- Bitcoin lost its most important support level and yet the positioning of the retailfutures remains stubborn bullish

- A classic double -edged sword scenario where the market direction depends on the spot demand that is inside

“Rates are here to stay,” said Trump. Shortly thereafter the markets responded. At the time of writing, Bitcoin [BTC] Had withdrawn with 8.66% to the charts, where the subsidy level was re -tested, because $ 1.30 billion in liquidations wiped the market.

In the meantime, 478K addresses fluctuated at $ 78,981 near Breakeven, while 5.94 million portfolios made up from $ 61,129 profit. If lung has been developed and Weak handsBitcoin casts more than $ 130 billion in market capitalization.

And yet a rising bid-as-ratio is a sign of increasing buy-side interest. Long positions in the retail trade were also stable with 73%. Historically, such setups preceded liquidity sweeping followed by sharp reversations.

In fact, a similar arrangement in March led to a sharp rebound of $ 77k-ZOU this dip can be a different hose trap?

An important catalyst that supports market sentiment

The FOMC -Crafts is on – 30 days out and markets are braced for impact. Despite increased Fud, the Pray-app ratio Remains in the 99th percentile and signals persistent buy-side interest.

With the Q2 disability grows, speed intensities are warming up, whereby some expect to be four cuts that the delay after the Tariff will prevent. Recession have opportunities skipped From 40% to 60%, and even JP Morgan now sees speed reductions soon.

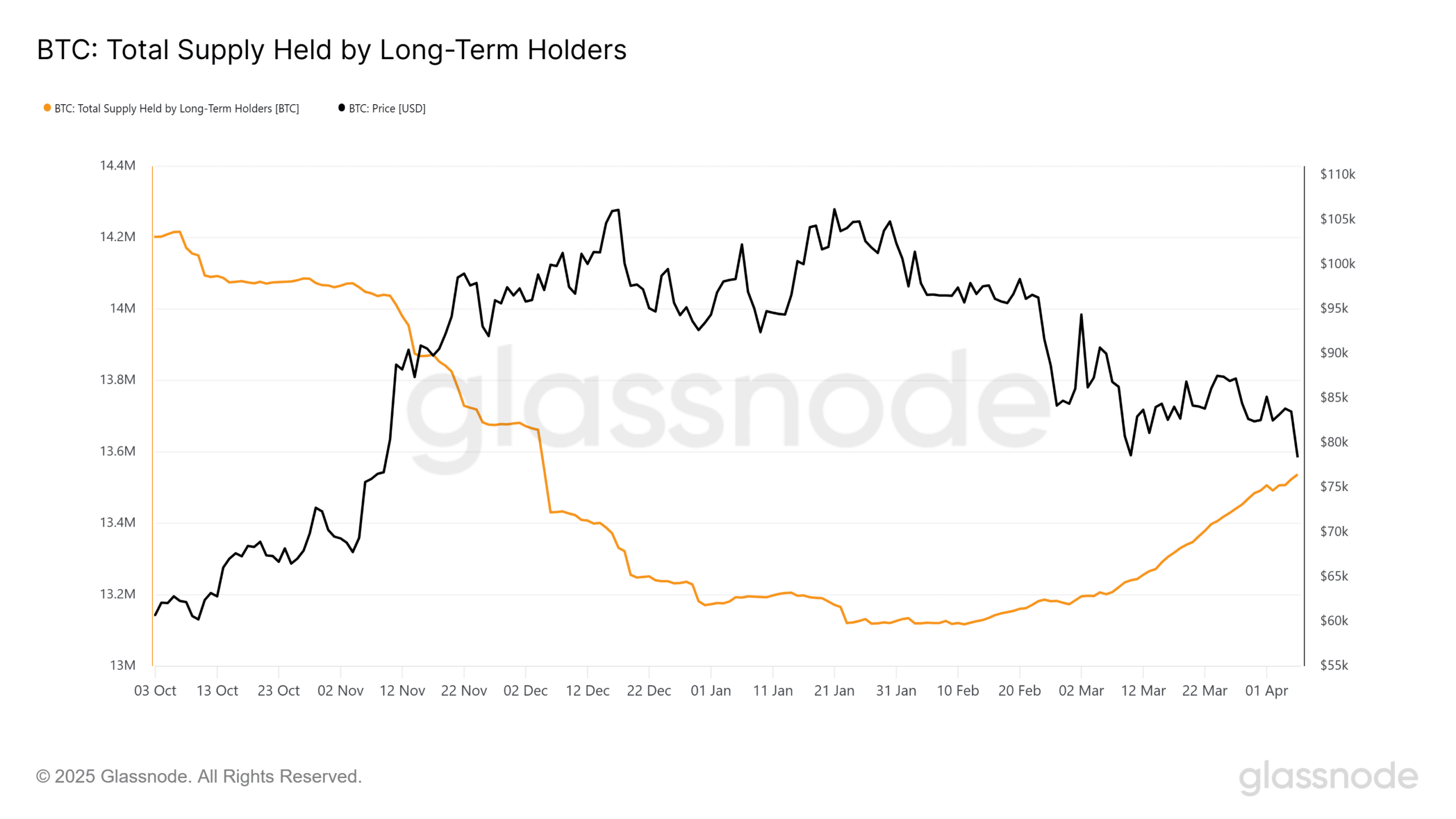

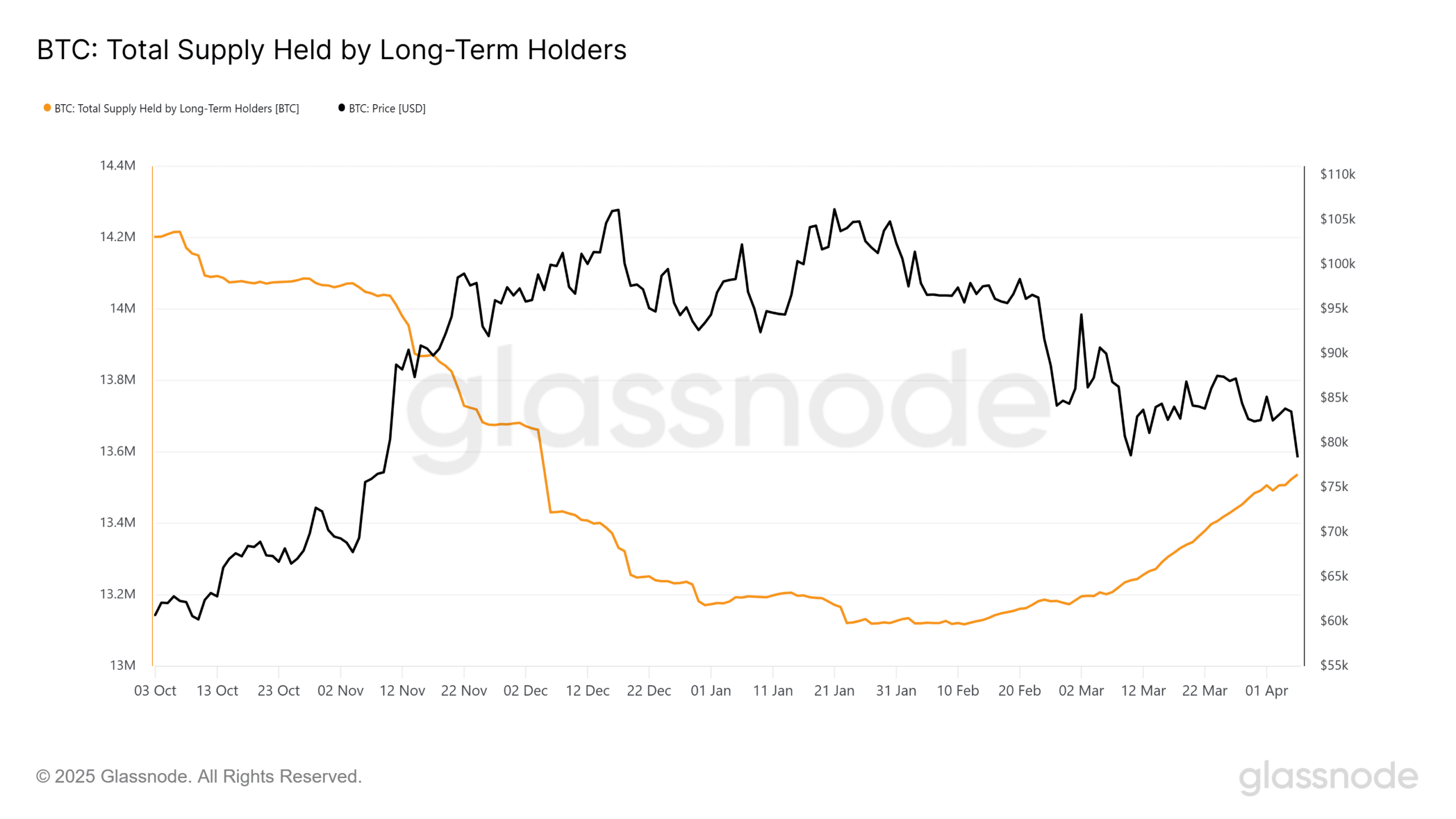

For Bitcoin the deployment is high – the resilience depends on how the Fed then moves. Until then, volatility is probably, although in the short term. Interesting is that the long-term holders of BTC (<155 days) have performed on accumulation and since 6 April 14k have added BTC with a highest highest point of three months.

Source: Glassnode

In the meantime, derivatives positioning does not remain – shakke – the financing percentages (FR) have kept green all week, which is a reflection of persistent bullish leverage.

However, this positioning risks are relaxed without an increase in spot demand. Until now, on-chain statistics have emphasized dip-buyping-a sign that investors are probably in a risk-adjusting mode instead of accumulation.

And yet, Bitcoin’s 50-50 long -term balance At current levels, an excellent setup for a Bear Trap presents. According to ambcrypto, if liquidity absorbs the pressure-side pressure, a volatility clip could cause rapid upward expansion.

Bitcoin’s fragile bullish structure

Undoubtedly the Bullish Set-Up from Bitcoin now shows cracks-the most important support levels, but derivatives traders remain heavy long. However, if the absorption on the buy-side applies, a sharp reversal can be on the table.

On the 12-hour heat map, a liquidity cluster of $ 72.94 million at $ 75,798 was swept, which activated a bounce of 1.20%. Whether this signals the absorption or only a temporary lighting can still be seen.

Source: Coinglass

Yet a strong Bear Trap can be in the making. In the light of the growing open interest, the FED-Pressure and LTH accumulation at a three-month high, the current Bitcoin dip can be in line with an arrangement with a “high risk, high-rewards”.

If liquidity clusters are always absorbed, Bitcoin can be ready for aggressive recovery.