Understanding regional market data is becoming increasingly important when analyzing the Bitcoin market. The global nature of Bitcoin means that trading activities in one region can significantly influence global price movements. By analyzing where this activity is most concentrated, we can gain insight into which regions exert the most influence on Bitcoin’s price.

Glassnode provides estimates for both the supply and price change of Bitcoin in three major regions: Asia, the European Union (EU), and the United States (US). By correlating the timestamps of all transactions created by an address with the working hours of different geographic regions, Glassnode determines the probability of each entity’s location. This approach ensures that regional data is as accurate as possible, given the decentralized nature of Bitcoin.

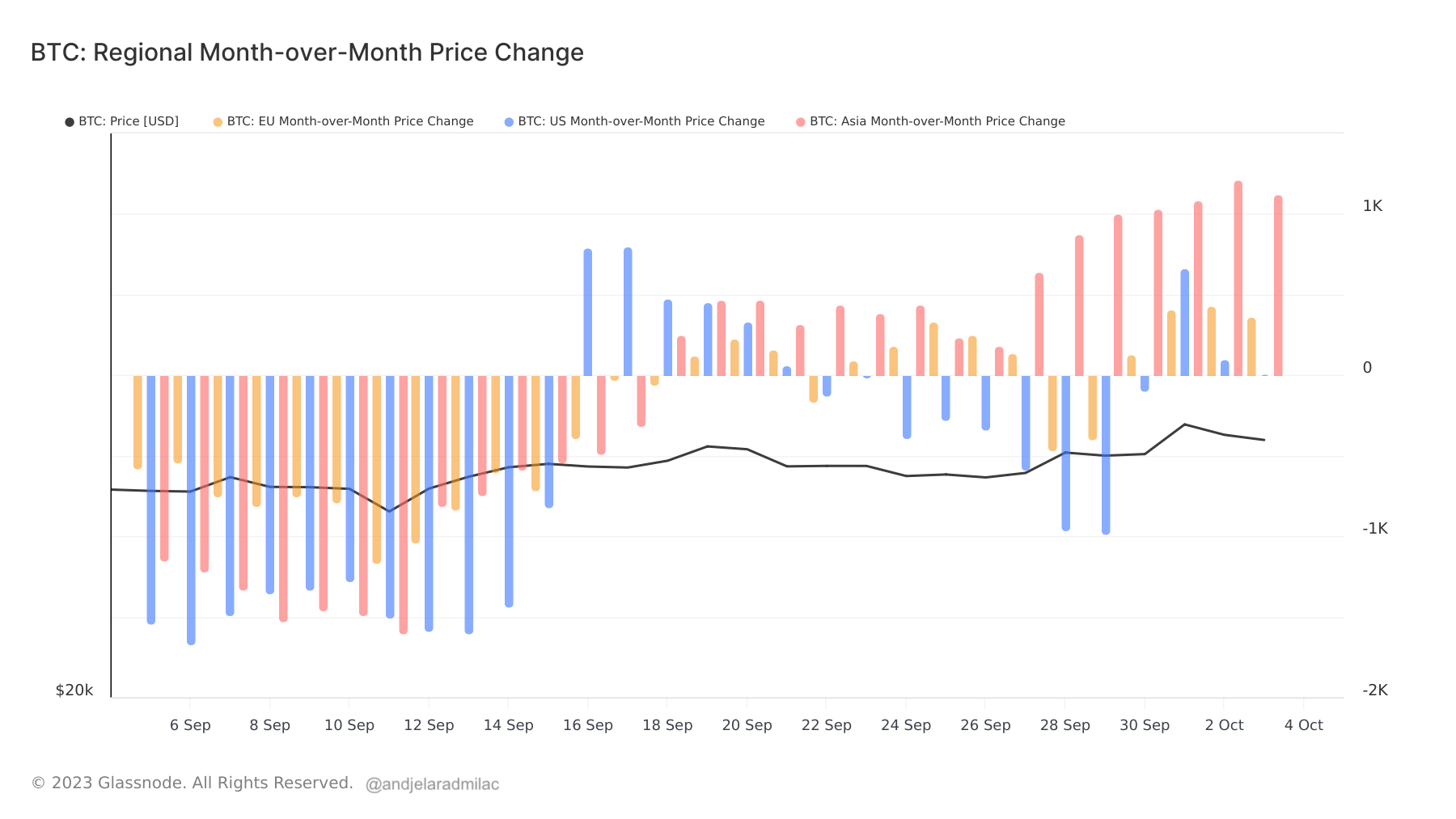

CryptoSlate’s analysis found that the most significant price movements are not coming from the US. Instead, month-on-month regional price changes indicate that Asia is leading the way. On October 2, the 30-day change in Bitcoin’s price in Asia reflected a substantial increase of $1,214. In contrast, the US and EU reported more modest month-on-month price changes of $103 and $431 respectively.

It is striking that the US experienced a dip in the last week of September, with the most significant drop being -$987 on September 29. This suggests that while Asian traders are accumulating Bitcoin, their counterparts in the US and EU are more cautious, with the US even showing signs of distribution.

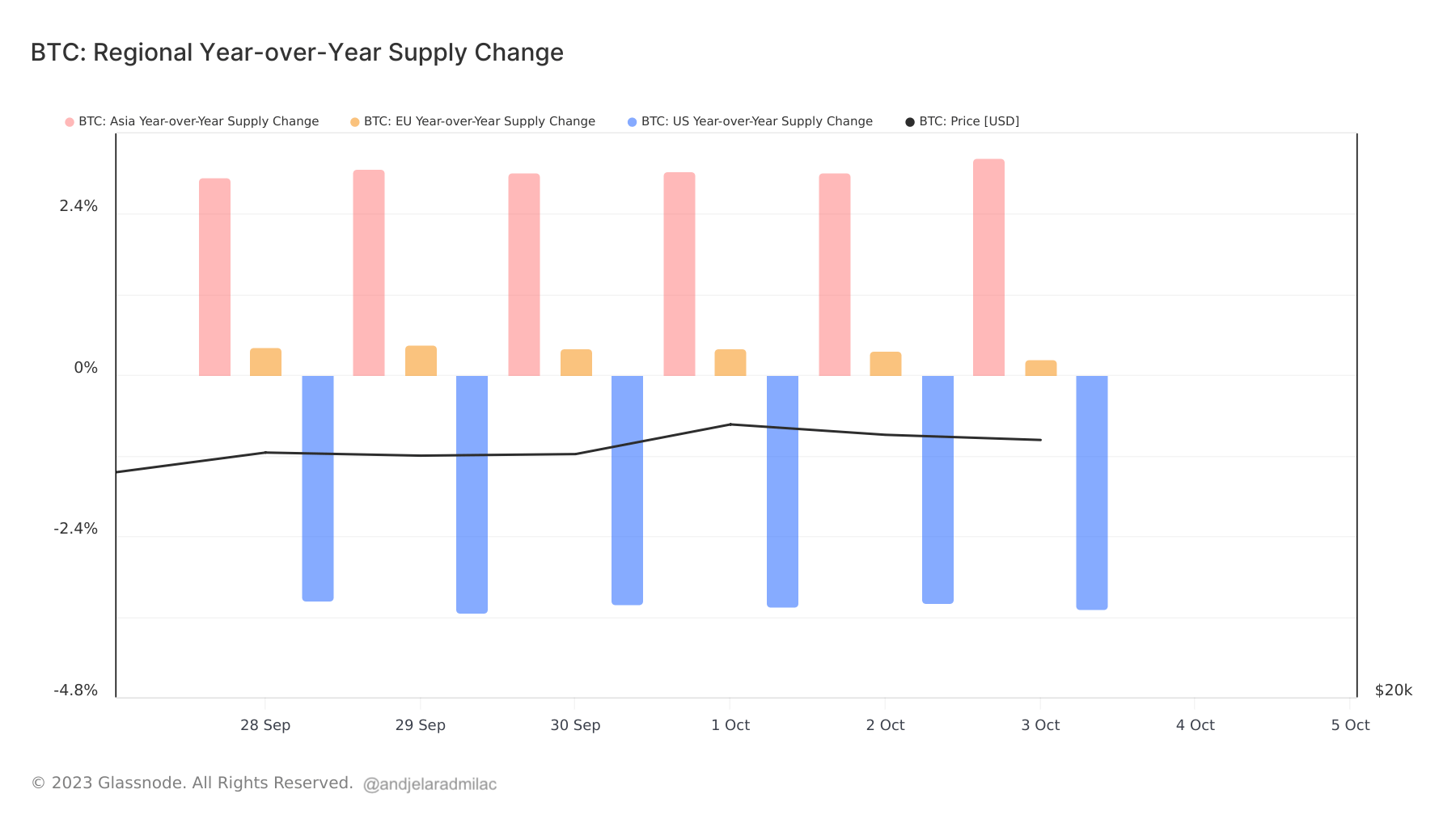

The regional year-on-year supply change provides further insights. On October 3, Asian Bitcoin supply rose 3.23% year-over-year. The EU also reported a slight increase, with an increase of 0.24%. However, US supply showed a decline of 3.48% year-on-year.

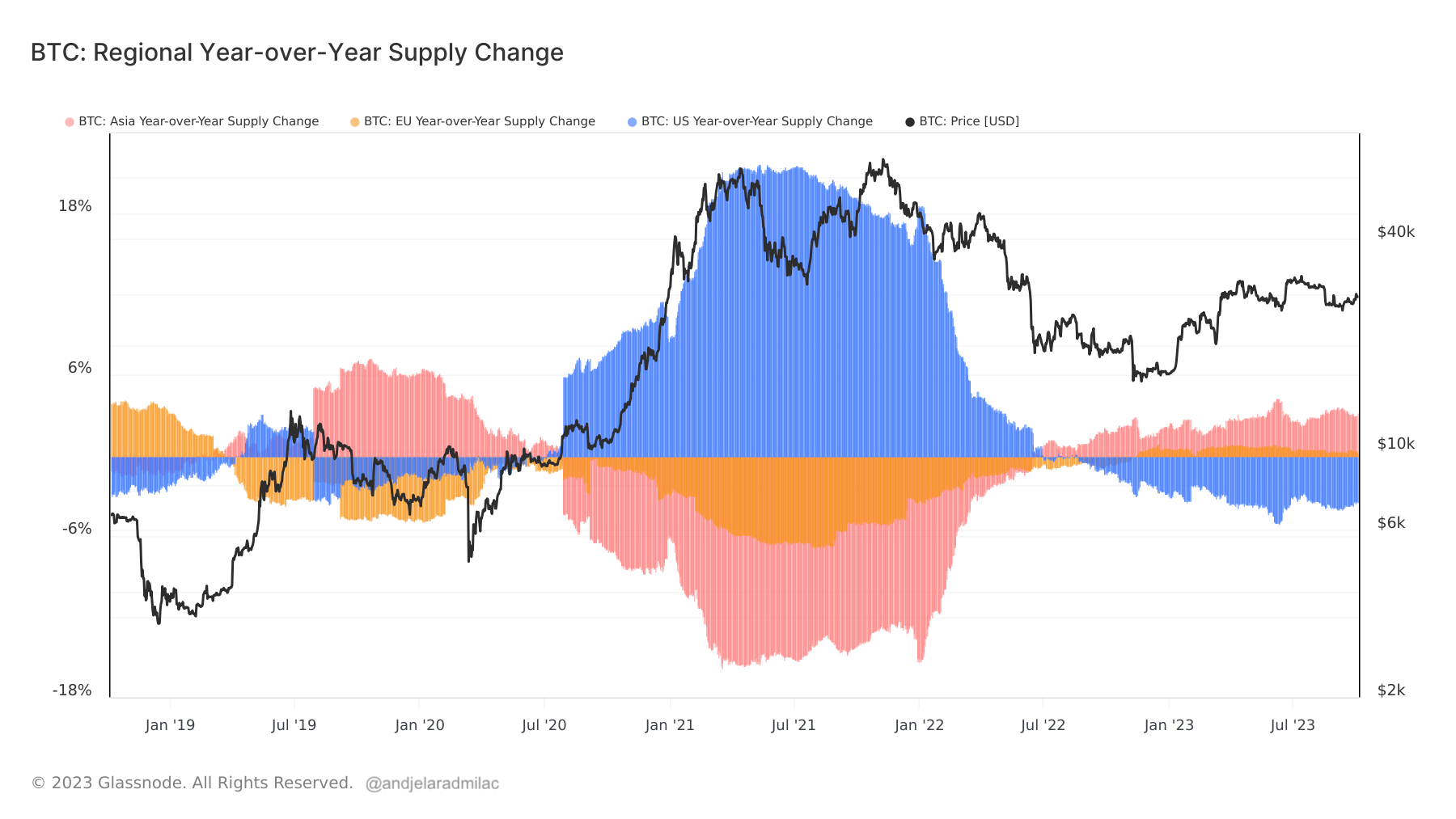

This decline is part of a broader trend that began in 2022, when the US Bitcoin supply experienced a gradual deflation. Since August 2022, U.S. supply has consistently shown negative year-over-year growth. Interestingly, after years of decline, supply in the EU started its upward trajectory in November 2022. In contrast, supply in Asia has increased in line with the decline in supply in the US, indicating a near-perfect inverse relationship.

The data suggests that while Asian traders are bullish on Bitcoin, the US and European markets are more cautious. The increase in supply in Asia indicates growing confidence in the cryptocurrency, while the decrease in the US suggests a more conservative stance. The modest increase in the EU could be indicative of cautious optimism.

Regional data provides valuable insights into the global Bitcoin market. Current trends suggest a shift in market dynamics, with Asia emerging as a dominant force in Bitcoin trading.

The post Bitcoin’s Regional Dynamics: Asia Bullish, US and EU in Distribution Mode appeared first on CryptoSlate.