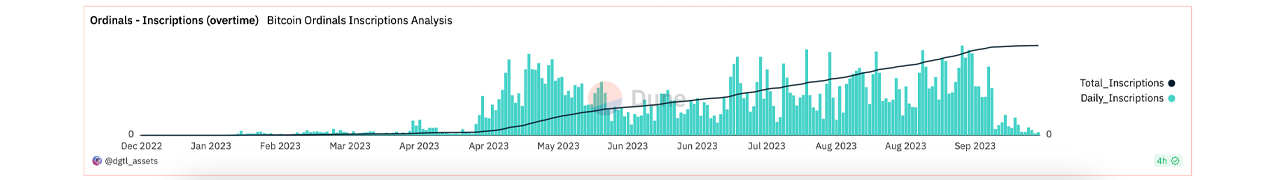

Since September 25, 2023, the trend of Bitcoin-based Ordinal inscriptions has noticeably decreased, reaching the most moderate level since mid-April. On October 3 and 4, fewer than 17,000 inscriptions left their mark on Bitcoin’s distributed ledger, as both the number of inscriptions and associated fees showed a marked decline.

Ordinal’s declining numbers, Bitcoin NFT sales decline and the BRC20 market

With more than 35 million Ordinal inscriptions recorded, the wave of inscription we have witnessed is showing signs of slowing down. Last week, Bitcoin.com News highlighted this cooling of the inscription, and the decline has continued. The daily registration of Ordinal inscriptions has fallen to a level reminiscent of that before April 20, 2023, when 8,844 inscriptions were etched into the Bitcoin blockchain that day.

After that day, the inscriptions shot up at a significant pace. In just a span of time from April 21, the number rose from 1.24 million to a whopping 4.5 million inscriptions on May 7, 2023. On that particular day in May, as many as 400,091 inscriptions were recorded within a span of 24 hours. This enthusiasm continued throughout the summer months, with the daily rate peaking at 440,760 registrations on September 15.

From September 15, 2023 to October 8, 2023, the number of daily ordinal inscriptions decreased significantly.

However, just ten days later the landscape changed dramatically. In addition, bidders pay fewer fees to miners. As of now, miners have pocketed approximately 2,120.92 BTC, which amounts to approximately $59 million, from processing inscription transactions. Diving deeper, a majority (52.6%) of these inscriptions can be categorized as “text/plain; charset=UTF-8” with a count of approximately 18.54 million.

Close behind, 42.4% are labeled ‘text/plain’, which amounts to approximately 14.93 million inscriptions. Other notable entries include 757,950 inscriptions of the “PNG” image type, 313,962 of the “JSON” variety, 228,210 of the “WEBP” format and 131,025 with the tag “SVG”. The slowdown in signups has given bitcoin miners a breather, allowing them to tackle the large backlog of transactions that have built up over the past five months.

Sales of plain inscriptions have seen a notable decline, with a marked decline since the end of June. Data from cryptoslam.io shows a shift in Bitcoin’s position, which now sits at eighth position in non-fungible token (NFT), or Ordinal, sales. This past week, Bitcoin-focused NFT sales totaled $926,023, which is a significant 58% decline from the previous week.

Yet there is a silver lining. The BRC20 token market has experienced a modest increase of around 3% this week, reaching a value of $180.31 million. However, the majority of today’s BRC20s have lost 0.6% in 24 hours. The ORDI token has the largest market cap at $71 million, followed by DFUK at $46 million, and MOON securing the third spot at $23 million. But it is worth noting that ORDI is down 87.81% from its peak on May 8, 2023, while MOON is down 71.20%. Over the past day, BRC20 tokens have seen approximately $9.2 million in global trading activity.

What do you think of the decline in the ordinal inscription? Share your thoughts and opinions on this topic in the comments below.