- Bitcoin is showing several signals that indicate that it is back on a bearish leg, at least in the short term.

- Can Bitcoin adapt to market expectations despite the fact that October has started with some profit-taking?

Bitcoin [BTC] Investors have shown a lot of optimism about BTC in October, to the point that Uptober is trending. This could be due to several factors, such as lower interest rates, historical performance in October, and BTC’s latest bullish performance.

While bullish expectations for Bitcoin are high in October, there are signs that things could turn out differently. For example, a recent CryptoQuant analysis suggests that BTC’s latest highs observed in late September could mark the final local high.

The analysis was based on BTC’s NVT golden cross and its recent rise above 2.2. Another analysis suggests that Bitcoin will likely struggle to maintain bullish momentum in October, based on historical performance.

According to the analysisBitcoin rose for two weeks after a major rate cut in 2019, followed by two months of bearish performance.

These observations suggest that Bitcoin may still be subject to selling pressure despite the prevailing pressure. This is already evident from BTC’s latest performance.

The cryptocurrency has already given up some of its September gains, indicating that some investors have taken profits.

Bitcoin’s selling pressure is accelerating

Bitcoin recently threatened to dip below $60,000 on October 1. It exchanged hands for $61,430 at the time of writing. The price has fallen 7.8% year to date from the highest price in September.

This means it is on track to decline towards the $59,580 and $57,940 price ranges according to the Fibbonacci retracement.

Source: TradingView

The decline is sufficient indication that the hype after the interest rate cut announcement is over. However, this raises more questions than answers. Will demand resume as price retests the Fibonnacci level?

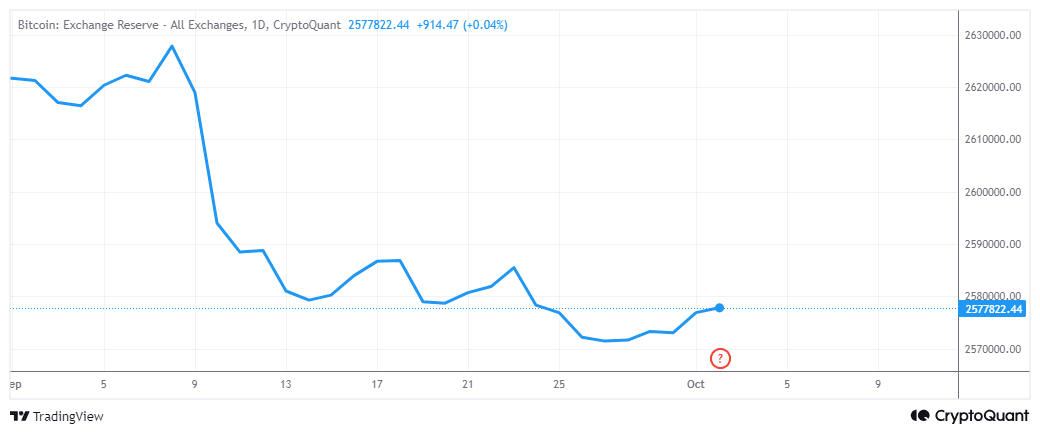

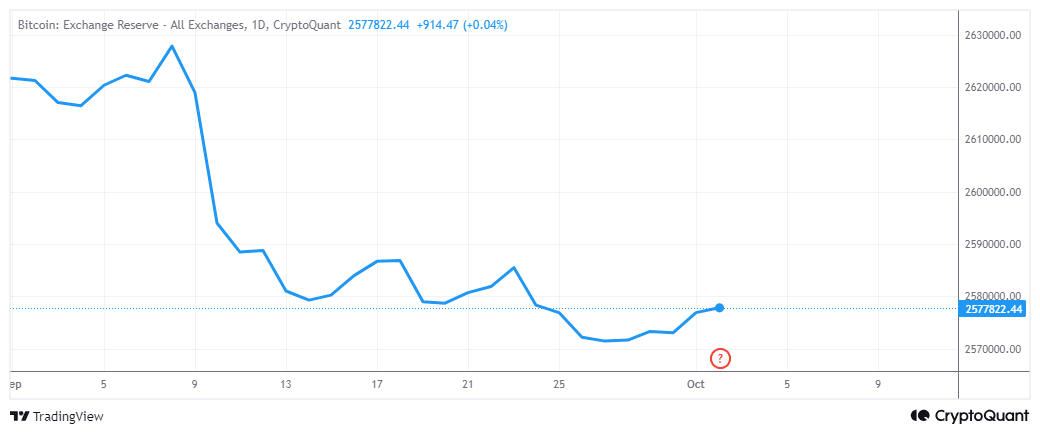

On-chain data presented information consistent with the bearish outcome. For example, Bitcoin exchange reserves have maintained a general downward trend in recent months, with slight increases here and there.

Bitcoin exchange reserves ended September with a slight increase. This confirms that some coins have moved from private wallets to exchanges. In most cases, this corresponds to a resurgence of selling pressure seen in recent days.

Source: CryptoQuant

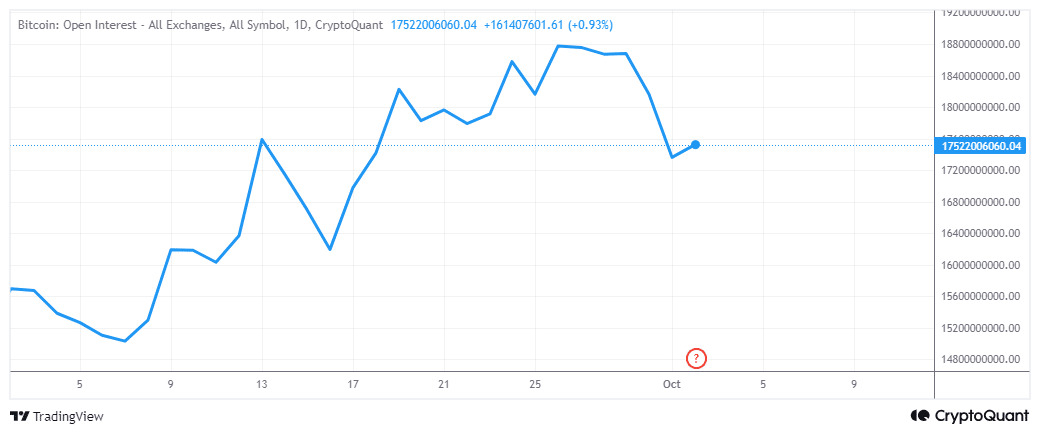

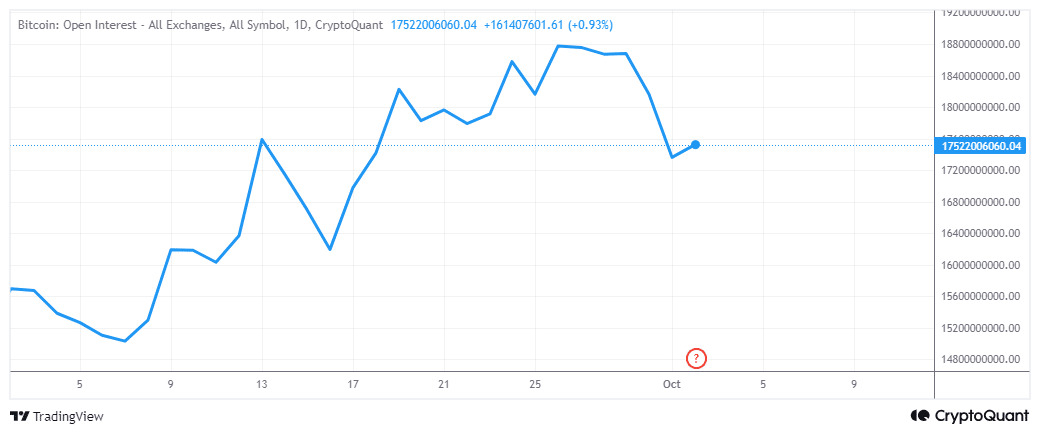

The increase in foreign exchange reserves also corresponded with a dip in Bitcoin open interest since September 26. This confirms that Bitcoin demand in the derivatives segment also slowed.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price forecast 2024-25

The findings suggest a significant possibility that BTC could face increased selling pressure in the near term. As is currently the situation, but this does not necessarily provide a clear timetable.

It could be a short relapse or last longer depending on how things will unfold.