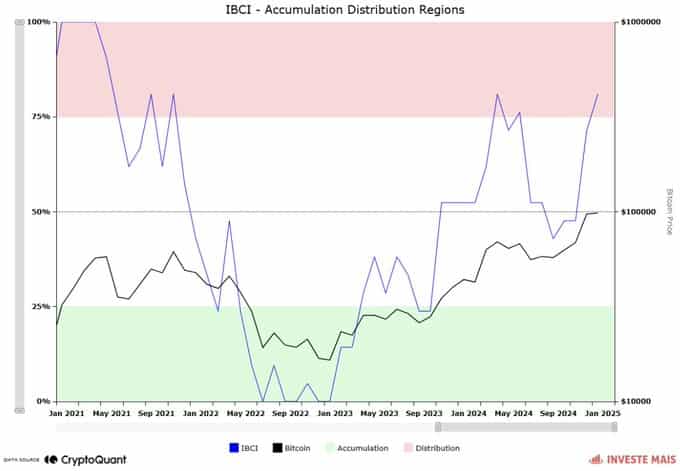

- Bitcoin Cycle Indicators (IBCI) have exceeded a critical point at the graph, which indicates that there could be a decrease on the horizon.

- BTC has developed strong support levels that can influence a price increase if a price correction takes place.

Bitcoin [BTC]Has shown a slight decrease in the last 24 hours, with only 1.08%. However, it is still traded above $ 100,000 region.

Despite the bullish market sentiment, corrective phases are inevitable and are part of the wider market cycle.

The analysis of Ambcrypto showed that a corrective phase could approach and has identified important regions that could support a recovery in prices.

Distribution phase threatens BTC

The Index of Bitcoin Cycle indicators (IBCI) on cryptoquant showed that the Activum has entered a distribution zone, a level that was last reached eight months ago, in May 2024.

IBCI is a combination of different market indicators – seven in total – including Puell Multiple, MVRV, NUPL and Sopr.

A distribution is indicated when the IBCI enters the red area on the graph, starting at 75%, which means that there is still growth potential for BTC; However, the sales activities have started.

Source: Cryptuquant

As soon as IBCI reaches the 100%zone-what happens when all seven indicators enter their distribution phase-BTC would reach a market top, where the price would be lower highlights and lows.

IBCI above 50%, where BTC is currently located, suggests that a corrective phase is expected before BTC resumes its upward process.

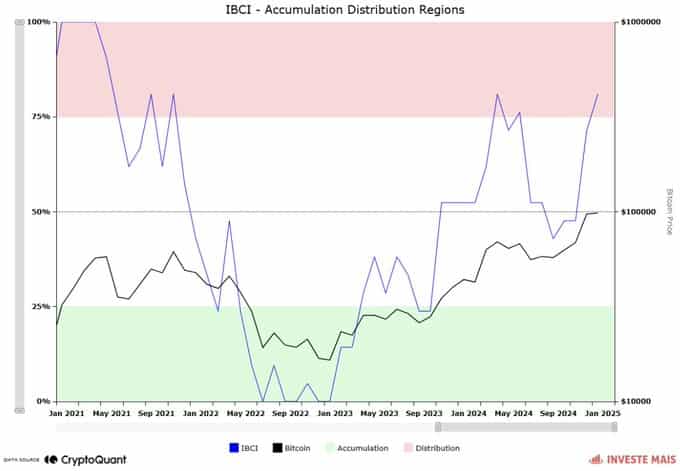

Further analysis of Ambcrypto identified a potential recovery level should a correction take place before the market top is reached.

A decrease up to the mid -90,000 before the rally

With the help of the in/out of money around price, an on-chain-metic to determine potential support and resistance zones on the map, certain amcrypto where a potential withdrawal of BTC would be taken care of due to the demand for a continuous increase.

This demand zone is between $ 94,800 and $ 97,000, with a central range of $ 96,500. About 1.36 million BTC buying orders of 1.4 million addresses support this reach.

Source: Intotheblock

A corrective phase in this region would be followed by a price increase back to the $ 100,000 region, with the possibility that BTC would reach a new high point from there.

Other observed market activities could also play in favor of BTC for an increase, including the creation of a stock including BTC.

The American stock could give BTC a boost

The construction of a stock of American digital assets, as announced in the recent Implementation Decree of January 23 by President Donald Trump, could be in favor of BTC.

Read that of Bitcoin [BTC] Price forecast 2025–2026

A digital stock including BTC implies that the US government can maintain the cryptocurrency as part of its reserves.

According to Arkham, the US government already has around 198,000 BTC, worth $ 20.71 billion. If the government increases its possession, this could stimulate the question and positively influence the price process of BTC.