- Bitcoin’s uptrend continued while the volume of profit-taking decreased.

- BTC is up 1.76% in the past day.

In the past 48 hours, Bitcoin [BTC] has experienced a sharp rise in the price charts. During this period, BTC has risen from a low of $89164 to a local high of $97657.

With Bitcoin making significant gains over the past two days, the crypto community continues to talk about its prospects.

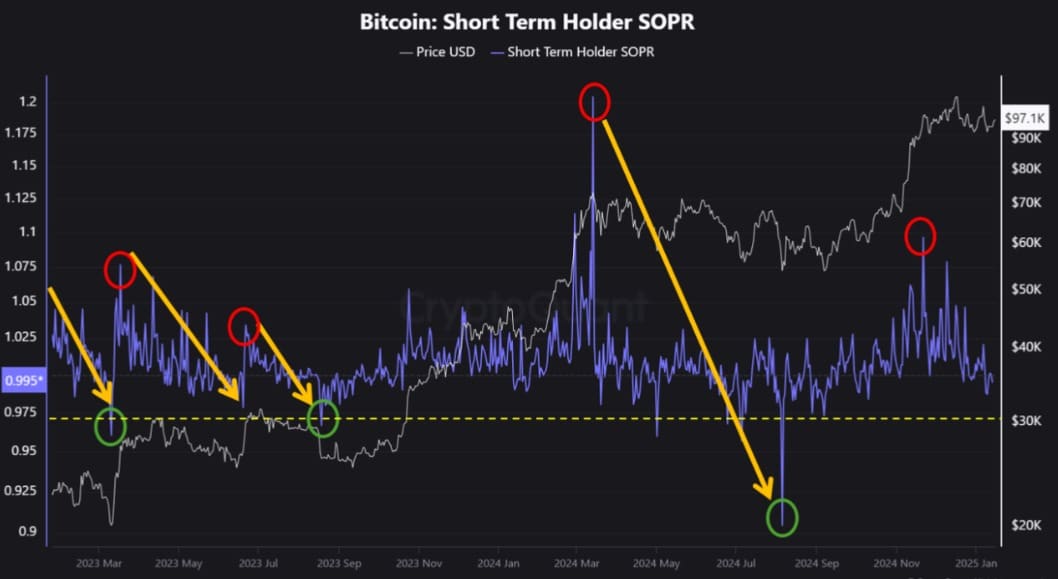

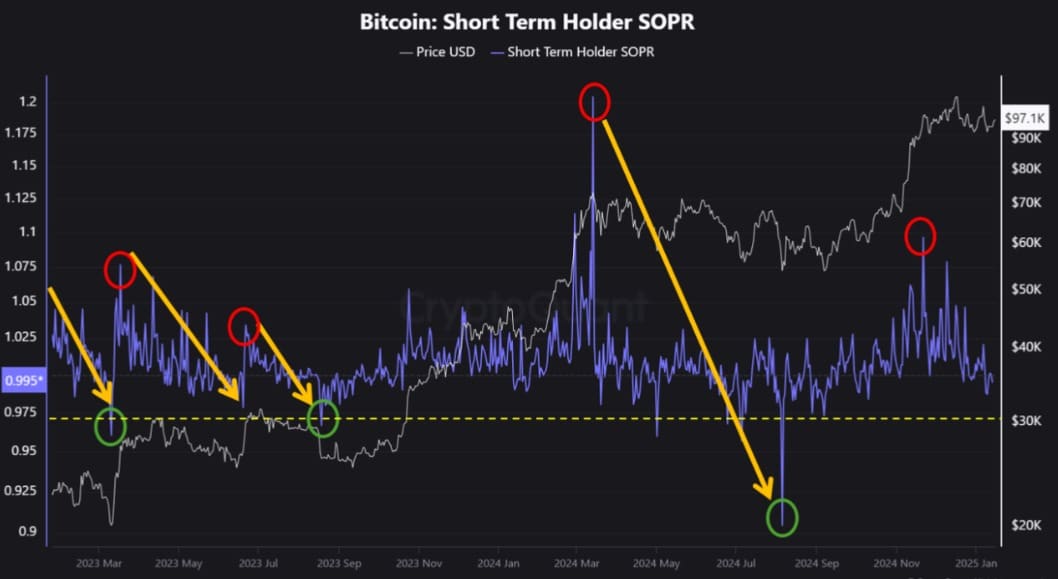

CryptoQuant Analyst Dan has suggested that Bitcoin’s upward cycle is still ongoing, citing the short-term SOPR.

Bitcoin’s upward cycle is still ongoing

In his analysis, Dan stated that aggressive short-term trading in Bitcoin is a no-go as the upward cycle is still ongoing.

Source: CryptoQuant

According to him, the short-term SOPR shows a consistent pattern. During market corrections it shifts from red circles to green circles. This shift dampens market participants’ optimism about possible price increases, but only allows the market to recover.

Significantly, the higher the red circle, the more it indicates profit-taking by big whales, leading to deeper or longer correction phases.

However, current market conditions show a significantly smaller profit-taking volume compared to March 2024. This indicates that this correction period is likely to be shorter than the previous one, which lasted seven months.

Since the current correction has already lasted more than a month, there is a good chance that the upward trend will resume in the first quarter of 2025.

In the short term, BTC could see one or two sharp declines that could push the SOPR down in the short term before another sustained uptrend occurs. Therefore, aggressive short-term trades are risky and require extensive caution.

What do BTC charts suggest

While the above analysis offers promising prospects, it is essential to check other market indicators.

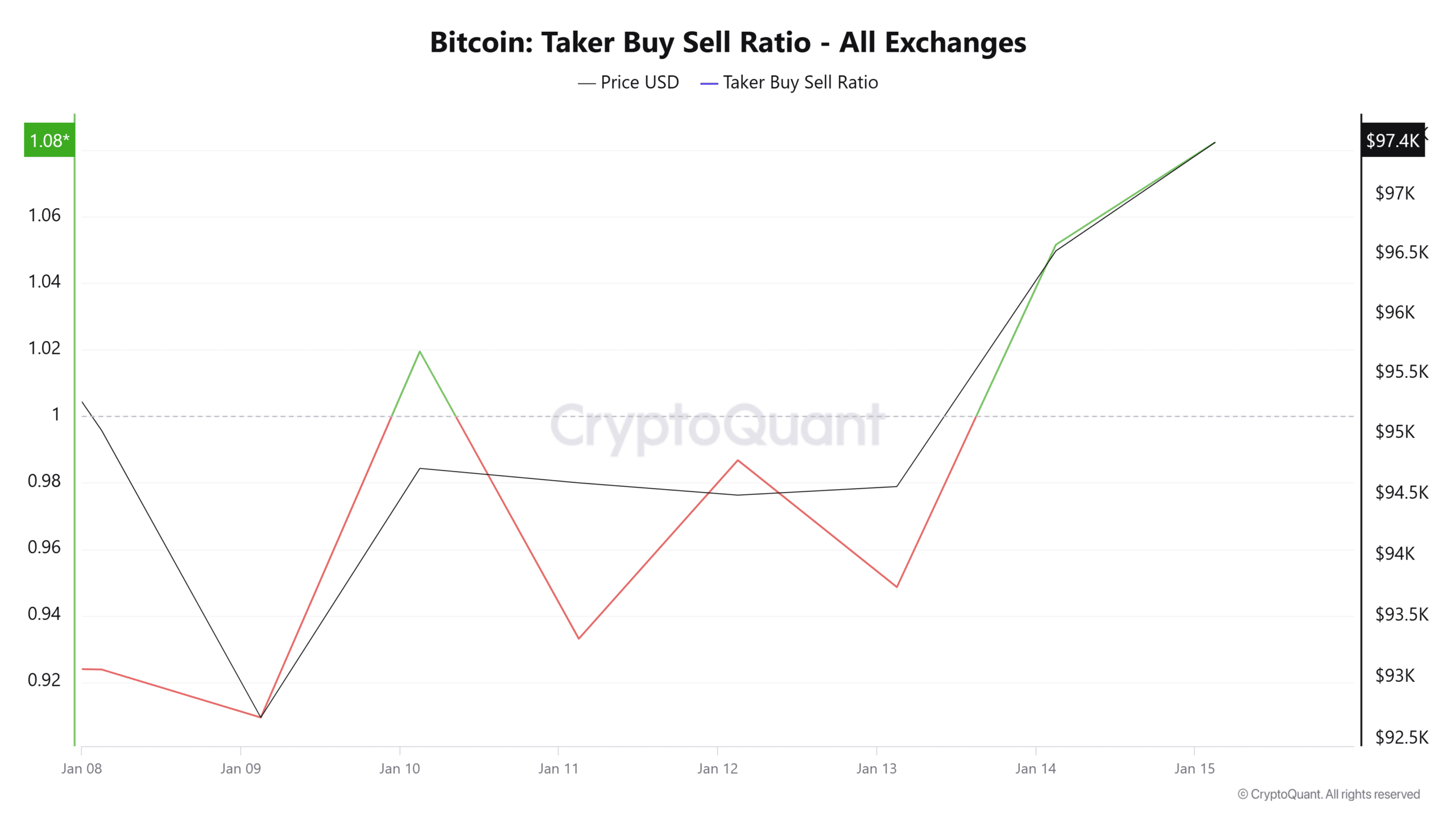

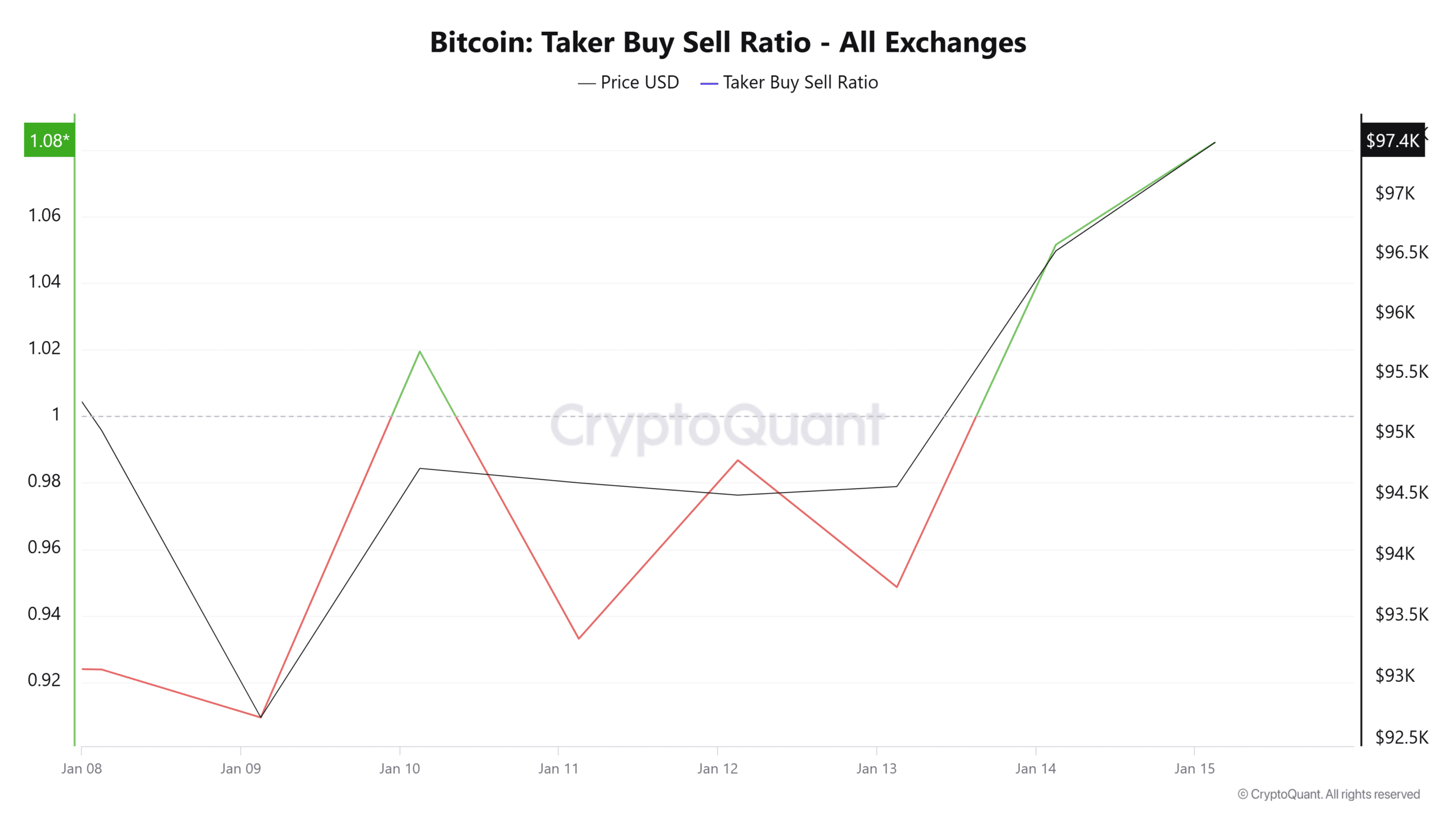

According to AMBCrypto’s analysis, Bitcoin is still experiencing strong buying pressure as market participants remain optimistic.

Source: CryptoQuant

For starters, Bitcoin’s taker-buy-sell ratio has increased over the past two days and remains above 1. When it remains above 1, it suggests that there are more buy orders than sell orders for BTC.

As such, buyers dominate the market, reflecting a strong accumulation trend.

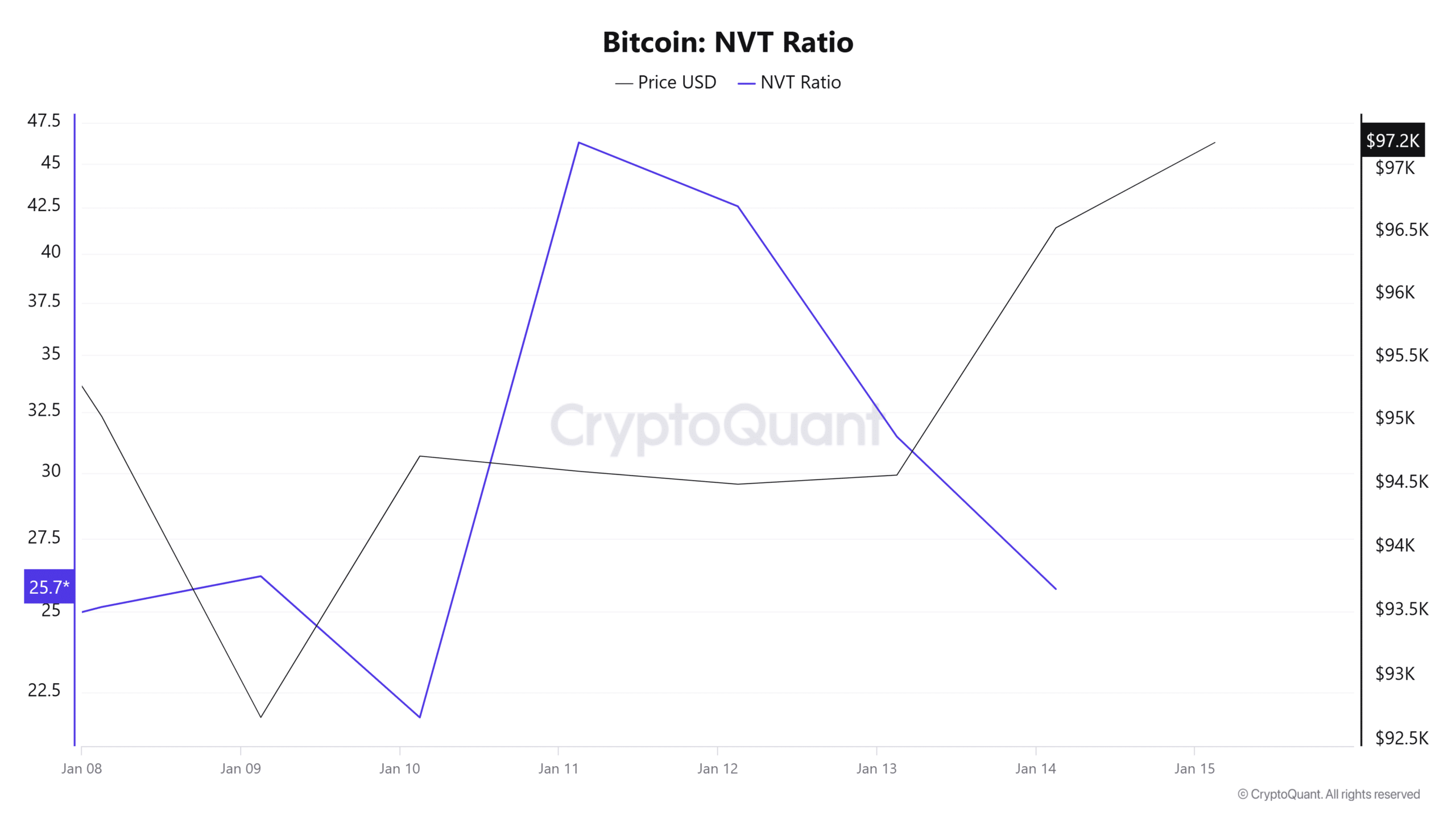

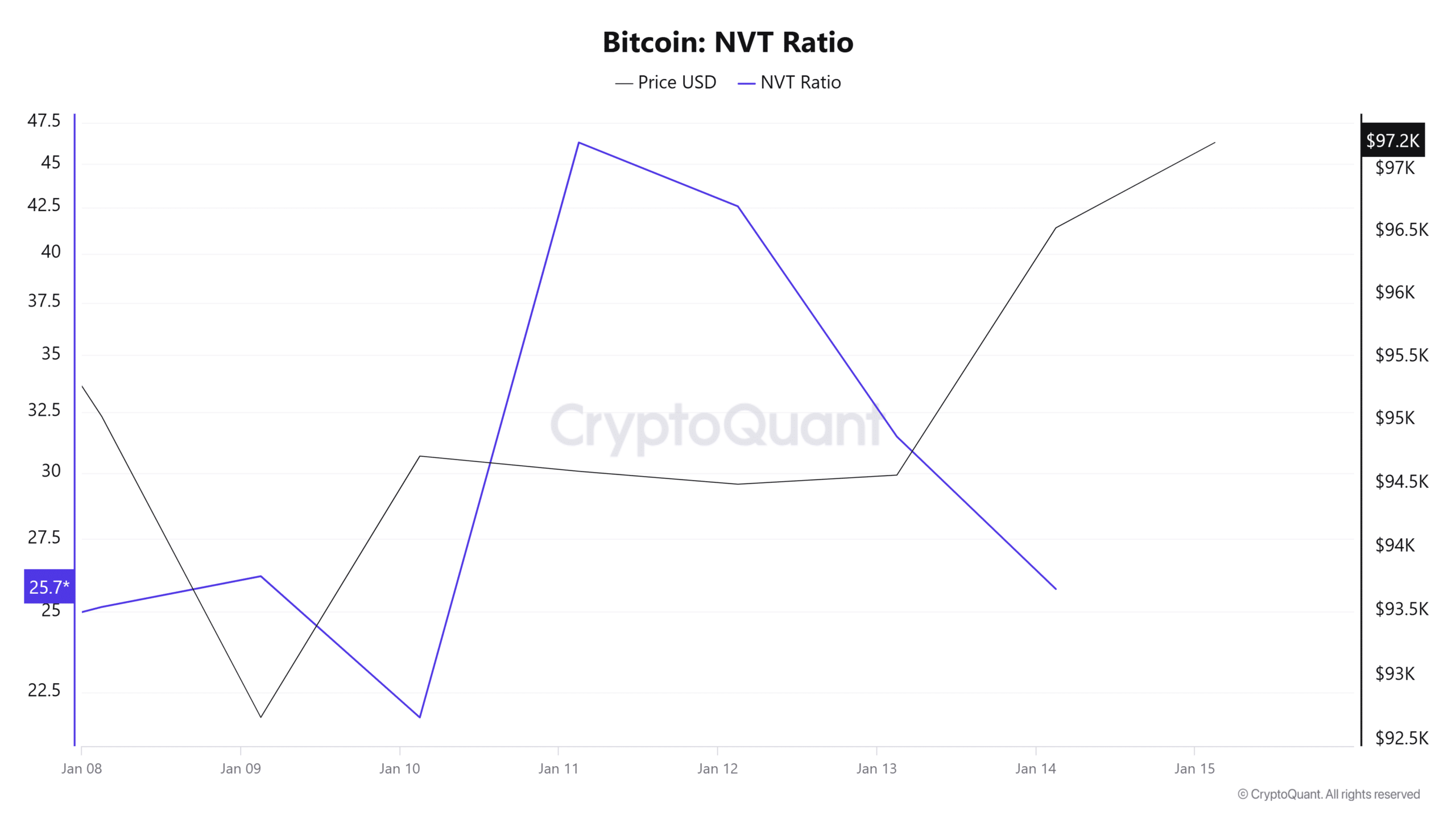

Source: Cryptoquant

Furthermore, Bitcoin is experiencing a recovery in the number of active users and total participants. This is evidenced by a continued decline in the NVT ratio over the past 4 days.

When the NVT ratio falls, it indicates strong demand for the network, indicating strengthening market fundamentals.

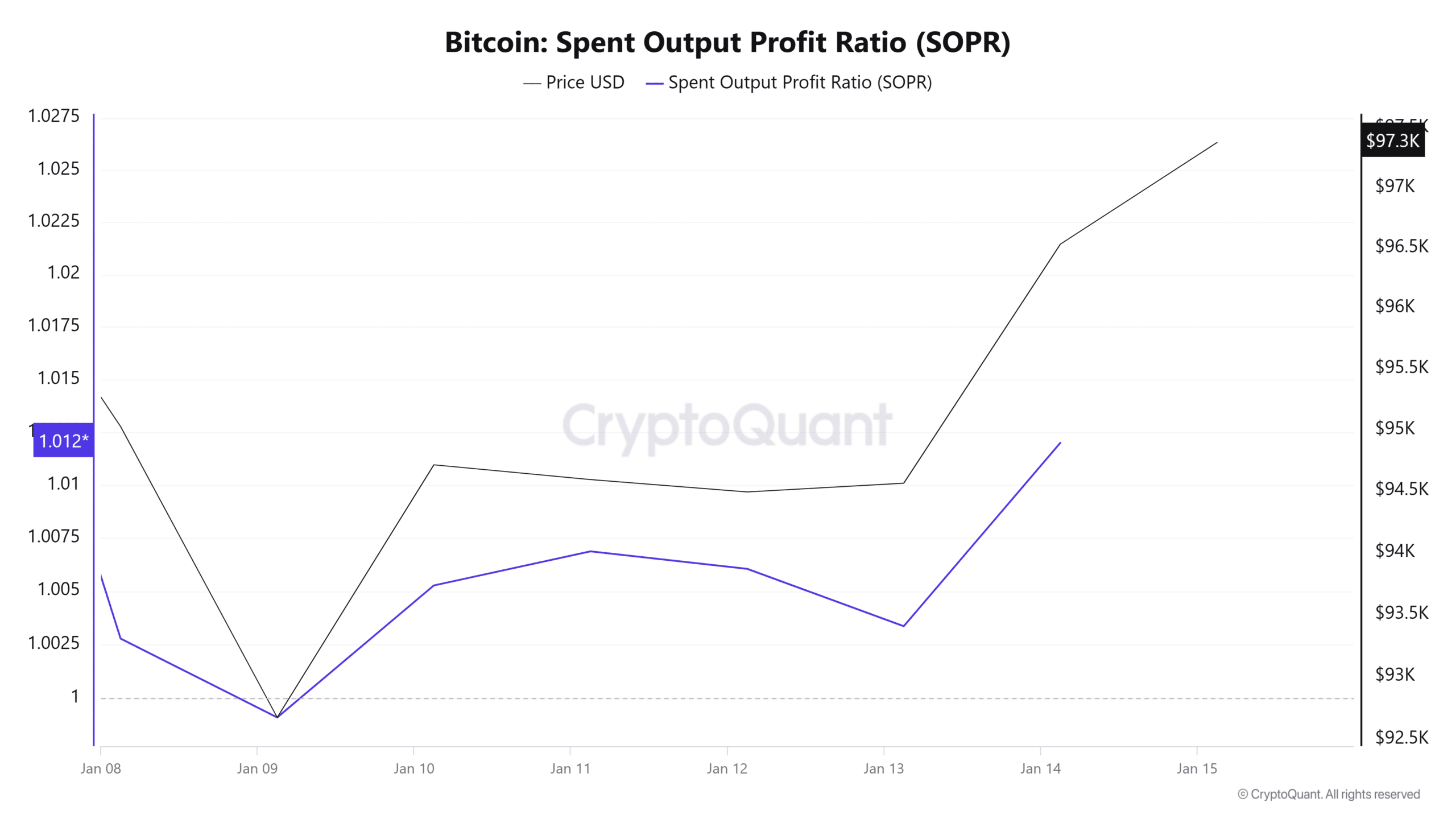

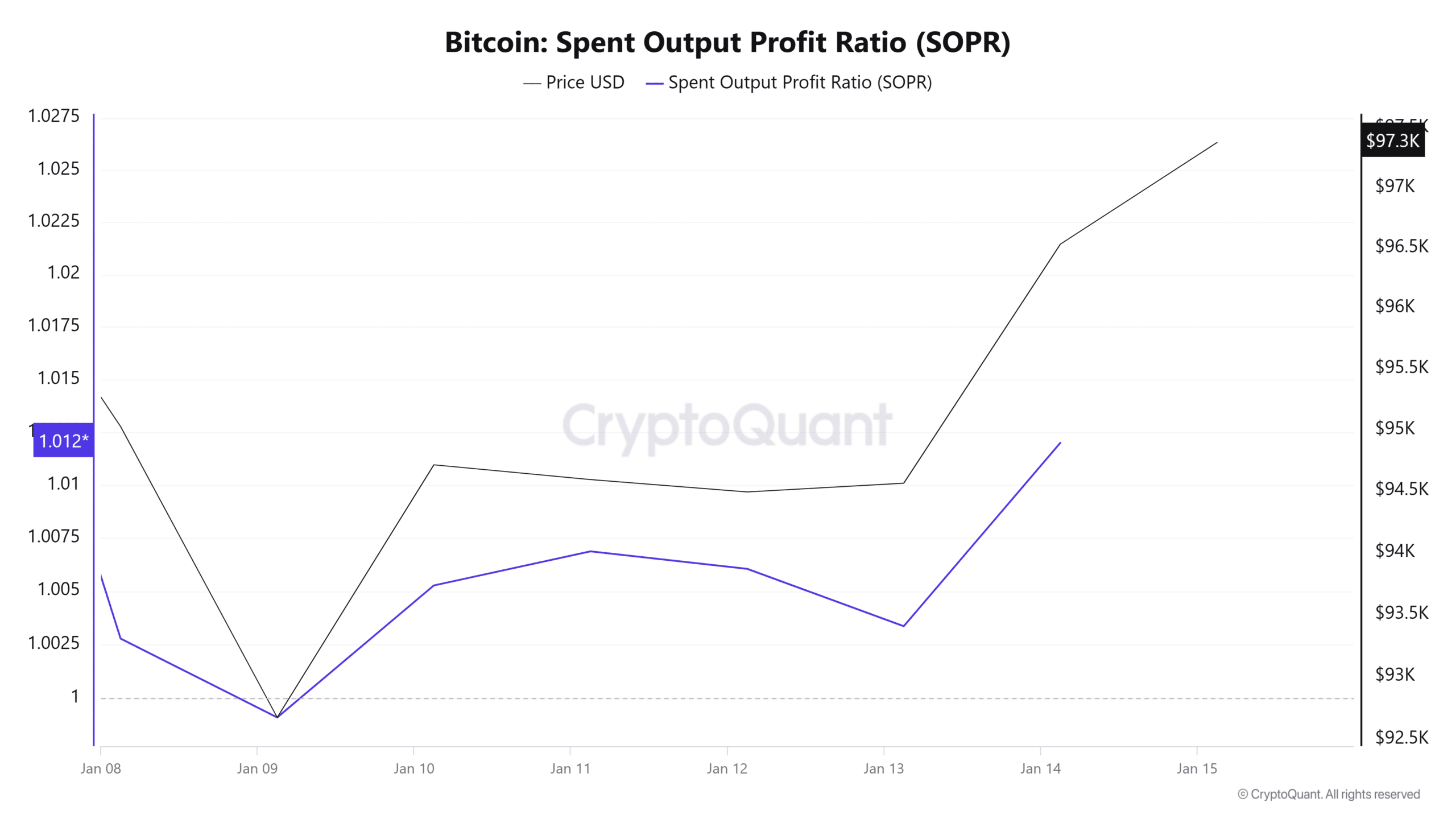

Source: CryptoQuant

Bitcoin’s SOPR has remained above 1 for the past six days. When SOPR remains above 1, it indicates strong market sentiment, with traders willing to sell and reenter the market at a higher level. Profit taking is not discouraging buyers as demand remains robust.

– Read Bitcoin (BTC) price prediction 2025-26

Simply put, Bitcoin is still experiencing strong demand as buyers continue to take new positions, reflecting strong bullish sentiment.

If bulls take control of the market, BTC could reclaim $98,800 and then attempt $100,000. However, a correction could see the crypto drop to $96,560.