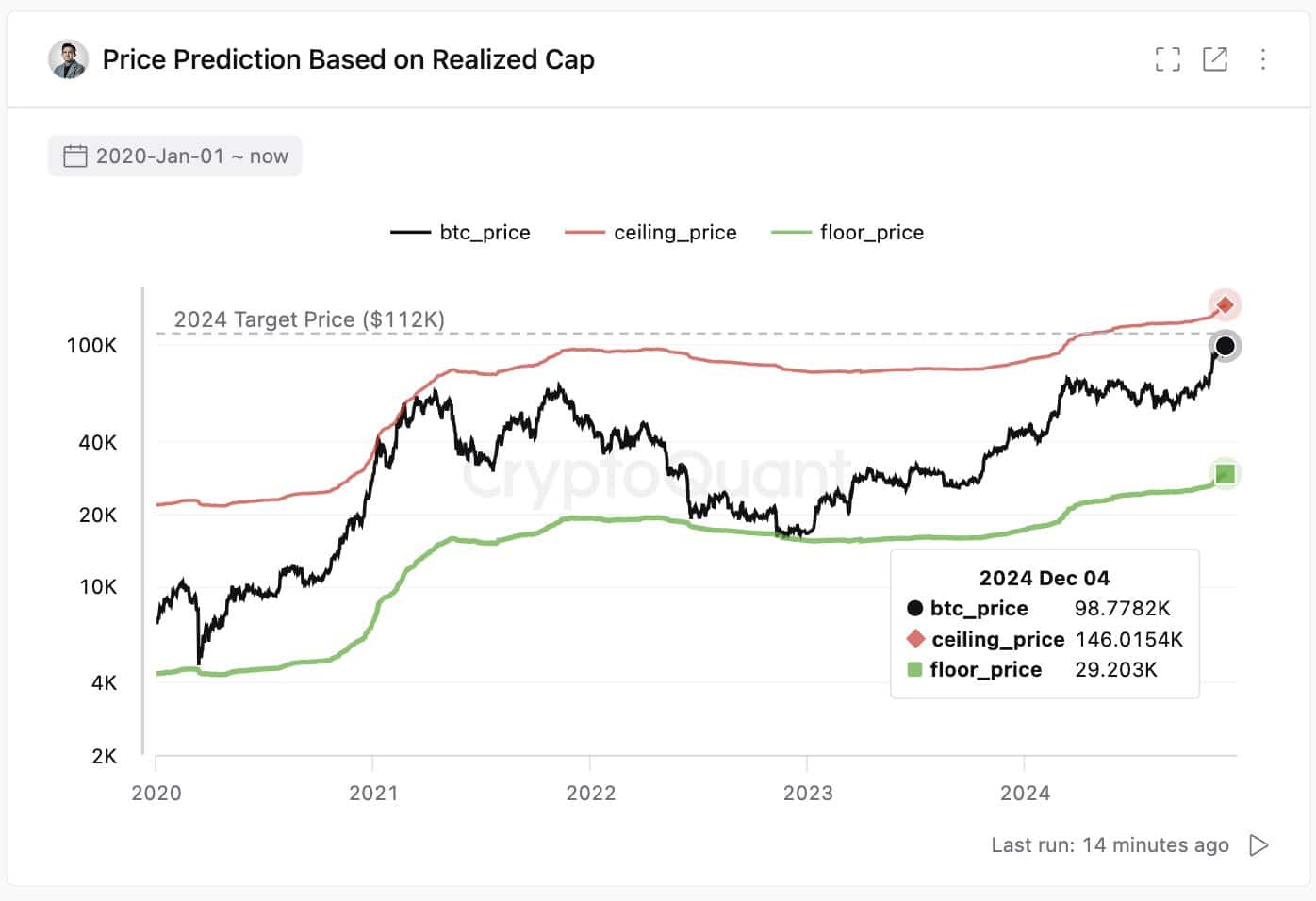

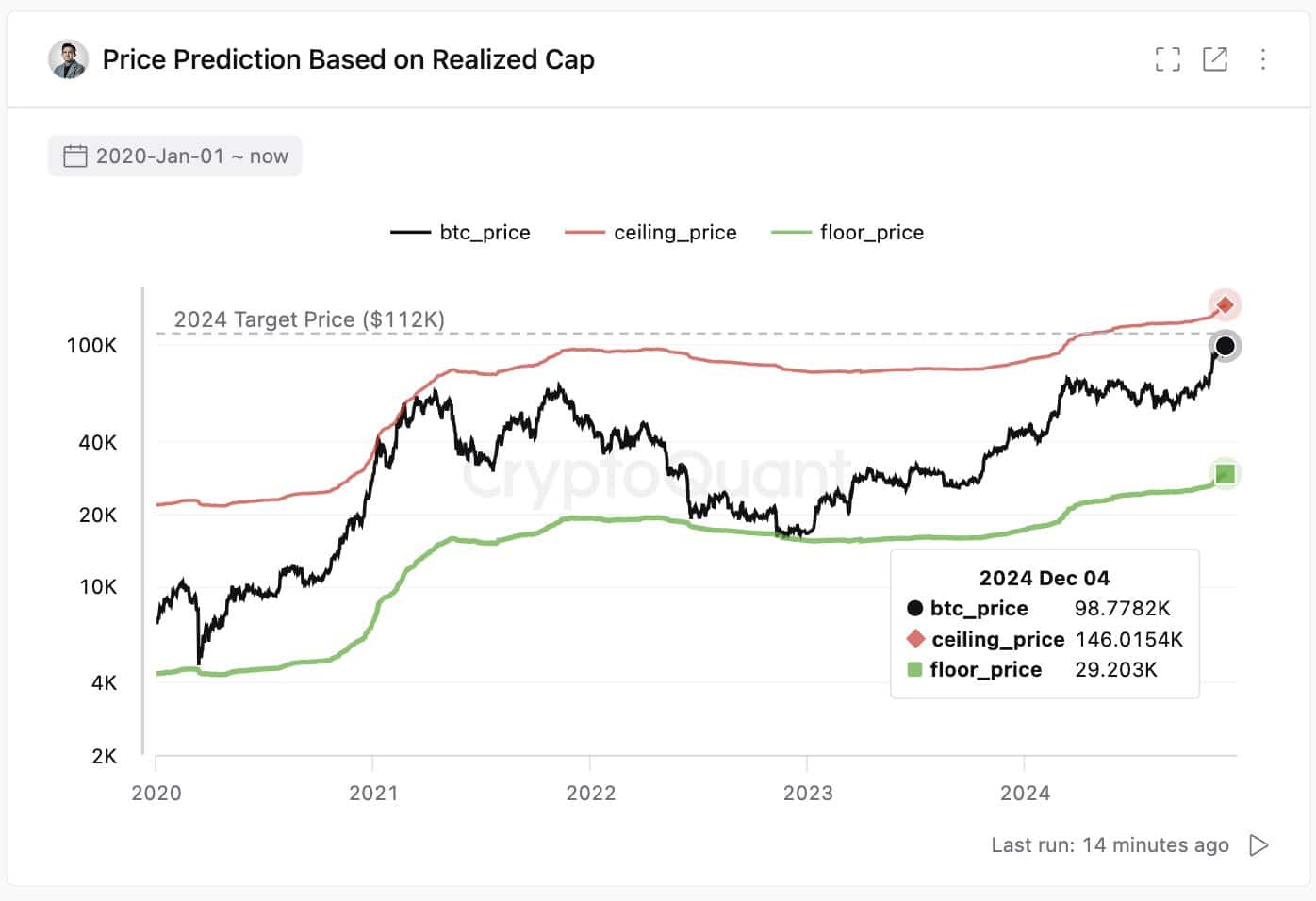

Bitcoin’s realized limit reflects the new capital inflow

Bitcoin’s realized cap – which reflects the total value of coins at their last transaction price – has seen good growth, underscoring the new capital inflow into the market.

Over the past 30 days, Bitcoin’s ceiling price has risen from $129,000 to $146,000, as noted by CryptoQuant CEO Ki Young Ju, This highlights the increased confidence of investors and the new liquidity entering the ecosystem.

Source:

This dynamic is a critical indicator of the health of the market, showing that the recent price action is not only driven by speculative trading but also supported by tangible buying activity.

Notably, Bitcoin remained well below the bubble threshold at $102,000, which would require a 43% increase to break.

Such data points to a balanced market rally, based on sustainable demand rather than irrational exuberance.

The combination of the realized limit with the price suggests that Bitcoin’s upward momentum could have even more room to grow, driven by solid fundamentals.

Bitcoin’s $102,000 Price and 43% Rise

Bitcoin’s current price of $102,000 places Bitcoin firmly in a growth phase, but still far from the ceiling price of $146,000 – a level often associated with “bubble” conditions.

The 43% difference underlines the relative durability of the current rally compared to previous euphoric peaks.

This threshold, as derived from Bitcoin’s realized cap data, represents a hypothetical upper bound where speculative exuberance could dominate rational valuation.

The need for a 43% increase reflects both the magnitude of liquidity required and the subdued pace of current inflows, suggesting market participants are focused on accumulation rather than chasing parabolic moves.

Read Bitcoin’s [BTC] Price forecast 2024-25