- Analysts gave their opinions on BTC’s sensitivity to global liquidity conditions.

- BlackRock’s Mitchnick saw BTC as a risk asset; Alden considered it a “risk to gold.”

Bitcoin [BTC] was reportedly more sensitive to global liquidity conditions than gold and other asset classes.

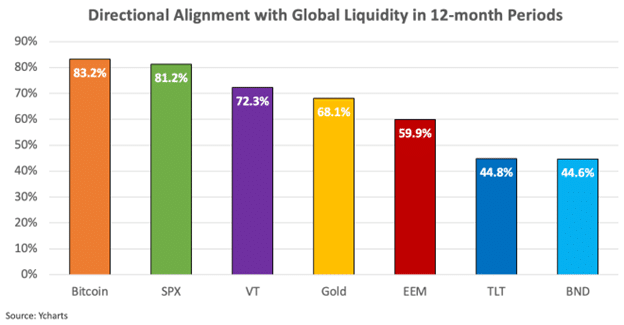

According to Lyn Alden, a renowned macro analyst, BTC responds to global liquidity conditions 83% of the time more than any other asset.

“Bitcoin moves towards global M2 83% of the time; more than other assets.”

Source: Lyn Alden

BTC: a ‘risk-on’ or ‘risk-off’ asset?

US stocks, as denoted by SPX, are the second most responsive assets to global liquidity conditions, while gold came in fourth.

This indicated that BTC was more of a ‘risk-on’ asset that performed better when rates were low or during quantitative easing cycles.

That also suggests that BTC is less of a relative hedging asset than gold. According to Alden, BTC is “risk on gold” because it is new, sound money, but some capital allocators have a limited understanding of it and treat it as a “risk on asset.”

She added that the correlation can last another 5 to 10 years before BTC starts behaving like gold.

“If it gets really big, it could switch more to a gold-like correlation, which isn’t that far off.”

However, Robbie Mitchnick, Head of Digital Assets at BlackRock, views BTC as a “risk-off” and hedging asset. For context, risk-off assets tend to perform well during periods of uncertainty and turmoil.

Mitchnick noted that BTC and gold have virtually no long-term correlations with US stocks, with occasional and temporary positive appreciations. He added:

“When we think of Bitcoin, we first think of an emerging global monetary alternative… Scarce, global, decentralized, non-sovereign assets. And it is an asset that has no country-specific risk, that has no counterparty risk.”

According to Mitchnick, rising inflation and investor concerns about US political/fiscal sustainability will be key growth drivers for BTC, making it a risk-off asset.

That said, there have been ongoing ones debates about whether BTC is more sound money with extra benefits potential compared to gold.

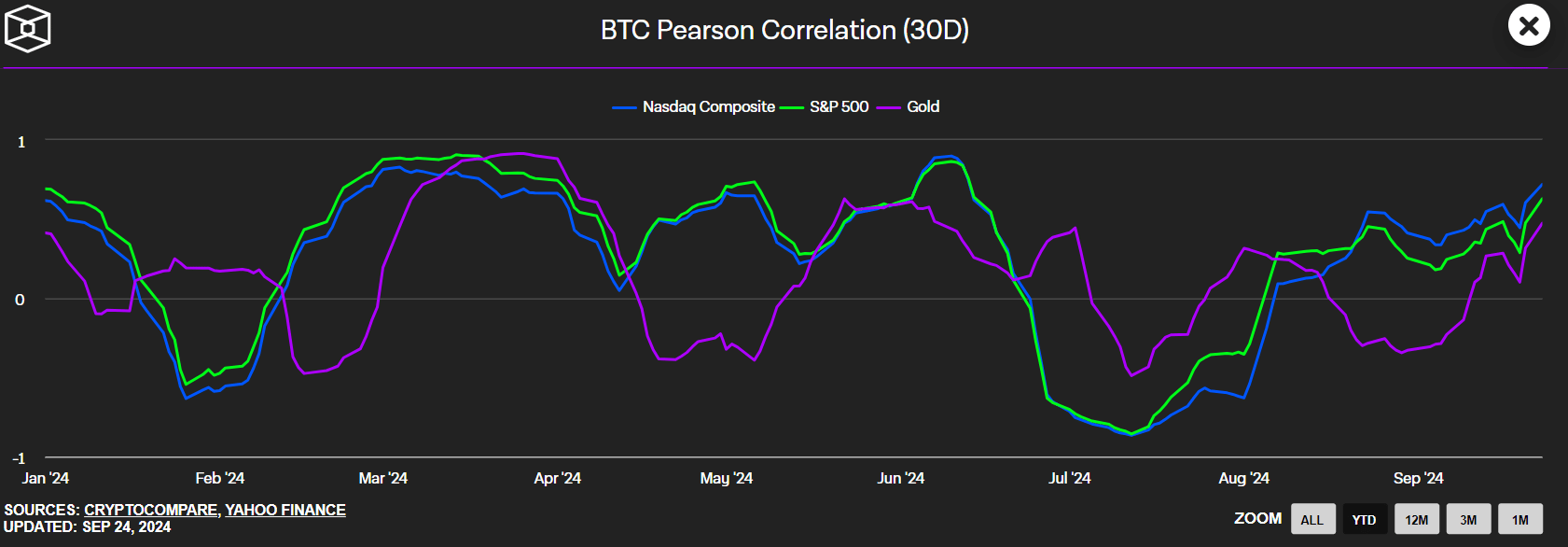

In the short term, however, Alden’s projections seem more likely. BTC behaves like a ‘risk-on’ asset.

Even according to BTC Pearson Correlationthe cryptocurrency became increasingly positively correlated with US equities in the third quarter.

Source: Het Blok

Put another way, BTC’s price action could be forward-looking at updates to the US Fed’s monetary policy, rather than near-term crypto-specific events.

In short, the US PCE (personal consumption expenditure) data, released on September 27, will drive BTC volatility.

Moreover, the recent Chinese economic stimulus measures and expected The easing cycle will also boost BTC in the medium term.

Ergo, monitoring this front can be useful as part of a macro approach to risk management strategy for BTC investors and traders.