- Bitcoin could be on the verge of breaking out of its bullish flag pattern.

- Assessing the possibility of resistance building at a critical level.

Bitcoin [BTC] has delivered an impressive bullish charge over the past two weeks. Recently, the cryptocurrency has struggled to gather enough momentum for a sustained uptrend, or move well above the $60,000 price range.

Fast forward to the present and Bitcoin has destroyed the $60,000 resistance level and pushed it even higher. The price of 1 BTC at the time of writing was $63,404, representing an 18.35% rally in the last 14 days.

With just 10 days left in September, Bitcoin is on track to end the month in the green if it can maintain current levels. However, it is likely to encounter some resistance as it crosses into the next major resistance zone at $65,000.

Why the $65,000 Level is Crucial for Bitcoin

BTC price fluctuations between March and present have formed a bullish flag pattern. If the price follows the pattern, it means that a bullish breakout will eventually occur. Now seems an ideal time for that outbreak.

Source: CryptoQuant

A strong rise above $65,000 would likely break the trend of lower highs we have seen in recent months. If this pattern is broken, it means that the price is likely to re-enter the price discovery area.

The recently announced rate cut could prove to be the next catalyst for the liquidity needed to fuel new strong bullish sentiment.

Can the Bitcoin Bulls Maintain the Current Momentum?

Lookonchain recently noted that five miner wallets that have been active since 2009 recently moved their BTC. This increases the possibility of some selling pressure developing. The findings indicate that approximately 250 BTC worth more than $15 million was transferred.

Bitcoin miners’ reserves continued to decline over the past 24 hours, reaching a 5-week low of 1.81 million BTC.

Source: CryptoQuant

A surge in Bitcoin miner reserves would indicate confidence in Bitcoin’s ability to maintain its lead. However, current observations indicate the opposite. This also coincides with the risk of appetite on the largest exchange.

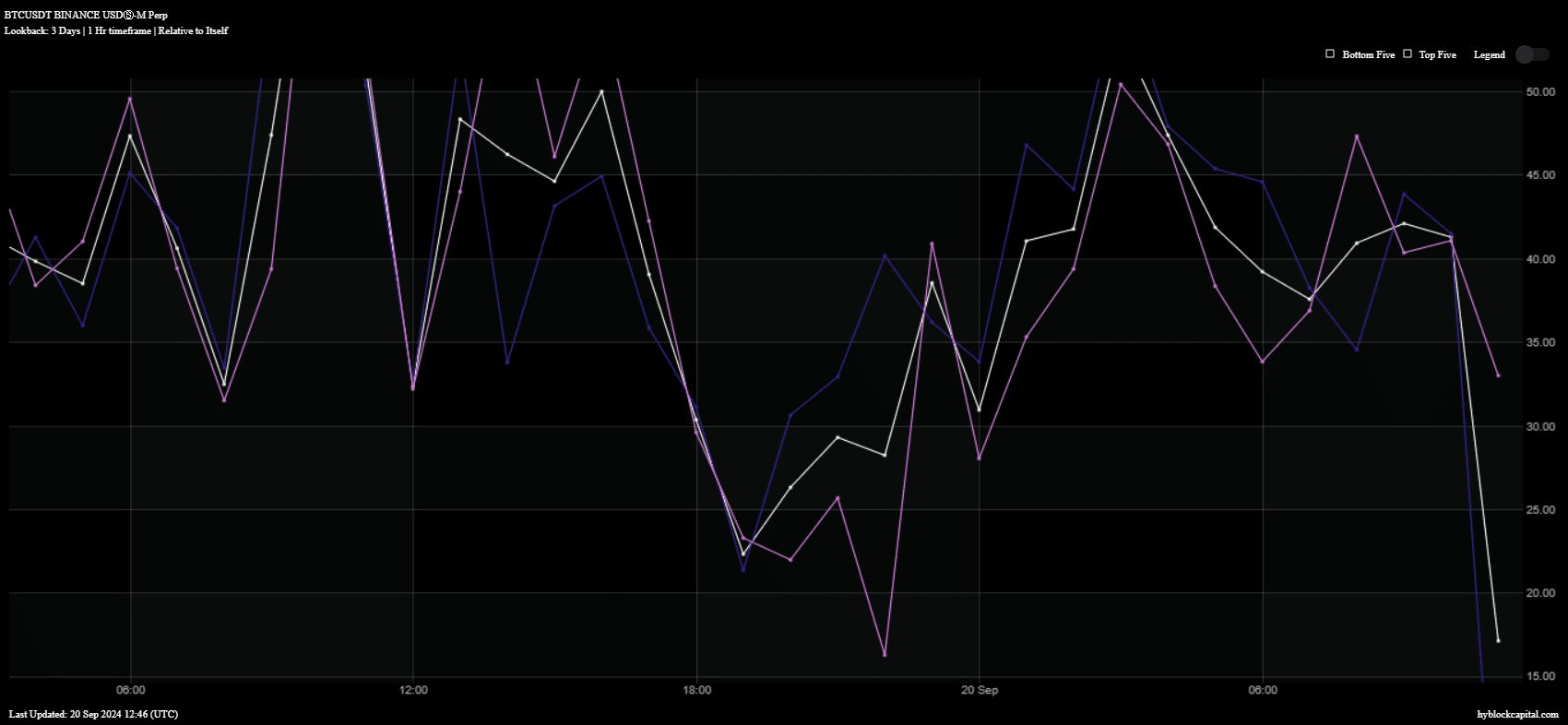

Net long positions have fallen sharply over the past 24 hours, indicating lower confidence in Bitcoin’s potential near-term upside.

HyblockCapital

Read Bitcoin’s [BTC] Price forecast 2024–2025

Net shorts remained relatively higher than net longs, despite also showing signs of some decline. This could also indicate that there is some uncertainty about the possible downturn.

Bitcoin holders could see the recent uptrend as a sign of momentum building for the next big long-term rally. This may lead them to switch from swing trading to a long-term HODL strategy.