- Selling sentiment was dominant among US investors

- Market indicators pointed to a continued price decline in the short term

Bitcoin [BTC] has been on a rollercoaster for a few weeks now. This was best evidenced by BTC successfully surpassing $64,000 before falling below $60,000 in just a few days.

Although the currency’s volatility has remained high, institutional investors are considering stockpiling the cryptocurrency. Will this cause BTC to turn bullish in September?

Do institutional investors accumulate Bitcoin?

Bitcoin witnessed a +9% price correction last month. At the time of writing this was the case trade at $58,184.19 with a market cap of over $1.13 trillion.

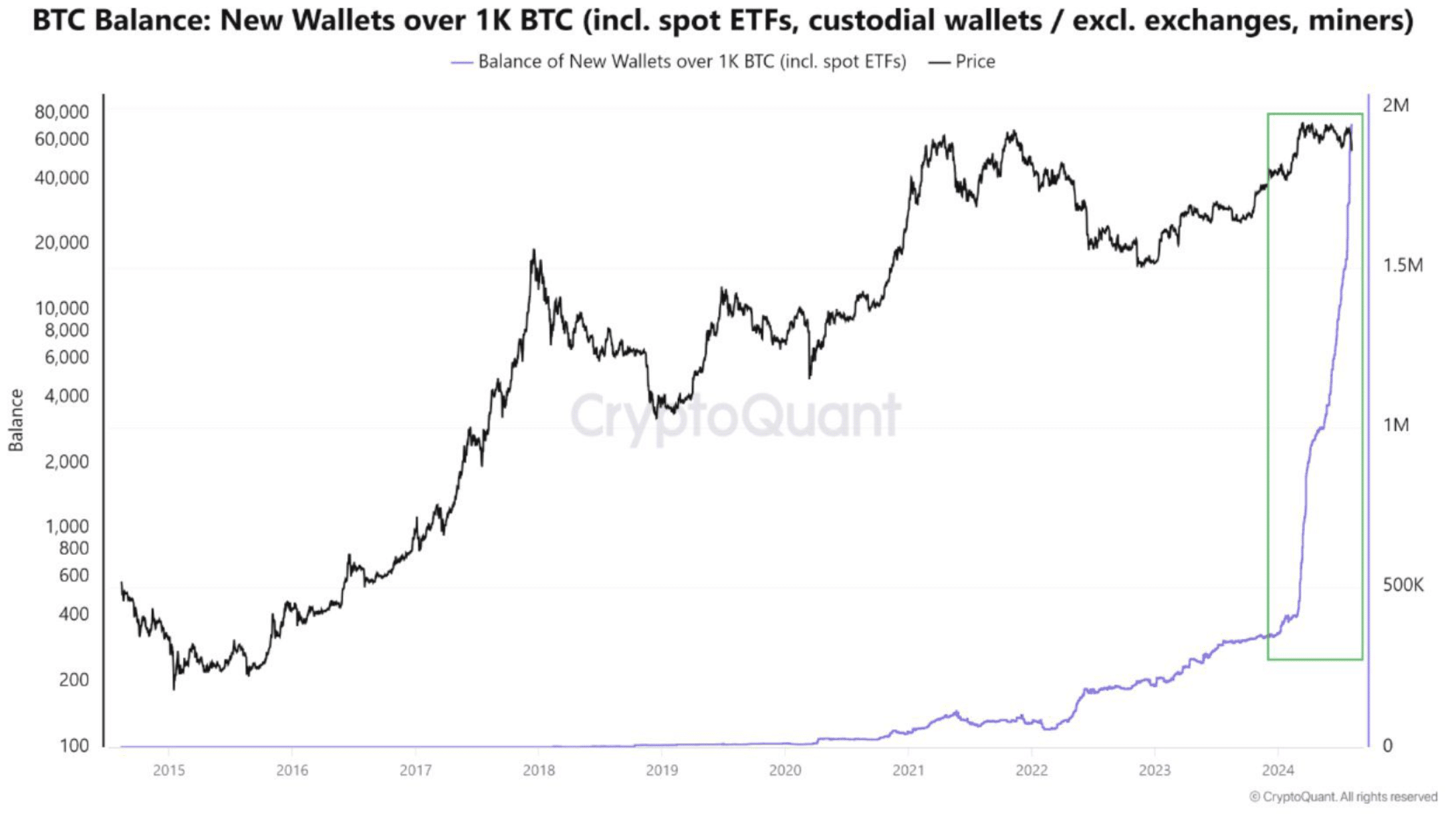

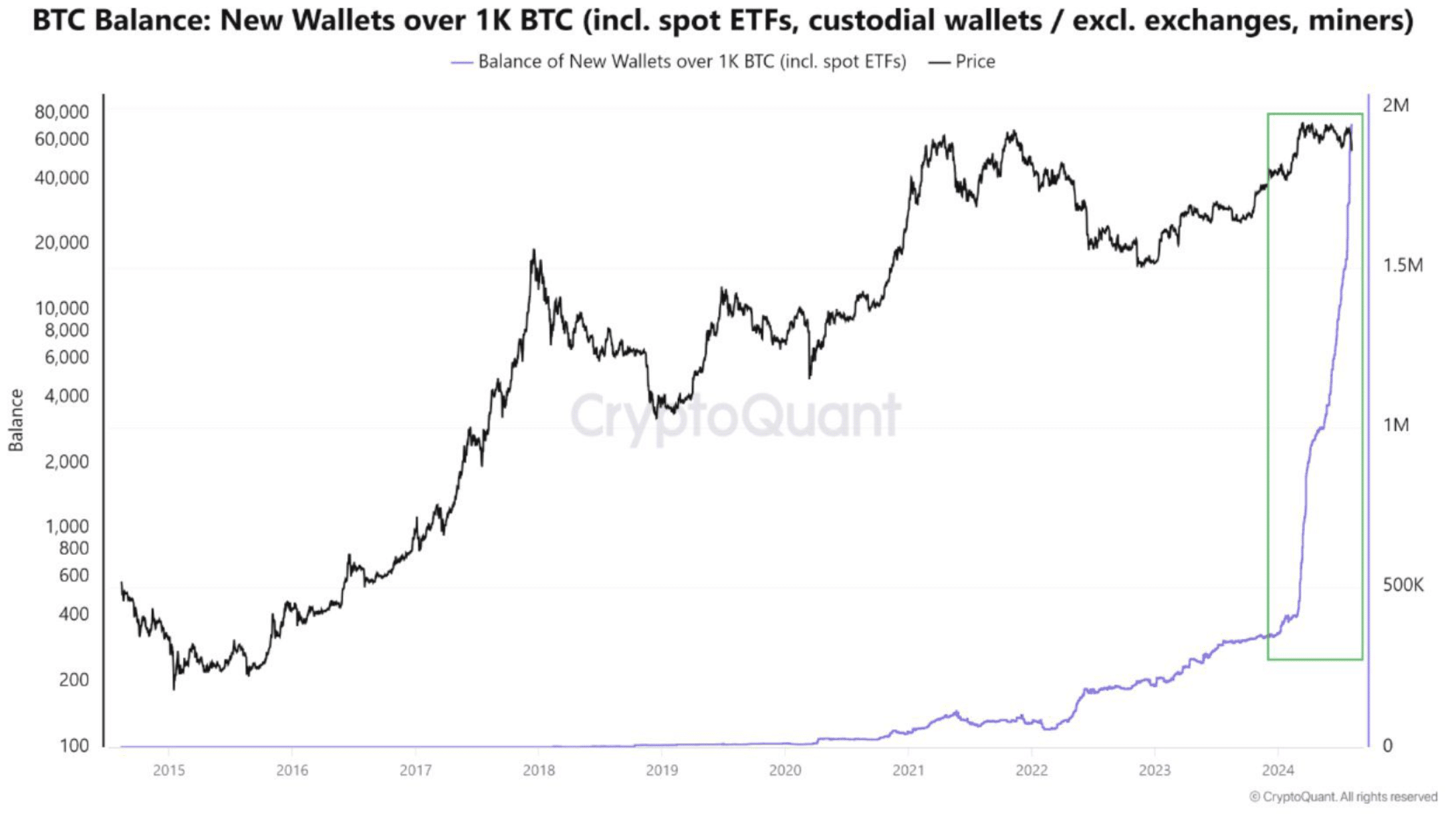

In the meantime, Vivek, a popular crypto influencer, recently shared a tweet to draw attention to an interesting development. According to his analysis, the number of BTC balances at new addresses with more than 1k BTC has increased sharply in recent months. This clearly suggested that institutional investors have shown confidence in BTC. It also means that they expect the price of the king coin to rise in the coming weeks or months.

As a new month is already upon us, AMBCrypto took a closer look at the state of Bitcoin. This, in an effort to see if institutional investors’ faith in BTC would pay off this month.

Source:

What BTC’s September month could look like

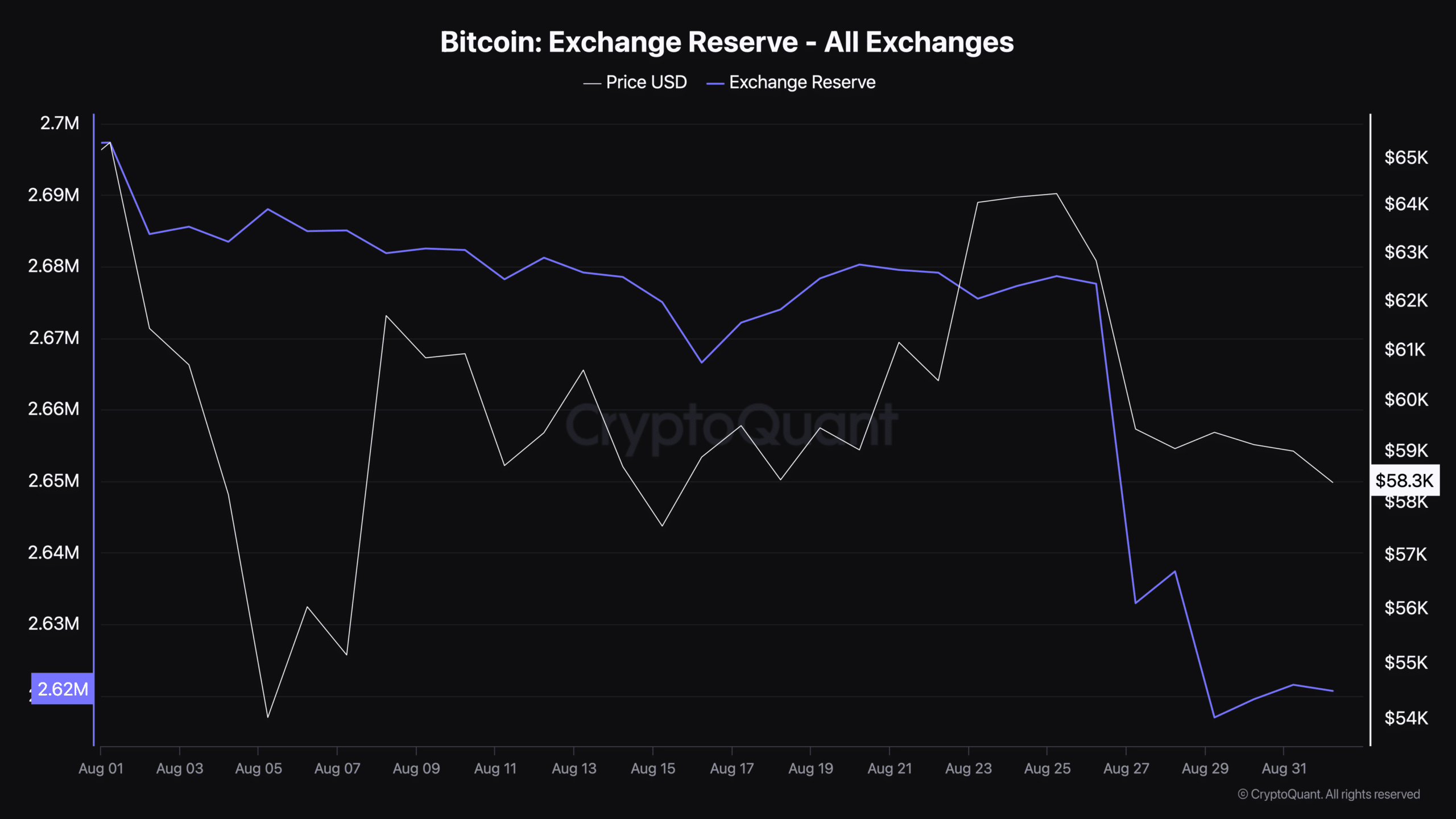

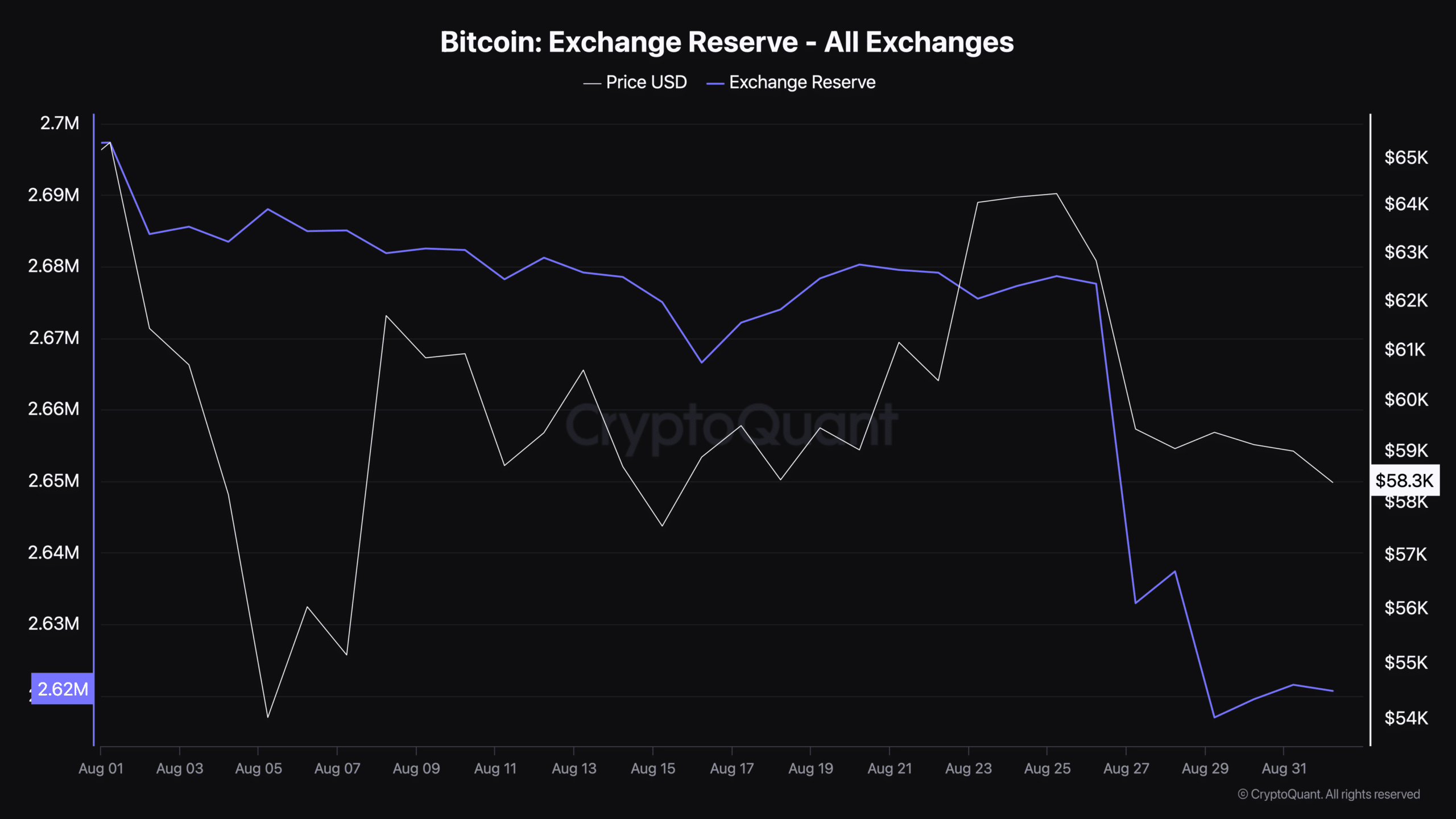

AMBCrypto’s analysis of CryptoQuant facts revealed that BTC’s foreign exchange reserves fell sharply on August 27. This clearly suggested that buying pressure on the coin was high, often resulting in price increases.

Source: CryptoQuant

However, not everything seemed to be in the currency’s favor. For example, the Coinbase premium turned green, meaning selling sentiment among US investors was strong. Moreover, the Fund’s premium was also red. This indicated that investors in funds and trusts, including Grayscale, have relatively weak buying sentiment.

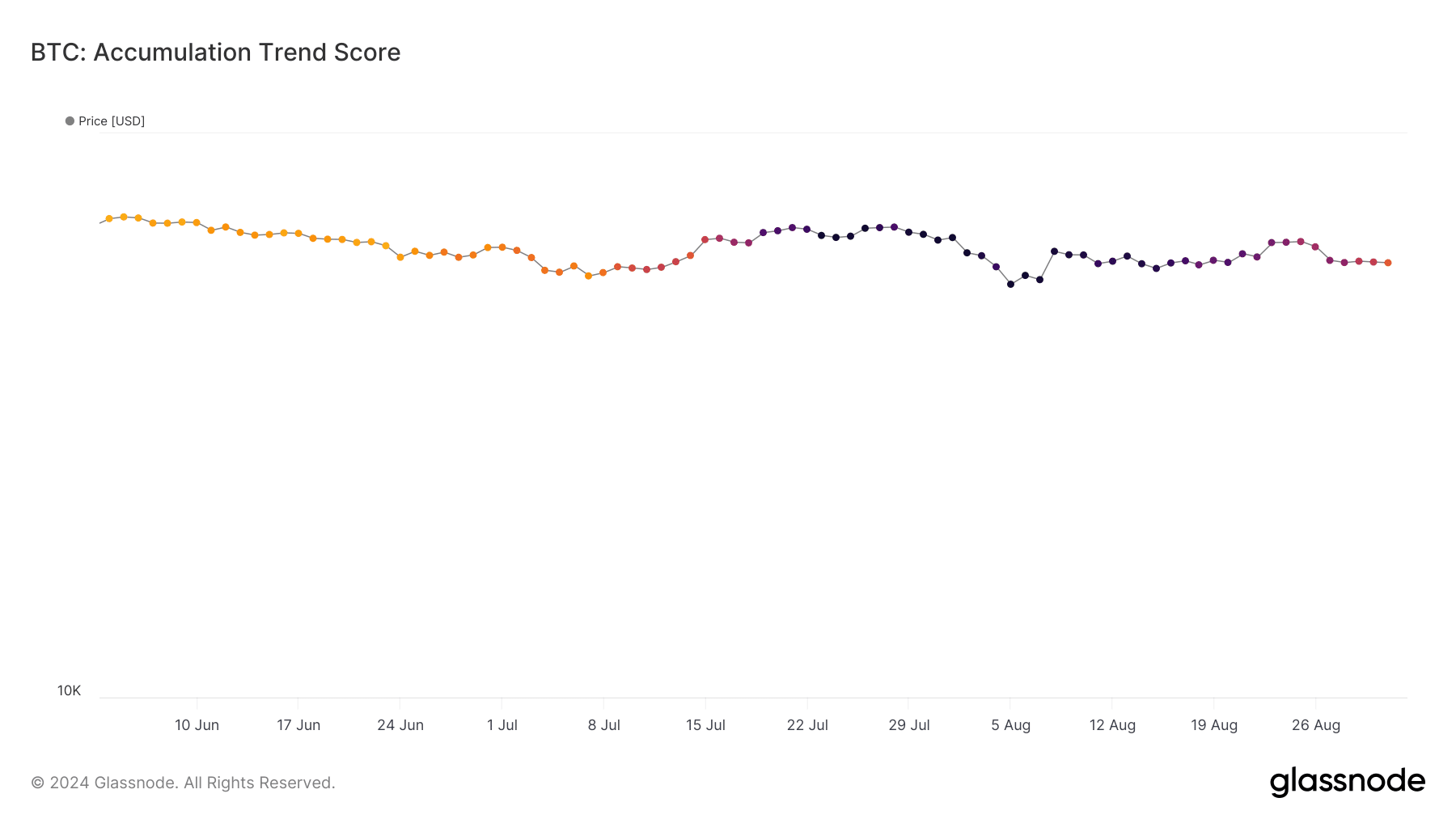

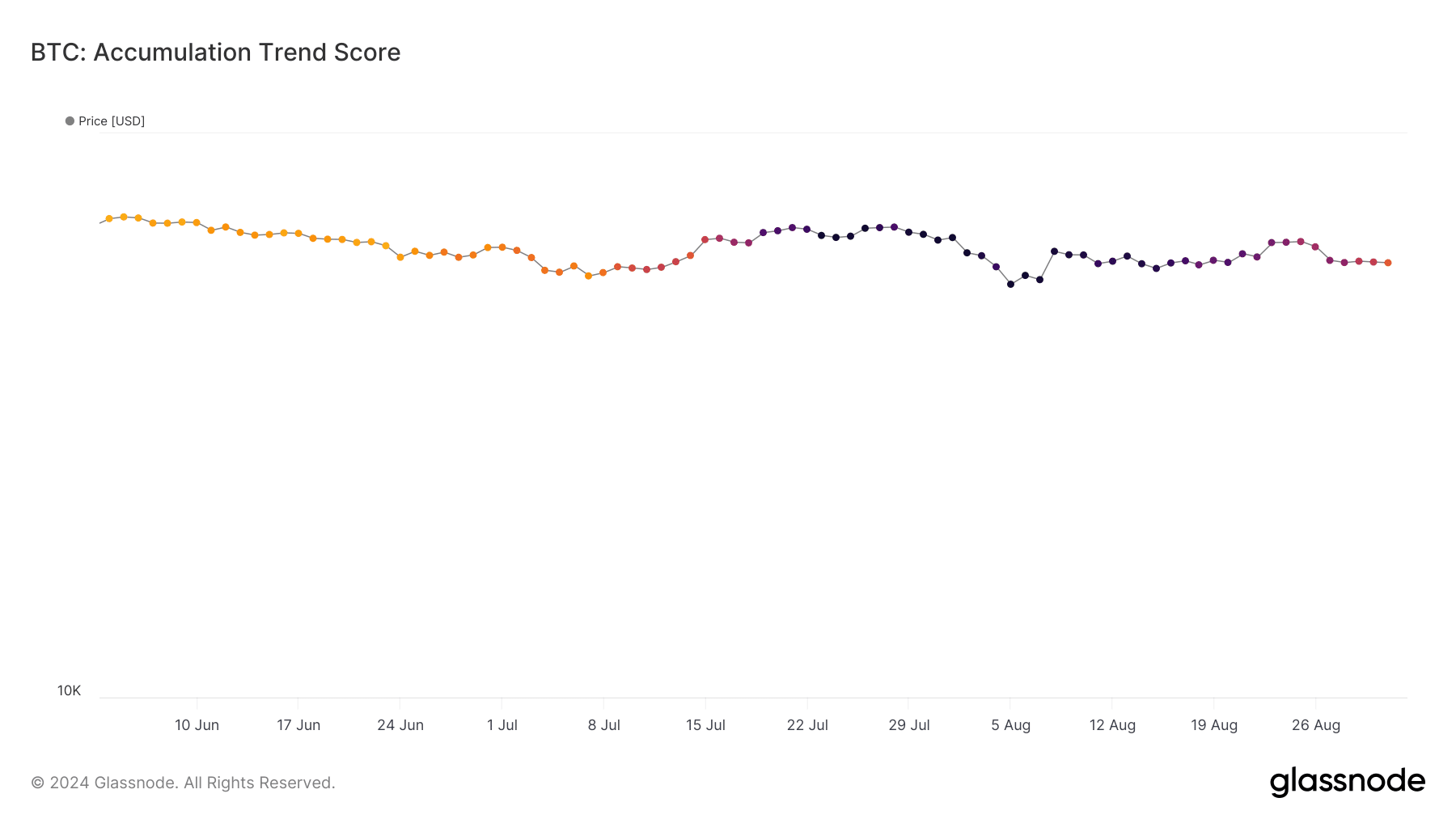

Apart from this, AMBCrypto’s review of Glassnode’s data revealed that Bitcoin’s accumulation trend score had a value of 0.35 at the time of writing. To start, the accumulation trend score is an indicator that reflects the relative size of entities actively accumulating coins on-chain in terms of their BTC holdings.

A number closer to 0 indicates investors’ reluctance to accumulate. On the other hand, a value closer to 1 indicates an increase in buying pressure. Since the value was close to 0 at the time of writing, it seemed that buying pressure was easing.

Source: Glassnode

Read Bitcoins [BTC] Price prediction 2024–2025

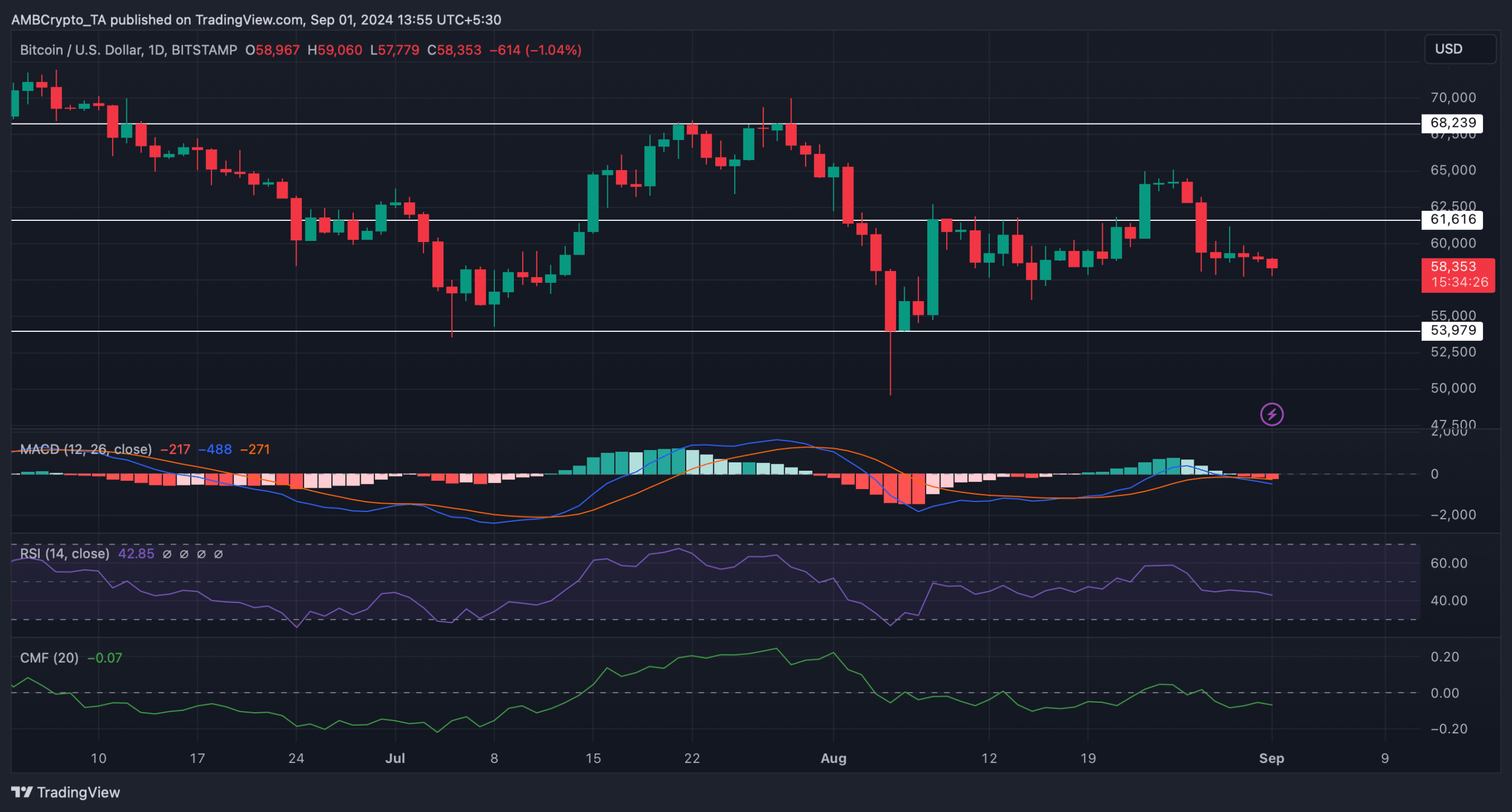

Finally, AMBCrypto analyzed BTC’s daily chart to better understand what to expect from it in September.

The technical indicator MACD showed a bearish crossover. Both the Chaikin Money Flow (CMF) and Relative Strength Index (RSI) also recorded declines. Together, these indicators suggested that investors might have to wait longer for Bitcoin to turn bullish in September.

Source: TradingView