- Bitcoin remains stable because Altcoin statistics show steep falls of involvement and performance.

- Altcoins show repeated negative momentum signals, in line with historical correction periods.

Recent data signals in chains Varying trends between Bitcoin [BTC] And the rest of the Altcoin sector.

Analysts at Cryptoquant confirmed Bitcoin’s continuous consolidation above $ 83,000.

Source: Cryptuquant

In the meantime, altcoins are struggling with increased volatility, sliding engagement statistics and depressive ratings.

Momentum -trends tell the first part of the story

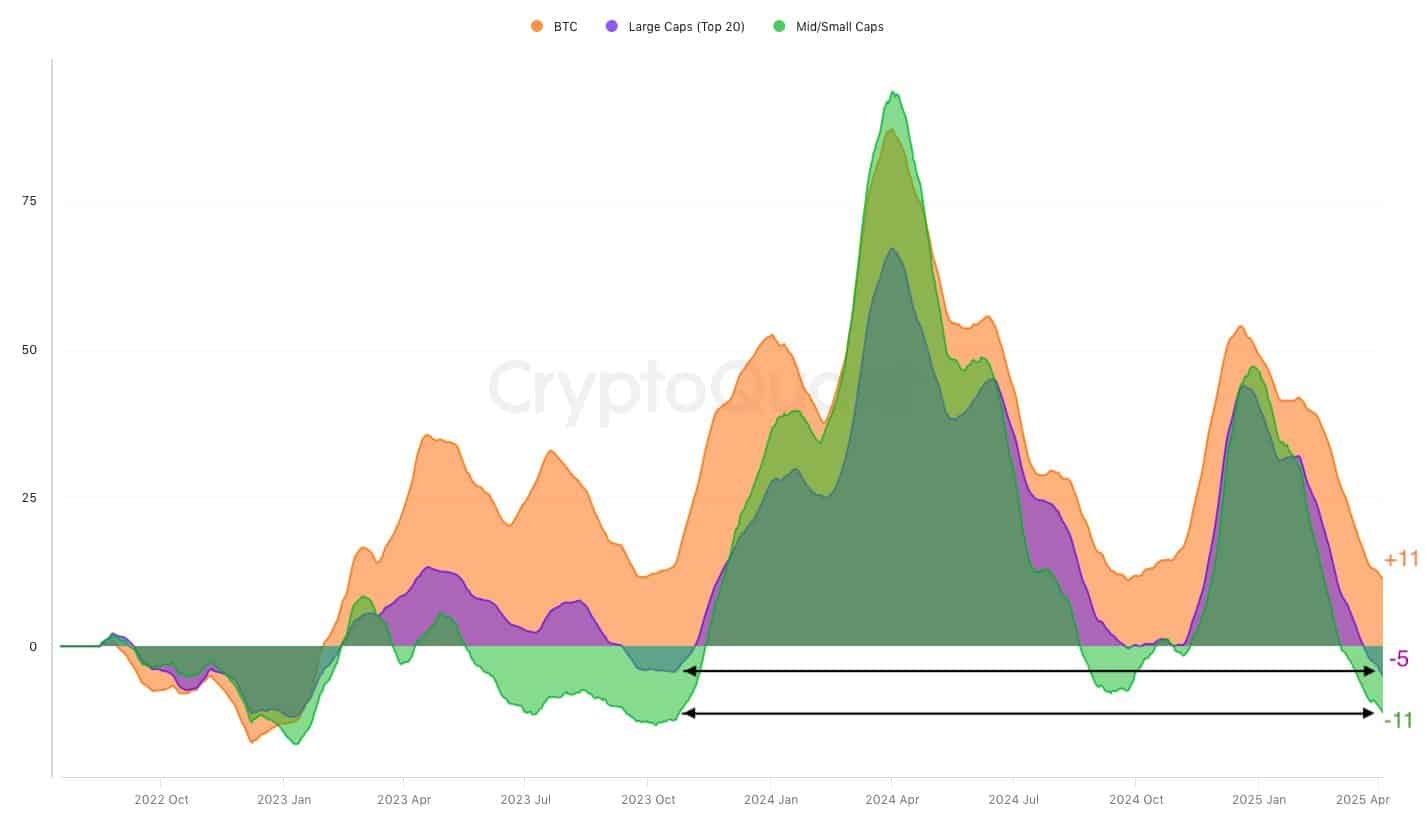

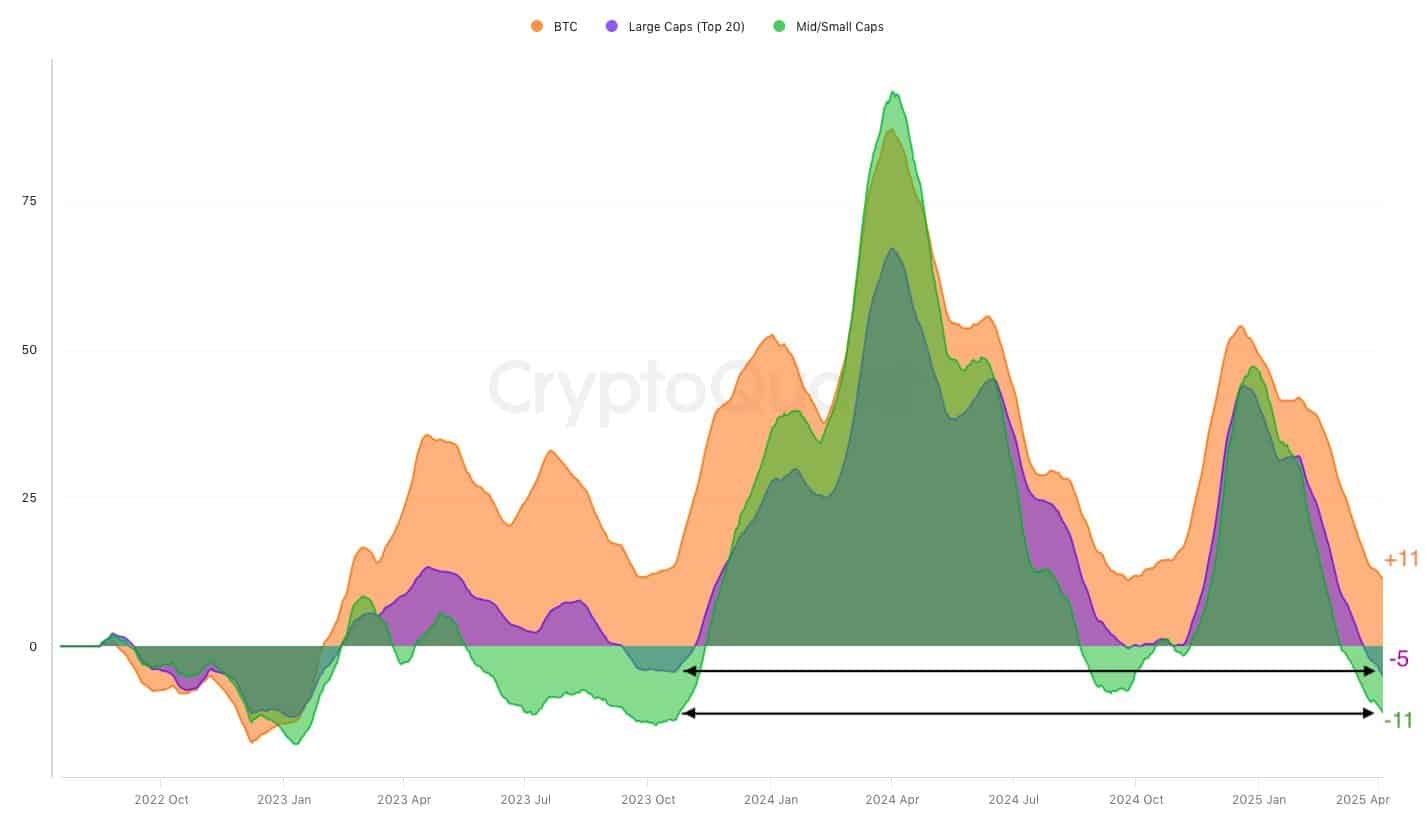

From October 2022 to April 2025, the 365-day advancing average of Bitcoin (DMA) consistently exceeded 30-day averages across the market, which underlined its dominant momentum.

Altcoins seem to lose steam. Because the ratio between 365 and 30-day averages for non-BTC assets at -11%was at the time of the press, which the decline in October 2023 witnessed.

Both the CAP-CAP and Middle-to-Klein Cap Altcoins have been re-displayed in repeated negative territory of systemic underperformance compared to Bitcoin.

Short growth spurts were created between April and June 2024. Having said that, these intervals proved fleeting, with Altcoins not maintaining a real momentum.

Bitcoin, however, showed consistent resilience by both bullish and corrective waves, which strengthened his dominance position.

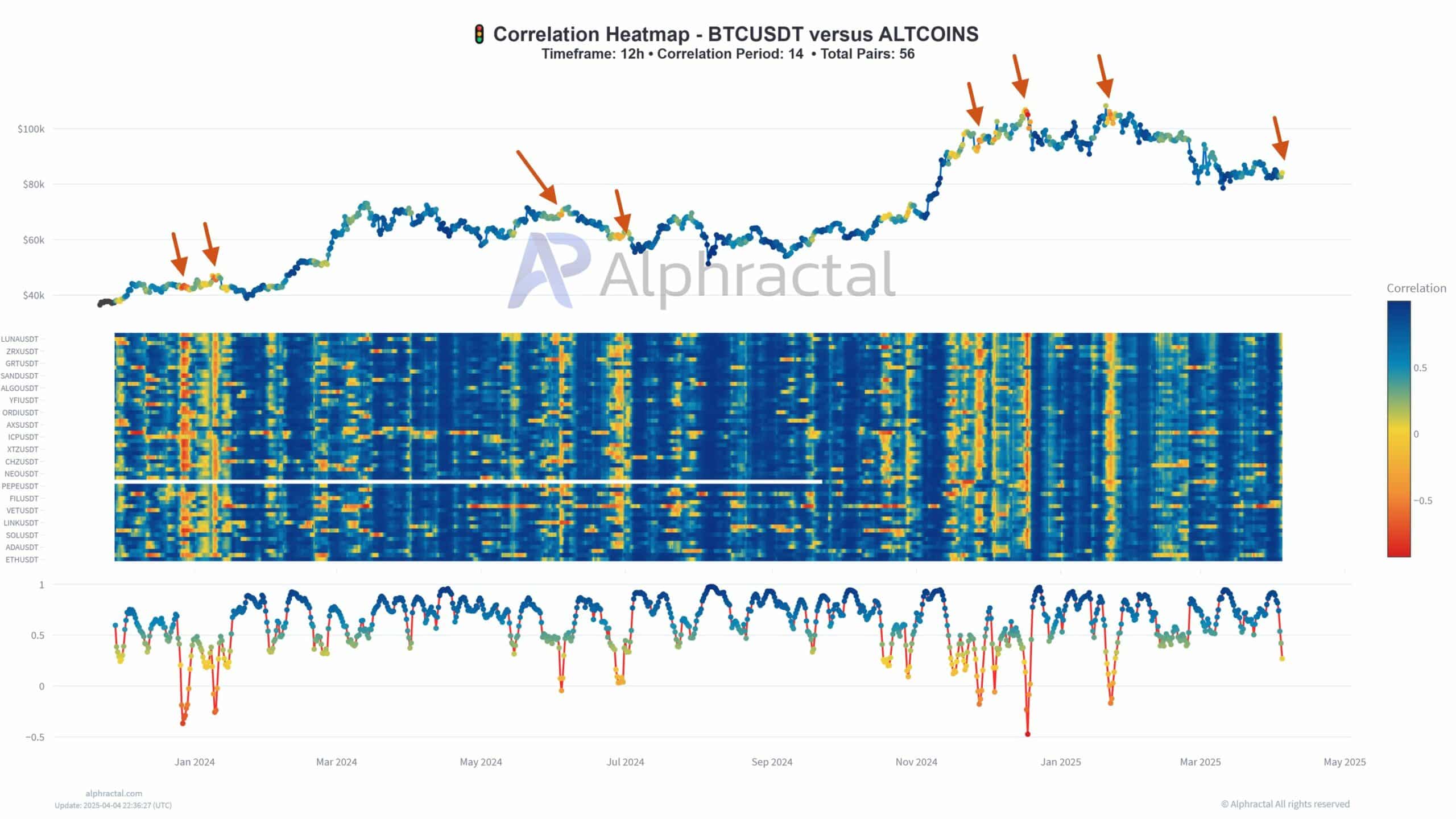

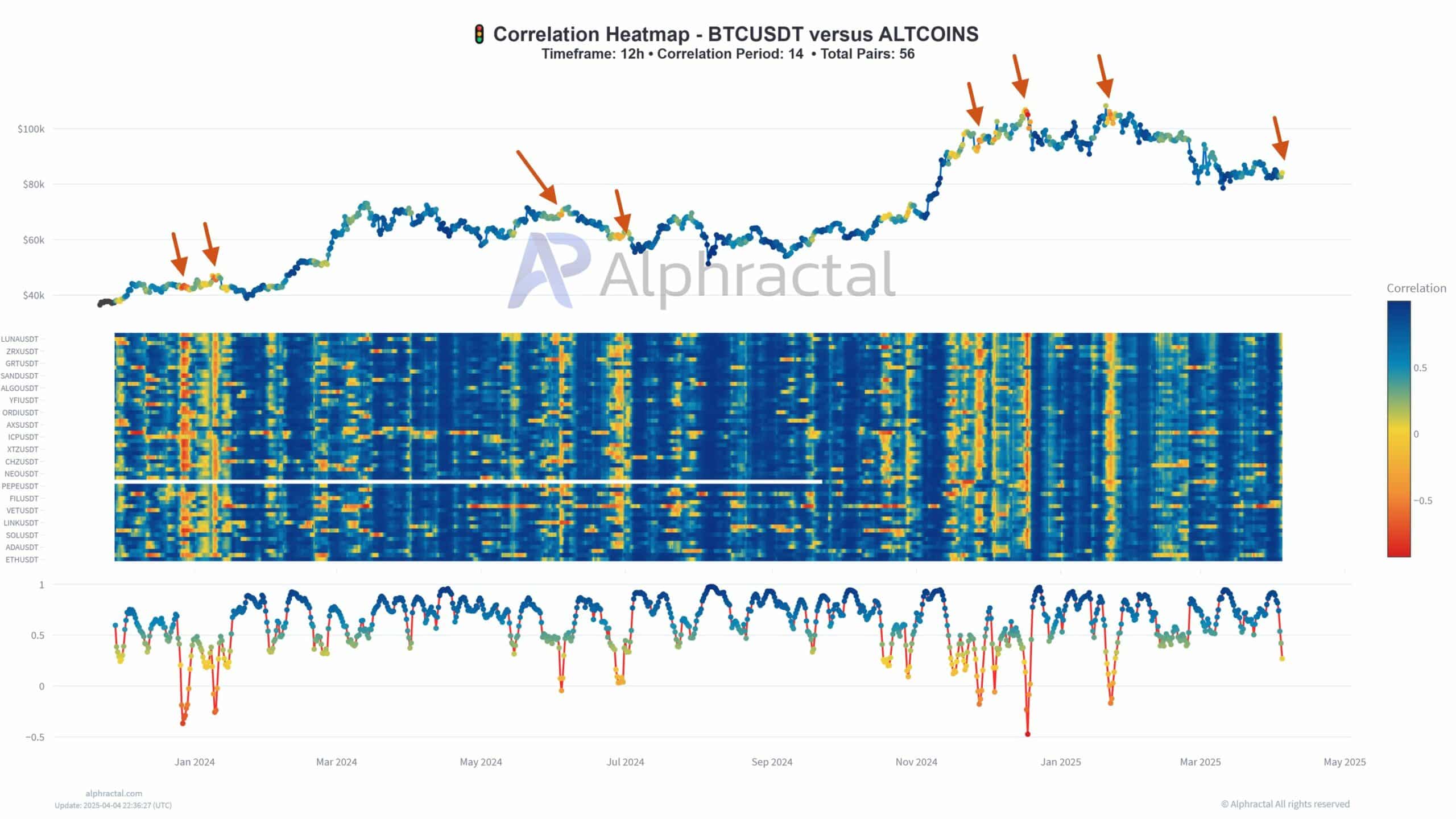

In addition, the correlation heat of Alphractal shows this divergence.

BTC, on the other hand, remained resilient

Since the beginning of 2024, correlation scores Altcoins were waved wild between BTC and 56.

Source: Alfractaal

In addition, a lower correlation levels – often marked in blue – have prior to the volatility peaks and price intervention for Bitcoin prior to Bitcoin, while they are also in accordance with local BTC tops.

At the time of writing, the correlation values between +1 and -0.5, which means instability in how Altcoins reflect the price action of Bitcoin.

Performance data from leading Altcoins reveal a bleak photo.

Source: X

Ethusdt fell -9.9% to 0.749, bnbusdt dropped -25.1% to 0.4299, ltcusdt disappeared almost by -99.66%, trade in the vicinity of 0.0006 and Linkusdt tumbled -33.97%.

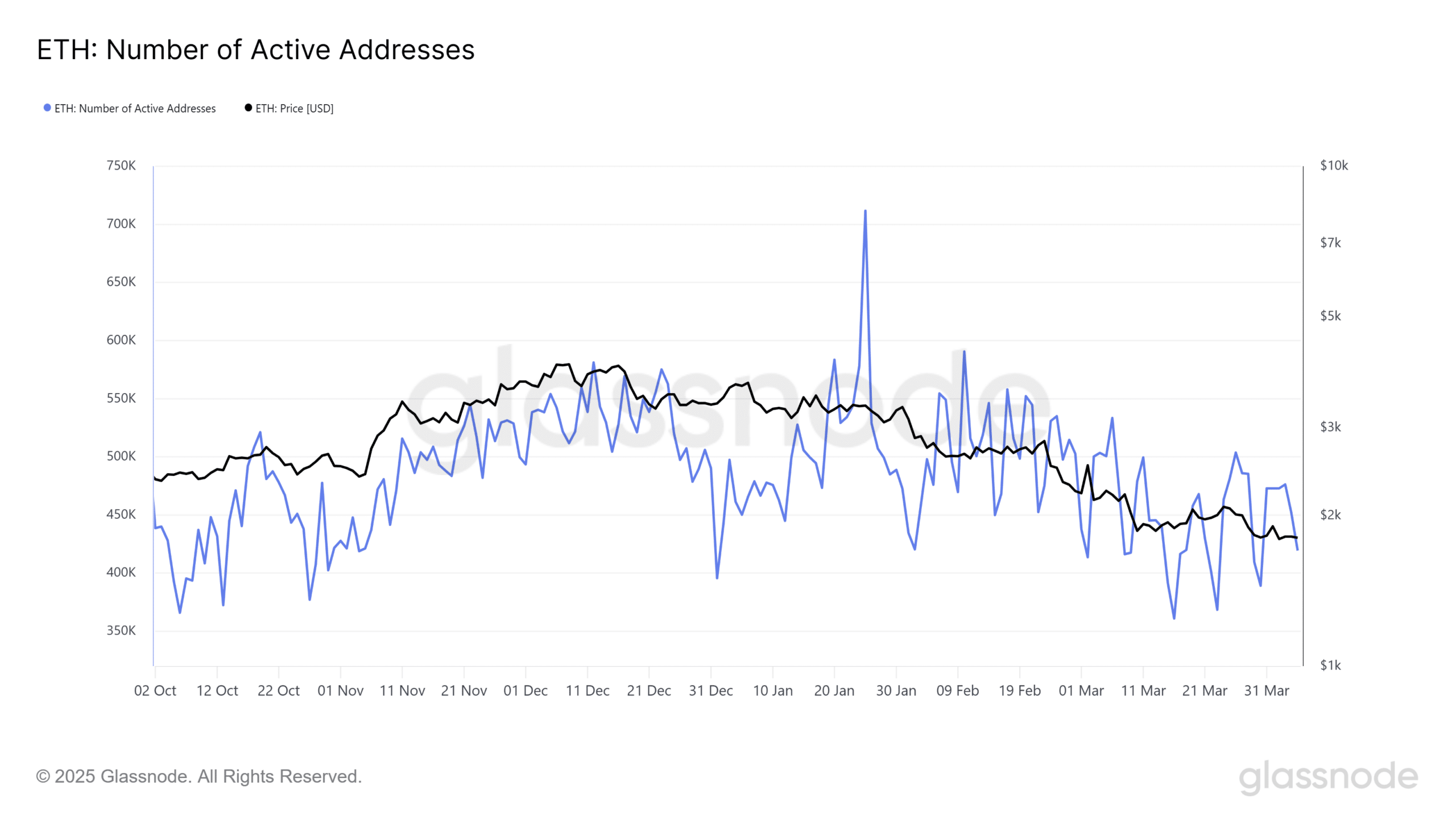

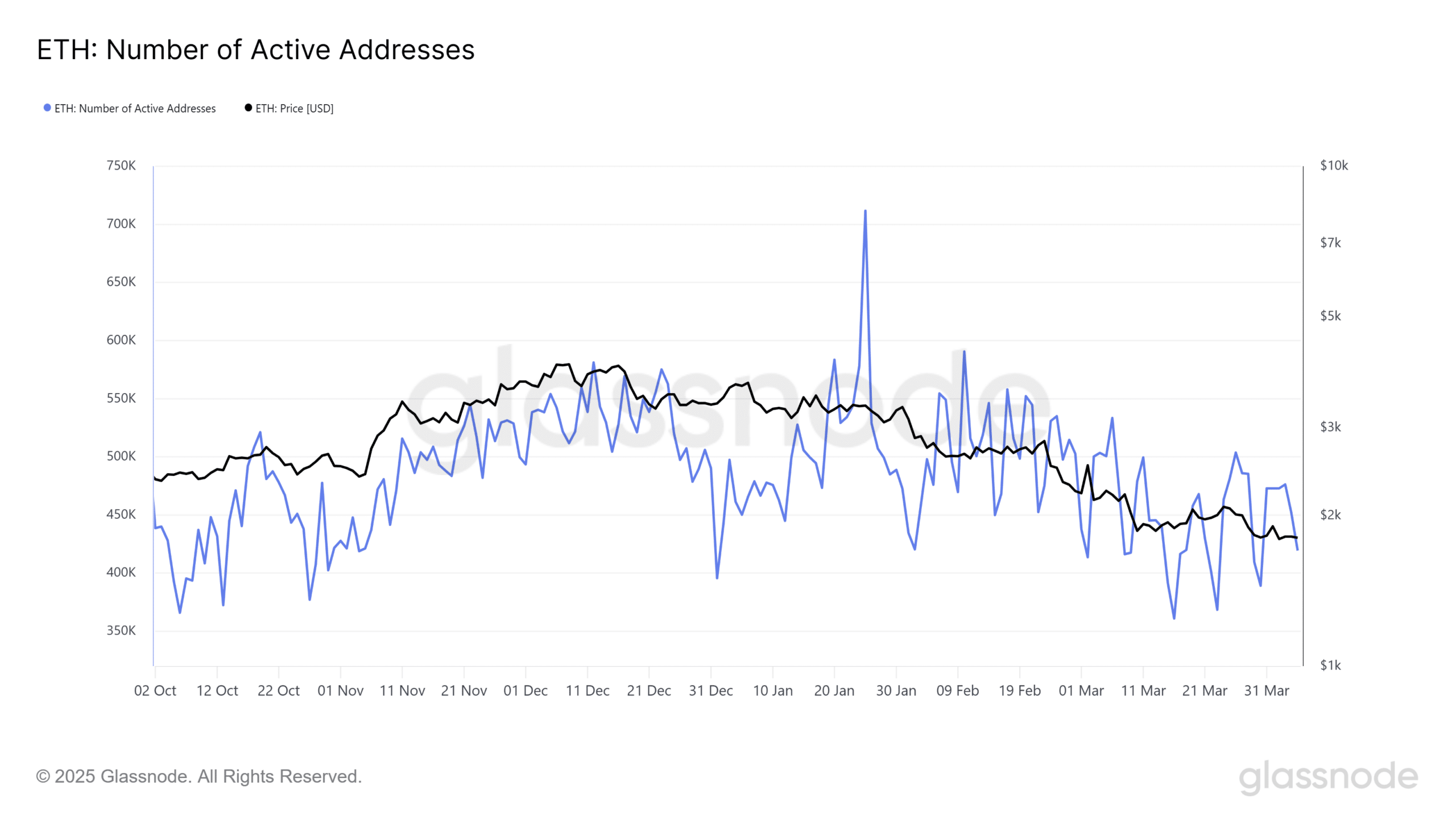

Ethereum’s [ETH] On-chain statistics confirm the vulnerability.

Source: Glassnode

From the end of January to April the first week, for example, the daily active addresses fell by 41%, which fell from 711.578 to 419,445. On the other hand, ETH itself collapsed from $ 3,319.97 to $ 1,805.96 – a dive of 45.6%.

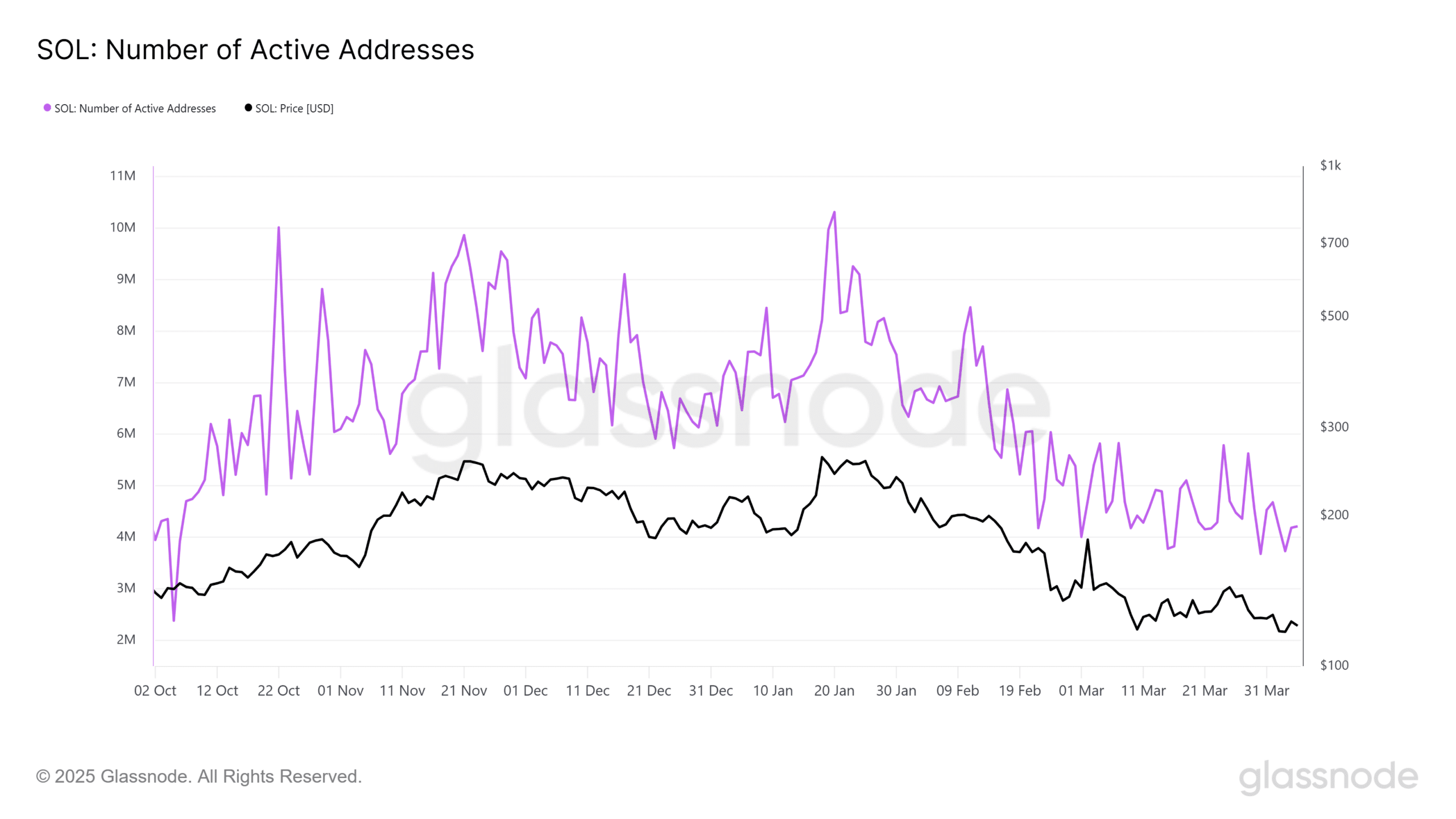

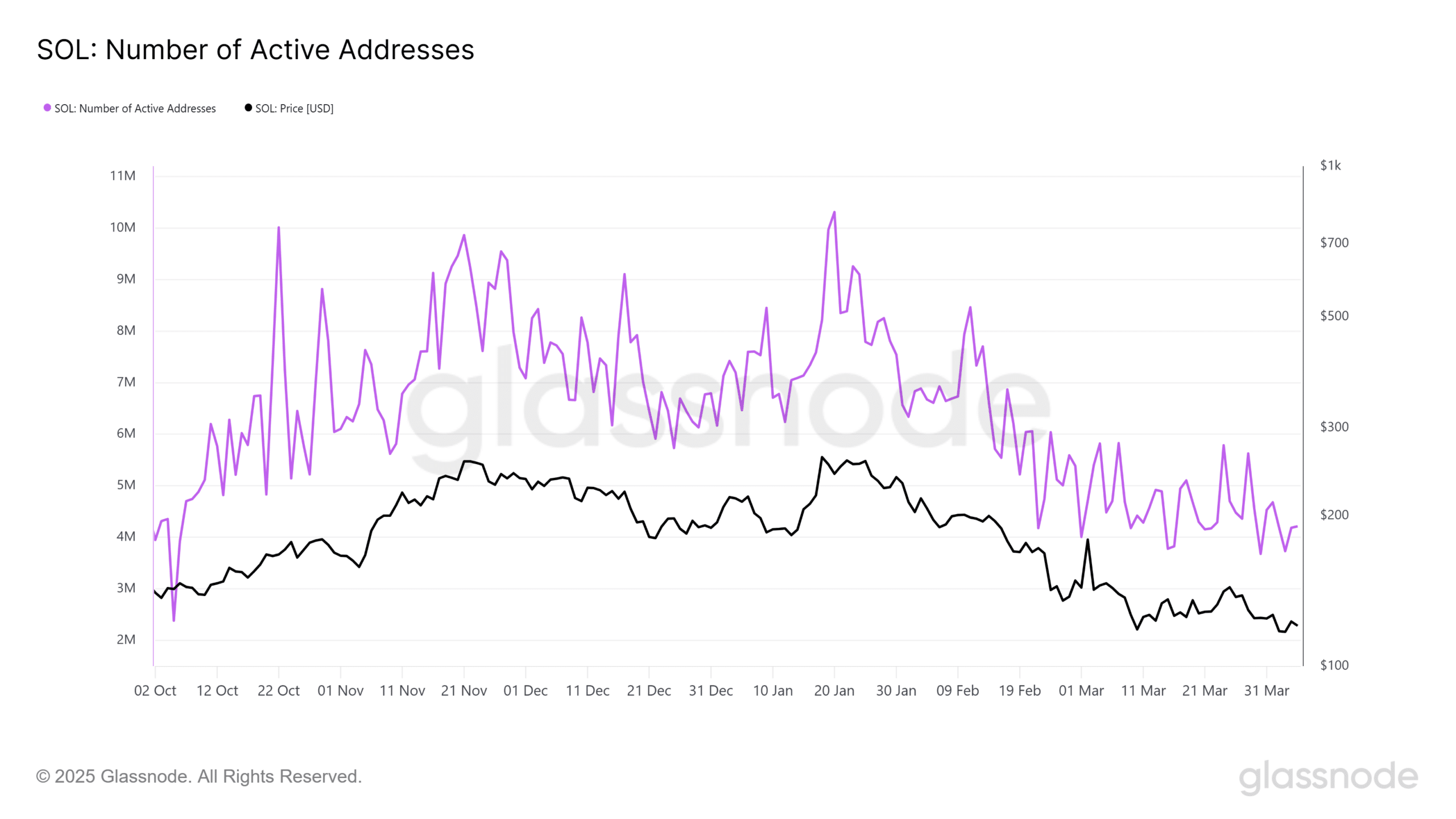

In fact, a similar pattern is clear in Solana [SOL].

Zooming in Solana reveals a deeper correction

Solana Active addresses slid 59% – from 10.3 million on January 20 to 4.18 million on April 4 – while the price reduced 49%, from $ 242.35 to $ 122.77.

Source: Glassnode

BTC looks more stable in comparison.

Active addresses fell by only 26%, from more than 1.1 million in December 2024 to 809,254 by 5 April. At the same time, the price consolidated between $ 80,000 and $ 86,000 to March and April.

Source: Cryptuquant

The transaction volume on the Bitcoin network fell by 45%and fell from 533,599 on March 23 to 293,310 by 5 April. Nevertheless, the price of Bitcoin only fell by 4% in the same period, indicating a phase of consolidation instead of capitulation.

This data emphasizes a stark contrast between Bitcoin, the leading active of the crypto market and its alternatives.

Altcoins seem to be confronted with deeper challenges for engagement, which go beyond simple price decreases. In the meantime, Bitcoin remains the most resilient option, although some consider the reduced network activity as a sign of decreasing speculative interest.