Bitcoin took another blow on 10 March, withdrew under $ 82,000 and sent tickles to the Crypto market. The newest loss of value for the world’s best digital active comes after weeks of considerable profit. Traders are currently not sure whether this is only a temporary hiccup or the start of a more significant correction.

Important levels to check

Arthur Hayes, the Chief Investment Officer at Maelstrom and co-founder of BitMex, anticipates that Bitcoin can experience resistance at $ 78,000. He describes Bitcoin’s gloomy show as one “Ugly starts” until the week.

Hayes suggests that the next important support zone could be around $ 75,000 if the price of Bitcoin Non -normalize above this level.

An ugly start of the week. Looks $ BTC Will test $ 78k again. If it fails, $ 75k is the next in sight. There are many options that have hit $ 70- $ 75k, when we get into that reach, it will be violent. pic.twitter.com/Q4CQ0RThGJ

– Arthur Hayes (@Cryptohayes) March 9, 2025

Investors have expressed concern about the decrease, especially those who have just reached the market. The market analysis company 10x research described the dip as a “classic correction”. The company also revealed that traders who bought the coin in the past 12 weeks were responsible for around 70% of the sales pressure. Panic sales of new investors can make volatility worse.

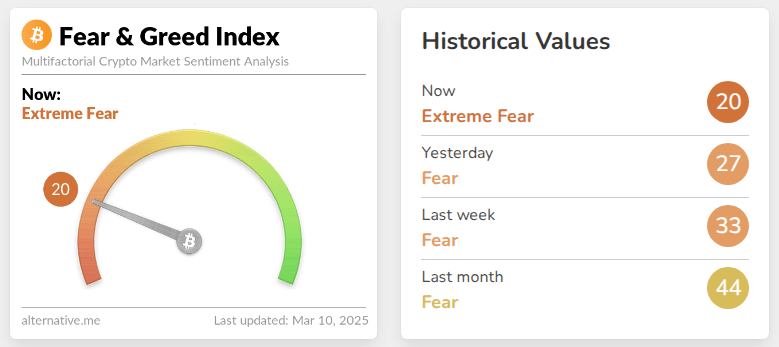

Status: Extreme fear

Sentiment has changed rather dramatically. The Bitcoin anxiety and greed index -mood is a lecture of 20, and shows that it has fallen in “Extreme fear.” This is in stark contrast to the past weeks, when optimism was high. A low rating when it usually suggests that traders are nervous, which can cause more price fluctuations in the short term.

Data shows that a good majority of Bitcoin options are falling between $ 70,000 and $ 75,000. As Bitcoin approaches these levels, traders can change their position, which would generate more volatility.

Upcoming inflation data can influence prices

The upcoming US Inflation Report has the potential to significantly influence the subsequent method of acting by Bitcoin. Investors keep a close eye on the monetary policy of the US Federal Reserve, because any indication of stricter or individual financial circumstances may influence the price route of Bitcoin.

An increase in inflation that exceeds expectations may increase the chance of extra interest rate increases, which can exert pressure on risk assets and bitcoin. Conversely, a decrease in inflation can possibly relieve market volatility and promote stability.

The way for the crypto

At the time of writing, traders carefully check $ 78,000. A successful maintenance above this level may reinforce trust, while a break underneath can lead to extra losses. Sharp movements such as these are becoming increasingly common as Bitcoin continues to develop as an active.

Featured image of Gemini Imagen, Graph of TradingView