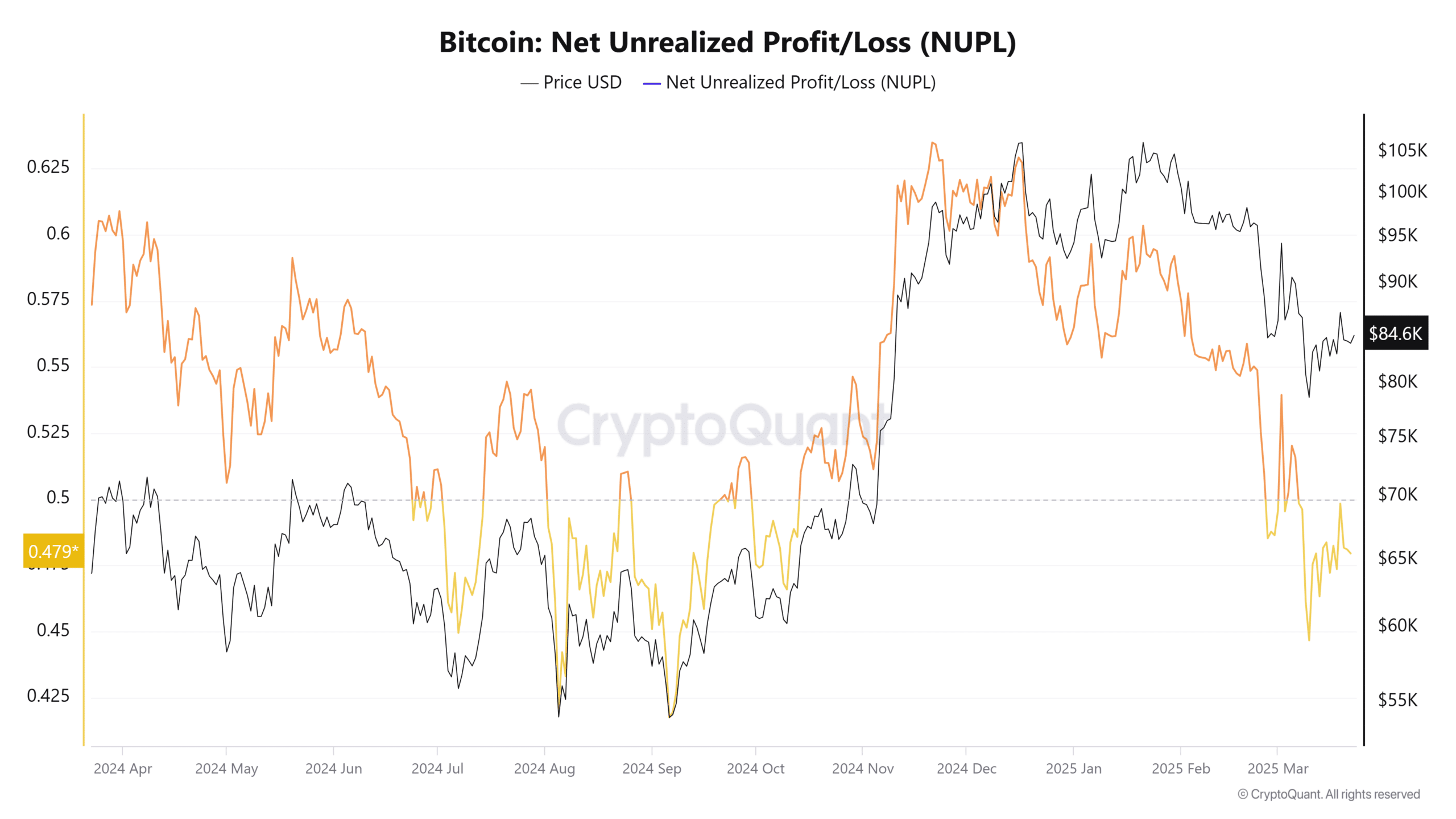

The net non -realized profit/loss (NUPL) ratio offers further insights into the general market sentiment.

Made a profit, but what is the next?

Source: Cryptuquant

The NUPL ratio, which measures non -realized profits within the network, climbed from 0.442 to 0.627 between August and December 2024, as a result of widespread winning and accepting the Bitcoin rally.

By March 2025, NUPL dropped to 0.480, which exceeded a price decrease of 21% with a decrease of 23.4%. This suggests that the market remains profitable, but a phase of realization has taken effect.

It is crucial that the sharper decrease in NUPL compared to the price correction-23.4% versus 21% indicates that whales and holders in the long term belonged to the realizing profit.

Despite this withdrawal, the metric continues to float over Bearish Territory, indicating that the market in general remains profitable.

Bitcoin: a break … or a pivot point?

Whales shift assets, taking a profit is underway and the volatility continues to exist.

But with NUPL in profit and stabilizing Netflows, the market seems to keep its land – carefully balanced between distribution and resilience.