- Bitcoin’s biggest breakout weapon can also double as his sharpest macro trigger.

- A clean image of our crypto -sentiment is more important than ever.

Bitcoin [BTC] Makes in fresh highlights, the conversation shifts from momentum to size. How high can this leg go, and where is the next liquidity ceiling?

But in addition to a price promotion, there is a deeper structural story: Bitcoin is geopolitically tied up. With our spot ETF entry and the Coinbase Premium Index (CPI) flashy green, Wall Street is clear in the mix.

Bullish in the short term? Absolute. But now the graph has a macro -beat, which makes every pump a lot of layers – and more volatile.

In the American Bitcoin safe

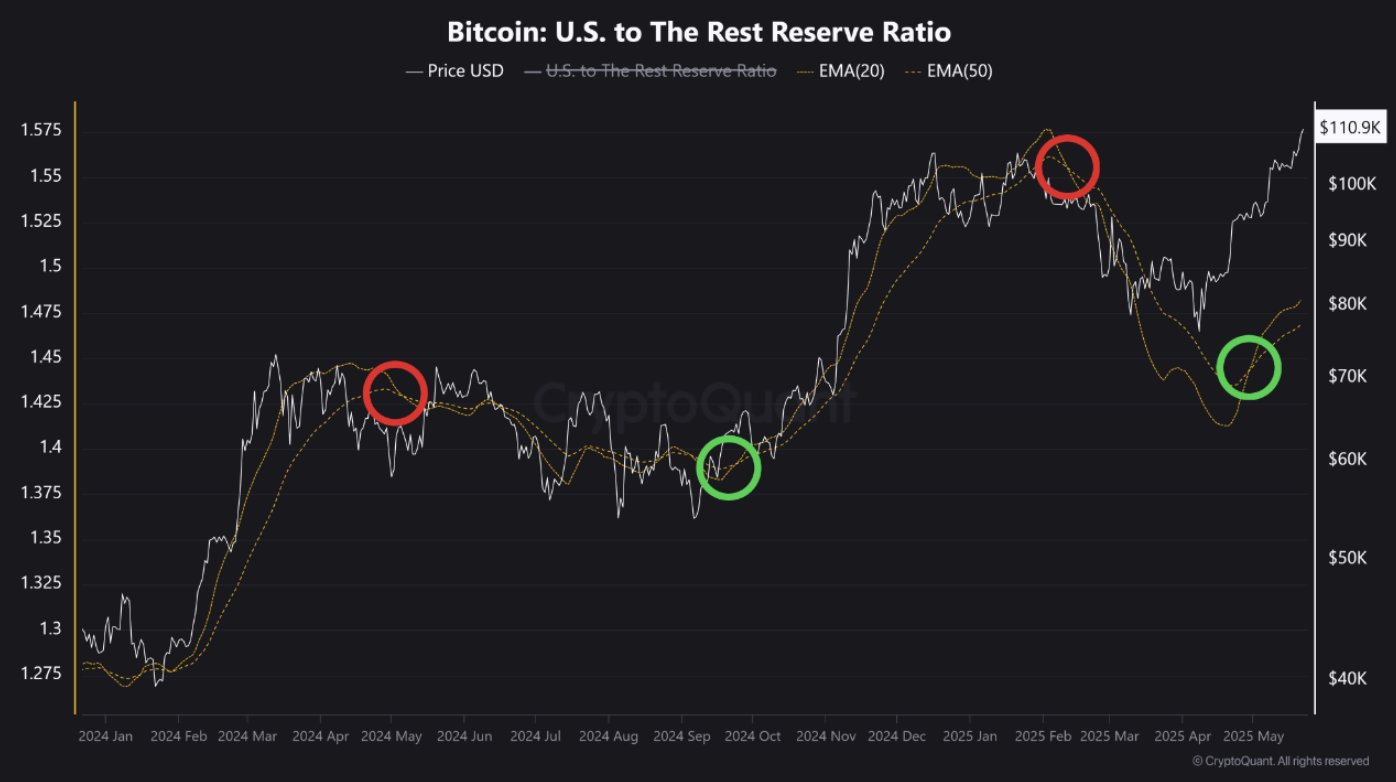

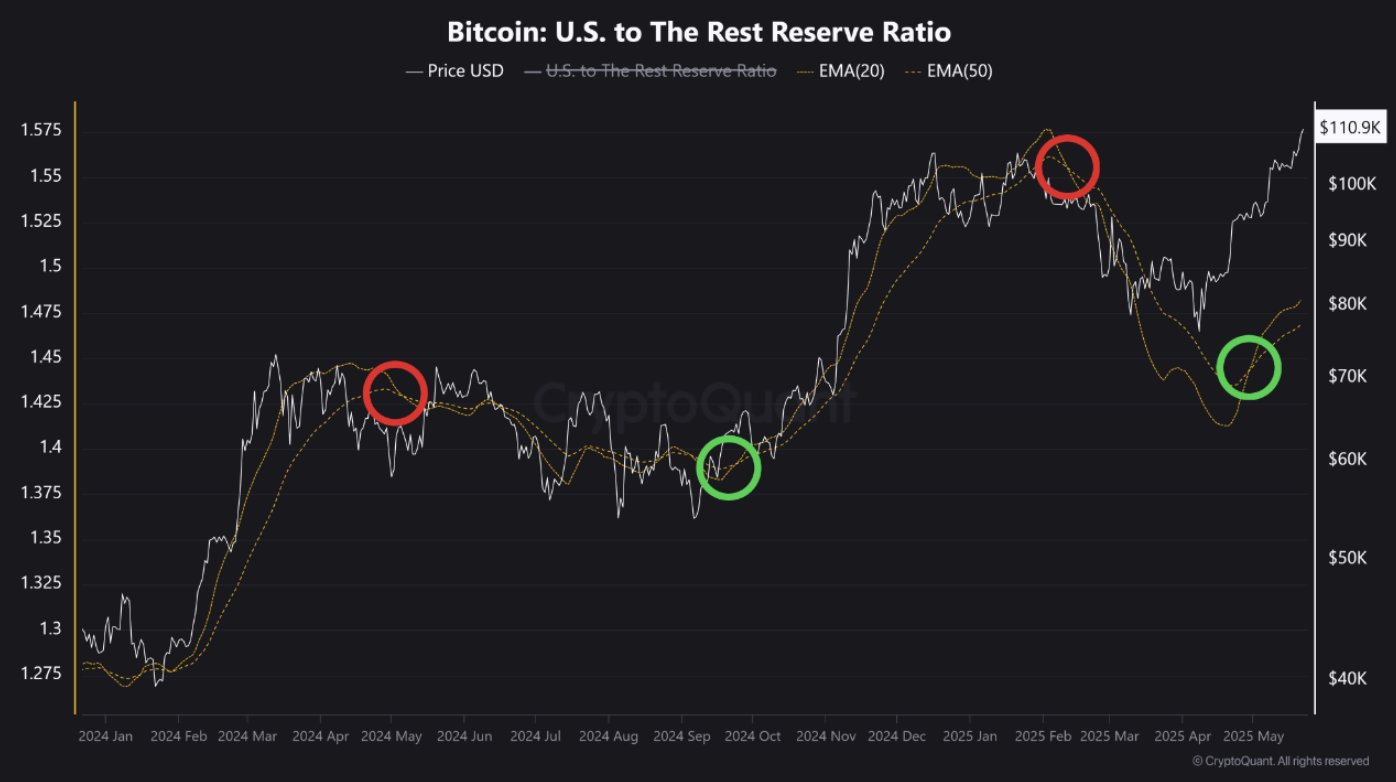

Cryptoquant -Data Blinks an important signal: when the BTC US -Reste Reserve Ratio peaks, this often marks heavy accumulation by American players set up golden crosses -Prime setups for bull runs.

At the moment that well -known pattern is back on. The recent Green Circle determines critical “dip zone” identical to Q4 2024, which started a monster 75% rally.

Source: Cryptuquant

Feed this golden cross, US Bitcoin Spot ETFs are in a tear and register seven straight days of net intake.

The last on May 22, a stunning $ 935 million moved in, with BlackRock’s IBIT ETF only transporting $ 877 million, perfectly synchronized with BTCs 1.81% daily close at $ 111,917.

Overlay that with a green Coinbase Premium Index (CPI) And you have an arrangement that reflects earlier accumulation-to-expansion cycles. If this rhythm applies, the next price discovery zone from BTC can stretch to the $ 192.5k lever.

Will the appetite of Wall Street Momentum change in mania?

Nobody can forget the crash after “Trump Pump”. Bitcoin hit two consecutive all-time highlights in less than 30 days, only to get trapped in a VolatilityVortex that sent the spiral-shaped.

January 20 marked the bending point. While Trump returned the Oval Office, the risk markets returned. The headlines were stacked with tariff production chanter, sticky inflation prints and a fed signaling longer tighter.

Wall Street played defensive and crypto too.

That is when the BTC: our -Restreserve -Ratio rotated red, showing that our investors quickly withdrawn. Large outskirts of American stock exchanges are perfectly set up with the fall from Bitcoin up to $ 76k, all in less than 100 days.

Source: TradingView (BTC/USDT)

Looking ahead, if the rates kilt and inflation cools, risk-on flows can continue to rise and fresh American capital in the veins of Bitcoin pumps.

But beware – Macro Fud is a lurking beast. When it is large, the defensive mode of Wall Street kicks back.

That golden cross? It’s bullish, but haunts a 75%+ blast rally in November style? Too optimistic for the time being.